Lucid Energy Group is the largest privately held natural gas processor in the Permian Basin, providing the full range of gas midstream services to more than 50 customers in New Mexico and West Texas, according to the Targa release. (Source: Lucid Energy)

Targa Resources Corp. on June 16 agreed to acquire Lucid Energy Group in the Permian Basin from Riverstone Holdings LLC and Goldman Sachs Asset Management.

The $3.55 billion cash transaction, which will increase Targa size and scale in the Delaware Basin, follows the company’s recent “bolt-on” acquisition of Southcross Energy in the Eagle Ford for $200 million. Targa said it has available liquidity, including cash on hand, its existing $2.75 billion revolving credit facility, and committed debt financing to fund the Lucid acquisition.

“The strength of Targa’s standalone financial position has afforded us the flexibility to consider attractive opportunities to grow our business through acquisitions, as evidenced by our ability to finance the purchase of Lucid utilizing available cash and debt with estimated pro forma year-end 2022 leverage around 3.5 times, well within our long-term leverage ratio target range,” Targa CEO Matt Meloy commented in a company release.

Lucid Energy Group is a leading privately held natural gas processor in the Permian Basin led by Michael J. Latchem as president and CEO. The company is supported by growth capital commitments from a joint venture formed by Riverstone Global Energy and Power Fund VI LP, an investment fund managed by Riverstone Holdings LLC, and investment funds managed by Goldman Sachs Asset Management.

“We congratulate Mike Latchem and the entire Lucid team on today’s milestone,” Baran Tekkora, a partner at Riverstone and co-head of private equity, said in the Targa release. “The transaction with Targa will position Lucid for its next stage of growth, while creating enhanced opportunities for its employees, customers and communities.”

Riverstone and Goldman Sachs had acquired Lucid Energy in 2018 from Lucid Energy Group I LLC, which later changed its name to Cogent Midstream, for roughly $1.6 billion cash. Cogent has since been acquired by Canes Midstream LLC.

“We are pleased to have partnered with Lucid and Riverstone over the last several years, as the company has continued its growth as a leading gas gathering and processing platform in the Delaware Basin,” added Scott Lebovitz, partner and co-head of the infrastructure investing business within Goldman Sachs Asset Management.

As part of the transaction in 2018, Lucid I and its financial sponsor, EnCap Flatrock Midstream, agreed to sell its Delaware Basin subsidiary, Lucid Energy Group II LLC to a joint venture controlled by Riverstone and Goldman Sachs. The transaction, which closed first-quarter 2018, included committed debt financing provided by Jefferies LLC.

Following close of the transaction, Lucid II retained the name Lucid Energy and operated as a Riverstone and Goldman Sachs portfolio company. Its assets were located in the core of the northern Delaware Basin and are known as the South Carlsbad Natural Gas Gathering and Processing System and the Artesia Natural Gas Gathering and Processing System.

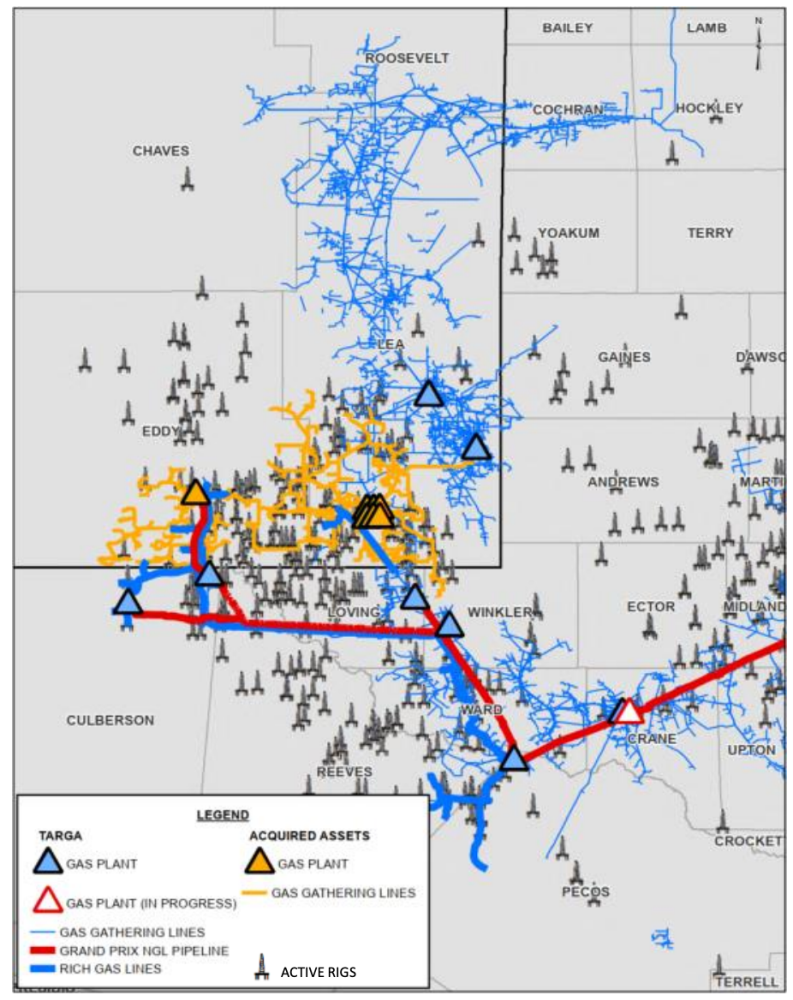

On June 16, Targa said the acquisition of Lucid will add approximately 1,050 miles of natural gas pipelines and approximately 1.4 Bcf/d of cryogenic natural gas processing capacity in service or under construction located primarily in Eddy and Lea counties of New Mexico. Approximately 70% of current system volumes are sourced from investment-grade producers.

Additionally, Lucid’s assets are anchored by long-term, fixed-fee contracts and acreage dedications from a diverse set of high-quality customers totaling more than 600,000 dedicated acres.

“Lucid’s management team has developed an attractive position in the Delaware Basin and we look forward to continuing to provide value-added services to the producer customers,” Meloy said in the company release.

“This is an exciting acquisition,” he continued, “that aligns with our integrated strategy as we are expanding and diversifying our Permian Basin footprint with Lucid’s complementary presence at an attractive investment multiple that we expect will further enhance the creation of shareholder value and continue to drive more volumes through Targa’s downstream businesses.”

Lucid’s Delaware Basin footprint overlays some of the most economic crude oil and natural gas producing acreage in North America, according to the company release. Targa noted that current rig activity supports over 20 years of drilling inventory on Lucid’s greater than 600,000 dedicated acres, which are further supplemented by significant volumes subject to minimum volume commitments.

“Over the past several years, Lucid has firmly established itself as a leading midstream processor in the Delaware Basin, with a talented team, sophisticated operations and infrastructure, and strong customer partnerships,” commented Lucid Energy CEO Mike Latchem in the release. “I am immensely proud of what we have achieved, as today’s transaction is a testament to the commitment and expertise of our team members and our strategy of growing the business for the benefit of all stakeholders.”

On June 16, Targa said it now estimates full-year standalone adjusted EBITDA to be between $2.675 billion and $2.775 billion and reported year-end leverage ratio of about 2.7 times. Targa’s updated financial expectations assume NGL composite prices average $1.05 per gallon, crude oil prices average $100/bbl and Waha natural gas prices average $6 per MMBtu for the remainder of 2022.

“The acquisition is expected to be immediately accretive to distributable cash flow per share. This acquisition further supports our already strong cash flow profile and ability to return an increasing amount of capital to our shareholders through common dividend increases and common share repurchases,” Meloy added.

The Lucid acquisition is expected to close in the third quarter. Completion of the transaction is subject to customary closing conditions, including regulatory approvals.

Evercore and Mizuho Securities USA LLC are Targa’s financial advisers and Vinson & Elkins LLP is acting as the company’s legal counsel on the transaction. Jefferies LLC is financial adviser, and Latham & Watkins LLP and Fried, Frank, Harris, Shriver & Jacobson LLP are legal counsel to the seller group.

Recommended Reading

Chesapeake-Southwestern Deal Delayed Amid Feds Scrutiny of E&P M&A

2024-04-05 - The Federal Trade Commission asked Chesapeake and Southwestern for more information about their $7.4 billion merger — triggering an automatic 30-day waiting period as the agency intensifies scrutiny of E&P deals.

Which Haynesville E&Ps Might Bid for Tellurian’s Upstream Assets?

2024-02-12 - As Haynesville E&Ps look to add scale and get ahead of growing LNG export capacity, Tellurian’s Louisiana assets are expected to fetch strong competition, according to Energy Advisors Group.

EQT, Equinor Agree to Massive Appalachia Acreage Swap

2024-04-15 - Equinor will part with its operated assets in the Marcellus and Utica Shale and pay $500 million to EQT in exchange for 40% of EQT’s non-operated assets in the Northern Marcellus Shale.

EQT, Equitrans to Merge in $5.45B Deal, Continuing Industry Consolidation

2024-03-11 - The deal reunites Equitrans Midstream Corp. with EQT in an all-stock deal that pays a roughly 12% premium for the infrastructure company.

EQT Ups Stake in Appalachia Gas Gathering Assets for $205MM

2024-02-14 - EQT Corp. inked upstream and midstream M&A in the fourth quarter—and the Appalachia gas giant is looking to ink more deals this year.