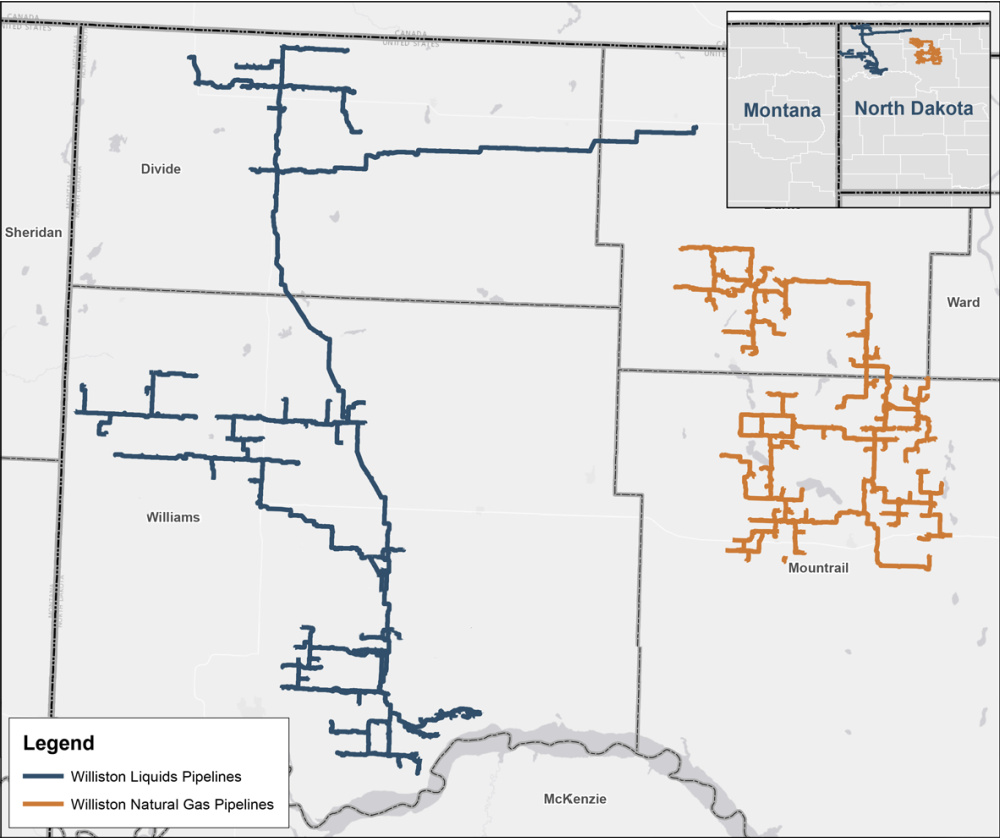

The Bison gas gathering system is located in Mountrail and Burke counties in northwestern North Dakota. A large U.S. independent crude oil and natural gas company and Chord Energy Corp. are the key customers of Bison, according to the Summit release. Pictured are Summit’s North Dakota operations. (Source: Summit Midstream Partners LP)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Summit Midstream Partners LP sold its Bison Gas gathering system in North Dakota for $40 million in cash as part of Houston-based Summit’s plans to streamline its portfolio, according to CEO Heath Deneke.

“With the sale of Bison Midstream, Summit’s focus in the Williston Basin will be on growing its crude oil and produced water gathering systems primarily located in Williams and Divide Counties, North Dakota,” Deneke, who serves as president and chairman as well as CEO of Summit, commented in a release on Sept. 19.

The Bison deal follows the sale of Summit’s Lane gathering and processing system in the Permian Basin to Matador Resources Co. in June for $75 million. The combination of the divestitures builds additional financial flexibility to reinvest in “more strategic scale-building opportunities” across Summit’s footprint, Deneke added.

Summit Midstream Partners focuses on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in the continental U.S. The company’s portfolio is divided into four segments: the Barnett, Northeast, Permian and Rockies.

Following the sale of the company’s Bison gas gathering system, Summit will still own the Polar and Divide system in the Williston Basin, which includes more than 295 miles of crude oil and produced water pipelines, spanning throughout the central and western parts of Williams and Divide counties in North Dakota, from the Missouri River to the Canadian border.

“We remain excited about the level of customer development activity in central Williams County and pro forma for the transaction, we continue to expect over 50 new wells behind our liquids system in 2023,” Deneke said on Sept. 19.

The Bison gas gathering system, located in Mountrail and Burke counties in northwestern North Dakota, was acquired by Steel Reef Infrastructure Corp., an integrated owner and operator of associated gas capture, gathering and processing assets in North Dakota and Saskatchewan.

Bison gathers, compresses and treats associated natural gas that exists in the crude oil stream produced from the Bakken and Three Forks shale formations. A large U.S. independent crude oil and natural gas company and Chord Energy Corp. are the key customers of Bison Midstream, according to the Summit release.

Natural gas gathered on the Bison system is delivered to Aux Sable Midstream LLC’s Palermo Conditioning Plant in Palermo, North Dakota. The gas is then delivered to downstream pipelines serving Aux Sable's 2.1 Bcf/d natural gas processing plant in Channahon, Illinois.

Pro forma for the Bison transaction, Summit will have approximately $90 million drawn on its $400 million ABL credit facility, resulting in over $300 million of available liquidity, according to Deneke.

“We continue to expect to trend toward the high end of our 2022 Adjusted EBITDA guidance range of $205 million to $220 million,” he said.

Locke Lord LLP served as legal adviser to Summit and Bracewell LLP was legal adviser to Steel Reef for the Bison transaction.

Recommended Reading

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Veriten’s Arjun Murti: Oil, Gas Prospectors Need to Step Up—Again

2024-02-08 - Arjun Murti, a partner in investment and advisory firm Veriten, says U.S. shale provided 90% of global supply growth—but the industry needs to reinvent itself, again.

Paisie: Economics Edge Out Geopolitics

2024-02-01 - Weakening economic outlooks overpower geopolitical risks in oil pricing.

Global Oil Demand to Grow by 1.9 MMbbl/d in 2024, Says Wood Mac

2024-02-29 - Oil prices have found support this year from rising geopolitical tensions including attacks by the Iran-aligned Houthi group on Red Sea shipping.

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.