Targa Resources Corp. is buying back the interests in its development company joint ventures (DevCo JV) from investment firm Stonepeak Partners LP for approximately $925 million, the Houston-based midstream company said in a Jan. 10 release.

The assets from the DevCo JVs—originally formed in 2018—include a 20% interest in Grand Prix NGL Pipeline, a 25% interest in Gulf Coast Express Pipeline and a 100% interest in Train 6 fractionator in Mont Belvieu, Texas. The transaction, which is scheduled to close on Jan. 14, had previously been discussed during the company’s third-quarter earnings call last November.

“With all assets set to be consolidated as of Friday, we anticipate a near-term sale of GCX (Gulf Coast Express Pipeline) could be in the works as previously rumored sales price of ~$750 million would reduce the net outflow to $175 million resulting in a TPHe sub-2.0x transaction multiple on the remaining Grand Prix and Frac 6 interests,” analysts with Tudor, Pickering, Holt & Co. (TPH) wrote in a Jan. 11 research note.

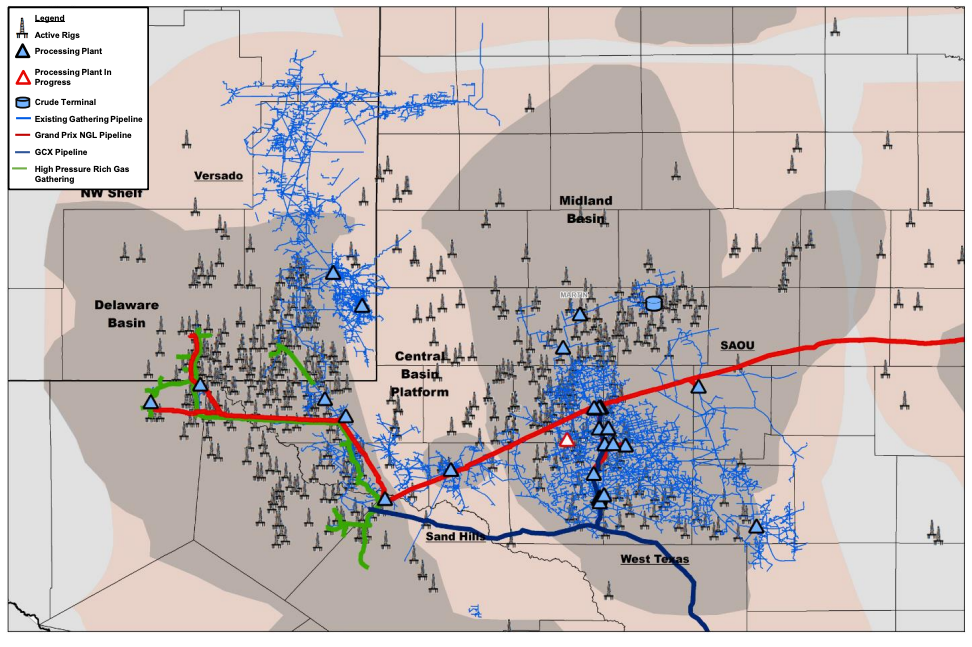

The Gulf Coast Express Pipeline transports natural gas from the Permian Basin to outside Corpus Christi on the Texas Gulf Coast. The pipeline began operating in September 2019 and can carry 2 Bcf/d of natural gas. Other owners of the Gulf Coast Express include Kinder Morgan Inc., Altus Midstream and DCP Midstream. Meanwhile, the Grand Prix NGL Pipeline connects Permian supply to key demand markets, including the U.S. petrochemical hub and Targa’s LPG export position in Mont Belvieu, also located on the Texas Gulf Coast.

Targa had agreed in February 2018 to form the DevCo JVs with Stonepeak Infrastructure Partners to support the development of the three key fee-based downstream assets. The partnership was expected to significantly reduce Targa’s equity funding needs for 2018 and 2019, according to a company release from that time.

As part of the initial DevCo JV agreement, Stonepeak committed an aggregate of approximately $960 million of capital, including an initial contribution of approximately $190 million that will be distributed to Targa to reimburse the company for capital spent to date. Targa committed to fund approximately $150 million related to its share of the DevCo JVs’ future capital costs.

In total, the DevCo JVs were estimated to be worth roughly $1.1 billion. Targa had also retained the option as part of the agreement to acquire all or part of Stonepeak’s interests for a four-year period beginning on the earlier of the date that all three projects have commenced commercial operations.

Targa had approximately $3.2 billion of available liquidity at year-end 2021 and intends to fund the DevCo acquisition using available liquidity, the company said. Pro forma for the acquisition, Targa will own a 75% interest in its Grand Prix NGL Pipeline, 100% of its Fractionation Train 6 in Mont Belvieu, Texas, and a 25% equity interest in the Gulf Coast Express Pipeline.

With the elimination of the DevCo structure and broader capital simplification, TPH estimates that Targa’s existing valuation guidance of about 5.5 times EBITDA translates to about $170 million of additional earnings though the firm said it models slightly above that for Targa for fiscal-year 2022 given ramping NGL throughput.

“While we currently expect <$100 million of excess FCF in 2022, the sale would result in a significantly higher total of TPHe ~$760 million that could be used to accelerate the Series A pref buyout in addition to common equity,” the TPH analysts wrote.

Recommended Reading

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.