Enerplus Corp.’s future is tied to the past — largely because the Williston Basin E&P’s past is predictable, profitable and its seemingly spent wells may yet have something left in the tank. (Source: Hart Energy)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

FORT WORTH, Texas — Enerplus Corp.’s future is tied to the past — largely because the Williston Basin E&P’s past is predictable, profitable and its seemingly spent wells may yet have something left in the tank.

The company is opening up older wells, which originally underperformed, with plans to restimulate dozens of them on its Bakken leasehold, Enerplus COO Wade Hutchings said at Hart Energy’s recent SUPER DUG conference. And while the company will ratchet down activity in the Marcellus Shale while natural gas prices remain in the gutter, the company still expects to return plenty of free cash flow (FCF) to investors.

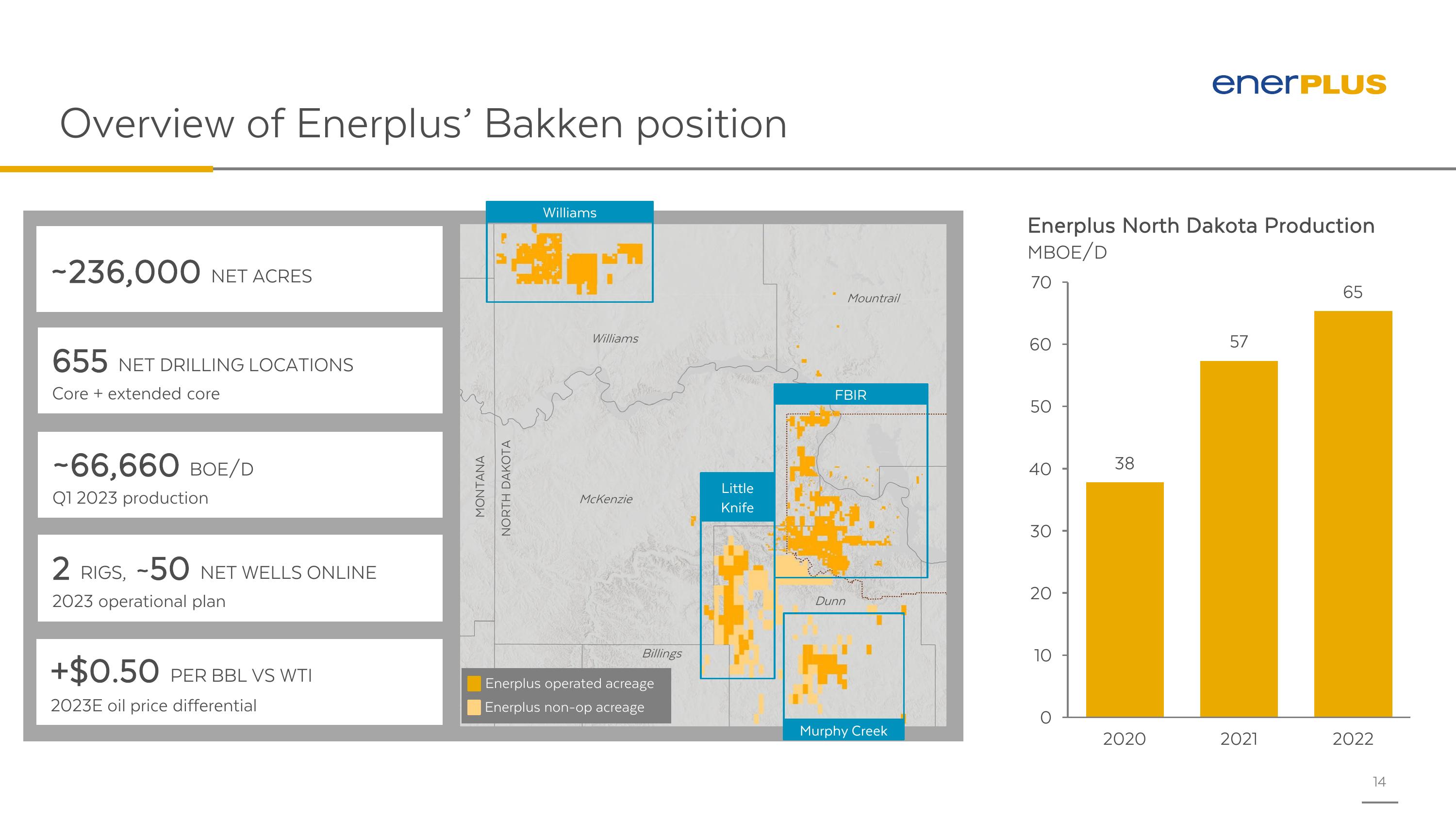

Roughly half of Enerplus’ 2023 completions programs are focused on the company’s legacy position in Fort Berthold Indian Reservation (FBIR), North Dakota, where management likes what they see: a development model that is “very mature, very well established,” Hutchings said.

Enerplus originally acquired the acreage almost 15 years ago and has thrived there despite a sometimes-complicated regulatory environment.

The regulatory and operating environment on FBIR is unique, with a sometimes-complex web of regulations at state, local and federal levels,” Hutchings said. “But our long commitment to the area and our deep relationships within the community are one of several keys that has given us the ability to successfully navigate and thrive in that environment.”

Hutchings said Enerplus, a Canadian company with offices in Denver, has more than a decade of inventory left in the Bakken. That includes some newer areas the company is itching to try out.

Enerplus augmented their North Dakota Bakken position in 2021 with the acquisition of Little Knife, Murphy Creek and Williams. These three areas are less developmentally mature than FBIR and require additional design elements before they start producing at capacity, but Hutchings says that the offset results are promising.

“We’ve been looking forward to 2023 when we will be able to first demonstrate the viability and productive capacity of the acreage that we have,” he said. “If we translate that acreage map into inventory, we have like 655 net remaining locations that we characterize as core or extended core.”

Enerplus’ underappreciated cash machine

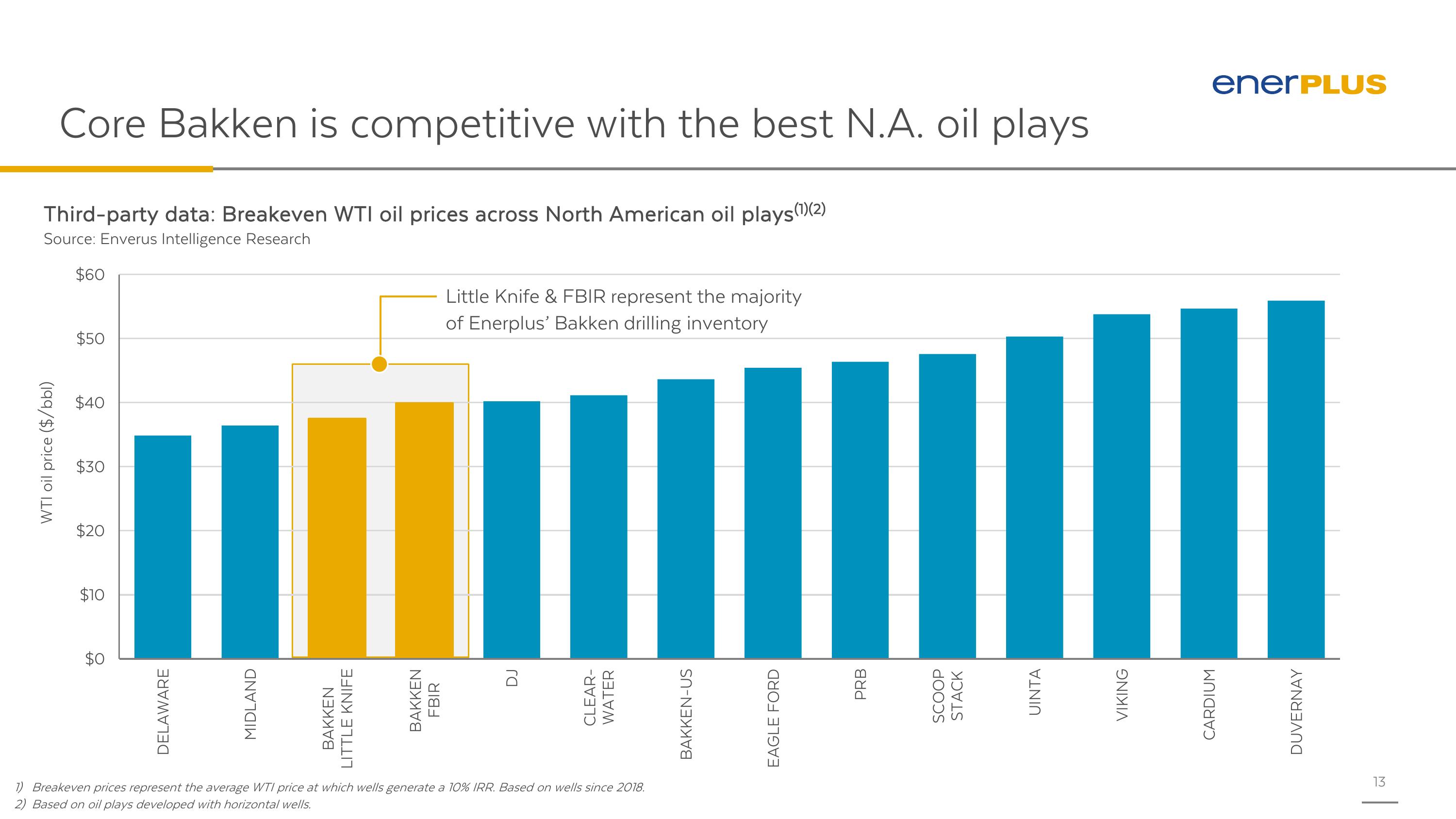

Hutchings pointed out the competitiveness of Enerplus’ FBIR and Little Knife plays to counter what he called the “underappreciated nature of the Bakken.”

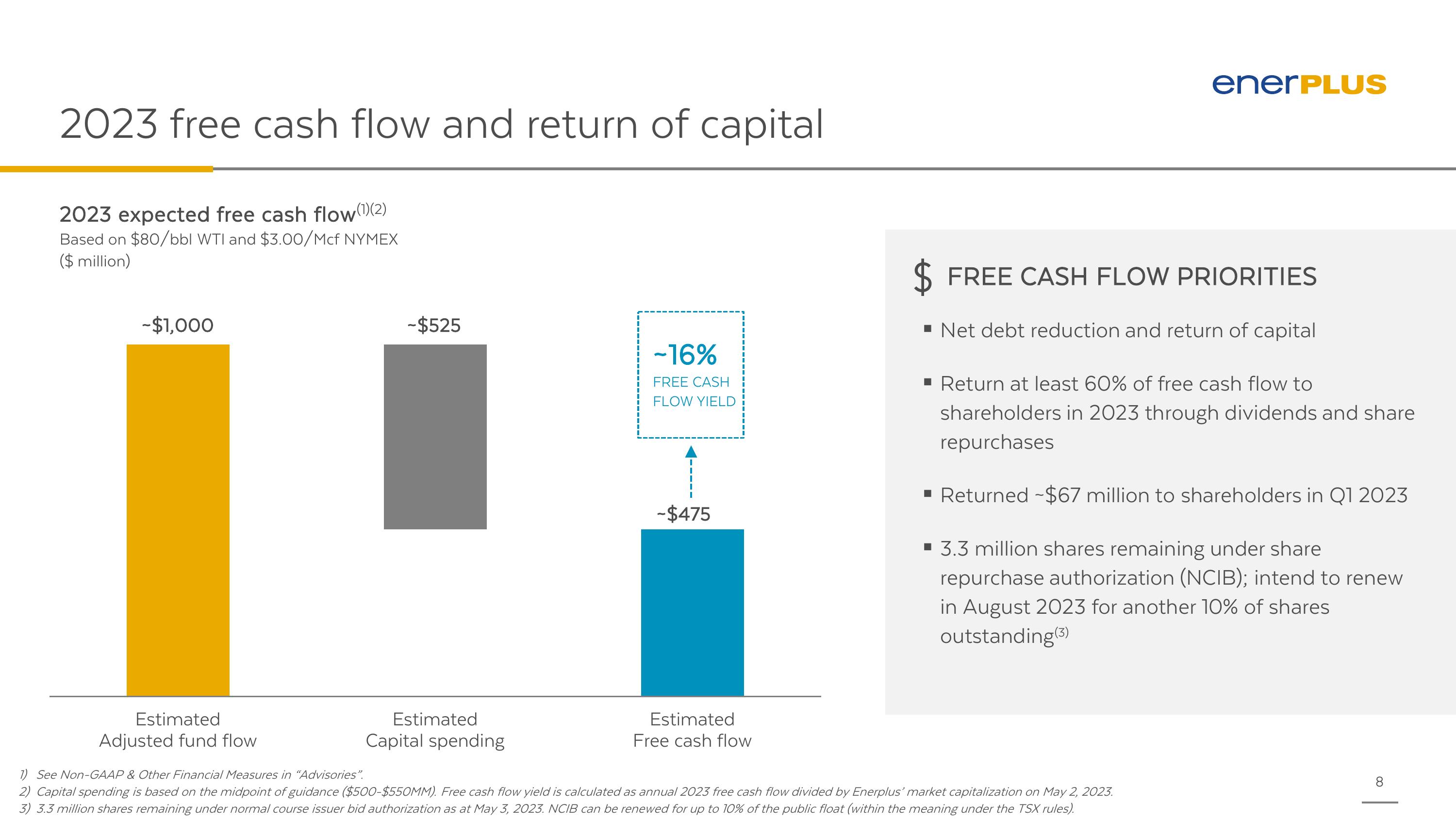

Despite significantly reduced E&P spending in the Marcellus Shale due to lower gas prices, Enerplus still expects to generate a “competitive” FCF of $475 million this year based on $80/bbl WTI and $3/Mcf NYMEX.

Hutchings said that the company has committed to returning at least 60% of that FCF to shareholders and, under current conditions, the management projects that the company will be essentially debt free by the end of the year.

Partly, that’s due to the company’s Williston inventory.

According to Enverus’ rankings of North American breakeven WTI oil prices in various plays and subplays, FBIR and Little Knife, which represent the majority of Enerplus’ Bakken drilling inventory, command a higher oil price than the Delaware and Midland basins.

“Core Bakken and FBIR and Little Knife are very competitive among North American oil plays in terms of returns and breakevens,” Hutchings said.

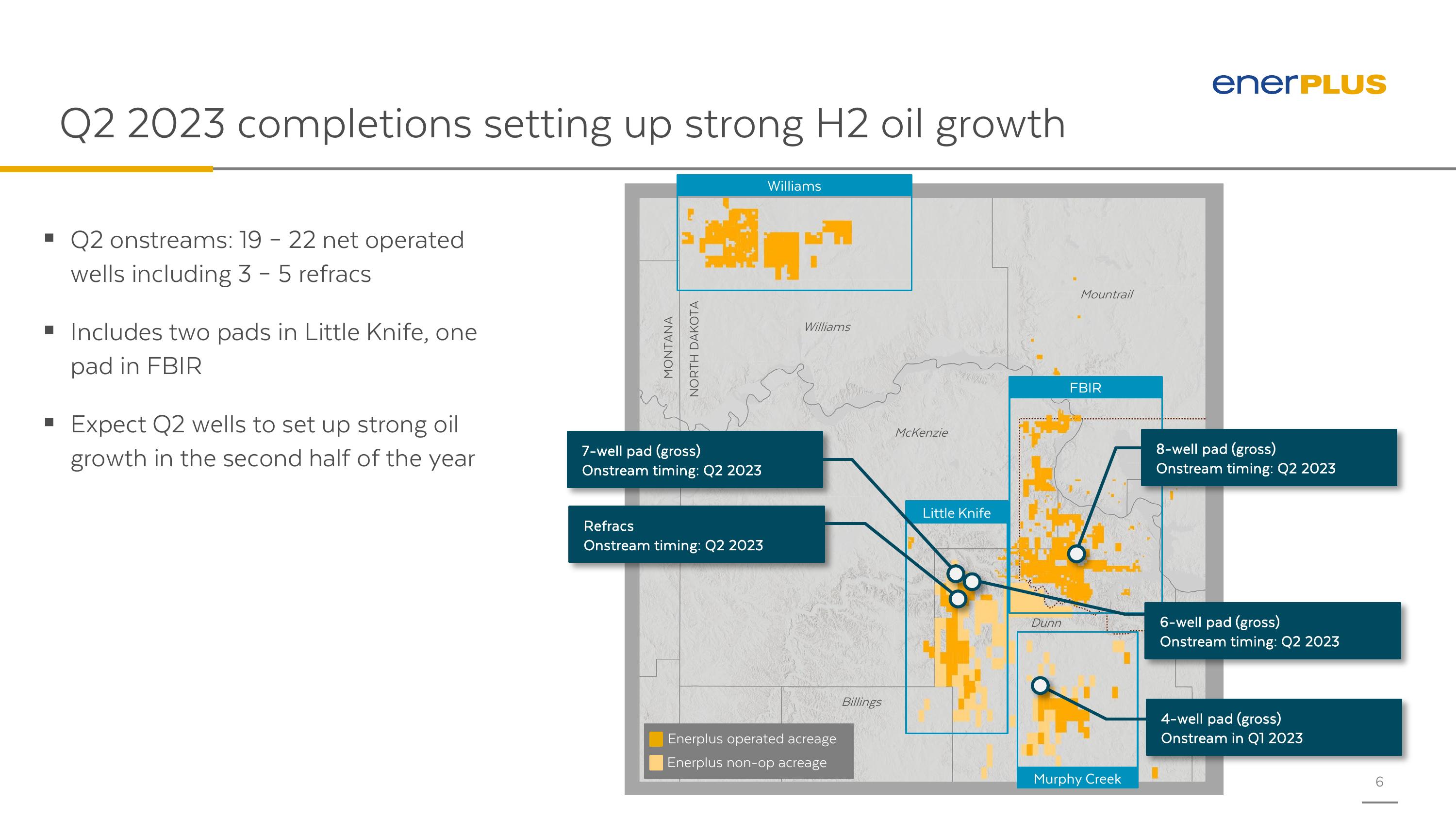

Enerplus expects second-quarter 2023 to set up strong oil growth in the second half of the year. They plan to bring online 19 to 22 net operated wells in addition to a new pad in FBIR and two new pads in Little Knife — their first in the area.

Everything old is new again

In addition to the new wells and pads, the company also plans to bring online their first set of refracs on production and eventually are planning for 3 to 5 refracs. The refrac candidates came from a pool of wells that were evaluated in 2021, Hutchings said. The wells were completed years ago but they were determined to have relatively low recoveries. Hutchings believes that “there’s good potential to increase those recoveries with modern restimulation.”

“That's really important for us to get a true test of the viability of that concept,” Hutchings said. “Today, we don't include refrac opportunities in our decade-plus drilling inventory, but if these wells are successful, we could see another approximately 60 additional value created well refracs that we can add to our inventory.”

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Marathon Chasing 20%+ IRRs with Los Angeles, Galveston Refinery Upgrades

2024-02-01 - Marathon Petroleum Corp. is pursuing improvements at its Los Angeles refinery and a hydrotreater project at its Galveston Bay refinery that are each boasting internal rate returns (IRRs) of 20% or more.