Oil platform in the Gulf of Mexico. (Source: Shutterstock)

Talos Energy kicked off 2023 with the announcement of commercial deepwater discoveries in the Gulf of Mexico that will tie back to the nearby Ram Powell platform, the company said Jan. 3.

The company reported the Lime Rock and Venice prospects, which the company holds 60% working interest in each, had found oil and natural gas in the fourth quarter of 2022. Talos operates the Ram Powell tension leg platform (TLP) with 100% interest.

Talos reported finding 78 ft of pay in the Lime Rock primary target and 72 ft of pay in the Venice primary target, saying in a press release that both had “excellent geologic qualities.”

Pressure, fluid and core samples were collected to confirm the discoveries. Talos also said the expected combined gross recoverable resources are in-line with pre-drill estimates of 20 MMboe to 30 MMboe, with 40% being oil and 60% being liquids.

Talos expects combined gross production rates in-line with pre-drill estimates of 15,000 boe/d to 20,000 boe/d. Talos said the pair will produce through a shared riser system at the Ram Powell facility. Lime Rock’s subsea tieback to Ram Powell will be 9 miles while Venice’s will be 4 miles.

Completion operations on the project are planned for the second half of 2023, with first production from both wells anticipated by the first quarter of 2024.

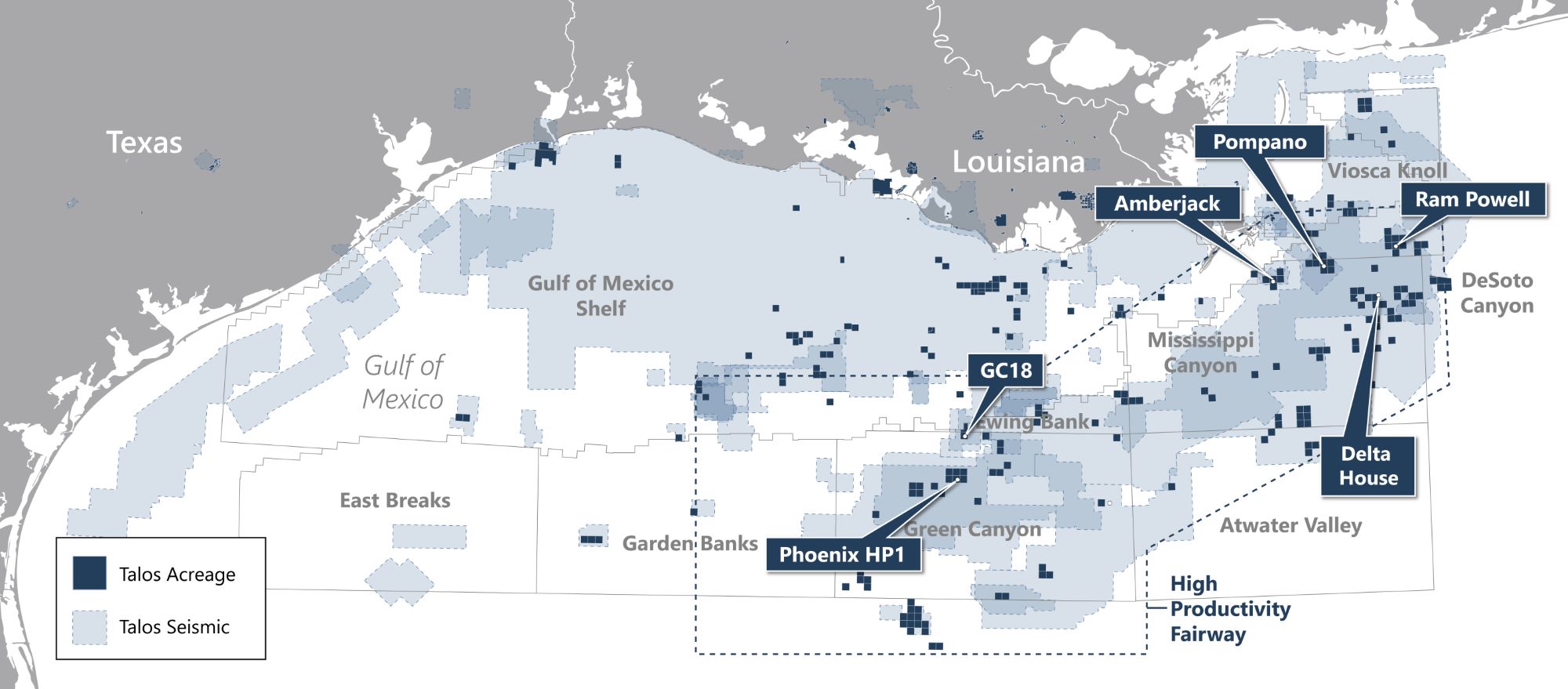

Talos acquired the Ram Powell TLP, located in 3,200 ft water depth, in 2018 and carried out projects aimed to increase production rates and reduce costs while simultaneously seeking nearby drilling prospects that could be tied back to the production facility. The Ram Powell TLP is in Viosca Knoll Block 956.

Lime Rock and Venice were the first two deepwater exploitation wells in the company's current open-water rig program that started in the fourth quarter of 2022, which will continue in the first half of 2023 with the Rigolets and Lisbon prospects, among others. Separately, Talos expects results from its operated Mount Hunter development well and its non-operated Puma West exploration well in first-quarter 2023. The company's non-operated Pancheron exploration well is also expected to spud in the first half of 2023.

“These two discoveries are case studies of the exciting potential that infrastructure-led development can bring in the U.S. Gulf of Mexico,” Talos President and CEO Timothy S. Duncan said. “Demonstrating our ability to successfully leverage existing infrastructure also reinforces the strategic merits of our pending acquisition of EnVen Energy Corp., which will double our deepwater infrastructure footprint by adding six major facilities. Ram Powell provides a blueprint for future optimization, development and exploration potential around those assets and our own."

Recommended Reading

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

Wanted: National Gas Strategy for Utilities, LNG

2024-02-07 - Chesapeake CEO Nick Dell’Osso and Mercator Energy President John Harpole, speaking at NAPE, said some government decision-makers have yet to catch on to changes spreading across the natural gas market.

Venture Global Seeks FERC Actions on LNG Projects with Sense of Urgency

2024-02-21 - Venture Global files requests with the Federal Energy Regulatory Commission for Calcasieu Pass 1 and 2 before a potential vacancy on the commission brings approvals to a standstill.

GOP’s Reaction to White House LNG Pause Takes Shape

2024-01-31 - The U.S. House Energy, Climate and Grid Security subcommittee set the date for a hearing on the Biden administration’s recent pause on LNG export approvals for Feb. 6; Republican Louisiana Sen. John Kennedy pledges to block Biden nominees.

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.