This map shows Thousand Club wells in red and other wells in gray. (Source: Bernstein & Co. LLC)

For those hoping to discover the next big North American resource play, the news from Bernstein & Co. LLC is not happy. In a report titled “Bernstein’s E&Ps: What the 2015 ‘Thousand Club’ tells us about 2016 emerging resource plays,” researchers reported that most of the wells in the “Thousand Club”—wells that peak at more than 1,000 boe/d—are in well-known resource plays such as the Eagle Ford, Utica, Marcellus and Bakken.

“This observation supports our view that the hunt for new resource plays is increasingly difficult,” the report noted.

This annual study relies on well files for wells in Canada and the U.S. Researchers extract the wells with more than 1,000 boe/d. “We expect that 1,000 barrels (oil equivalent) is a good (if arbitrary) cutoff to separate the elite plays from other plays, being representative of an economically highly attractive flow rate given sufficiently low costs,” they noted.

The Winners

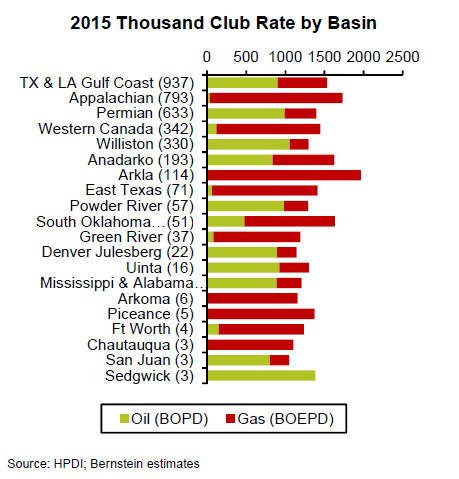

At the 1,000-boe/d cutoff point, about 3,600 wells make the cut from a population of about 40,000, meaning that roughly 10% of unconventional wells joined the club. About two-thirds of these high producers are in the states of Texas, Pennsylvania and North Dakota.

Since the authors were considering oil equivalent, they decided to pull out just the wells that are oil producers given the disparity between oil and gas prices during much of the study period (Figure 1). The 1,000 bbl/d of oil peak producers represent only 2% of all of the wells drilled during the time period studied. Not surprisingly, most of these wells are in Texas, New Mexico and North Dakota. Furthermore, only about 10% of these wells, fewer than 100, are in reservoirs other than the well-known unconventional oil plays such as the Eagle Ford, Bakken and Permian Basin.

“Said another way, two-tenths of one percent of North American wells are high-rate from ‘new’ potential plays or less-known plays,” they noted.

Research indicates that the industry already knows the reservoirs that are most likely to add members to the Thousand Club. The authors noted that some wells might look inordinately productive due to reporting errors. Regardless, 74% of all of the wells come from four basins.

Location, Location, Location

The authors further broke down the Thousand Club wells by basin. “Not surprisingly, the Middle Cretaceous Eagle Ford Shale dominates both the overall Thousand Club but also this basin’s Thousand Club,” they noted. “The reservoir immediately above the Eagle Ford—the Austin Chalk—also made the list—a well-known prolific reservoir whose quality is good but quantity limited.”

The Buda Lime, immediately below the Eagle Ford, also had three wells that joined the club. However, no wells from the Pearsall Shale made the cut. Other reservoirs that made the cut include the Edwards Lime (one well), Upper Cretaceous Olmos tight sand (eight wells), Woodbine, Frio, Vicksburg, Yegua, Wilcox and Midway. A single Cook Mountain reservoir with Yegua production also made the list.

In the Appalachian Basin, Marcellus wells dominate the Thousand Club, with the Utica coming in second. The database also includes Upper Devonian- and Ordovician-aged wells.

In the Permian, “The Trend,” which is a mix of Spraberry and Wolfcamp reservoirs, along with Wolfcamp and Bone Spring shales, brought in the most 1,000-boe/d representatives. Canyon and Delaware also were present after previous absences. Other reservoirs that made a marginal appearance included Anhydrite, San Andres, Devonian, Penn, Wichita, Brushy Canyon and Clear Fork.

“Thus, while the basin is home to a number of stacked pay zones, for now industry is happy to exploit the most obvious targets,” the authors noted.

The Western Canada Sedimentary Basin (WCSB) has greater variety than other resource plays as far as its Thousand Club representation. “At a high level, we express three ‘rules’ for the WCSB: (1) it is prolific and confusing (in the sense that many stratigraphic horizons are hydrocarbon-bearing and can be classified under a variety of names), (2) it is gas-prone (i.e., with a propensity for natural gas as opposed to black oil), and (3) it is distant (i.e., typically host to the worst pricing differentials and higher cost structures),” the authors noted. “As such, we note a number of members of the Thousand Club but caution against believing the next Eagle Ford is to be found.”

Reservoirs that did make the list include the Montney, Mannville, Fahler, Horn River, Spirit River, Notikewin, Triassic, Doig, Evie, Cardium, Dunvegan, Gething, Edmonton, Belly River, Blue Sky, Celtic, Ellerslie, Wilrich, Halfway, Viking and Wabash.

The Williston Basin brings up few surprises; the Bakken, Three Forks and Sanish reservoirs all enjoy membership to the club. The authors noted that pre-Devonian opportunities might exist in this basin, but so far no wells have yielded the cutoff peak production rate.

In the Anadarko Basin, the Woodford, Mississippi Lime, Granite Wash, Cleveland, Hoxbar and Marmaton reservoirs top the list. The Springer Shale also made the club. Other newcomers include the Hunton Formation (conventional limestone); Wilcox (age equivalent to the Texas trend); the Bromide Formation (a conventional target sometimes referred to as Viola); the Cherokee tight gas sand; the Meramec (part of the Mississippi Lime sequence); and a few single-well members such as the Chester, Douglas, Lansind, Marchand and Oswego.

The Arkla Basin is completely dominated by the Haynesville, the authors noted.

The Powder River Basin was represented by the Parkman, Niobrara, Sussex and Frontier reservoirs. All but the Niobrara tend to be sandstones abutting source rocks, the authors noted.

Positioned For Success

Companies whose wells are most likely to join or remain in the Thousand Club have, in the authors’ opinion, two main advantages. “First, access to high-quality proven core resource play acreage is a compelling source of competitive advantage,” they noted. “Second, companies exposed to potential emerging resource plays are also scarce and therefore prized. Companies overrepresented in the Thousand Club have such acreage.

“We also believe that discovering new resource play acreage is challenged. Finally, we believe that the best economics are found in the sweet spots of the best resource plays.”

Of the myriad shale players in North America, EOG Resources and Devon Energy have the best exposure overall, they noted. “We believe the standout performance of Devon in [the] Thousand Club is indicative of [its] improving resource base and well execution as [it] joins industry leader EOG at the head of the club,” they noted.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.