(Source: Integrity Bio-Chem)

[Editor's note: This story originally appeared in the April 2020 edition of E&P. Subscribe to the magazine here.]

Creativity in the oil field has been quietly percolating in the offices of E&P companies since the 2014 downtown. The best minds in geology, geochemistry, geophysics and engineering have moved on from “how do we stimulate these rocks?” to “how do we profitably stimulate these wells?”

Reconsideration has been broad, starting as chaotic exercises, but it has evolved with rigor to reveal the outlines of the next generation of fluids. Unfortunately for chemical suppliers, engineering design firms and pressure pumpers that do not hear the operators, the market has become a Darwinian exercise in the survival of the cost fittest. The initial blunt force response by these companies was cost reduction in an effort to keep the lights on. Costs were reduced by reflexively removing additives from fluids like clay control and surfactant-based products, product substitution (proppant) and leveraging supply and demand conditions (polyacrylamide friction reducers).

Not surprisingly, some of these early decisions are now being reconsidered without losing the focus of more diligent cash management. The reconsideration has revealed several pockets of valuable technology introductions, especially for stimulation chemicals.

Future of clay control

None of the common fluid additives have endured more scrutiny than clay control products—deservedly so. The rapid growth of the hydraulic fracturing business in the early 2000s put the industry in a position to reach for the familiar, the easy and the available. Cation exchange-based additives like potassium chloride and choline chloride products, among others, were quickly deployed even though the mineralogy of vanishingly few landing zones contained the smectite-rich zones encountered during drilling. In 2015 it became apparent that the need for swelling clay control was minimal. Clay control was among the first chemicals to be scratched from fluid prescriptions.

However, the dynamic interaction between rock and fluids continued to present clay-related challenges for sustaining hydrocarbon production. Sloughing clays still harmed fracture conductivity and fracture face softening still eased proppant embedment. Both problems fell squarely in the realm of clay control but in a different context to the first-generation clay control products.

Advances in biopolymer chemistry occurred in parallel to the domestic hydraulic fracturing boom and are now available to solve these problems. Specific features such as structure (linear, cyclic, condensed, etc.) and molecular weight are available with capability-controlled production practices. Additionally, economically promising reactions to functionalize these biopolymers for enhanced performance are now serving the oilfield market. These reactions also deliver the certainty of formulation improvement and overall fluid compatibility.

Technical mastery of these features leads to the multifunctionality needed to create value for solutions providers and deliver field production increases in this era of return on investment (Figure 1). New biopolymeric clay control solutions can be chemically engineered to slow proppant embedment, the process that leads to the constriction of the fracture network (i.e., conductivity decrease). Testing shows that first-generation clay control products fail to address proppant embedment. Nor should they. The exchange base reaction designed to address hydration simultaneously reduces the clay structure producing nanoscale voids backfilled with formation waters.

This structural change and subsequent backfilling are likely key factors in fracture face softening that could increase embedment. Although there is much work to be done to understand the dynamic chemistry at the fracture interface, a clay control additive not producing changes in the mineral structure certainly addresses this softening mechanism.

Flow aids

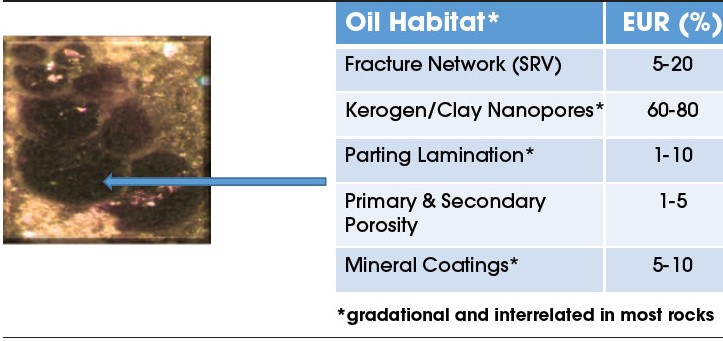

After more than 160 years from the first producing oil well, the industry is still teaching itself how to produce the large remaining oil reserves in low-permeability reservoirs. Estimates of the remaining hydrocarbon resource in newly developed unconventional reservoirs exceed 80%. The industry knows that this oil is still available. Thus far, it focused on optimizing proppant sizing, types and loadings, fluid pumping rates and volumes, perforation density, and sequencing changes to all the above. However, none of these recent efforts access the first 100 μm of the unpropped oil migration path (i.e., the matrix). This unproduced oil is stored in habitats of nanoporous, oil saturated kerogen networks, moldic porosity and parting laminations. The oils of these habitats span a range of hydrocarbon (e.g., linear, cyclic,polar and non-polar) and aqueous (e.g., salinity and metal) chemistry (Figure 2).

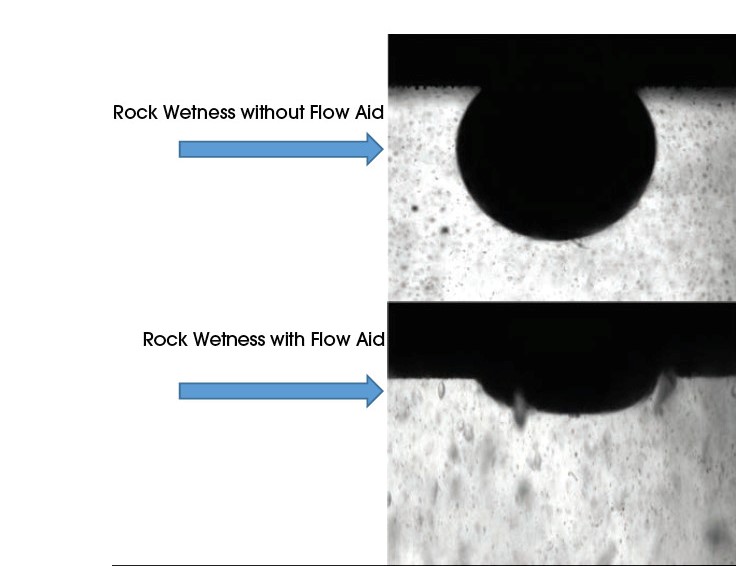

The first-generation flow aids are engineered fluid additives typically centered on the established properties of surfactants to increase hydrocarbon production. A key property of flow aids is the ability to lower surface and interfacial tension between liquid-liquid and liquid-solid (mineral) interfaces. This process is called “wetting,” and the main purpose is to lower the energy required for oil to flow through formation waters. By lowering the surface tension of the waters in the near-wellbore region and stimulated rock volume, flow aids are said to connect the reservoir to the well (Figure 3).

Another property sought from flow aids is to avoid emulsifying the hydrocarbon and aqueous phases in produced crude oil. Both properties are readily assessed by well-controlled laboratory experiments. However, at best, these tests give a first-principle glimpse of how the product may perform in the reservoir.

There is still an opportunity to increase the value of flow aids with advanced formulation chemistry. Current flow aid formulations are relatively primitive and focus on the conditions in the fracture network. Chemically engineered flow aids that are designed to simultaneously interact with more of the individual habitats where larger oil stores reside will improve production in the future. Although the geochemistry of the reservoir and surfactants challenge the compatibility control of these products, precedent for the advanced formulation is found in many consumer markets.

Future value

Chemical solutions providers must accept the fact that the overpromoted products of the first cycle introduced a credibility tax that can now be paid with the value of product multifunctionality. Clear examples exist for clay control and production flow aids. Clay control performance can be expected to simultaneously address hydrating clays, sloughing clays and fracture face softening.

Hydrocarbon production aids can be expected to wet more than one oil habitat in the landing zone, break the oil and manage more reactions between hydrocarbons, waters and metals. The geologic complexity of unconventional reservoirs requires more than singular purpose chemicals. Resource plays are spatially and temporally dynamic assets that are not optimally developed with boilerplate solutions. Chemical technology exists that easily transfers into the oil field, especially for forward thinkers capable of determining the aggregate return of well cost investment on well production.

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.