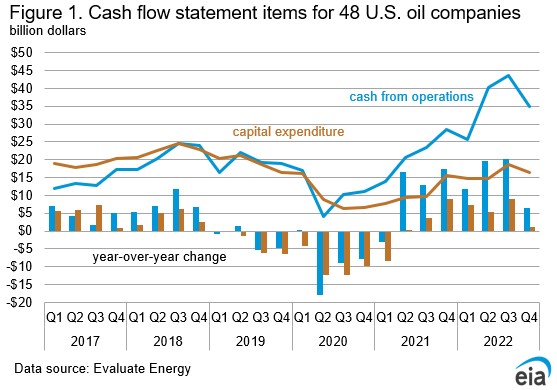

The U.S. Energy Information Administration analyzed the financial reports of the public companies that produce more than a third of all U.S. crude. EIA predicted that E&P companies’ capital expenditures will continue to increase as revenues decline. (Source: Shutterstock.com)

E&P shareholders enjoyed distributions far above their historical average in fourth-quarter 2022 despite an operations cash squeeze caused by lower crude oil prices, according to a government study of 48 publicly traded companies.

The U.S. Energy Information Administration (EIA) analyzed the financial reports of the public companies that produce more than a third of all U.S. crude. EIA predicted that E&P companies’ capital expenditures will continue to increase as revenues decline.

In the fourth quarter, E&P companies’ cash from operations suffered a 20% decline —dropping to $35 billion in the fourth quarter.

The 2022 fourth quarter distribution was the most in five years, reaching nearly $19 billion. That included $10.7 billion spent for share repurchases and $8.2 billion for dividends.

EIA found that “more cash from operations went to shareholder distributions than to any other use, including capital expenditure.” The study defined shareholder distributions as the sum of dividends and share repurchases. About 40% of the share repurchases were from a one-time, $4.3 billion acquisition of common stock by the Oklahoma City-based Continental Resources Inc., as part of plans to take the company private.

The EIA study also found that cost inflation continues to bite, but supply chain constraints appear to be easing. The study noted, however, that “recent cost inflation suggests more capital expenditure spending would be needed today to support similar levels of production compared with past years.”

Forty-two of the companies published guidance that detailed their plans for operations and spending. EIA analysis of the guidance found that companies plan to increase capital expenditure by 5%.

Late last month the Federal Reserve Bank of Dallas reported that 30% of oil and gas firms identified cost inflation as the greatest influence on the profitability of their firm. Another 30% identified the health of the global economy as a primary factor.

The EIA did not study private companies, so its study noted that the findings do not represent the entire upstream oil and gas sector.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Fracturing’s Geometry Test

2024-02-12 - During SPE’s Hydraulic Fracturing Technical Conference, industry experts looked for answers to their biggest test – fracture geometry.

Haynesville’s Harsh Drilling Conditions Forge Tougher Tech

2024-04-10 - The Haynesville Shale’s high temperatures and tough rock have caused drillers to evolve, advancing technology that benefits the rest of the industry, experts said.

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.