(Source: Shutterstock.com)

Suncor Energy is growing its position in the Canadian oil sands through a major acquisition.

Suncor agreed to acquire all shares of TotalEnergies’ Canadian operations, TotalEnergies EP Canada Ltd., for about CA$5.5 billion (US$4.1 billion).

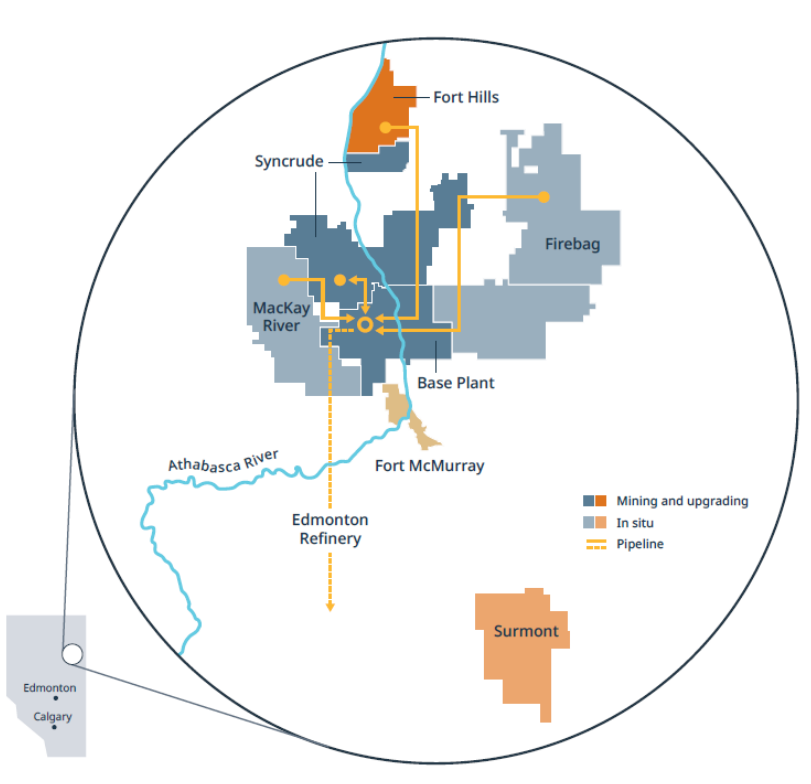

The deal includes Total’s 31.23% interest in the Fort Hills oil sands mining project and the French company’s 50% interest in the Surmont in situ oil sands asset.

Suncor expects the deal to add 135,000 bbl/d of net bitumen production capacity as well as increase the company’s oil sands reserves by 2.1 billion bbl.

Rich Kruger, president and CEO at Suncor, said the deal helps Suncor secure long-term bitumen supply to upgraders at its Base Plant operation in Alberta at competitive costs.

“These are valuable oil sands assets that are a strategic fit for us and add long-term shareholder value,” Kruger said in a statement. “The acquisition also introduces flexibility and optionality into our long-range capital plan, providing us with further discretion in respect of the timing and scope of future oil sands developments.”

Suncor will pay CA$5.5 billion in cash, or around US$4.1 billion at the current exchange rate, to acquire Total’s Canadian operations. The deal also calls for future additional payments of up to CA$600 million (US$440 million)depending on commodity benchmark pricing and achieving certain production targets.

Suncor plans to finance the acquisition through debt, which is expected to raise the company’s net debt levels above a target range of between CA$12 billion and CA$15 billion. Suncor anticipates returning to a preferred net debt target by 2024.

Recommended Reading

The Secret to Record US Oil Output? Drilling Efficiencies—EIA

2024-03-06 - Advances in horizontal drilling and fracking technologies are yielding more efficient oil wells in the U.S. even as the rig count plummets, the Energy Information Administration reported.

Plus 16 Bcf/d: Power Hungry AI Chips to Amp US NatGas Draw

2024-04-09 - Top U.S. natural gas producers, including Chesapeake Energy and EQT Corp., anticipate up to 16 Bcf/d more U.S. demand for powering AI-chipped data centers in the coming half-dozen years.

Core Scientific to Expand its Texas Bitcoin Mining Center

2024-04-16 - Core Scientific said its Denton, Texas, data center currently operates 125 megawatts of bitcoin mining with total contracted power of approximately 300 MW.

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.