(Source: Talos Energy Inc.; Shutterstock.com)

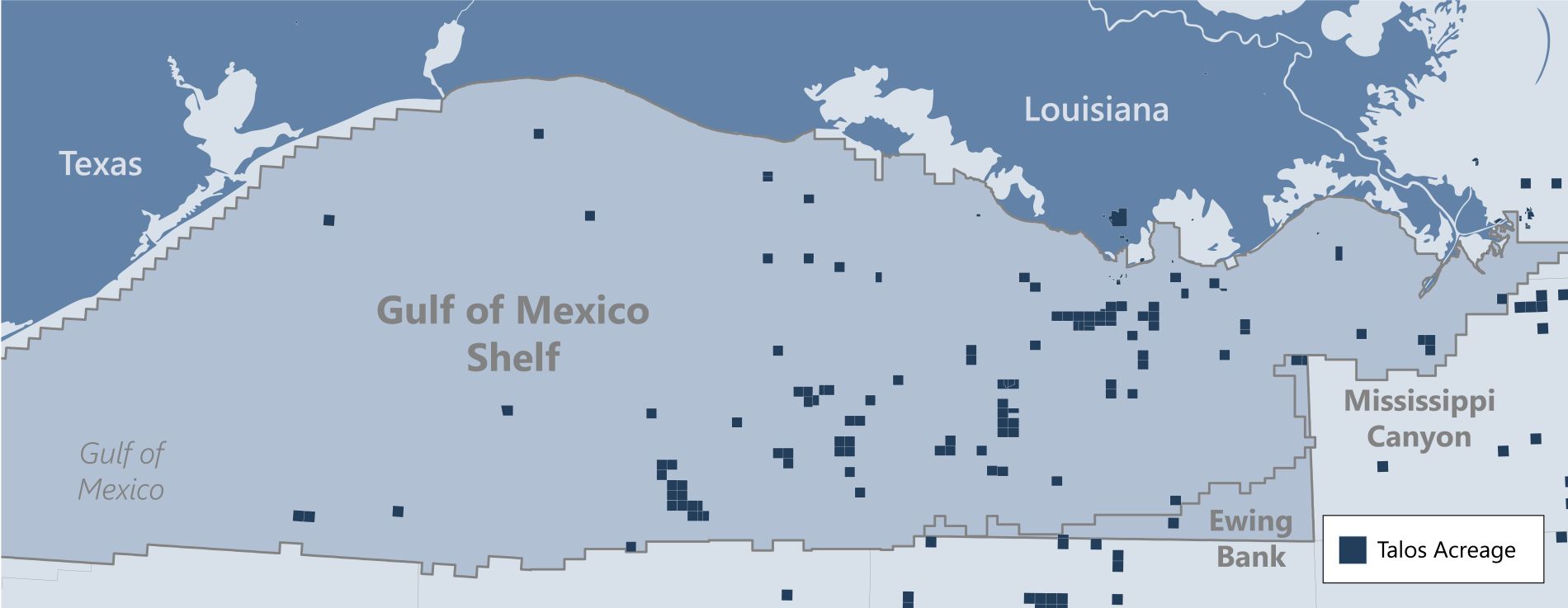

Talos Energy Inc. tacked on additional assets located in its U.S. Gulf of Mexico (GoM) shelf core area through a bolt-on acquisition on June 22.

In a release from the Houston-based company, Talos said it had agreed to pay $65 million for 16 selected assets from affiliates of Castex Energy 2005. The purchase price will be funded through the issuance of approximately 4.95 million Talos common shares at closing and $6.5 million of cash.

Among the acquired assets are multiple prolific, producing fields that were originally discovered and/or operated by predecessor companies led by current Talos management.

Commenting on the transaction, Talos President and CEO Timothy S. Duncan said: “This tactical deal with a compelling valuation highlights the importance of continuing to remain opportunistic and commercial in the current environment. The ability to utilize our equity as consideration in this transaction and the previously announced second lien notes exchange transaction demonstrates both our focus on executing value accretive transactions for our shareholders as well as our commitment to protecting our strong credit profile, both of which better position us to continue to evaluate further opportunities.”

Castex Energy is a private oil and gas company focused on exploration and development in South Louisiana and the GoM Shelf.

In December 2014, private equity firm Riverstone Holdings LLC committed $150 million to Castex Energy 2005. The company filed for bankruptcy in 2017, emerging a year later controlled by prior first lien lenders.

Talos previously acquired certain assets from Castex Energy in a transaction that closed February 2020.

The acquisition announced June 22 includes operatorship of 11 fields in which working interest was previously acquired. Securing additional ownership plus operatorship for the majority of the assets provides Talos with greater control moving forward, CEO Duncan added in his statement.

The acquired assets generate an average daily production of about 6,400 boe/d, comprised of roughly 15% oil and 85% natural gas. As of April 1, the assets had proved reserves of approximately 17.6 MMboe, with over 66% classified as proved developed reserves.

Talos said it plans to hedge a significant portion of total volumes from the acquired assets through 2022 in order to secure “favorable long-term commodity pricing, supporting underlying transaction economics.”

For the 12 month period ended March 31, the assets generated operating cash flow of approximately $31.2 million, according to the Talos release.

In the release, Talos said it had executed the definite agreement to acquire the select assets from affiliates of Castex Energy 2005 on June 19. The effective date of the transaction is April 1, with closing expected in third-quarter 2020.

Intrepid Partners LLC advised Castex Energy 2005 in the transaction. Vinson & Elkins advised an affiliate of Talos Energy in connection with the acquisition.

Separately, Talos said its borrowing base had been reduced by 14% to $985 million following its semi-annual redetermination process. Pro forma for the redetermination, Talos had approximately $121 million of cash on hand and $650 million drawn under its credit facility as of May 31.

“We are very pleased with the continuing strong support we’ve received from our bank group considering the historic dislocation in our industry in recent months,” Duncan said. “As we look forward to the second half of 2020, we’re highly confident in the financial strength of the company and believe we are well-positioned for continued growth.”

Recommended Reading

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

Veriten’s Arjun Murti: Oil, Gas Prospectors Need to Step Up—Again

2024-02-08 - Arjun Murti, a partner in investment and advisory firm Veriten, says U.S. shale provided 90% of global supply growth—but the industry needs to reinvent itself, again.