(Source: Shutterstock/Hart Energy)

[Editor’s note: This is the second part of a series. For part 1, visit Stratas Advisors’ website.]

With second quarter results hitting the wires, a few key items are weighing on shalers: layoffs, reductions in capital spending and less than exciting well results.

Pressure appears to be mounting on North American shale if recent disclosures by a cadre of oil and gas companies are indicative of the broader industry.

Unit costs are rising in key productive areas and recent well results in select areas are falling short of expectations. Consequently, exploration and development plans are being adjusted and capital efficiencies are again being questioned.

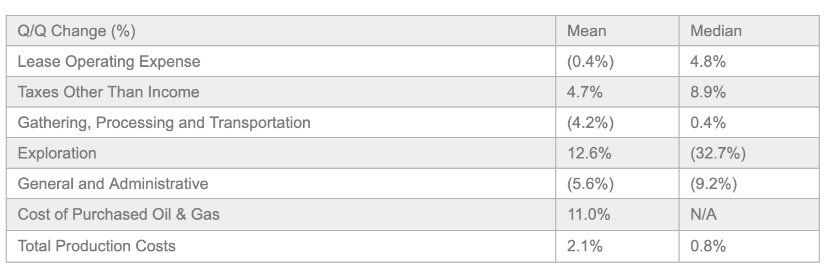

Looking at the change of quarterly production costs, coupled with news of lower than expected well results, leads to the belief that capital efficiency is waning. As such, operators are lowering rig counts in order to keep capital budgets in check while honing in on the optimal drilling strategies.

Should West Texas Intermediate prices slip below $45 per barrel for a sustained period of time, reductions in rig counts could be severe enough to slash year-end 2020 shale production by as much as 500 Mbbl/d (5%).

Capital Efficiency Is Down

Of the handful of public operators reporting so far, concerns have arisen as to the outlook for North American shale in whole.

For starters, unit costs per barrel ($/Boe) on average from operators with recent announcements are seeing higher total production costs (up $0.40). The median increase is $0.10/Boe.

Looking to the third quarter, Stratas expects average costs will rise another $0.30/Boe and median costs another $0.70/Boe.

While uncertainty looms on the decisions to be made with operators in the near term, Stratas presents a hypothetical scenario. It is almost universally known that the shalers feel pressure to live within cash flow. It has been witnessed that as costs have risen, so too have budgets. Consequently, rigs are being dropped in hopes to obtain positive cash flow in 2020. Notably, horizontal oil rigs have dropped 12% since fourth-quarter 2018 in the U.S.

But what if that isn’t enough?

Oilfield service operators have been stretched to the gills by trying to appease upstream operators on costs. And the jury is still out on the effectiveness on large scale development. The idea here is to maximize drilling efficiency by lowering downtime for a rig and increase production by tighter spacing, say from 4-6 wells per section to 8-12. One operator in particular spaced its wells too closely in the Permian, resulting in excessive communication between the parent/child wells and therefore experienced less than expected production performance.

The increased production costs coupled with lower expected volumes suggests that capital efficiency is waning.

Recommended Reading

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.