Talos Energy’s recent Bayou Bend carbon capture and sequestration (CCS) expansion east of the Houston Ship Channel now offers customers CO₂ injection access both onshore and offshore. The project also provides a corridor to move “blue products” from the nation’s largest refining and petrochemical corridor. (Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Talos Energy’s recent Bayou Bend carbon capture and sequestration (CCS) expansion east of the Houston Ship Channel now offers customers CO₂ injection access both onshore and offshore. The project also provides a corridor to move “blue products” from the nation’s largest refining and petrochemical corridor.

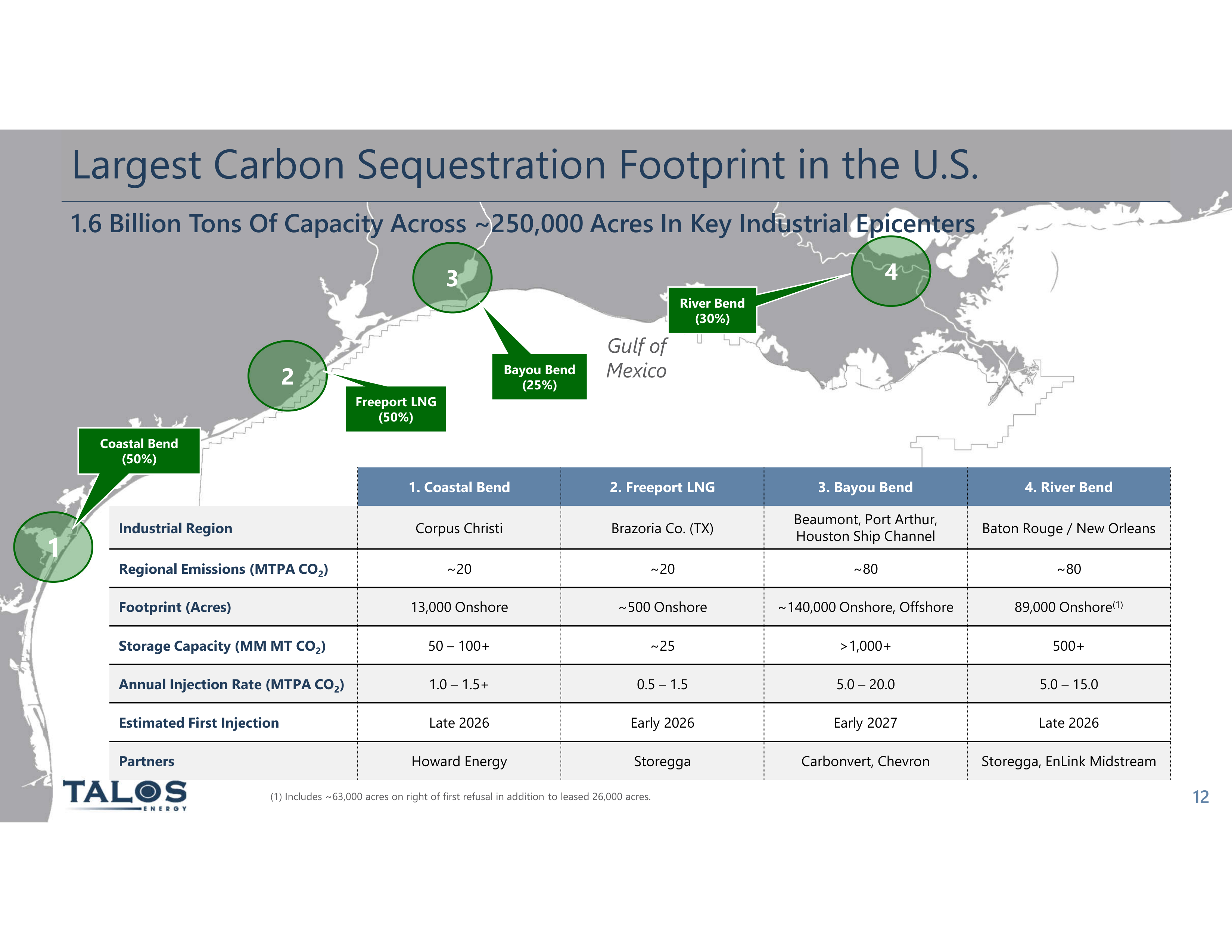

While two-thirds of Talos’ production portfolio is in deep water, the Houston-based company now leases about 250,000 total acres for CCS– 210,000 onshore and 40,000 offshore. The acreage is in four key industrial areas along the Texas and Louisiana Gulf Coast: near Corpus Christi, Brazoria County, the Houston Ship Channel-Port Arthur and the Baton Rouge-New Orleans corridor.

Talos offers the largest carbon sequestration footprint in the U.S. with 1.6 billion tons of capacity, Robin Fielder, Talos’ chief sustainability officer and executive vice president for low carbon strategy, told Hart Energy.

“Our whole thought was to get out early, lean in, go acquire the most strategic core space and start working with parties to try to track the emissions,” Fielder said at the Offshore Technology Conference in an exclusive interview.

“We wanted to be near the emissions, where you either had a midstream solution or could build a midstream solution that's fairly close by. That's how we built out our stores,” she said, adding that Talos works to build additional places to take carbon if a major pipeline system is down.

The newest onshore addition is the expansion of Talos’ Bayou Bend, which, in March, added 100,000 onshore acres to the existing offshore sequestration acreage. As part of the expansion, the project is now operated by Talos’ largest partner, Chevron.

For its CCS projects, Fielder said Talos use saline-filled reservoirs, which have tremendous storage capacity and are plentiful in the Gulf of Mexico (GoM). Fielder said federal tax incentives from the 2022 Inflation Reduction Act are bringing new business interests to the GoM’s geology.

“We're unapologetic for being an oil and gas company, but we can continue to do it smarter and cleaner,” Fielder said. “We're the ones who are going help design the solutions to help some of our partners decarbonize.”

She described the company’s strengths as data, seismic imaging and experience, which translate from offshore oil and gas production to the nascent CCS industry.

Talos’ strategy is technology agnostic with a focus on relationships, including ties with legacy landowners. Executive bonuses are tied to emissions reduction, and the company takes a rigorous approach to government permit processes, often repurposing data required in the state and federal permit applications, she said.

In its CCS endeavors, Talos found offshore success with the state of Texas, which offers a unique arrangement as the sole owner of contiguous acreage from the surface to the minerals. And, Fielder said, the onshore CCS wells are cheaper and easier to drill, offering greater optionality to customers who want sequestration either onshore or offshore.

Recommended Reading

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.

Betting on the Future: Chevron Technology Ventures’ Investment Strategy

2024-04-09 - After a quarter century, Chevron Technology Ventures seeks both incremental and breakthrough technologies with its early-stage investment program.

Haynesville’s Harsh Drilling Conditions Forge Tougher Tech

2024-04-10 - The Haynesville Shale’s high temperatures and tough rock have caused drillers to evolve, advancing technology that benefits the rest of the industry, experts said.