Talk about too much of a good thing.

In just a few years the U.S. has gone from being considered a mature province to producing more oil and gas than Russia and diminishing Saudi Arabia’s ability to control global prices. In the process, however, supply has outpaced demand, and commodity prices have dropped accordingly.

Operators will not quit drilling shale wells. But with slower activity in the next few months, they might start drilling and completing them more optimally. And there’s where technology can help.

An Integrated Approach

Oil and service companies are starting to view the shale proposition in a more integrated fashion. While efforts in the past have focused on drilling the wells as quickly as possible, now effective completions are taking center stage.

Mo Cordes, vice president of integration at Schlumberger, said that studies on perforation effectiveness have provided some sobering results. “We started looking at all of the different shale plays across North America, and one thing we found was that a large part of the lateral was not producing,” Cordes said. “We ran a number of production logs in these laterals and found that 40% of the perf clusters were not contributing to production.”

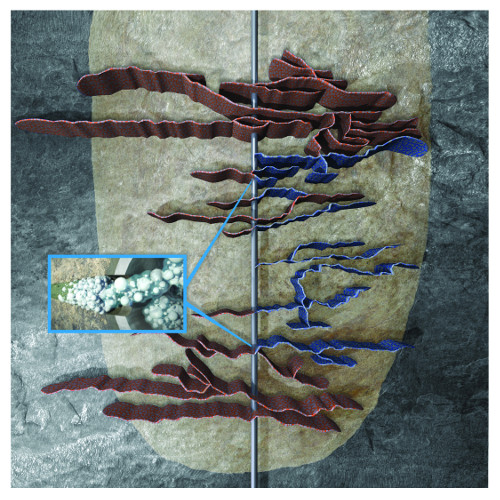

The Schlumberger BroadBand Sequence fracturing service enables sequential stimulation of perforation clusters, maximizing wellbore coverage and reservoir contact. (Source: Schlumberger)

This discovery prompted the company to examine new ways of ensuring more productive completions. “There’s really not one silver bullet,” he said. “It’s a series of workflows and technologies that are starting to unlock the full potential of these plays and improve the productivity.” He added that some areas are seeing up to 40% improvement in production.

The Schlumberger approach integrates drilling, completions and production along with a full understanding of the reservoir. This pulls on the expertise of many different people within the company.

“We’ve moved away from the cookie-cutter approach to optimizing the completion along the lateral to ensure we improve the productivity,” he said. “We’re seeing 80% and in some cases close to 100% contribution of the lateral when we put this process together.”

Baker Hughes recently launched its NextWave service to maximize value from the existing wells in unconventional reservoirs. “The first wave isn’t over yet,” said Sergey Kotov, manager of integrated technology for Baker Hughes. “The difference is that going forward we need to change our approach to unconventional reservoir development to one that is more strategic. The first wave focused more on wells and cost efficiencies rather than long-term production and ultimate recovery.”

He added that past approaches led to inconsistent results. “This could be justified when oil prices were $100/bbl, but even then it was unacceptable,” he said. “Now it has become more critical.”

Increasingly, operators are turning to refracturing to optimize their completions. The service covers a broad spectrum of solutions and offers a comprehensive approach to rejuvenating existing underperforming wells. Candidates are screened through a review of production data, reservoir quality and initial completion and then diagnosed. Next a rejuvenation program is designed, and economic analysis is performed. This leads to a detailed operational plan.

Different wells will require different treatments. Some might benefit from cleanouts, chemical treatments and installation of artificial lift systems, while others might require mechanical isolation and restimulation.

Refracking

Costs might have come down somewhat, but it’s still an expensive proposition to drill a shale well. Kotov said that well rejuvenation costs a fraction of the cost of a new well. “It’s a faster payback and provides increased bookable reserves since we’re adding reserves by accessing more reservoir and changing the decline curve,” he said. There is also lower HSE risk because the infrastructure is already in place, he said.

Not every well makes a superb refracking candidate, however. “When the industry started doing refracks in shales, the results were very diverse from play to play and from well to well,” he said. “We needed to understand the reservoir and use a holistic approach to identify the candidates.”

Cordes said that having a wide variety of technologies helps to optimize these plays. For instance, Schlumberger applies its HiWAY flow-channel fracturing technique to increase fracture conductivity, and it uses its BroadBand Sequence fracturing service during refracturing to improve production. “It’s one of the best diverting agents,” he said. “That allows refracturing to work.”

A study recently conducted by Baker Hughes indicated an average EUR increase of 53% in the Eagle Ford Shale and 69% in the Bakken. Schlumberger’s Cordes added that some wells perform better after refracking than their original IP rates.

Data Mining

As more data become publicly available, many operators and service companies are turning to multivariate analysis to look for patterns in their producing fields that might provide clues to future success.

The process is not simple, according to “Data mining from shale plays critical in low-price environment,” an article in Ryder Scott’s Reservoir Solutions quarterly publication. “As many as 100 variables in geology, well architecture, completions, stimulations and production may apply to a single well location,” the article stated. “Those parameters en masse generate an enormous number of combinations requiring iterative processes to detangle and analyze.”

Randy LaFollette, director of applied reservoir technology at Baker Hughes, told Ryder Scott that his approach is to use multivariate analysis combined with pattern recognition from GIS systems.

This approach “better predicts dependent variables based on observed values even in cases where relationships are complex and non-linear,” the article stated.

Less Expensive Takeaway

A good deal of the cost involved in shale development is in infrastructure. A company called Polyflow LLC has developed an alternative to laying and welding miles of steel pipes in the field. Called Thermoflex, it’s a reinforced thermo-plastic pipe that comes on enormous spools and is simply unspooled in the field.

PolyFlow’s Thermoflex pipe is unspooled in a field. The thermo-plastic pipe offers numerous advantages over other types of pipe. (Source: PolyFlow)

According to Polyflow CEO Jim Medalie, Thermoflex has several advantages over steel. “Number one, it’s a very safe product to use,” he said. “There’s no welding involved or large machinery required. It alleviates a lot of the risks and issues with steel and other heavier composite materials.”

Second is reliability. The pipe has liners that are resistant to hydrocarbons along with the other substances that tend to reside in wellbores. No corrosion inhibitors are needed as the pipe cannot corrode.

Finally, there’s the increased return on investment. “Our product is less expensive to install and less expensive to operate, and it goes in faster,” Medalie said. “If you can get the well flowing two days faster than with another product, that’s two days of return from the oil that you’re producing from that well.”

Related article: Need For Improved Technology Remains Despite Strides

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Orange Basin Serves Up More Light Oil

2024-03-15 - Galp’s Mopane-2X exploration well offshore Namibia found a significant column of hydrocarbons, and the operator is assessing commerciality of the discovery.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.