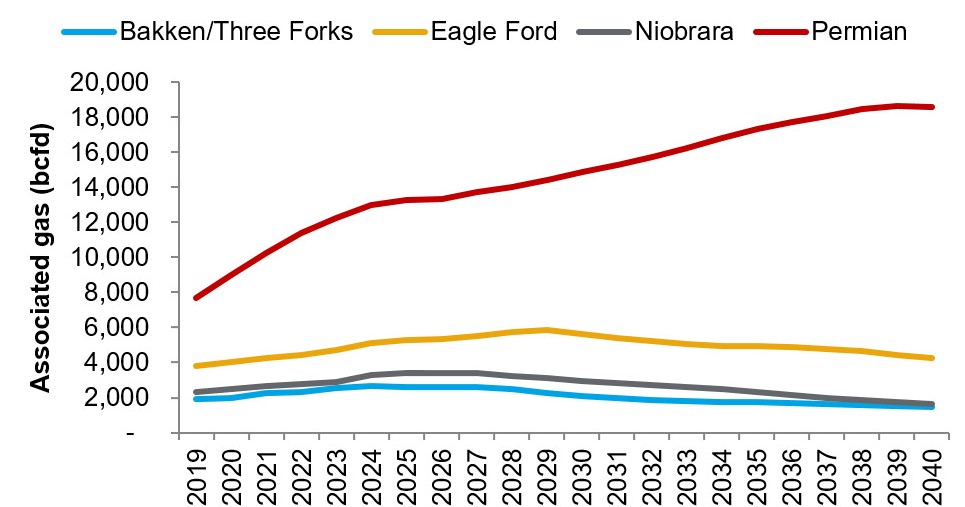

The shale revolution has shifted the energy landscape in the U.S., and the center of that change is the Permian Basin. Technology and new infrastructure have made the Permian Basin the largest and fastest-growing region in the world for oil production. The volumes of associated gas from the basin are driving significant changes in both U.S. and global energy markets.

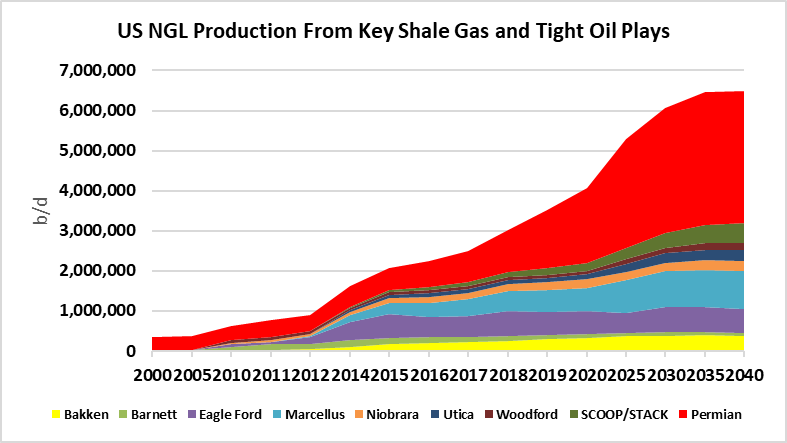

Growing demand for ethane has led operators in the Permian to look for new technologies that would enable them to increase ethane production. These include processing systems that improve NGL recovery and provide the operator with the option to choose between ethane recovery and rejection, with lower energy consumption.

One operator in the Permian Basin interested in expanding its gas processing capacity evaluated performance of the standard gas subcooled process (GSP) technology commonly used in the U.S. against the supplemental rectification with reflux (SRX) process from Honeywell UOP. The operator concluded the SRX process extracted the highest level of propane and heavier propane-plus components while providing the flexibility to recover NGL in ethane rejection or recovery mode, while operating at high energy efficiency.

Until recently, the industry was focused on “fast gas,” where midstream gas processors sought to maximize their internal rate of return on investments by quickly bringing gas processing plants into production. Today, these processors are shifting from “fast gas” to more sustainable and flexible, low-cost production.

IHS Markit recently reported that it expects 45% growth in the production of NGL in the U.S. during the next five years and total production to reach nearly 6 MMbbl/d by 2025. The Permian Basin is the most profitable shale basin in the U.S., and it has the largest inventory of low-cost wells.

Permian wells can be profitable at WTI pricing at or above $45/bbl. Oil production from the Permian continues to run at more than 4 MMbbl/d. Drilling there has focused on oil with large volumes of associated gas that is rich in NGL. In fact, the volume and pricing of associated gas has created a resurgence in petrochemical production and the emergence of the U.S. as a global player in LNG.

While ideal as a petrochemical feedstock, ethane often can constrict recovery of higher-value liquids due to constraints in pipeline capacity. But demand for ethane increasingly has been driven by new domestic ethane cracking capacity and new infrastructure to export ethane to global markets.

Ethane remains the swing NGL, as pricing continues to be driven upward by petrochemical demand but limited by its value relative to other liquids and transportation constraints. Volatility in ethane pricing created an opportunity for flexible gas plants to optimize recovery to improve returns in ethane rejection or recovery.

Because the Permian Basin is close to shipping facilities and petrochemical capacity along the Gulf of Mexico, the flexibility to efficiently operate in ethane rejection or recovery mode—while maximizing recovery of NGL—is critical.

A technology shift is occurring in natural gas processing plants, which are focusing on higher recoveries with greater operational flexibility and lower compression-energy requirements. A growing number of these plants are choosing NGL recovery solutions that can move between ethane recovery and rejection to capitalize on changes in ethane pricing.

Price volatility in ethane gives flexible gas processors new opportunities for profit. Greater volatility means that swings in ethane rejection or recovery adjust to changes in netback value. Operators also require full recovery of propane and high-energy efficiency to deliver profit during periods of ethane rejection.

GSP versus SRX

Most of the installed gas processing capacity in the U.S. uses GSP technology developed by Ortloff Engineers during the 1970s. UOP acquired Ortloff in October 2018, and it now is part of UOP’s Gas Processing Technologies business.

While for decades the standard practice for U.S. gas processors has been to use GSP technology—which uses modularization to enable “fast gas”—its use amid rising demand and production of NGL has caused a major loss of valuable propane in rejection mode and has prevented recovery of high levels of ethane.

The limited flexibility and NGL recovery of GSP led a Permian Basin operator to compare the technology with UOP’s SRX technology. Both were applied in a wet gas field containing large volumes of high-Btu gas. The economics of this play are driven by low-cost oil with additional NGL and is typical of a field in the Permian Basin. The study also included UOP and Ortloff processes such as supplemental rectification with compression, supplemental rectification process, single column overhead recycle and recycle split vapor.

The study evaluated solutions that improve ethane recovery flexibility and propane-plus recovery and minimize energy consumption—both to improve the return on capital, given ethane price volatility.

The study indicated that SRX technology reached ultrahigh recovery rates, with near-total ethane recovery while in recovery mode. Because it incorporates ways to efficiently create reflux, SRX enables the process to achieve any level of ethane recovery while maintaining ultrahigh recovery of propane-plus. The SRX technology also maintained full recovery of NGL products with lower energy consumption when operating in full ethane

rejection.

In rejection mode, SRX technology recovered nearly all propane-plus with 24% less energy, while GSP only recovered 87% of propane-plus with no reduction in energy consumption. If the GSP plant was not constrained by energy consumption, the system could have recovered up to 95.5% of propane-plus. But energy consumption would have been 21% higher than in recovery mode. In rejection mode, SRX used 24% less compression than GSP while still recovering more propane-plus.

The study showed that the SRX cryogenic facility’s flexibility enabled the operator to take advantage of the ethane recovery and rejection because the operator could adjust ethane recovery to meet demand and manage the entire ethane recovery range while sustaining NGL recovery. The SRX technology maximized processing economics through lower energy consumption and higher propane recoveries during rejection.

As a result of the study, UOP is deploying SRX technology elsewhere in the Permian Basin. In addition to the new SRX capacity being added, typically in stages of 200 MMcf/d to 300 MMcf/d, UOP also is implementing modular solutions to retrofit existing GSP units to near-SRX performance. The modular execution of these projects shortens project schedules and enables the units to be customized for the unique gas composition in the region.

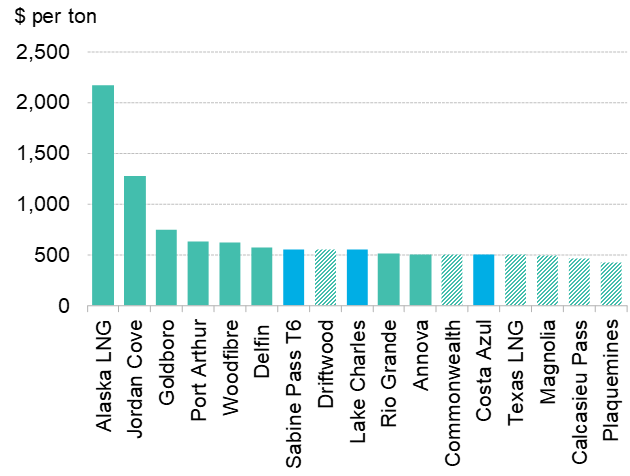

Unit Cost for Select Proposed LNG Projects

Associated gas aiding US LNG boom

Natural gas production in the Permian is largely associated gas, which is a byproduct of oil production. This gas has been a key enabler for the LNG boom in the U.S., helping it to become the largest LNG producer by the early 2020s. This growth resulted from the longterm availability of low-cost feedstock, avoidance of large capital costs associated with upstream drilling, and innovative pricing and construction techniques such as modular facilities.

Modular technology, a disruptive technology in LNG, allows U.S. greenfield plants to become the lowest cost liquefaction providers, enabling competition with brownfield sites.

Associated Gas Production by Play