Analysts forecast U.S. natural gas supply will rise this summer along with pipeline exports to Mexico and LNG exports. (Source: Shutterstock.com)

Rebounding rig counts, recovering oil and gas prices and growing global demand signal an improved outlook for the natural gas sector with production forecast to rise.

But don’t rejoice yet.

There are risks to summer U.S. gas production, analysts say.

“Three things that come to mind are pipeline maintenance and outages, economic curtailments and hurricane season related to shut-ins,” Eugene Kim, director of Americas gas research for energy consultancy Wood Mackenzie, said during a recent webinar.

A planned facility modification as part of The Williams Cos. Inc.’s Leidy South Project in Pennsylvania, for example, might impact some production. Add to this the potential for low gas prices to prompt some producers to curtail volumes. Plus, another active Atlantic Basin hurricane season could shutter coastal LNG facilities while impairing Gulf of Mexico production and possibly operations farther inland, impacting demand, he said.

Despite potential risks, current conditions appear better than a year ago when the COVID-19 pandemic slowed global demand, forcing producers to shut in wells.

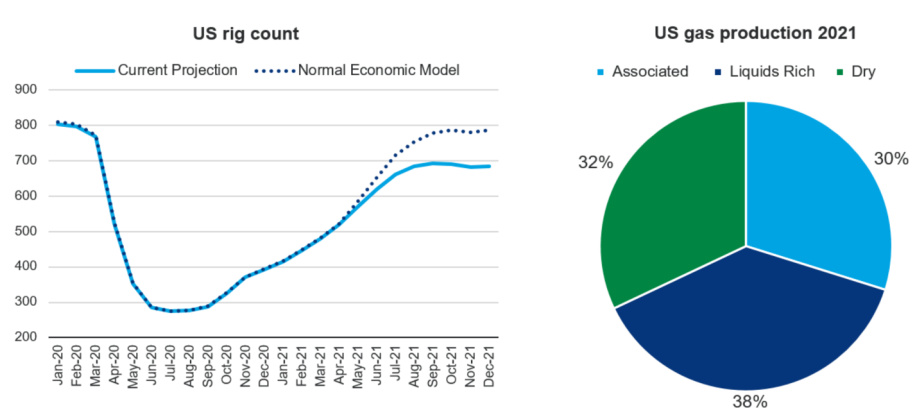

Though still below pre-collapse levels, rig counts have recovered as producers work to climb even steeper treadmills brought on by extended periods of low activity when oil prices plummeted along with gas prices.

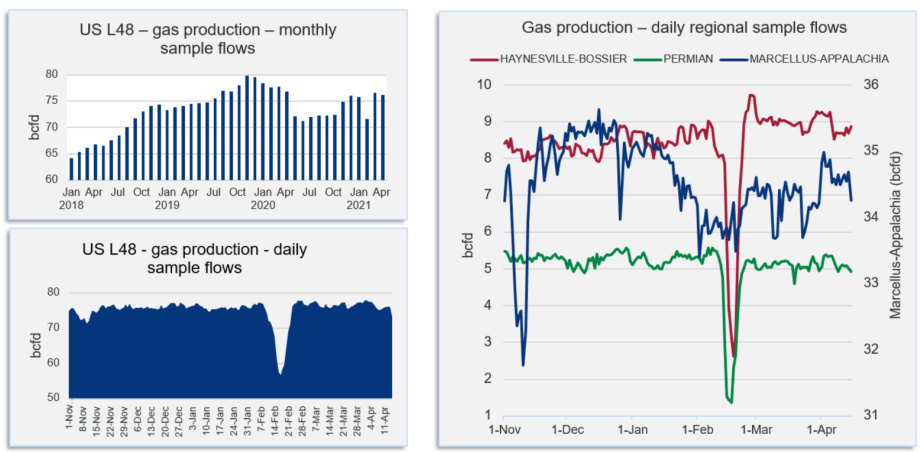

Analysts at Wood Mackenzie forecast a year-on-year supply increase of nearly 2.1 Bcf/d this summer, including about 400 MMcf/d of Canadian imports. The growth is not considered meaningful. It’s essentially a recovery from last summer’s price-related production shut-ins, according to Eric Fell, research director of short-term gas for Wood Mackenzie.

“That’s really what is driving that 1.6 Bcf a day of production increases,” Fell said. “It’s more about the weak comps or weak production last summer than outright growth in the current summer from where we are today.”

Forecasts show burgeoning Haynesville production. Of the seven main hydrocarbon-producing regions in the U.S. tracked by the Energy Information Administration (EIA), the Haynesville is the only one forecast to see gas production growth in May. The EIA’s latest Drilling Productivity Report shows gas production in the Haynesville up by 104 MMcf/d to about 12.2 Bcf/d.

“Haynesville production has been gradually increasing and is expected to continue through the summer with higher gas prices and less investor pressures from a larger subset of producers that are PE backed or private,” Kim said. “Rigs here have been steadily increasing and back above pre-collapse levels.”

Also, back to pre-collapse levels is the oily Permian Basin, which produces enough associated gas to make it the second-biggest gas producer. Considering only about one-third of gas production in the U.S. comes from dry gas plays, eyes will be on associated gas production from liquids-rich plays like the Permian and oil prices.

However, “it’s getting really difficult to monitor due to significant production volumes flowing on recent intrastate pipelines such as Gulf Coast Express and Permian Highway. And this summer, even more so when Whistler is expected to start up,” Kim said of Permian production. “Those three pipes alone represent 6 Bcf a day of Permian gas takeaway capacity.”

Appalachian production, though still off record highs, “has been outperforming our expectations as of late,” he added.

This comes as the producer landscape changes. Consolidation could shrink overall investments and limit growth, analysts say.

“A large universe of the producers are either in the distress or delever category and are unlikely to grow production anytime soon in order to create stronger balance sheets,” Kim said. “Those that can deliver growth have also maintained capital discipline and are only projecting modest growth rates. … Many have already pledged to reinvest only 70% to 80% of cash flow back into the fields and some even less while the balance is put toward debt production and shareholder returns. Continued investment pressure could drive this even lower.”

Focus on emissions reduction and responsibly sourced gas, he added, “will undoubtedly slow down the pace of getting a well drilled, completed and eventually hooked into the gas grid. These changes are good for tackling mounting investor pressures, but ultimately deter the rapid production growth rates we have witnessed in the past at similar prices.”

Eyeing Demand, Exports

Industrial demand is expected to rise about 0.8 Bcf/d, Fell said, after pointing out summer power demand down by more than 3 Bcf/d.

For what it’s worth, the world wants more natural gas and LNG feed gas.

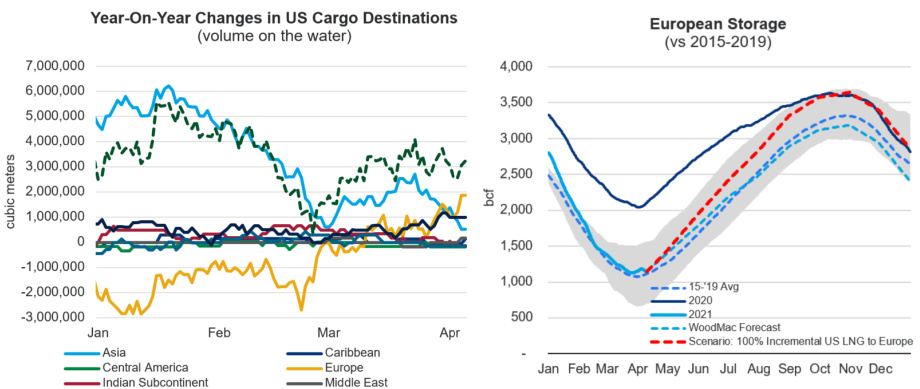

“We’re anticipating U.S. pipeline exports to Mexico to be up by approximately 1.2 Bcf a day, which is a huge jump that will be one of the biggest summer-on-summer increases we’ve ever seen,” Fell said. He attributed the surge to production declines in Mexico, increasing demand and new pipeline infrastructure enabling more exports to Mexico.

Wood Mackenzie forecasts shows U.S. gas demand of about 10 Bcf/d for the summer, which is about 4.3 Bcf/d more than 2020.

“We had some small increases in U.S. liquefaction capacity through 2020, but the majority of the change is due to the recovery of U.S. exports after the 2020 cancellations,” explained Eric McGuire, director of Americas gas research for Wood Mackenzie.

Unlike last summer when profit margins for U.S. exports were negative, profit margins for exports this year are more than $2 for the summer, he said. “That’s more than enough incentive to keep shippers moving LNG all summer.”

So, can the market absorb the year-on-year increase in U.S. LNG exports?

Yes, according to McGuire.

“When we look at total global supply outside of the U.S., we expect total LNG supply to be relatively flat,” he said. “So, the primary change in global LNG supply this summer will be a result of increased exports from the U.S.”

Elevating confidence is growing Asian demand as the region, like other parts of the world, recovers from COVID demand destruction. Low European gas storage levels are also fueling opportunity for U.S. LNG exports, according to McGuire.

“Ultimately, when you put together our current base case for production, for domestic demand and for exports to Mexico and LNG, it points to just a little bit over 3.5 Tcf end of October balances,” Fell added, noting that would be the second-lowest seen since 2012. The lowest was in 2018. “You’re going to need higher prices to kind of get you there.”

U.S. natural gas futures were down 1.9% the morning of April 21 to about $2.674 per million British thermal units.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.