Cona Resources agreed to acquire all outstanding Pengrowth shares in a cash offer of 5 Canadian cents per share, which equates to a 75% discount to Pengrowth’s stock close on Oct. 31. (Source: Shutterstock.com)

Pengrowth Energy Corp. agreed on Nov. 1 to be bought out by privately-backed Cona Resources Ltd. after the company struggled for years to regain its footing after the 2014 oil crash and growing volatility in the Canadian energy market.

The transaction, valued at about C$740 million including the assumption of debt, is the “best available alternative” for the Calgary, Alberta-based oil and gas producer, the company’s president and CEO, Pete Sametz, said in a statement.

Following the oil market crash of 2014, Pengrowth took immediate action to shore up the company’s balance sheet by selling assets to pay down C$1.2 billion of debt, according to Ken Johnston, chairman of Pengrowth’s board of directors.

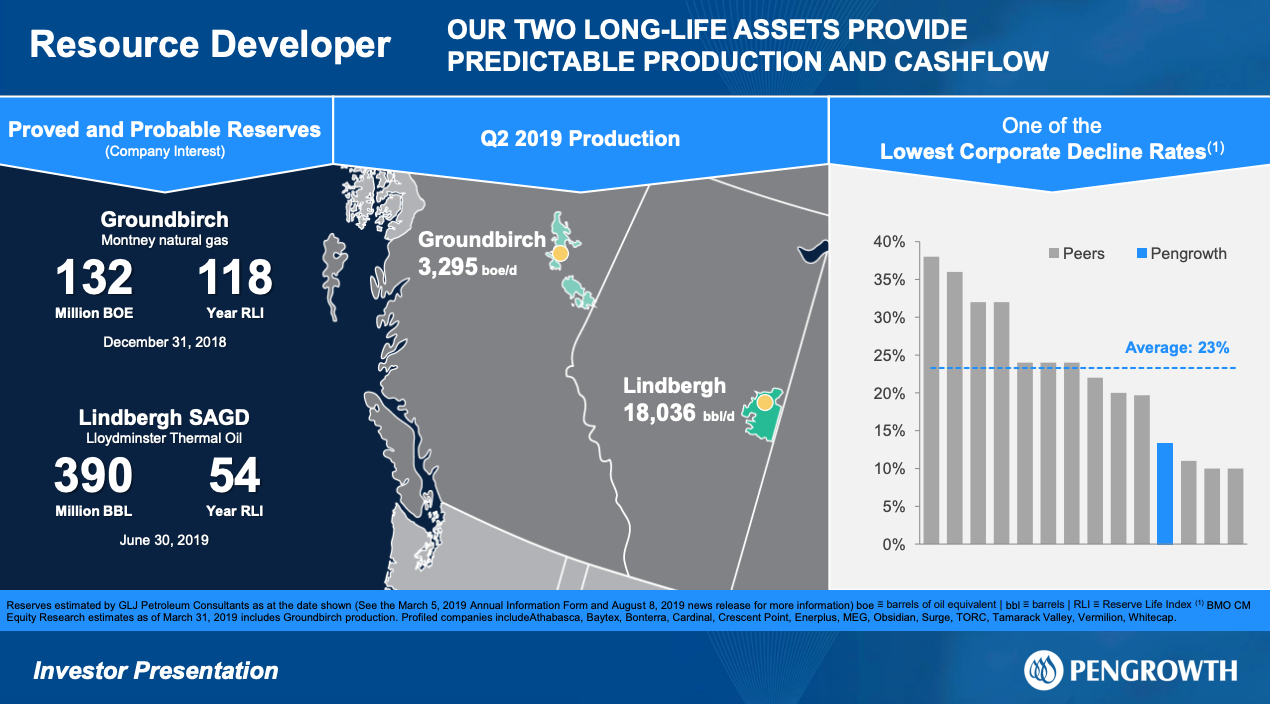

Johnston added that further efforts were undertaken in 2018 by marketing an additional overriding royalty on its Lindbergh asset, the largest capital project in Pengrowth history. The company also aimed to secure high-yield debt to replace its currently outstanding secured debt.

“Both funding initiatives proved unsuccessful,” he said in a statement. “The extreme volatility in the price of Western Canadian oil in the fall of 2018, coupled with an uncertain political and regulatory environment, has led to a severe funding crisis in the Canadian energy capital markets which impeded the company’s ability to achieve a funding solution.”

As part of the transaction agreement, Cona Resources, a portfolio company of Waterous Energy Fund, will acquire all outstanding Pengrowth shares in a cash offer of 5 Canadian cents per share, which equates to a 75% discount to Pengrowth’s stock close on Oct. 31.

“Despite the discount this transaction represents to Pengrowth’s recent trading price, we strongly recommend our stakeholders support the arrangement agreement as it represents the most attractive alternative for all stakeholders given the current environment where there is essentially no access to capital for the company or participants in the Canadian oil and gas industry, in general,” Sametz said in the statement.

Per Sametz, in addition to repaying the company’s looming secured debt bill, the deal will also provide some measure of value for Pengrowth shareholders and other stakeholders.

Pengrowth said in the release it expects to close the transaction in late December. Tudor, Pickering, Holt & Co. and Perella Weinberg Partners LP were financial advisers to Pengrowth in connection to the transaction as well as a strategic review the company launched in March 2019.

Recommended Reading

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.