A Talos-Stone leviathan would hold interests in 1.2 million gross acres with reserves of about 136 MMboe and access to Talos’ offshore Mexico prospects. (Source: Hart Energy)

Readying an E&P broadside at the Gulf of Mexico (GoM), Talos Energy LLC and Stone Energy Corp. (NYSE: SGY) said Nov. 21 they will merge in an all-stock transaction that the companies say represents an equity value of $1.9 billion.

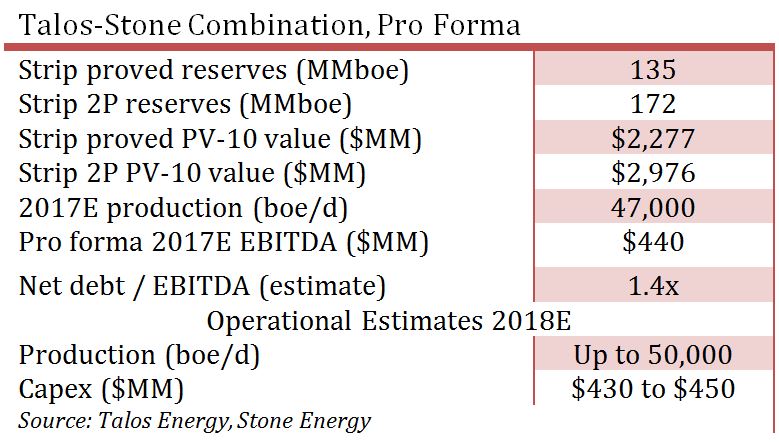

The combined company will be named Talos Energy Inc. and stocked with pro forma proved reserves of about 136 million barrels of oil equivalent (boe), of which 70% is oil. The reserves have a strip-priced PV-10 value of $2.28 billion, the companies said.

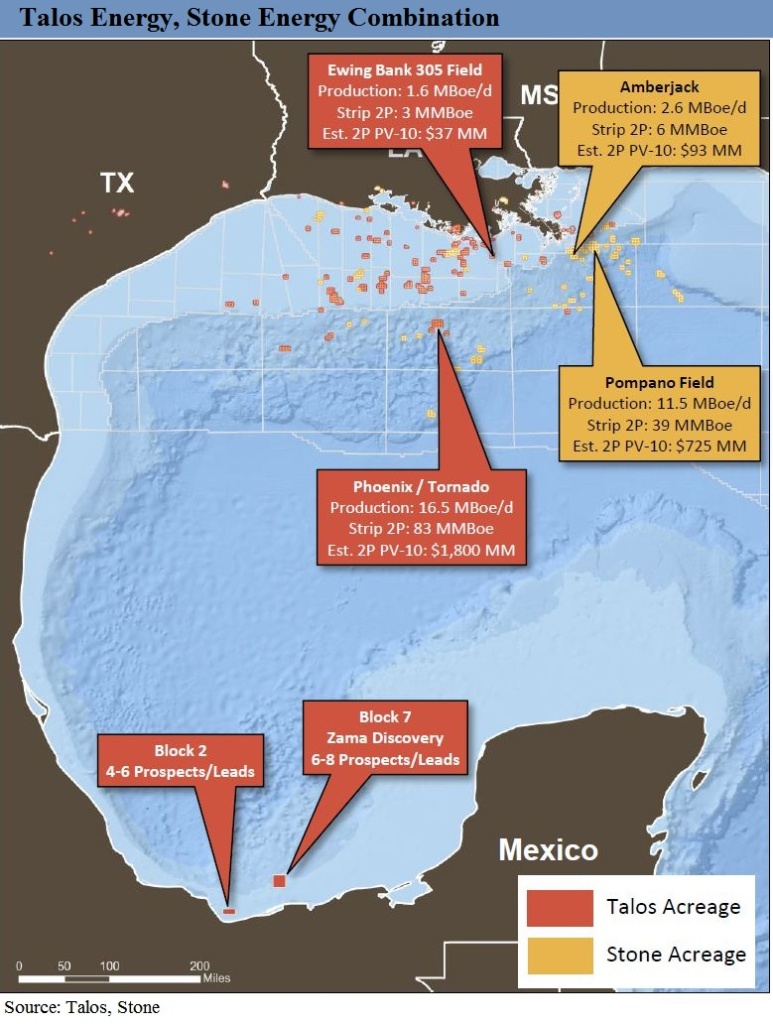

A Talos-Stone leviathan would give the company reign over 1.2 million combined gross acres, including 160,000 acres offshore Mexico. Estimated 2017 average daily production for the new company is anticipated to be 47,000 boe/d. Talos, based in Houston, reported Nov. 21 that its third-quarter production averaged 28,700 boe/d.

The boards for both companies unanimously approved the combination. The deal value is partly based on Lafayette, La.-based Stone's stock price of $35.49 as of Nov. 20, or about $700 million in equity value.

Talos CEO Timothy S. Duncan said the combination represents an important step toward a goal of becoming a premier offshore E&P. The company’s core areas will be deepwater GOM and the Zama discovery located offshore Mexico.

“The combined talent, technical resources and balance sheet of the resulting company will allow us to accelerate development of our own robust project inventory while also giving us the horsepower to pursue compelling transactional and exploration opportunities,” Duncan said.

Duncan said operating synergies and capital efficiency give Talos and Stone an opportunity to create a GoM “frontrunner.” The combined companies said they expect to achieve up to $25 million in annual pre-tax synergies from supply chain management and other operational efficiencies by the end of 2018.

The Zama discovery, operated by Talos, is estimated by the company to have gross crude oil reserves between 1.4 billion barrels (Bbbl) and 2 Bbbl. Talos drilled the first private sector offshore exploration well in the history of Mexico, which led to Zama—one of the 15 largest shallow-water discoveries of the past 20 years, the company said. Talos has two lease blocks offshore Mexico with an additional 10 prospects.

RELATED: Talos Energy CEO Talks About Historic Zama Well

The combined company’s other prospects include the deepwater GOM’s Phoenix and Pompano fields.

In October, Talos completed the Tornado II deepwater drilling campaign in the Phoenix Field in about 2,700 ft of water. The Tornado II drilling campaign consisted of an exploratory test penetration in a fault block adjacent to the company’s initial Tornado discovery in 2016, followed by a sidetrack well to delineate the initial reservoir.

Financially, the new company is expected to have a $1 billion credit facility with $600 million in initial borrowing capacity and no material long-term note maturities until 2022, the companies said.

“Upon closing, the combined company's pro forma unrestricted cash, undrawn credit facility and ability to access public capital markets will provide flexibility to pursue additional attractive growth opportunities,” the company said.

Pro forma, the company’s estimated 2017 net debt-to-2017 EBITDA ratio will be 1.4x and the new Talos will have liquidity of between $325 million and $375 million.

Neal P. Goldman, chairman of Stone, said the transaction represents the culmination of Stone’s announced strategic review process and offers a compelling opportunity for shareholders to benefit from a combined company.

“Talos Energy Inc. will have substantial scale, important asset diversification and a talented management team, along with the strong financial position to continue to grow value for our combined shareholder base,” he said. “I am very proud of Stone's success in growing shareholder value since its financial restructuring in February 2017 and I am confident Tim [Duncan] will lead the combined company to even greater success.”

At closing, Talos stakeholders will own 63% of the combined company and Stone shareholders will own the remaining 37%. Stone’s second lien notes will be exchanged into Talos’ second lien notes and the company will carry a net debt of $611 million.

Duncan will lead the combined company with a board comprised of six directors named by Talos and four named by Stone.

The transaction is subject to the approval of Stone shareholders, consent of a majority of the unaffiliated holders of Stone's 7.5% senior secured notes due 2022 and successful completion of an exchange of the Stone notes for Talos notes. The deal must also pass regulatory approvals.

Franklin Advisers, Inc. and MacKay Shields LLC, investment managers for about 53% of Stone’s outstanding shares, have entered into voting agreements to vote in favor of the transaction, subject to certain conditions.

The transaction is expected to close in the first or second quarter of 2018, the companies said.

Citigroup acted as lead financial adviser and UBS Investment Bank as financial adviser to Talos in the transaction. Vinson & Elkins LLP and Paul, Weiss, Rifkind, Wharton & Garrison LLP were the company’s legal counsel.

Petrie Partners Securities LLC acted as financial adviser to Stone and Akin Gump Strauss Hauer & Feld LLP was the company’s legal counsel in the transaction.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

Global Energy Watch: Corpus Christi Earns Designation as America's Top Energy Port

2024-02-06 - The Port of Corpus Christi began operations in 1926. Strategically located near major Texas oil and gas production, the port is now the U.S.’ largest energy export gateway, with the Permian Basin in particular a key beneficiary.

The Problem with the Pause: US LNG Trade Gets Political

2024-02-13 - Industry leaders worry that the DOE’s suspension of approvals for LNG projects will persuade global customers to seek other suppliers, wreaking havoc on energy security.

BWX Technologies Awarded $45B Contract to Manage Radioactive Cleanup

2024-03-05 - The U.S. Department of Energy’s Office of Environmental Management awarded nuclear technologies company BWX Technologies Inc. a contract worth up to $45 billion for environmental management at the Hanford Site.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.