Following closing of the Deltastream acquisition, Tamarack Valley Energy plans to raise its annual dividend by 25% to 15 Canadian cents per share. Pictured, an oil pumpjack in Alberta, Canada. (Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Tamarack Valley Energy Ltd. agreed on Sept. 12 to acquire Deltastream Energy Corp., a privately held pure-play Clearwater oil producer, for total net consideration of CA$1.425 billion.

“The acquisition of Deltastream solidifies Tamarack as the largest producer in the Clearwater oil fairway. This transaction builds on the company’s core position in the Clearwater, which is recognized as North America’s most economic play,” commented Brian Schmidt, president and CEO of Tamarack.

Separately on Sept. 12, Topaz Energy Corp. said it will buy a newly created 5% gross overriding royalty on all current and future oil production from Deltastream’s entire Clearwater acreage for total cash consideration of CA$265.3 million Topaz has a strategic relationship with Tourmaline, according to its release.

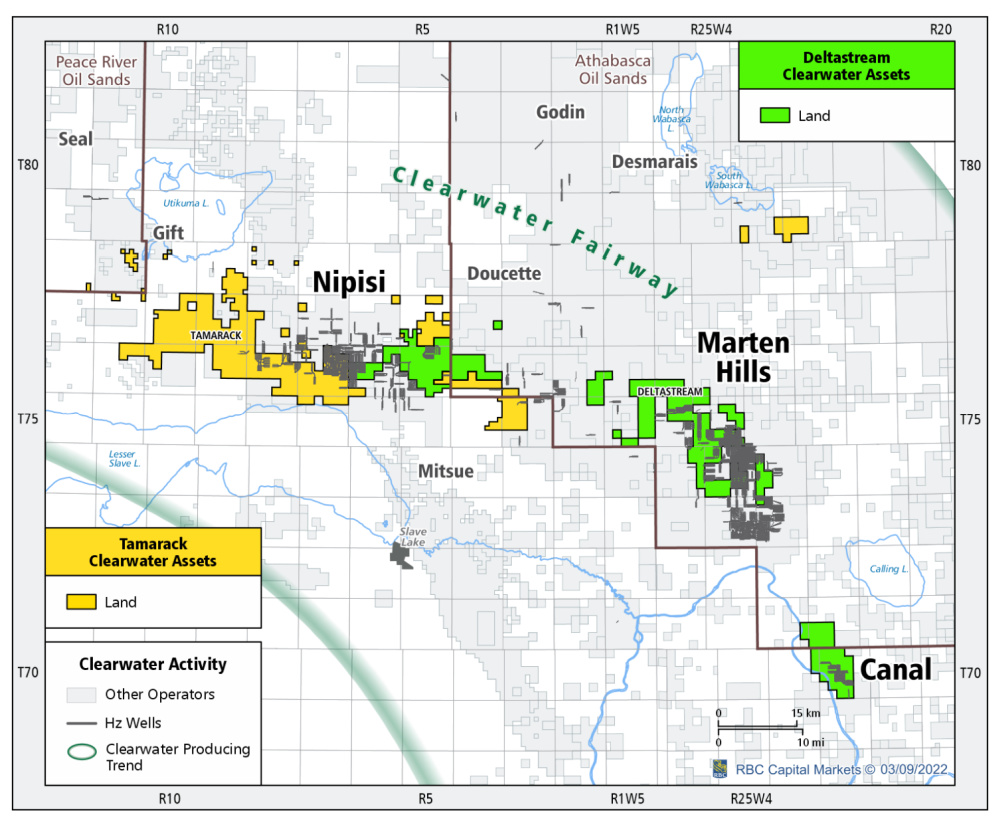

The acquisition of Deltastream, which is backed by ARC Financial, adds an additional 184 net sections of core Clearwater acreage in Alberta at Marten Hills, Nipisi and Canal to Tamarack’s portfolio. The company plans to boost output of the acquired assets by 18% to 23,000 boe/d next year.

“ARC Financial is excited to be a shareholder in Tamarack and participate in value creation from the company’s Clearwater, Charlie Lake and enhanced oil recovery operations,” Bill Slavin, managing director at ARC Financial, commented in the Tamarack release.

“Tamarack has a demonstrated track record of prudent balance sheet management and capital discipline and is led by a highly respected management team with extensive operational and capital markets experience,” Slavin continued. “Tamarack’s proactive approach to the environment, Indigenous partnerships and ethical governance is aligned with ARC’s values.”

Consideration for Deltastream comprises CA$825 million in cash, CA$300 million in deferred acquisition payment and CA$300 million in equity at CA$3.75 per share. The company plans to raise its annual dividend by 25% to 15 Canadian cents per share upon closing, expected before the end of October.

At closing, Tamarack will also enter into a hold period agreement with ARC Financial, who owns approximately 85% of the issued and outstanding common shares of Deltastream (on a non-diluted basis). Of the Tamarack shares issued to ARC Financial, 50% will be subject to a six month escrow period and 50% of the shares will be subject to a 12-month escrow period.

Recommended Reading

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

2024-01-25 - The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.