Talos President and CEO Timothy S. Duncan said what makes this acquisition unique is the combination of high-margin production and a deep portfolio of prospects. (Source: Shutterstock.com)

Talos Energy Inc. went on a buying spree on Dec. 10 to deepen its portfolio in the U.S. Gulf of Mexico (GoM) in a series of deals worth $640 million.

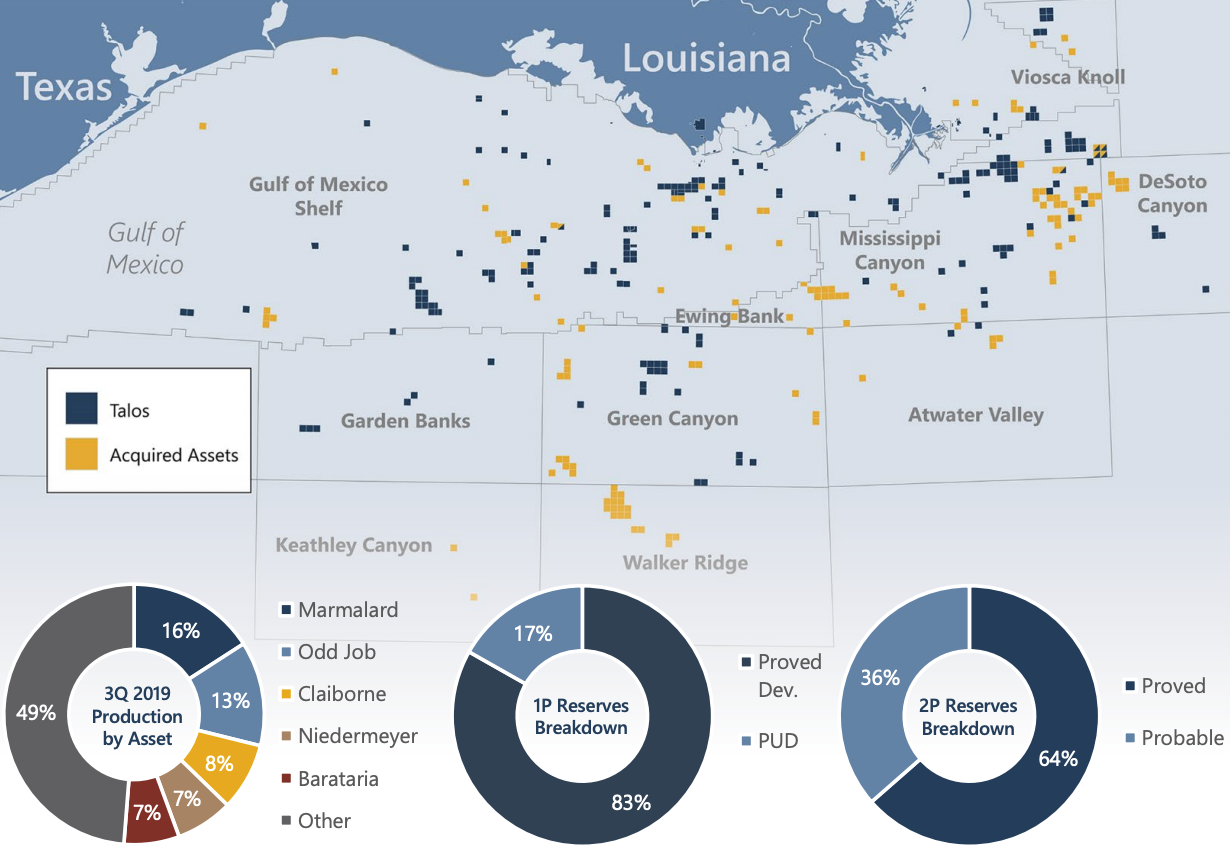

The Houston-based company signed agreements with ILX Holdings LLC, Castex Energy LLC and Venari Resources LLC to acquire assets that include over 40 identified exploration prospects located on a total acreage footprint of roughly 700,000 gross acres. Production during the third quarter was about 19,000 barrels of oil equivalent per day (boe/d), consisting of 65% oil and over 70% liquids.

Talos Energy expects the acquisitions will not only strengthen its position in the GoM, but also provide increased scale and free cash flow (FCF) including about $150 million of FCF for the remainder of 2019. The company’s production is also expected to increase to 72,000 boe/d based on third-quarter results.

“Hard to poke holes in [Talos’] rationale to execute on $640 million worth of deals done at 4.25 times 2019 FCF and three times EBITDA–it’s accretive across pretty much everything you’d care about,” Mike Kelly, senior analyst with Seaport Global Securities LLC, wrote in a Dec. 11 research note, “and with 700,000 gross acres added, this isn’t a PDP blow-down mercy killing sort of transaction either.”

Kelly added what Seaport likes best about the transactions is that Talos’ pro forma FCF yield for the third quarter takes a massive leap forward to 15% vs. 7% on a standalone basis as a result.

The transactions place Talos in the top 20% of all S&P Oil & Gas Exploration & Production (XOP) index E&P constituents in key metrics, including FCF yield, net debt to adjusted EBITDA and adjusted EBITDA margin, all based on actual pro forma third-quarter 2019 annualized figures, according to the company release.

Talos President and CEO Timothy S. Duncan said what makes this acquisition unique is the combination of high-margin production and a deep portfolio of prospects.

“As we consider the full scale of the pro forma business, the combined cash flow profile and the significant exploration portfolio, we are excited about the tremendous potential to build long-term value, not only from these assets alone but from the optimization of the combined asset base, high-grading of investment opportunities, follow-on business development and M&A activity,” Duncan said in a statement on Dec. 10.

The company plans to fund the transactions with $250 million in new Talos shares and existing liquidity sources, including a borrowing base that has been increased by $100 million to $950 million. Talos said its borrowing base will increase further to about $1.2 billion at the closing of the ILX and Castex acquisitions expected in first-quarter 2020. The company’s transaction with Venari already closed.

Guggenheim Securities LLC was lead financial adviser to Talos and provided a fairness opinion with respect to the ILX and Castex acquisitions. J.P. Morgan Securities LLC also provided financial advice to Talos related to financing and led the arrangement of increased commitments with respect to the company’s revolving credit facility and borrowing base. Vinson & Elkins LLP was legal adviser to Talos. Evercore Inc. and Latham & Watkins LLP served as financial and legal advisers to Riverstone Holdings LLC, respectively.

Affiliates of Apollo Global Management and Riverstone Holdings LLC collectively control about 63% of Talos outstanding common stock. Both ILX Holdings and Castex Energy are Riverstone portfolio companies. Venari Resources is backed by Warburg Pincus, Kelso & Co., Temasek Holdings Private Ltd. and The Jordan Co., according to the company website.

Recommended Reading

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

E&P Highlights: April 8, 2024

2024-04-08 - Here’s a roundup of the latest E&P headlines, including new contract awards and a product launch.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.