The third quarter’s transactions totaled about $8.3 billion, the lowest since the cyclical oil price bottom hit the industry in first-quarter 2016. (Source: Hart Energy)

Third-quarter A&D continued to stall after the brisk and high-value deals that began the year, punctuated by Permian Basin transactions falling to their lowest level since second-quarter 2015, according to a new report by Raymond James analysts.

But the Permian was still on E&Ps minds, as several selloffs were made in pursuit of acreage or pure-play status in the basin.

“The third quarter of 2017 emphatically stated buyers and sellers are in a standoff,” the report said.

The third quarter’s transactions totaled about $8.3 billion, the lowest since the cyclical oil price bottom hit the industry in first-quarter 2016. Private-equity backed buyers also showed a healthy appetite for non-Permian castoffs across the Lower 48.

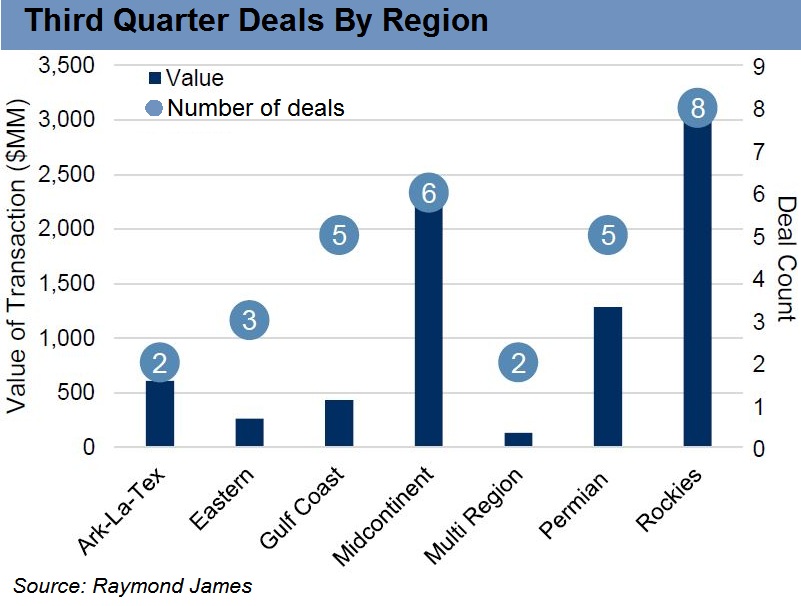

Comparing the second and third quarters, the number of transactions fell by 17 to 31 deals while the average deal value dipped a third to $266 million. Raymond James sees a combination of crude price volatility, uncertainty due to Hurricane Harvey and value realizations weakened deal flow.

West Texas Intermediate oil prices bounced up to $51.67 per barrel at the end of the quarter after stumbling blindly into a low of $42.53 in late June. The impacts of Harvey may have delayed Permian and Gulf Coast deals, as well.

Another potential factor: larger-scale joint ventures have allowed lower priority areas to be drilled rather than divested, while also shifting reserved into proved producing status, Raymond James said. In particular, DrillCos, which inject private-equity money into public company projects, are increasingly popular since E&Ps retain their assets.

So far in 2017, DrillCos have accounted for $2 billion in capital commitments, including $430 million in the third quarter. For all of 2016, about $1.1 billion in DrillCos were announced and $912 million in 2015.

“Many E&P companies have viable drilling locations sitting 10, 20 or 30 years out into their drilling inventory and operators have focused their limited capital budgets on core leaseholds,” Raymond James said.

While the recent trend has been to sell assets with a long shelf life to pay down debt or to fund capex, “DrillCos offer operators an alternative to divestment, providing an otherwise untapped cash flow stream.”

Rockies Rules

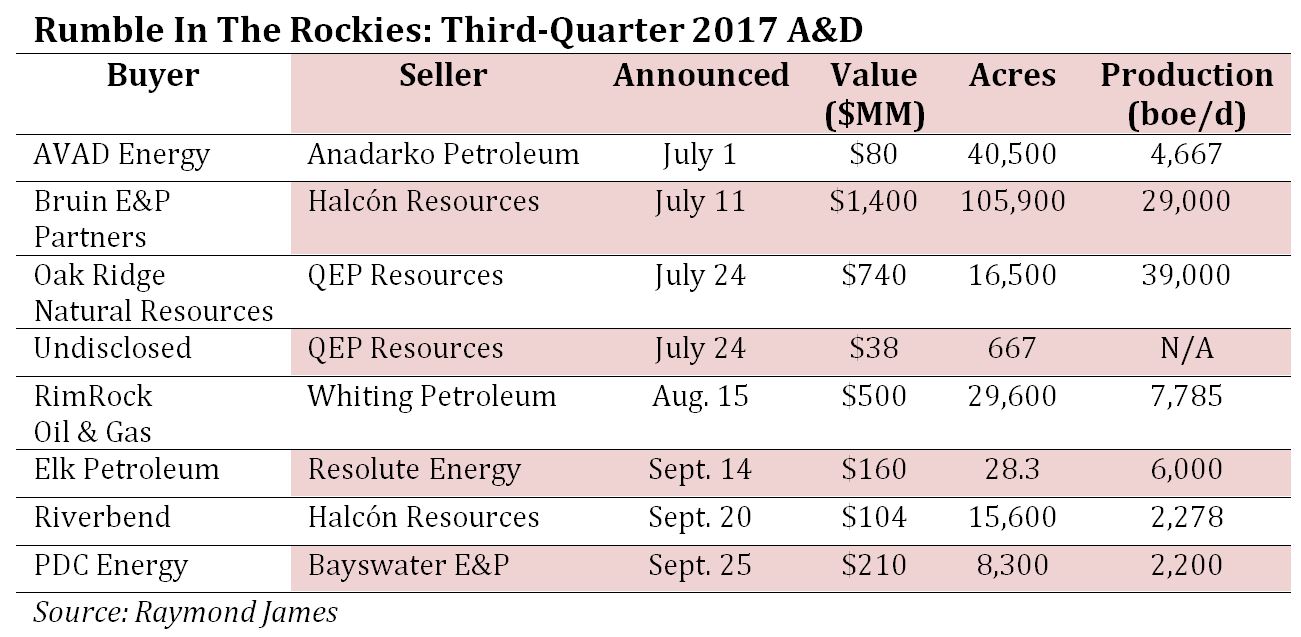

For the first time in six quarters, the Rockies region outstripped all areas in A&D activity in the third quarter. Led by the Bakken, the area racked up $3.2 billion from eight deals.

Nevertheless, many deals in Wyoming, Utah and North Dakota still reverberated in the Permian.

QEP Resources Inc. (NYSE: QEP) said in July it would sell its 17,4000 net acres in the Pinedale Anticline Field in Wyoming for $740 million. The company also closed a June sale of Wyoming assets for $37.5 million. Two days later, QEP said it would buy 13,800 net Permian acres in Martin County, Texas, for $732 million.

Resolute Energy Corp. (NYSE: REN) and Halcón Resources Corp. (NYSE: HK) made similar moves in different basins with the same endgame: Permian pure-play status.

In the Paradox Basin, Resolute agreed in September to sell its EOR assets in the Aneth Field in Southeastern Utah for $160 million. Halcón announced deals in July and September to divest Bakken interests and exit its 122,000 net acre Williston Basin position for a combined $1.5 billion.

For the Bakken, in particular, one area stood out as a place for public companies and private-equity firms to do business: the Fort Berthold area.

Halcón’s two deals and a third, $500 million divestiture by Whiting Petroleum Corp. (NYSE: WLL) totaled $2 billion in the Rockies, or about 62% of the region’s deal value, Raymond James said. All of the buyers were backed by private-equity firms.

Plains Dealing

Deal activity roared back to life in the oil and gas industry’s breadbasket, with transactions centering on Oklahoma’s Scoop, Stack and Merge plays in third-quarter 2017, Raymond James said.

As with deals in the Rockies, most assets were sold by public companies to private-equity backed buyers.

In the quarter’s largest deal, blank-check company Silver Run Acquisition Corp. II (NASDAQ: SRUNU), Alta Mesa Holdings LP and Kingfisher Midstream LLC announced a merger that would create the first publically traded Stack pure-play company. The deal, valued by the companies at $3.8 billion, includes cash payments of nearly $1.6 billion from Silver Run and its private-equity backer Riverstone Holdings LLC.

Overall, the Midcontinent saw the announcement of six deals totaling $2.3 billion—about 28% of Lower 48 transaction value in the third quarter, Raymond James said. Most deals, including Alta Mesa’s merger, were Oklahoma focused.

So far in 2017, Chesapeake Energy Corp. (NYSE: CHK) has divested about $360 million, primarily in the Midcontinent, according to August regulatory filings. Raymond James listed the buyers as Trinity Operating, BRG Energy and Echo Energy.

In two deals totaling $140.5 million, Continental Resources Inc. (NYSE: CLR) sold about 32,500 net acres in the Stack play and Arkoma Basin in Oklahoma.

In Texas deals, ConocoPhillips Co. (NYSE: COP) said it sold its Panhandle assets for $184 million in a deal announced in July. Rice Energy Inc. (NYSE: RICE) also said in August it had agreed to sell 36,000 net producing acres in the Barnett Shale for $175 million.

The Midcontinent appeared to be a solid target for private capital. In the third quarter, nearly all of the region’s transactions involved a private equity-backed buyer, including Silver Run’s Alta Mesa merger, which included $600 million cash from Riverstone Holdings.

“Of the 16 announced deals in the region year-to-date, 12 included private or privately-backed buyers with 11 deals involving public seller,” Raymond James said.

The Haynesville Says Hello

Haynesville activity stepped up in the third-quarter, led by deals announced by Houston-based Rockcliff Energy II LLC.

On Aug. 1, Rockcliff said it would buy 210,000 net acres in the Haynesville, Mid-Bossier and Cotton Valley from Samson Resources II LLC for $525 million. Two weeks later, the company added another 60,000 net acres of Haynesville rights for an undisclosed price, quickly ramping the company’s position up by one-third.

In total, the deals put Rockcliff in a 180,000 net acre Haynesville Shale stronghold.

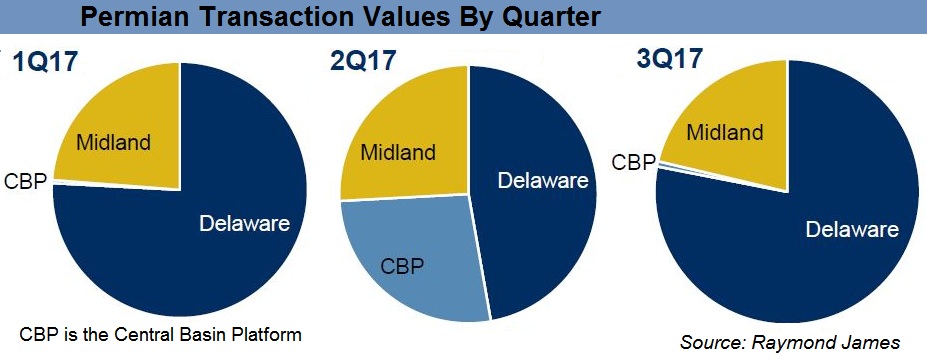

Permian Pause

Transactions in the Midland and Delaware basins dried up in the third quarter as E&Ps shift to development and entry prices remain high.

With $1.3 billion from just five deals, it was a steep fall from the second quarter’s $2.8 billion, 12-deal pace.

A limited amount of large, private packages may also have stymied deal flow, though the deal drought may not last as assets shake loose.

In the third quarter, however, deal activity was muted, though acreage prices increased. In the Midland, asset prices in the third quarter averaged $28,000 per net acre, with QEP skewing the average up with its $51,000 per acre deal.

In the Delaware, RSP Permian Inc. (NYSE: RSPP) bought assets in Loving and Winkler counties, Texas, in deals worth $227.9 million. The deal sold for $32,000 per acre, 39% more than the trailing 12-month average of $23,000, Raymond James said.

Deal prospects still linger, most prominently with BHP Billiton Ltd.’s (NYSE: BHP) decision to divest its U.S. oil and gas assets. The company’s 105,000 net acre Delaware position will be the “crown jewel for potential suitors,” Tudor, Pickering, Holt & Co. said in an August report.

Depending on the outcome of bankruptcy proceedings, Breitburn Energy Partners LP could auction its 17,502 net acre Midland position. The company has received two unsolicited offers—both from Diamondback Energy Inc. (NASDAQ: FANG)—with the latest offering of $725 million for its Midland acreage.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Sapura Acquires Exail Rovins’ Nano Inertial Navigation System

2024-02-01 - Exail Rovins’ Nano Inertial Navigation System is designed to enhance Sapura’s subsea installment capabilities.