(Source: Aker Solutions)

Subsea was the fastest-growing segment of the offshore business bar none, before the oil price headed south. Forecast compound annual growth rates (CAGR) for the market of between 10% and 15% by respected industry analysts were commonplace even until early 2015.

But having been virtually force-fed contracts since 2010 by the industry’s relentless drive and deep pockets to go even deeper in search of fresh hydrocarbons, the subsea sector’s major participants suddenly saw their bloated order books start to shrivel as new orders dried up almost overnight.

Some smaller companies closed up shop, while others survived only through drastic cutbacks in all areas. All recognized that their very survival relied on their ability to adapt and innovate.

Revival

But in true renaissance style, the subsea sector is showing early and encouraging signs of undergoing what might with hindsight turn out to be a genuine cultural rebirth.

This revival has been sparked through the ongoing adoption of more versatile and sustainable applications of new and existing technologies and also through the industry simply doing a better job of accessing, communicating and coordinating the allround expertise it has contained within its own ranks.

At the center of its efforts to bring about this renaissance are the words that have been thrown around so much in recent times—simplifi cation, standardization and collaboration.

Harry Brekelmans, Shell’s project and technology director, appropriately took up the theme at a recent annual event organized and held by GE Oil & Gas in the recognized capital of the original Renaissance movement itself—Florence, Italy—where according to consensus it all began in the 14th century.

Collective response

It was exciting, Brekelmans said, to be in the city that was “the birthplace of the Renaissance—a time of exploration, discovery and great inventions. The oil and gas industry is in need of its own renaissance in how we collectively respond to the tough environment we find ourselves in.”

The industry should continue to focus on how it can use the ongoing period of sustained low prices to “step up and work together better,” he added.

Learning how to work better together is a must. Compared to a decade ago, it typically takes the industry twice as long today to draw up detailed development plans for an oil and gas fi eld and 50% longer to drill the wells and build the facilities.

According to estimates by consultants Independent Project Analysis, from the years 2000 to 2014 well costs almost tripled, pipelay costs soared by 60% and the cost of subsea equipment tripled. At the same time, there has been a “shocking decline in construction productivity, which has led to an enormous increase in costs.” These have quadrupled from 1996 to 2014.

Brekelmans continued, “External factors have not helped. Think of the ever-tighter regulations regarding local content and the environment [as well as] the increasing geological and political complexity. Salaries are also up.

“There are many factors we can control—the vast expansion in project documentation and assurance processes, for example. There are hundreds of industry standards for valves alone, and as a result we’re defeating the purpose of an industry standard. Solutions are too bespoke. There are many examples of wastage, such as rework.”

Efficient, competitive

It is not all gloom and doom, he went on, with the current oil price environment compelling the oil and gas industry to make its companies more efficient and more competitive.

There are four key areas in particular, Brekelmans said: applying greater scrutiny to project scope, focusing on efficient execution of a project, deploying affordable technology and, underpinning them all, a wholesale transformation of the supply chain.

In Shell’s case with its Stones Field being developed via an FPSO unit in the Gulf of Mexico (GoM), he pointed out that the company recently fundamentally redesigned its wells using practices developed in onshore drilling. “We reduced the capital cost of wells by more than 30%. We used less material to reduce installation costs, and we also reduced overall risk of delivery. They are now much simpler and much easier to drill and complete.”

Greater standardization of wells on its Mars and Ursa fields, also in the GoM, led to cost savings of $95 million, he added.

Rising salaries, man-hours

Subsea major Technip’s CEO Thierry Pilenko (Read the exclusive interview “Forsys forging ahead in subsea space” featured in this issue’s cover story) said at the same event that a number of things had conspired to raise costs over the years, including

difficult geology and geography, national content, inflation, the increased cost of talent, productivity and regulations. He pointed out that French operator Total, for example, moved some of its engineering work to India to use the talent available there, but salaries rose 50% during the last five years.

“We measure the amount of man-hours we spend engineering per piece of equipment such as compressors, and over the past 10 years we have gone from around 1,500 to 2,500 and then to 3,000,” Pilenko added.

On productivity, Pilenko said about 35% of the pipeline welding had to be redone on one of Total’s recent projects, leading to lost time and higher costs.

He also called for simplification of behaviors, giving an example that—although admittedly not subsea—was typical of the problem. The company had to move the placement of fire extinguishers by 3 in. on a platform under development for safety reasons. This requirement, for which the chief engineer had to sign off, led to a three-day delay. “This is what is killing us. We have thousands of ridiculous instances like that,” Pilenko said. “I’m not talking about changing the safety rules. We just need to use common sense.”

Sustainable future

Matt Corbin, head of subsea product management at Aker Solutions, stressed the need for further industry collaboration to help continue to reduce costs but admitted, “this does not happen overnight.”

Corbin commented during the Subsea Expo conference in Aberdeen, Scotland, that he believed “we can have a successful industry at $30/bbl oil, but not the way it is today.”

But crucially, things are changing, he continued. In terms of standardization and simplification of subsea technologies and services for the U.K. North Sea in particular, Corbin highlighted in a presentation how there has been “great collaboration across more than 25 subsea companies,” with 12 workgroups formed with the purpose of identifying various capex costs and schedule opportunities on a U.K.-focused “fit-forpurpose” basis.

This has produced some highly disparate results, he pointed out. Some instances produced a range of about 4% to 70% in cost differential on a reference case project due to material, documentation, test and design complexity. “An approximate 70% higher cost to do something than what the reference case was! It’s a very disparate group and illustrates the size of the potential prize,” he said, adding that the work also had shown up potential schedule differences compared to the reference case of up to 100%.

Small pools

Realizing such potential savings will of course be key to unlocking marginal resources that are currently languishing at or below the breakeven point.

In the U.K., for example, an initiative to unlock the potential of small pools has picked up pace dramatically over the past year, with the National Subsea Research Initiative (NSRI) saying it could help recover 1 Bbbl to 1.8 Bbbl of currently uneconomic oil. These untouched reservoirs (currently numbering 210) represent about 5% of U.K. reserves or 20% of future production, which could potentially entail $19 billion in capex and $16 billion in opex.

The NSRI is the technology arm of the industry body Subsea UK and was tasked with helping to find new disruptive subsea technologies that could unlock these smaller discoveries. A series of “hackathon” workshops brought the industry, technology developers, universities and research institutes together to brainstorm solutions.

But the NSRI said that, while the technical community believes technology forms part of the solution, the commercial structure of the industry constrains the economies of scale needed to make the recovery of oil from such reservoirs viable.

Barriers to development

Dr. Gordon Drummond, the NSRI’s project director, explained, “It was very clear that it is difficult to de-couple the commercial considerations from the technical aspects. Access to host facilities and infrastructure, noncollaborative behaviors between operators and small operators who don’t have the finances or the will to develop these resources were identified as barriers to the development of small pools.”

Technical solutions were discussed including tiebacks, subsea hot tapping, clustering arrangements and standalone facilities, he said, with the technologies believed to be the biggest potential enablers for unlocking small stranded fields said to be: compact FPSO units, production buoys and subsea production facilities (including boosting, processing and subsea storage), and enabling technologies that attain access to existing infrastructure such as hot taps and self-sufficient hookup modules.

The potential technical solutions from the hackathons were categorized into efficiency measures, near-to-market technologies that could be piloted fairly quickly and relatively easily, and longer-term ideas with merit.

There is a wider long-term prize than just solving the small pools challenge in the U.K. North Sea, of course, as much of the work would be equally applicable and exportable to any mature basin in the world.

Track record

Perspective is always a good thing, and it’s worth bearing in mind that the North Sea’s subsea market has been around a long time, having grown hugely compared to its early years.

In 1971 there were just four subsea completed wells in the North Sea—about 5% of the global market. By 1991 that had grown to 204 subsea completed wells in the region, representing 32% of the world market. Fast forward to 2015 and in the Norwegian sector of the North Sea alone there were about 600 subsea completed wells, equal to the 1991 figure for the global market. Statoil itself operates about 500 subsea wells, producing around half of its total hydrocarbons.

According to Nils Opdahl of the government body U.K. Trade & Investment, one of the key lessons learned in all that time is that developing new subsea technology takes time.

In the case of subsea processing advances, for example, in 2004 the then Norsk Hydro started its relevant technology development project, while Statoil began a similar initiative the year before. Statoil’s eventual subsea processing technology—a step toward its highly prized vision of a subsea factory—saw seabed compression technology only ready by 2012. The use of subsea gas compression on the Åsgard Field offshore Norway eventually followed in 2015.

Opdahl, speaking at Subsea Expo, also pointed out that North Sea subsea technologies have benefitted from a unique combination of market volume, challenges, cooperation and creativity. Equipment makers have systematically applied their experience from operation and installation of subsea wells and production systems, and improvements have been derived from the many “sub-technologies” embedded in those production systems and installation methods.

High and steady demand for subsea facilities has allowed step-wise development, long-term perspectives and continual activity, he added.

Subsea dating game

From the outside, the subsea sector has looked like something akin to a dating game as the downturn continued to bite, producing through necessity a plethora of recent new relationships and alliances as companies desperately sought to find like-minded compatible partners.

Technip’s Forsys joint venture (JV) with FMC Technologies is one of the better known subsea tie-ups aimed at bringing lower cost, standardized solutions to operators at an earlier stage in the development process, but it is by no means on its own.

Announced just over a year ago, it followed on itself from two earlier JVs—the pioneering OneSubsea alliance between Schlumberger and Cameron in late 2012, and the Subsea Production Alliance between Aker Solutions and Baker Hughes in 2014. All three were formed when the oil price was a good deal higher than today.

Aker, Total get close

One of the most recent collaborations has seen Aker team up with operator Total to collaborate on research and innovation specifically to develop new cost-effective subsea technology.

The pair said the initial four-year technical collaboration agreement will build on earlier cooperation and bring both companies closer in developing technologies that they say will reduce costs and increase value from subsea fields.

Focus areas will include further evolution of subsea processing and compression systems to boost the cost efficiency of deepwater gas production, development of electric subsea controls and the optimization of flow measurement technologies. The scope also is expected to be widened during the course of this year in a joint effort that Aker’s CTO Hervé Valla said would reinforce the companies’ common interest in finding more effective solutions to maximize value from subsea developments. “It allows us to work more closely with Total to solve technical challenges faced by the industry today and to reduce the time needed to bring subsea technology to the market.”

The pair has worked intensively recently on major deepwater subsea systems such as those used by Total offshore West Africa on its Angolan Kaombo and Dalia fields and the Moho Nord Field offshore Congo-Brazzaville. That has included collaborating on subsea boosting solutions and subsea plant for deepwater applications as part of Total’s ongoing deep offshore R&D program.

Compression alliance

Aker also linked up with MAN Diesel & Turbo in October last year to form the “Subsea Compression Alliance,” part of its push to develop the next generation of cost-effective high-capacity systems for use on very small oil and gas fields to increase recovery compared to conventional platform solutions.

The two companies cooperated on the successful delivery of the world’s first full-scale subsea gas compression system for Statoil’s Åsgard Field. Aker delivered the subsea compression system for the field, while MAN Diesel & Turbo was the first turbomachinery manufacturer to have developed a centrifugal compressor installed on the seabed. They said the aim of their alliance is to provide compression systems based on proven technology that are smaller, lighter and cheaper, without compromising effectiveness.

Not one to rest on its laurels, Aker also signed a master service agreement with Statoil, as did OneSubsea Processing. The agreements form the basis for potential new engineering, procurement and construction (EPC) for subsea equipment in the “medium-term future,” although that detail was not further defined. An EPC option agreement for a subsea production system also was signed between Statoil and OneSubsea, including framework agreements for subsea operations services and subsea add-ons.

Last year Statoil also signed a similar agreement and an EPC contract including options for an EPC project with FMC Kongsberg Subsea for a specific field development, Johan Sverdrup, offshore Norway.

The operator said in a release that the agreements simply formed a good basis for future collaboration with three leading subsea suppliers, “thereby simplifying collaboration in the time ahead.”

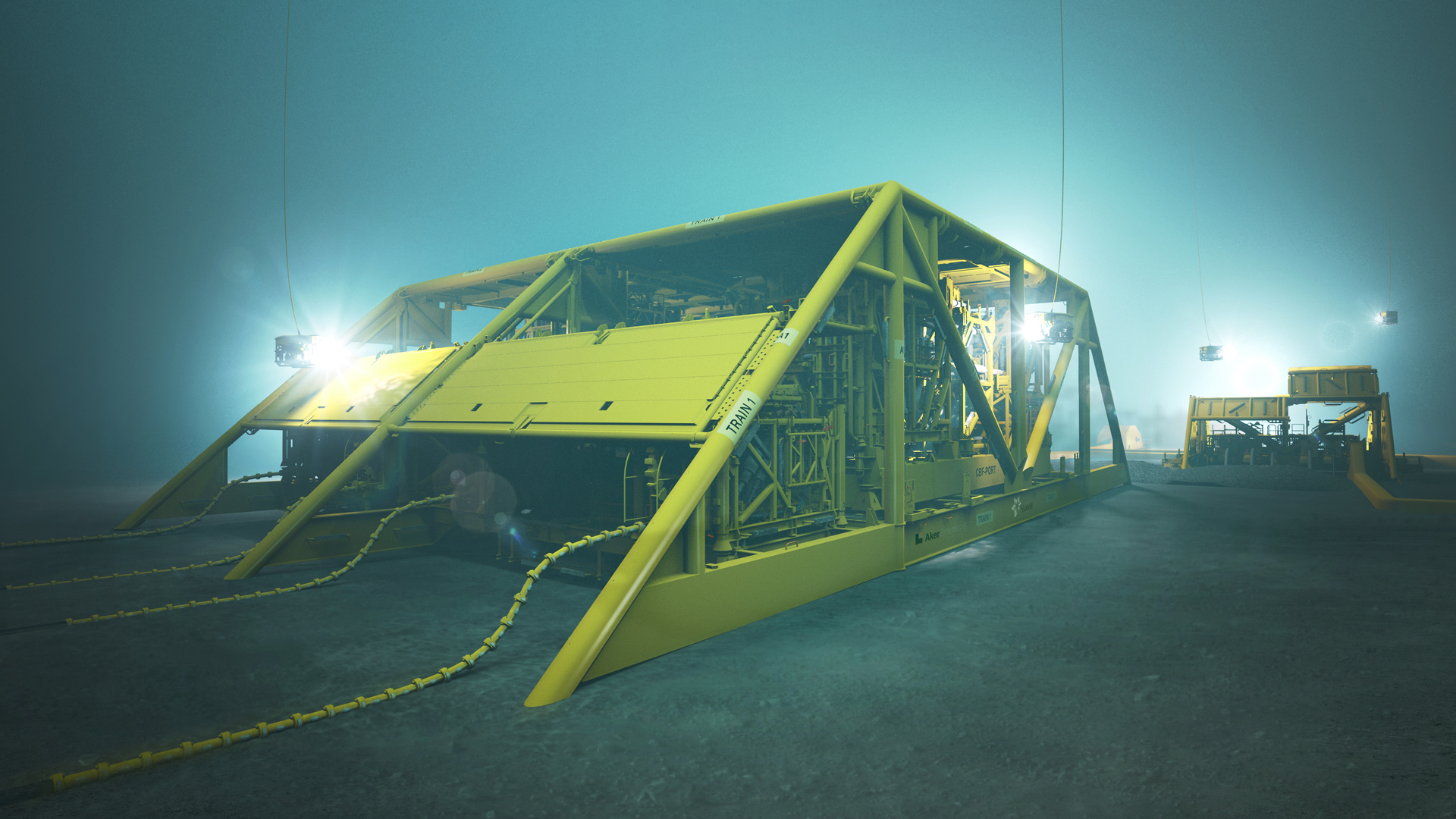

Subsea solutions can take a long time to gestate. In the case of subsea processing, Aker Solution’s work in subsea separation and booster stations started in the 1980s, but it took until September 2015 to realize the world’s first seabed gas compression system, supplied by Aker, on Statoil’s Åsgard Field offshore Norway. (Source: Aker Solutions)

Subsea alliances are increasingly necessary, such as Aker’s linkup with MAN Diesel & Turbo last year to form the Subsea Compression Alliance, aimed at advancing more cost-effective systems for smaller fields. The companies worked together to deliver the first full-scale seabed gas compression system to Statoil for the Åsgard Field. (Source: Aker Solutions)

Happy couples

Just as in life, not everyone is likely to end up playing happy couples, as Statoil added that future awards would go to “the suppliers who are willing to and capable of continuing the drive for sustained quality, standardization, higher efficiency and lower costs,” according to a release.

Another master service agreement signed by Statoil with GE Oil & Gas was more specific, being valid until 2025 and forming the basis for potential new contracts for subsea equipment and services on new projects and developments globally. The agreement is again a natural evolution of an ongoing working relationship, with GE having recently delivered subsea production equipment for the Norwegian operator’s Snøhvit gas field in the Barents Sea offshore Norway. The focus once again is on costs and efficiency, as Statoil endeavors to convert several of its currently marginal prospects and discoveries into commercially viable projects.

In February this year GE also launched a joint industry project with Statoil, Total and two other unnamed operators to develop a new subsea boosting system, including the use of a modular contra-rotating pump capable of reducing life-cycle costs by up to 30%. (Read “Innovation powering seabed pumping advances” featured in this issue’s cover story.)

Strong growth forecast

With the subsea market, even in these times, still forecast to grow faster than the general offshore market’s predicted 11% CAGR between 2017 and 2020, according to analyst Infield Systems, the prize is still very much worth chasing.

Such industry initiatives, alliances, partnerships and technology collaborations as those mentioned above represent more than just rhetoric and a spate of glad-handing. It is definitive evidence of a concerted effort by the subsea sector and its major clients to meaningfully turn things around, whatever the oil price might be. Operators too also recognize and have clearly acknowledged that they need subsea technologies and services to be a viable option in their field development and operations toolkit.

These might be little more than the first small waves of cultural change in the subsea market, but the early ripples of this renaissance could be far-reaching.

Contact the author at mthomas@hartenergy.com.

Read each April E&P cover story:

2020 vision sees return to market growth

Recommended Reading

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.