Presented by:

Carbon capture and storage (CCS) is becoming a priority for operators across the U.S., and companies like Stakeholder Midstream are providing attractive solutions.

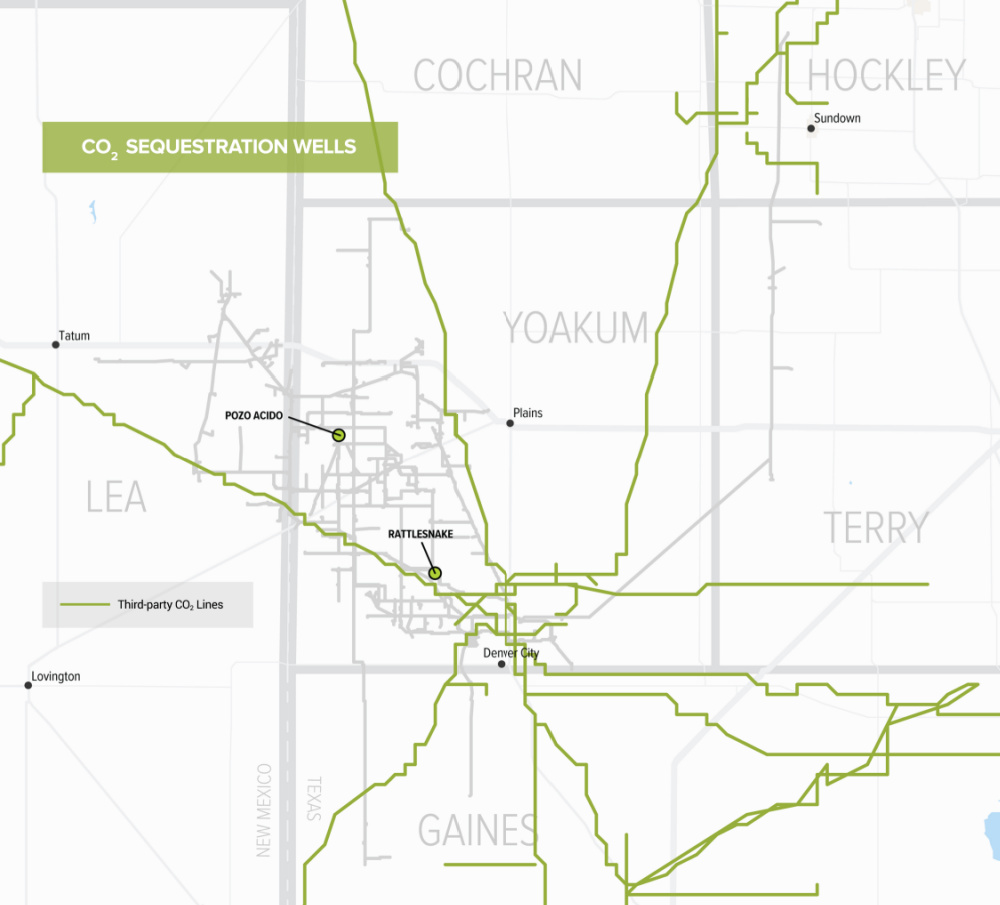

Backed by EnCap Flatrock Midstream, Stakeholder Midstream has assets in the Permian Basin near the Texas-New Mexico border. The company recently received approval from the EPA for a monitoring, reporting and verification (MRV) plan at a Permian Basin gas plant in Texas.

The Stakeholder plan is the first approved by the EPA in the state for permanent geologic sequestration of CO₂ that is not associated with EOR operations. It documents how Stakeholder will ensure permanent carbon capture and storage (CCS) of CO₂ in the Pozo Acido well from natural gas processed and treated at its Campo Viejo gas plant.

Reducing the industry’s carbon footprint

According to Rob Liddell, co-CEO at Stakeholder, CCS has been a focus for the company from day one.

“The world has changed, and there is more focus now on carbon emissions in oil and gas and across the board,” Liddell told Hart Energy. “We think sequestering CO₂ is one of the ways we as a country will be able to pull the lever and reduce our national carbon footprint and more specifically our industry’s carbon footprint.”

Fossil fuels will continue to support the world economy for the foreseeable future, Chief Commercial Officer Brett Baker said, “and we have a moral obligation to do whatever we can to ensure those fuels are produced, transported and processed in the most environmentally responsible way.” Reducing wellhead flaring is one way to mitigate the effects of hydrocarbon development, he told Hart Energy, “but after mitigating flared and vented gas, we believe injecting captured CO₂ is the way our industry is best situated to help reduce global emissions.”

“The world has changed, and there is more focus now on carbon emissions in oil and gas and across the board”—Robert Liddell, Stakeholder Midstream

The Permian Basin, the second largest shale gas-producing region in the U.S., is a good place to start expanding CCS capacity. According to GlobalData, a data analytics and consulting company, production capacity in the basin in 2022 was 19,891 MMcf/d, the majority of which is associated gas.

Liddell said one of the challenges in managing that associated gas is the fact that it is complex. “The gas stream produced in the San Andres has a lot of CO₂ and nitrogen in the gas stream,” he said. The Stakeholder technical team’s experience with that type of gas put the company in a good position to offer services that competitors do not.

Stakeholder started by managing its “Equity CO₂,” which Baker explains as, “CO₂ currently being captured and sequestered that’s associated with the gas that we manage at our facilities and gas pipelines.”

Equity CO₂ is part of normal gas treating and processing on site today. The company’s low-pressure gathering system receives gas from nearby producers and moves it to one of two processing facilities, where the gas is compressed and sent through an amine treater to remove CO₂ and other impurities, which are sequestered nearby.

The location of the disposal site in relation to pipeline infrastructure is another plus, Liddell explained. “We are at the backbone of the existing infrastructure of major CO₂ pipelines, all of which run through Stakeholder’s footprint,” he said. “Our location provides access for other emitters. We can access third-party CO₂ volumes that currently are being vented and sequester them in a timely and capitally efficient manner.”

Getting others on board

What Liddell and his team discovered as they began talking with producers and other midstream operators is that there are a lot of likeminded companies. “They are venting CO₂ now, but they want to be good corporate citizens. They want to be environmentally responsible,” he said.

Stakeholder intends to help those companies by providing sequestration services for their emissions. “We’ve been advantaged by the nature of our operations, which required us to drill the sequestration well and put in the equipment necessary to capture and inject,” Stakeholder COO Josh Roberts told Hart Energy.

“We believe the widespread development of CCS in the Permian Basin will be a giant step toward reducing localized and global emissions.”—Brett Baker, Stakeholder Midstream

Currently, Stakeholder is sequestering more than 90,000 metric tons/year, Baker said. “With updated capacity and the newly MRV-approved well, we will be able to sequester 691,000 metric tons/year of CO₂.” Development of a third sequestration well, now underway, will soon give Stakeholder the capacity to sequester greater than 1 million metric tons/year.

The added capacity opens up more opportunity for “Non-equity CO₂” (CO₂ from third parties) that will come from other processing facilities where CO₂ will be removed from natural gas streams and sent to Stakeholder for sequestration.

With the MRV award from the EPA, Stakeholder can provide operators in the Permian and other basins access to a permanent carbon sequestration option that allows them to substantially reduce their carbon footprint using a solution they can trust.

“One of the reasons the MRV approval was so important for us is that it validates our process,” Liddell said. “Our well is safe. Our process is responsible. This is a qualified home for CO₂.”

“We are in a unique position,” Principal and Co-CEO Gaylon Gray told Hart Energy. “We have robust infrastructure and are excited about the opportunity that this injection reservoir affords us.

“Ultimately, by partnering with other midstream providers and offering them an immediate solution for carbon management, we have the potential to dramatically reduce the carbon footprint of operations in the Permian Basin.”

Responsible development

One of the things that differentiate Stakeholder’s service is its geographic location. There are geologic advantages of injecting into the Devonian formation in Yoakum County, Roberts said, noting that it has some of the lowest seismicity in the Permian Basin and that the permeability and porosity of the rock make it ideal for sequestration.

“Ultimately, by partnering with other midstream providers and offering them an immediate solution for carbon management, we have the potential to dramatically reduce the carbon footprint of operations in the Permian Basin.”—Gaylon Gray, Stakeholder Midstream

Because CO₂ will be stored at a depth of about 12,000 ft, there is little chance of it affecting drinking water in the water table 10,000 ft above, he said. Additionally, “the storage area is 6,000 to 7,000 ft below the nearest producing zone, so there is limited risk of area drillers accidentally penetrating it.,” he said. With the Woodford shale acting as a seal above the formation, there is minimal likelihood of CO₂ escaping.

Though seismic events are unlikely, Stakeholder is installing a seismometer and will be trending and tracking CO₂ readings at nearby surface locations and monitoring its nearby water wells to provide assurance that there is no leakage.

Incentives enable broader adoption of sequestration

The U.S. Tax Credit for Carbon Sequestration (Section 45Q) incentivizes investment in carbon capture and sequestration by offering a tax credit that is calculated per metric ton of qualified CO₂ captured and sequestered.

Liddell said Stakeholder’s MRV approval and the ability to meet other statutory requirements allows the company—and other parties who use its CCS facilities—to qualify for 45Q tax credits.

“Stakeholder wanted to capitalize on these tax credits for CO₂ that we are currently removing,” Liddell said, “and now we can make our service available to other companies so they can capitalize on the tax credits too. The credits are a catalyst for companies now venting CO₂ to look seriously at sequestration solutions.”

Stakeholder’s experience with the EPA has been positive according to Liddell, who characterized the EPA representatives as “thorough and professional.” Within the industry, there is a tendency to think about government agency involvement as an obstruction, but Stakeholder’s engagement with the agency paints a different picture.

“Everyone wants to see progress,” he said. “We all want a pathway to safe wells that can be easily monitored and reported on.”

According to Liddell, all the agencies the company worked with to get MRV approval are agencies they have been utilizing through normal business activities. “Familiarity with the agencies and people put Stakeholder on the leading edge of opportunity and ultimately pushed us across the finish line,” he said.

The fact that the company secured approval for its Permian Basin activities is proof that the process works.

“When you’re the first to go out and do something, there are a lot of questions, ambiguity and hesitancy,” Liddell said. “MRV approval provides credibility for our offering. This is part of our industry’s future, and it’s achievable.”

Although policies are evolving, and requirements continue to change, Stakeholder is enthusiastic about being part of the process, Roberts said. “As we transition to the world of 45Q and carbon management, we understand that it is important for the industry to start taking steps in that direction. We are confident in our carbon sequestration solution from a policy and procedural perspective.”

Stakeholder has invested in garnering the resources, the consultants, and the third-party experts to impact the way this is going to be administered, Roberts said. “We have a deep bench of people with technical expertise and commercial polity to engage in this process and believe that we are emerging as leaders in carbon management.”

Brett Baker, Stakeholder’s chief commercial officer, summed up the company’s plans and its broader goals in simple terms. “We believe the widespread development of CCS in the Permian Basin will be a giant step toward reducing localized and global emissions. It’s important to us as a company to do everything we can to maintain a more sustainable and responsible future.”

Planning for the future

“Our hope is that a few years from now this is not unique,” Liddell said. “We have other wells we want to get permitted. We hope others will latch onto this.”

The initial step of securing MRV approval for the permanent sequestration of CO₂ at its Pozo Acido injection well is a critical one because it provides a foundation upon which Stakeholder can build.

“We are a young team and want to be doing this for a long time because it is important to the longevity of the sector,” Liddell said. “We are focusing on traditional gathering and processing opportunities in the hope that we can create opportunities and have a positive impact for our industry.”

The company is looking for additional locations that can be used for sequestration and is continuing to have conversations with CO₂ emitters across the play with the goal of finding more storage capacity and an established customer base for its offering.

“As we transition to the world of 45Q and carbon management, we understand that it is important for the industry to start taking steps in that direction.”—Josh Roberts, Stakeholder Midstream

Meanwhile, Stakeholder has plans to further build out its capture and sequestration facilities with the goal of readying them for operation in 2023.

Rapid expansion has been possible because of the company’s vision and the effort that has gone into planning for growth, Liddell said. “We did extensive modeling to determine what the capacity of our Pozo Acido well could be, while still ensuring safe and responsible CO₂ sequestration.”

As Stakeholder starts to commercialize this plan, it will have to invest in pipeline infrastructure and additional compression and pumps to optimize ultimate capacity, he said, but the capital expense will be worth it. “There are a lot of emissions in the sector that would fill up 1 million metric ton capacity without eliminating CO₂ in the midstream space,” he said.

Co-CEO Gray believes this approach will appeal to the company’s producers, who he said have been aligned with mitigating the overall environmental impact of the play and want it to be as clean as possible.

“They worked with Stakeholder to eliminate flaring at the wellhead and take the first steps toward carbon sequestration in an effort to reduce the environmental impact of operations in the basin,” he said, and they will continue to partner with Stakeholder to improve environmental stewardship in the region.

“We believe this marks the beginning of an important new aspect of the midstream business,” Baker added. “We hope this landmark approval will encourage other midstream operators to pursue similar paths so we as an industry can reduce our overall carbon footprint.”

Recommended Reading

Energy Transition in Motion (Week of Feb. 16, 2024)

2024-02-16 - Here is a look at some of this week’s renewable energy news, including the outlook for solar and battery storage in the U.S.

Energy Transition in Motion (Week of March 1, 2024)

2024-03-01 - Here is a look at some of this week’s renewable energy news, including Chevron’s plans for a solar-to-hydrogen facility in California.

Energy Transition in Motion (Week of April 19, 2024)

2024-04-19 - Here is a look at some of this week’s renewable energy news, including the latest on global solar sector funding and M&A.

Energy Transition in Motion (Week of March 8, 2024)

2024-03-08 - Here is a look at some of this week’s renewable energy news, including a record-setting 2023 for U.S. solar.

Energy Transition in Motion (Week of April 5, 2024)

2024-04-05 - Here is a look at some of this week’s renewable energy news, including the U.S. Environmental Protection Agency’s $20 billion ‘green bank.’