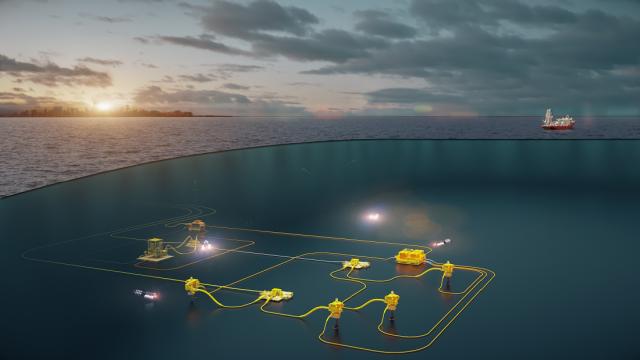

TechnipFMC says it provides innovative solutions that improve economics, enhance performance and reduce emissions. (Source: TechnipFMC)

TechnipFMC Chairman and CEO Doug Pferdehirt exudes confidence.

The subsea powerhouse doubled its subsea inbound orders to $1.5 billion in first-quarter 2021 compared to the previous quarter thanks to increased adoption of Subsea 2.0 technologies. Based on the belief that subsea activity will continue rising this year as global recovery leads to sustained growth, its top executive now anticipates TechnipFMC’s subsea inbound orders will surpass $4 billion by year’s end.

“The amount of tendering that’s happening in the general market has increased quite significantly,” Pferdehirt said this week at J.P. Morgan’s Energy, Power & Renewables Conference. “We were starting to see an uptick in the tendering activity even before the uptick in the commodity pricing; that’s just given even further and greater confidence and maybe the ability to accelerate some projects sanctioning as a result of the increased economics associated with the improved commodity outlook.”

Oil prices have bounced back from the historic lows seen last year when the global pandemic forced quarantines and a short-lived OPEC+ spat led to extreme volatility. With WTI above $72/bbl and Brent above $74/bbl today, some analysts have speculated it could reach $100. This comes as operators, with the financial capability, push forward with offshore projects.

TechnipFMC’s unique integrated engineering, procurement, construction and installation (iEPCI) model combined with subsea technologies sets it apart from others, he said, later noting up to 50% of its contracts are awarded directly to the company which this year split to create Technip Energies.

“There’s some very big greenfield developments that are out there, which I know surprises some people, and there’s a significant amount of obviously tieback opportunities around the world,” Pferdehirt said. “There’s a lot of strength geographically in South America—Brazil [and] Guyana really driving that—and in the North Sea, particularly in the Norwegian sector, and tieback opportunities in the Gulf of Mexico. So, there’s a lot of activity and a lot of enthusiasm.”

So, what’s driving its outlook for higher tendering, given some industry perception that oil and gas capex is lagging amid the energy transition?

Pferdehirt pointed to project economics, the quality of reservoirs offshore and favorable regulatory environments in most regions. He also acknowledged that not all clients have the same investment thesis.

Perhaps also helping is improved free cash flow. Rystad Energy said June 23 that deepwater and offshore shelf are recovering, each forecasted to end the year with nearly $60 billion in free cash flow from upstream activity, excluding cash from financing and hedging. The analysts also forecast that sanctioned greenfield investments, including onshore, could double that seen last year.

Traditionally, international oil companies have driven the offshore industry. However, there has been growing participation from national oil companies and independents, Pferdehirt said, adding that’s favorable for TechnipFMC. “Those clients may not have the same history or internal competencies in subsea developments,” he said, highlighting the benefit brought by a single company that can offer in a single contract services from early engineering through the life of a field.

When talk turned to pricing—as service companies, in general, have been hit during downturns—he spoke to TechnipFMC’s exclusive relationships with clients, saying those conversations are not pricing discussions.

“We’re looking at the project economics,” said Pferdehirt. “We’ve gotten a seat at the big table. We’re no longer at the suppliers’ table. … It’s not a pricing discussion, if you will. It’s a how do we maximize the project economics, which is good for the project, and if it’s good for the project, it’s proven to be very good for us as a partner in the project.”

When it comes to the traditional tendering market, he added the company’s tendering approach is disciplined, structured and selective.

“We don’t have to chase every tender,” he said.

“We’ll work where we believe we can bring the greatest differentiation, an example of which was the Petronas award, where we can leverage our iEPCI and our Subsea 2.0, as an example.”

Petronas Carigali in February awarded TechnipFMC a contract, valued between $250 million and $500 million, for FEED, iEPCI and commissioning of subsea production system, umbilicals, risers and flowlines for the Limbayong deepwater development project.

“In that market, I would say, we’re seeing more disciplined change,” he added. “And, you know, the pricing will obviously follow as the demand continues to absorb capacity.”

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.