(Source: Shutterstock.com)

Suncor Energy is growing its position in the Canadian oil sands through a major acquisition.

Suncor agreed to acquire all shares of TotalEnergies’ Canadian operations, TotalEnergies EP Canada Ltd., for about CA$5.5 billion (US$4.1 billion).

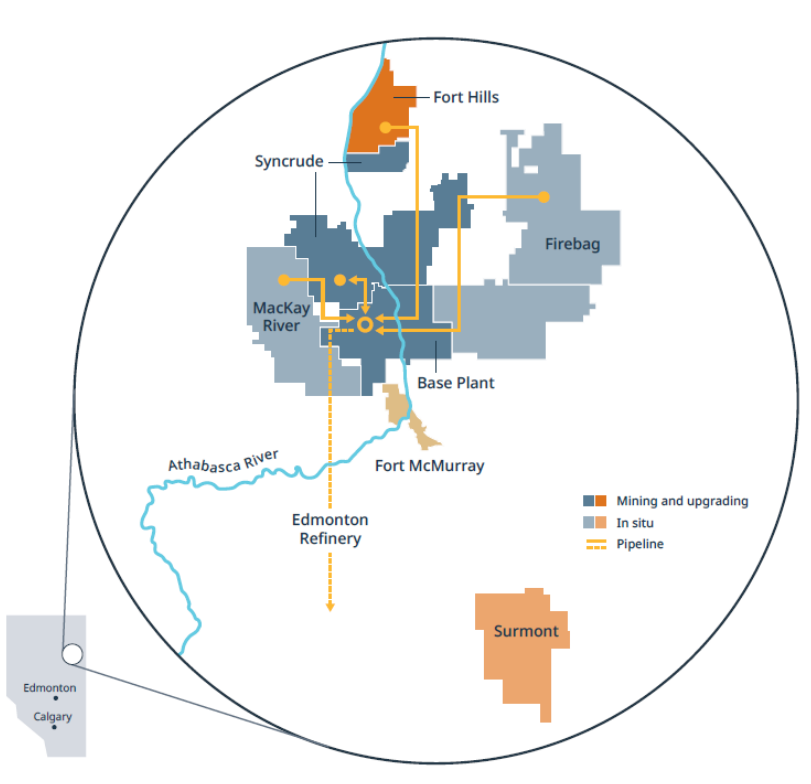

The deal includes Total’s 31.23% interest in the Fort Hills oil sands mining project and the French company’s 50% interest in the Surmont in situ oil sands asset.

Suncor expects the deal to add 135,000 bbl/d of net bitumen production capacity as well as increase the company’s oil sands reserves by 2.1 billion bbl.

Rich Kruger, president and CEO at Suncor, said the deal helps Suncor secure long-term bitumen supply to upgraders at its Base Plant operation in Alberta at competitive costs.

“These are valuable oil sands assets that are a strategic fit for us and add long-term shareholder value,” Kruger said in a statement. “The acquisition also introduces flexibility and optionality into our long-range capital plan, providing us with further discretion in respect of the timing and scope of future oil sands developments.”

Suncor will pay CA$5.5 billion in cash, or around US$4.1 billion at the current exchange rate, to acquire Total’s Canadian operations. The deal also calls for future additional payments of up to CA$600 million (US$440 million)depending on commodity benchmark pricing and achieving certain production targets.

Suncor plans to finance the acquisition through debt, which is expected to raise the company’s net debt levels above a target range of between CA$12 billion and CA$15 billion. Suncor anticipates returning to a preferred net debt target by 2024.

Recommended Reading

SilverBow Saga: Investor Urges E&P to Take Kimmeridge Deal

2024-03-21 - Kimmeridge’s proposal to combine Eagle Ford players Kimmeridge Texas Gas (KTG) and SilverBow Resources is gaining support from another large investor.

Benchmark Closes Anadarko Deal, Hunts for More M&A

2024-04-17 - Benchmark Energy II closed a $145 million acquisition of western Anadarko Basin assets—and the company is hunting for more low-decline, mature assets to acquire.

Uinta Basin's XCL Seeks FTC OK to Buy Altamont Energy

2024-03-07 - XCL Resources is seeking approval from the Federal Trade Commission to acquire fellow Utah producer Altamont Energy LLC.

Mesa III Reloads in Haynesville with Mineral, Royalty Acquisition

2024-04-03 - After Mesa II sold its Haynesville Shale portfolio to Franco-Nevada for $125 million late last year, Mesa Royalties III is jumping back into Louisiana and East Texas, as well as the Permian Basin.

Life on the Edge: Surge of Activity Ignites the Northern Midland Basin

2024-04-03 - Once a company with low outside expectations, Surge Energy is now a premier private producer in one of the world’s top shale plays.