TC Energy Corp. on Feb. 12 canceled the binding open season for the Keystone XL (KXL) oil pipeline it had launched at the start of the year, further signaling the end to the contentious project.

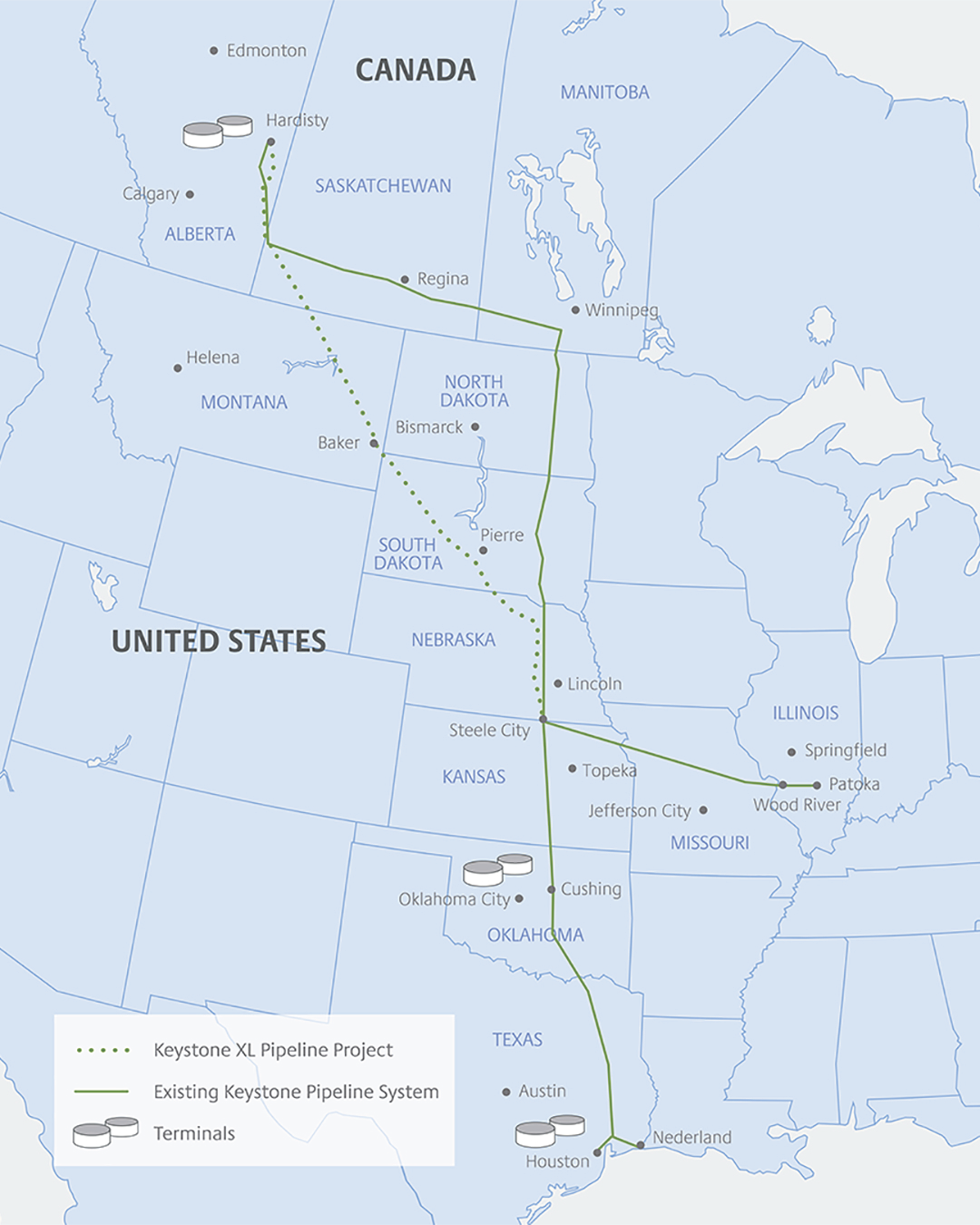

The KXL project was designed to move up to 830,000 bbl/d of Canadian crude from Alberta to Nebraska. Announced 12 years ago, the line was already well under construction in Canada.

While it was supported by the outgoing Trump administration, which approved the permit in March 2019, KXL’s ability to move forward in construction in the U.S., however, had been hobbled by intense opposition from landowners, Native American tribes and environmentalists.

TC Energy had launched the open season on Jan. 6 to solicit binding commitments for crude oil transportation services on the Keystone Pipeline System from Hardisty, Alberta, to Patoka, Illinois. The capacity offered would have become available when Keystone XL went into service.

Though, shortly after taking office on Jan. 20, U.S. President Joe Biden signed an executive order revoking KXL permit—effectively killing the project—as part of his promised to put the United States on a track to net-zero emissions by 2050.

RELATED:

Oil and Gas Industry Stung by Biden’s Blow Against KXL

Due to revocation of its presidential permit, TC Energy immediately suspended advancement of the Keystone XL pipeline project, causing it to eliminate more than 1,000 construction jobs.

On Feb. 9, the head of the U.S. Senate energy committee, Joe Manchin, urged Biden to reverse his opposition to the KXL pipeline, saying the project provides union jobs and is safer than transporting the oil via trucks and trains. Fourteen attorneys general, led by Austin Knudsen of oil-producing Montana, have also urged Biden in a separate letter to reverse his decision on the Keystone permit.

Reuters contributed to this article.

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.