The MRV approval provides a pathway for Stakeholder Midstream and third parties, who contract for CO₂ sequestration services in the plan’s Pozo Acido injection well, to qualify for 45Q tax credits. (Source: Shutterstock.com)

Stakeholder Midstream received “first of its kind” approval on Sept. 13 from the EPA for its monitoring, reporting and verification (MRV) plan of a carbon capture project in the Permian Basin.

“Our vision is to become one of the leading carbon solutions providers in the United States by helping producers and like-minded midstream companies across multiple basins decarbonize their operations,” commented Brett Baker, chief commercial officer at Stakeholder Midstream.

Based in San Antonio and founded in 2015, Stakeholder Midstream is an independent midstream company serving oil and gas producers operating throughout North America. The company is supported by a private equity commitment from EnCap Flatrock Midstream.

Stakeholder’s MRV plan is the first to be approved by the EPA for permanent geologic sequestration of CO₂ within the state of Texas that is not associated with EOR operations, according to the company release on Sept. 13.

“Carbon and emissions management is an integral focus and business segment for our company,” Baker said in the release. “We believe that by offering these services to third parties, including other gas processing plants in the Permian region and beyond, we can provide an environmentally responsible solution for CO₂ emitters to reduce the carbon intensity of their oil and gas operations and to meet their ESG goals.”

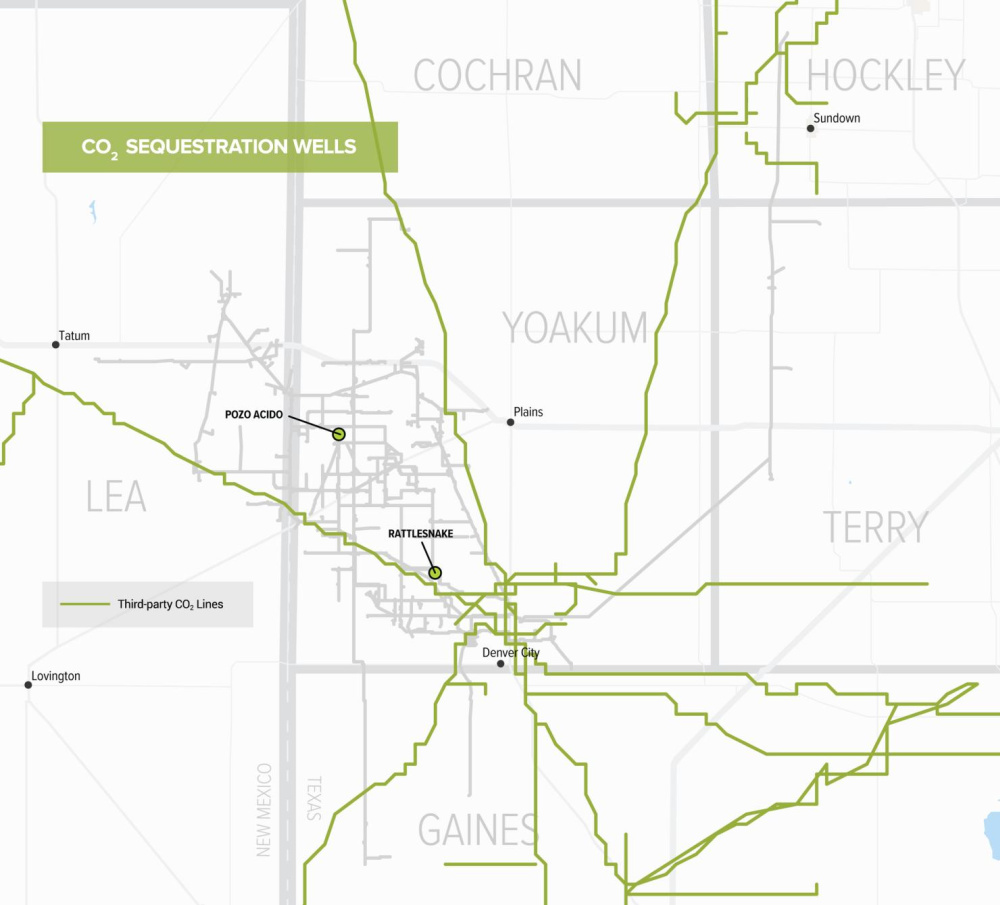

The MRV plan documents how the company will ensure permanent carbon capture and storage of CO₂ in the Pozo Acido injection well in the Permian Basin near the Texas-New Mexico border from natural gas that is processed and treated at Stakeholder’s Campo Viejo gas plant.

Stakeholder operates two permanent sequestration wells responsible for the secure geologic storage of more than 85,000 metric tons per year of CO₂. This effort is equivalent to eliminating the carbon emissions of 11,000 U.S. households or removing 18,000 internal combustion vehicles from the road, according to the company release.

One of those two permanent sequestration wells, Pozo Acido, is a state-of-the-art injection well, according to Stakeholder, designed to permanently sequester CO₂ by injecting the greenhouse gas into the Devonian formation more than two miles below surface and 10,000 ft below the water table.

The MRV approval, in conjunction with meeting other statutory requirements, will allow Stakeholder and other parties who contract to permanently sequester CO₂ in the Pozo Acido injection well, to qualify for 45Q tax credits, further facilitating the growing movement toward more responsible energy production.

Stakeholder is currently developing the final phases of its carbon capture equipment buildout with plans to install additional facilities in 2023.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.