Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Efforts to convert green hydrogen to a synthetic natural gas called electric natural gas (e-NG) are underway as Belgium-based hydrogen startup Tree Energy Solutions (TES) partners with TotalEnergies to bring a large-scale e-NG production unit to Texas.

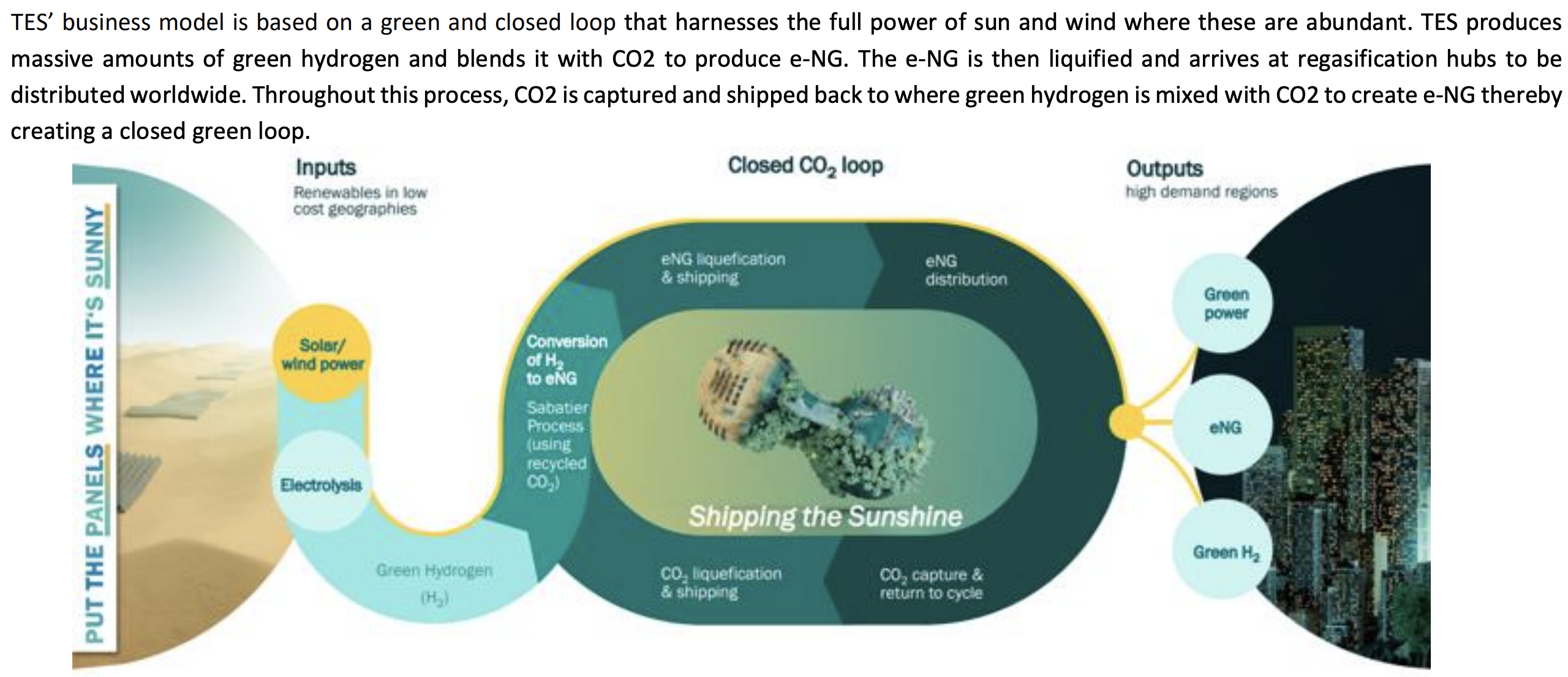

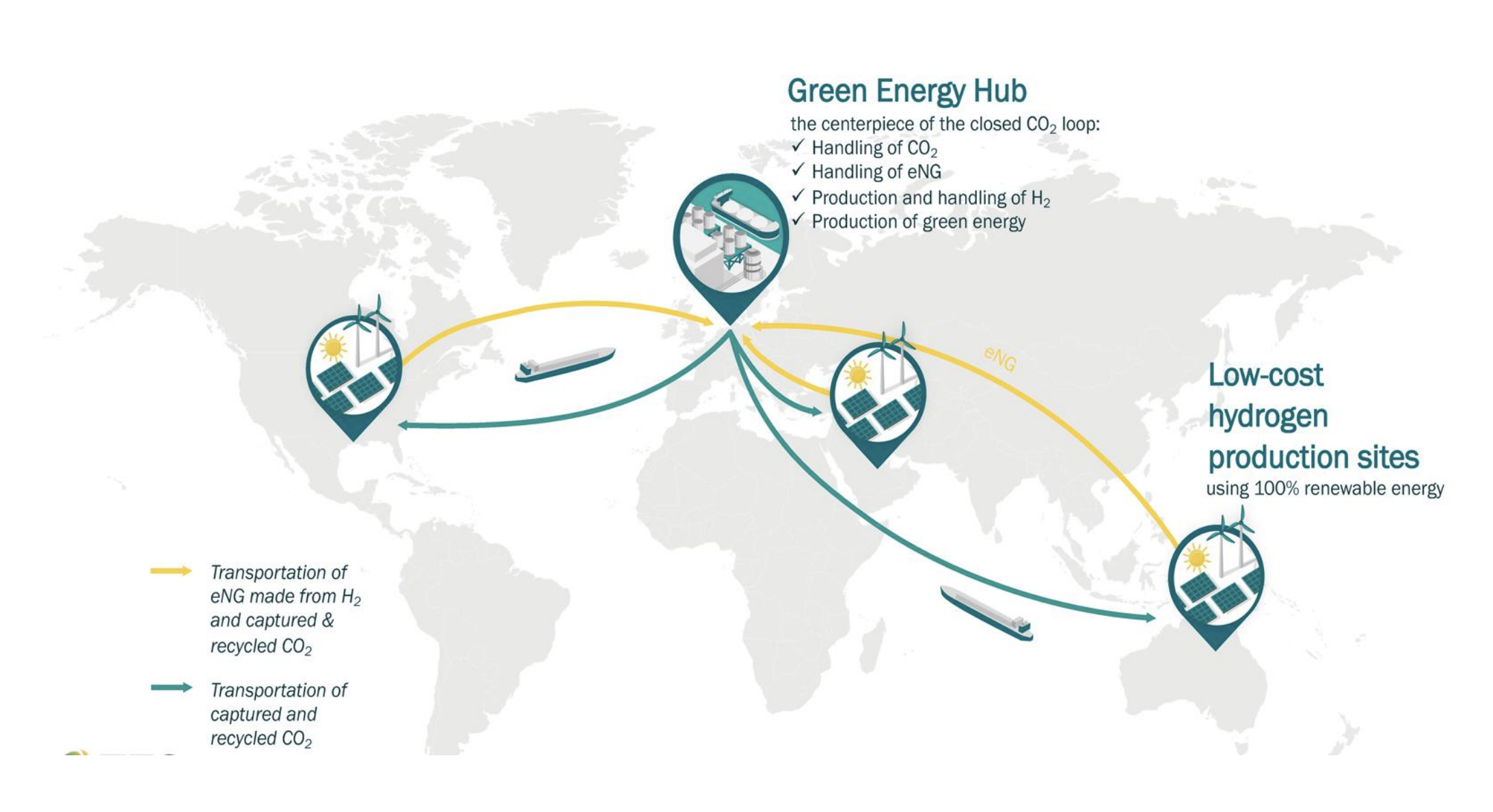

The move comes as parts of the world struggle to meet energy needs while reducing reliance on carbon-intense forms of energy. TES is on a mission to accelerate global decarbonization by combining CO2 with green hydrogen and moving the produced e-NG into global markets using existing infrastructure.

RELATED: TotalEnergies, TES Team Up in US for Synthetic Natgas, Hydrogen Project

Pending a final investment decision in 2024, the project in Texas will utilize a 1-gigawatt (GW) electrolyzer to produce hydrogen powered by about 2 GW of wind and solar energy to produce up to 200,000 metric tons (mt) of e-NG. The project will likely source biogenic CO2 from high-emitting regions such as the Gulf Coast, where reporting facilities in Houston alone reported to the U.S. Environmental Protection Agency more than 52 MMmt of CO2e in 2021.

Cynthia Walker, CEO of TES Americas, spoke to Hart Energy about e-NG, the company’s latest project and how the renewable energy source can play a major role in the clean energy revolution.

Velda Addison: What are some of the benefits of e-NG and how does it compare to fossil natural gas and renewable natural gas (RNG) such as from landfill waste?

Cynthia Walker: We think e-NG has a lot of benefits. There are many initiatives around the world to bring green molecules to market. One of the green molecules that there’s a lot of focus on is hydrogen. But we see hydrogen as a molecule in a way that is fairly illiquid because it’s used in a pretty narrow market today, primarily as a refinery feedstock and in the fertilizer value chain. We allow hydrogen to access multiple markets by transforming it into a natural gas molecule that can be used by anyone that uses natural gas today, and it can be transported through any existing natural gas infrastructure. So, we think the big benefit is it can be used today: no new infrastructure, no new plant equipment.

When you think of all the derivatives of hydrogen, one of the things that we think is unique about our derivative of e-NG is that there’s already an established premium market for green natural gas. That is the renewable natural gas market that you know of here in the U.S. … Our process is simply another way of producing a green molecule that has a similar carbon intensity reduction benefit and is price competitive with RNG today. We see it as renewable natural gas but better because we can do it more at scale and more in a manufacturing type of way.

VA: How do the production costs compare?

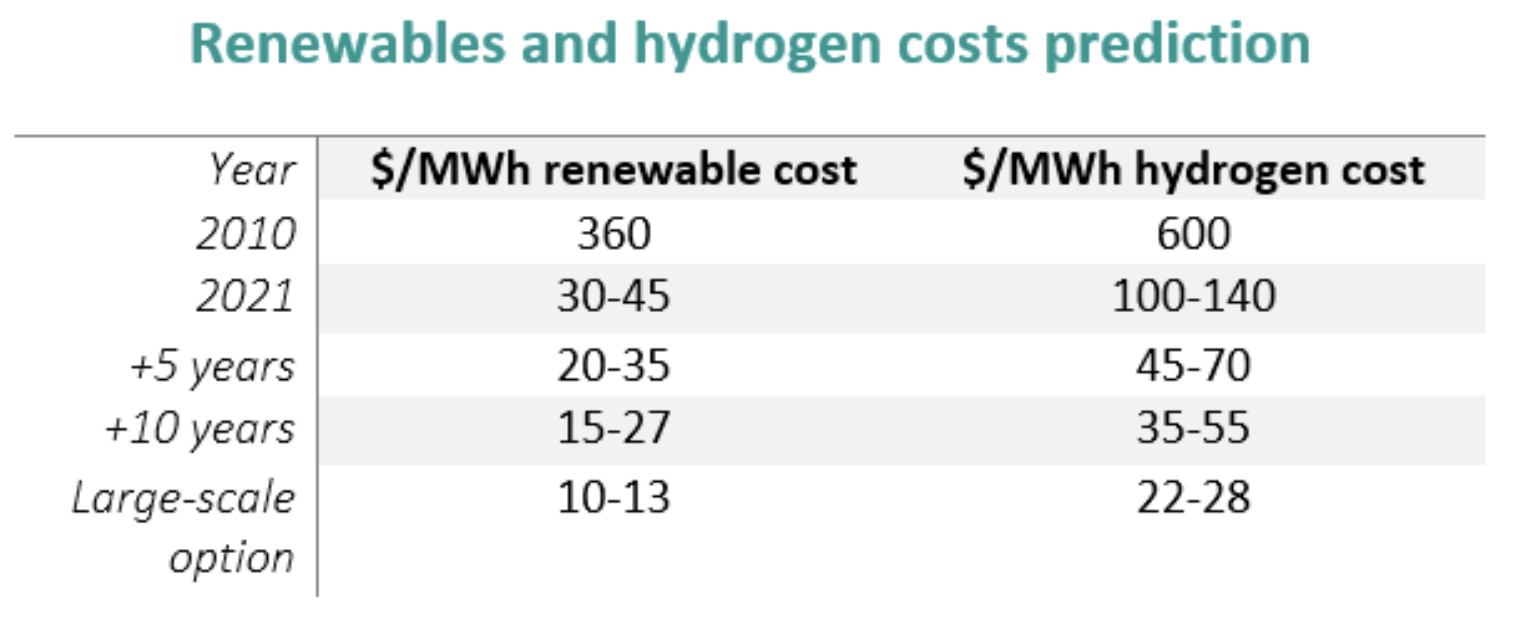

CW: There’s quite a bit of a range on renewable natural gas, as you may be aware — anywhere from the teens to even the $40s [per MMBtu], or we’ve heard some numbers closer to the $50s. We haven’t disclosed specifically what our production costs are going to be, but we do believe that our molecule competes within that very broad range. We think it will be cost competitive. But to put more specificity around the cost, overall, the biggest cost for us is our feedstock, and we really have two major feedstocks. One is the renewable electricity, and renewable electricity to produce the hydrogen is about 70% of the overall cost structure. Then, we have CO2, an essential feedstock. Depending on the quality of that CO2 and its location, it’s about 7% to 10% of the overall cost of our molecule.

We are at the height of the cost curve right now for hydrogen, therefore, as a derivative for e-NG. We expect costs can come down probably by at least 50% simply with the maturing of the supply chain and using advanced manufacturing for electrolyzers. One of the fantastic things about the IRA [Inflation Reduction Act] is it’s going to move those supply chains all to the U.S. We’re going to invest in advanced automation, and the cost of electrolyzers will come down easily by half.

VA: You mentioned that the process or the technology behind e-NG has been around for decades. So why haven’t we heard more about e-NG?

CW: There are multiple methods actually for methanization. The process that we use is called the Sabatier process. It was discovered by a French scientist back in 1912. He won the Nobel Prize in chemistry. It has been used by NASA, actually, to produce water on the space station. Water…for u, is a byproduct; for NASA, it was an essential life support mechanism for astronauts on the space station. But other than that, the sheer concept of needing to use CO2 to produce something was not something that society was focused on.

Essentially, if you think about our process, what we do is we recycle CO2. We follow the nature cycle, right? Trees, nature, takes in CO2. It recycles it into useful materials. That’s really what the whole process of producing e-NG does. It recycles CO2 into a useful molecule. As a society, we were focused on other forms of energy— traditional fossil fuels— so [we] didn’t need it.

VA: Has TES moved e-NG through an existing natural gas pipeline system here in Texas before, or is that part of the preliminary study process?

CW: The study will be about the design of the plant. There be won’t be physical movements of anything. We don’t see barriers because it’s chemically, essentially, equivalent to natural gas that is produced via the drill bit. So, we don’t see any showstoppers in that regard.

VA: Have you lined up power purchase agreements yet for the hydrogen? Do you also have to line up like similar agreements for the biogenic CO2? How does all of that work?

CW: We’ve had lots of conversations with renewable developers, renewable electricity providers. In our partnership with Total, it will be their responsibility to bring the renewables. They’re a very large, capable developer of renewables. We’re excited to partner with them. On the CO2 front, we’ll need to contract for the CO2. We’ve had lots of conversations with biogenic CO2 emitters, and we will continue to advance those discussions formally. Think of it as just like a feedstock. Just like a refinery or a chemical plant, we need to ensure in order to make that final investment decision that we have a firm long-term contract to support us building the plant.

VA: Do you see direct air capture being used as part of this process?

CW: Direct air capture is an interesting and promising technology from an overall climate perspective and certainly for the prospects of our e-NG development going forward. We could put a plant anywhere. Our biggest constraint right now is being close to a CO2 source and direct air capture just changes that dynamic.

However, direct air capture is extremely early stages. My former employer, Occidental [Petroleum], is the only one that I’m aware of in the U.S. that has a project underway out in West Texas. They actually just broke ground recently. We don’t see direct air capture being a solution for this first [e-NG] project. But we would love to see [direct air capture] become a lot more economic and be a part of our future plans either in the U.S. or anywhere else around the globe.

VA: What are some of the markets you envision e-NG being used?

CW: For this first project, we are targeting primarily the European market. The Asian market is also a possibility as well. We are producing a premium green molecule, so we will be looking for customers who value decarbonization the most. In Japan, they’ve set a target of filling their entire city gas natural gas distribution system, like our CenterPoint [Energy] here in the U.S., with 90% … e-NG. They’ve put mandates in place. Similarly, Europe has put some quotas and mandates around e-fuels being a requirement for the transportation industry. There are other mandates going in place. So, there’s lots of support to develop demand in the European and Asian markets.

In the U.S. what we see is pretty significant demand for renewable natural gas and a market that’s really undersupplied right now. We think our e-NG can fit right into that market as well. Here in the U.S., the majority of the RNG goes into transportation fuels. But there’s a growing piece of the pie that is going into natural gas utilities, again like a CenterPoint here in Houston. There are good markets everywhere but [demand is] really driven by internationally some of those quotas and mandates around green molecules.

VA: How do you see the market evolving over the next five to 10 years?

CW: TES has a big ambition. We would like to produce in 2030, a million tons a year of CH4 [methane] of green e-NG. What we just announced is about 20% of that target. I think actually a lot if not all of that production potentially could come from the U.S. and then we've got tremendous opportunity abroad as well. So ultimately, we have a longer-term target at being much bigger than a million tons a year. Of course, we always remind ourselves it starts with just one project, so we need to just get one online.

I would leave you with this. The United States has been a major force of change for the global energy system, and it started 15-20 years ago with the shale revolution, which you’ve reported on undoubtedly for a very long period of time. But I think the shale revolution is beginning to sunset; it’s beginning to mature. I think the U.S. has an opportunity now to step in and demonstrate huge leadership on the next revolution, which is around green molecules and green electrons. The opportunity to invest and the opportunity for the U.S. to play a massive role is multiples of the shale revolution. It’s three or four times. It’s a huge market. TES and e- NG hopes to play a very big role in it, but we’re going to start with just one.

Editor’s note: This interview was edited for length and clarity.

Recommended Reading

Early Startup of Trans Mountain Pipeline Expansion Surprises Analysts

2024-04-04 - Analysts had expected the Trans Mountain Pipeline expansion to commence operations in June but the company said the system will begin shipping crude on May 1.

TC Energy's Keystone Oil Pipeline Offline Due to Operational Issues, Sources Say

2024-03-07 - TC Energy's Keystone oil pipeline is offline due to operational issues, cutting off a major conduit of Canadian oil to the U.S.

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.