Justin Carlson is co-founder and chief commercial officer of East Daley Analytics in Colorado.

Natural gas futures have fallen hard in 2023, breaking below $3/MMBtu for much of the year. While a mild winter is contributing to bearish sentiment, the bigger problem in the view of East Daley Analytics is overheated supply growth. Sub-$2 natural gas prices are now clearly in view, and there may not be a lot the market can do to prevent them.

The decline has been swift for natural gas, with front-month Henry Hub contracts down by over 60% since mid-December 2022. Henry Hub was trading near $7/MMBtu ahead of a bitter Arctic front, but temperatures in key Midwest and Northeast markets rapidly warmed in January and have been at times balmy, cutting into heating demand.

On March 6, the April front-month futures contract traded for $2.60/MMBtu, and the Henry Hub strip was below the $3 price level through June 2023.

The drop in natural gas has been a long time coming. East Daley has been warning clients for nearly 12 months of imbalances through the 2023 calendar caused by rapid production growth through our “Macro Supply and Demand Forecast,” our aggregate forecast of U.S. natural gas production, demand and imports and exports via pipelines and LNG.

We noted in our inaugural “Macro Supply and Demand Forecast,” released in February 2022: “The pre-balance storage moves above the five-year average starting in March 2023 due to growing production, surpassing 4 Tcf by 4Q23. If the market is not expecting this trend, prices could make a sharp reversal.”

While a mild winter and a shift in the demand outlook contributed to the market sentiment, the momentum from supply growth will be the unexpected “nail in the coffin” that holds prices down.

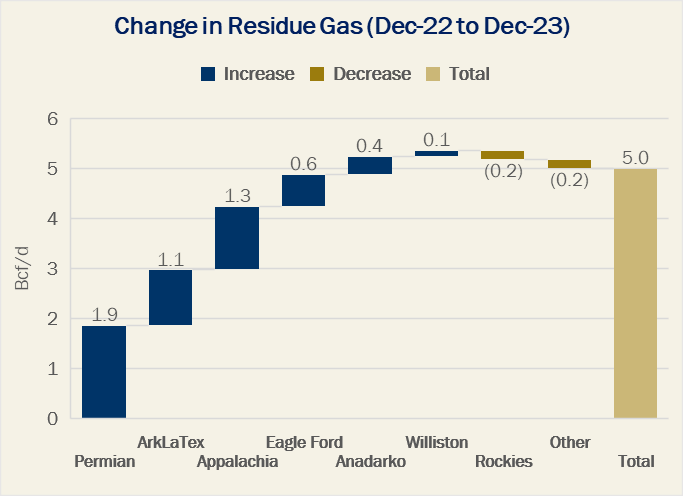

Overheated supply growth was a central theme of East Daley’s “2023 Dirty Little Secrets” report, released in December 2022, when we highlighted our outlook for 5 Bcf/d of “unconstrained” natural gas production growth in 2023 exit-to-exit, led by the Permian and ArkLaTex basins. At this pace of supply growth, storage would build rapidly and exceed the 4 Tcf upper limit on inventories before next winter.

Even after the latest market declines, the price cuts aren’t deep enough, according to our latest macro forecast. We see the need for a “shock to the system” to slow gas production growth and force producers to choke back wells and defer completions.

Too many rigs is the chief problem. The U.S. horizontal rig count totaled 715 rigs for the week of Feb. 24, 2023, according to East Daley’s Energy Data Studio, near the high of 724 horizontal rigs at the end of July 2022, when WTI crude prices were near $100/bbl.

Notably, we expect robust production growth to occur despite rig attrition this year, meaning we have already baked in declining rig counts over the course of 2023 in our macro model to help restore balance. We see supply growth as unavoidable due to the time lag before drilling and development activity leads to first production from new wells.

In the Permian, most growth will not arrive until late in the year when expansions to MPLX’s Whistler Pipeline (500 MMcf/d) and Kinder Morgan’s Permian Highway (550 MMcf/d) are schedule to begin service. Absent a drastic drop in crude oil prices, we do not expect the Permian to pull back. Thus, gas production must stop growing elsewhere to balance the market.

In our latest monthly “Macro Supply and Demand Forecast,” we provide two scenarios: an unbalanced forecast showing the severity of the natural gas supply problem and a “forced balance” scenario that avoids oversupply in 2023.

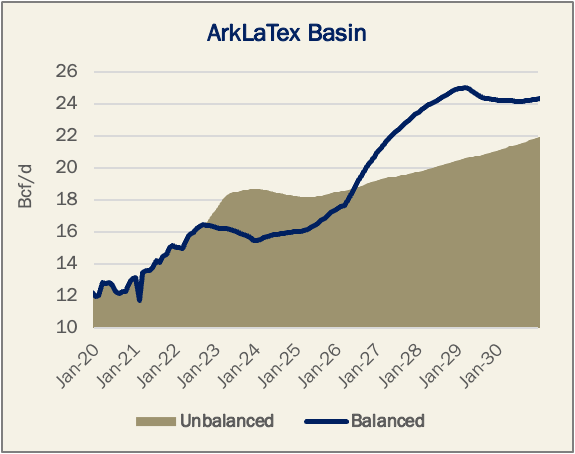

Figure 2 shows how these scenarios contrast in the Haynesville (ArkLaTex), to pick one basin. The solid area shows the unbalanced forecast where drilling activity, primarily from Aethon, Comstock Resources and Southwestern Energy, drives over 1.5 Bcf/d of supply growth.

The conundrum in the Haynesville is that the rigs are already in place to create this new growth. Therefore, to lower near-term production toward the balanced market, we reduce activity by 19 rigs year-over-year.

We also build an inventory of 350 DUCs by year-end 2023 to defer the start of new production. Since we presented this case, several Haynesville producers including Comstock Resources and Chesapeake Energy have announced rig cuts, but in our view these announcements so far are insufficient to avoid oversupply. If producers choose not to build DUCs, it may take more drastic supply cuts, such as well shut-ins, to balance the market.

The natural gas story is a nuanced one. In the long term, a massive ramp in LNG demand will require a boost in production from the ArkLaTex. This dynamic presents significant opportunities for upstream investment and infrastructure growth across the U.S. Of course, it won’t just be in the ArkLaTex where market forces reshape the supply curve. To reach a “balanced” market will require contributions from many basins.

Recommended Reading

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.