The Concho transaction follows Spur Energy’s acquisition in May of Percussion Petroleum LLC, a private-equity backed company focused in the Permian Northwest Shelf of New Mexico. (Source: Hart Energy)

Spur Energy Partners LLC—the new Permian-focused company led by Jay Graham—has struck again.

Roughly four months since making its debut with its first acquisition and partnership with New York-based investment firm KKR, Graham’s new venture has landed another deal—this time with one of the largest unconventional shale producers in the Permian Basin.

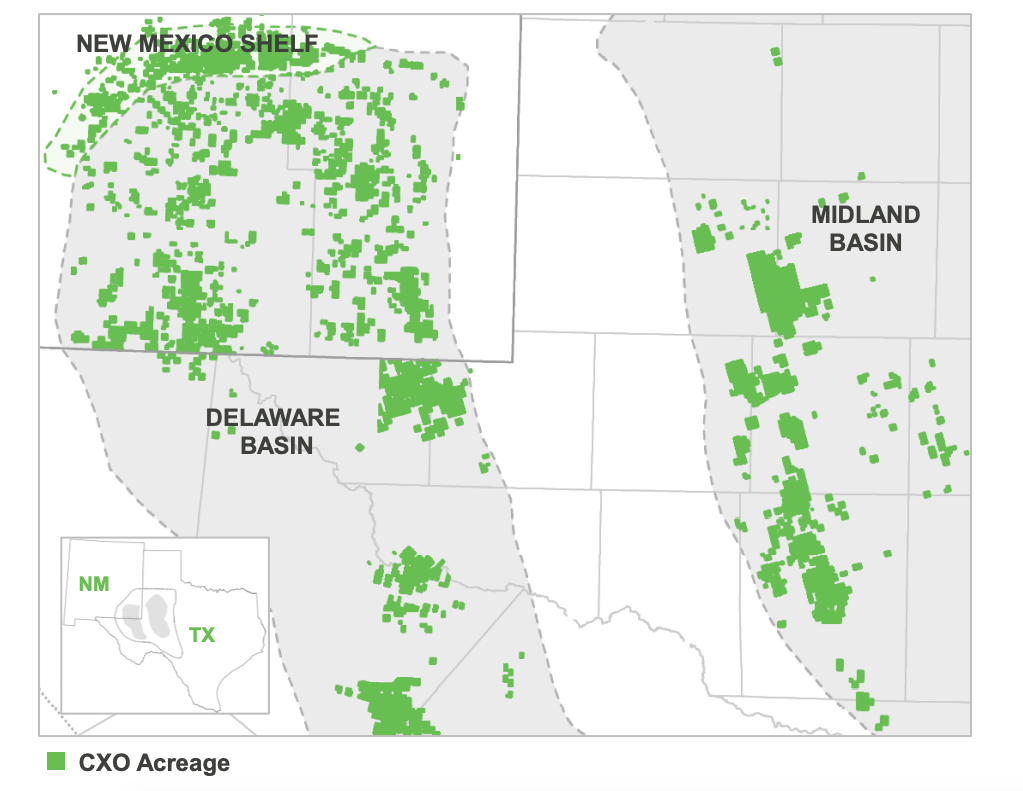

On Sept. 3, Concho Resources Inc. said it had agreed to sell its assets in the New Mexico Shelf to an affiliate of Spur Energy for $925 million. The divestiture includes roughly 100,000 gross acres and about 25,000 barrels of oil equivalent per day (boe/d) of current production.

The transaction follows Spur Energy’s acquisition in May of Percussion Petroleum LLC, a private-equity backed company focused in the Permian Northwest Shelf of New Mexico. The Percussion acquisition included 22,000 net acres in Eddy and Lea counties, N.M., within the core of the Yeso formation, for undisclosed terms.

Graham is the co-founder and former CEO of WildHorse Resources Development Corp., an E&P focused in the Eagle Ford Shale and Austin Chalk plays. In October 2018, Graham and his team agreed to sell WildHorse to Chesapeake Energy Corp. in a cash-and-stock transaction worth nearly $4 billion. The transaction closed Feb. 1.

In his latest venture, Graham is focused on delivering long-term investor returns by building Spur into a “large-scale business in the oil and gas sector,” he said in a statement in May.

Spur’s acquisition from Concho will add to the position it acquired from Percussion Petroleum in the Permian Northwest Shelf, which produced about 9,200 boe/d, comprised of 85% liquids, during first-quarter 2019.

Following the sale, Concho said it will maintain a large presence and development program in southeastern New Mexico and will continue to support the local communities in which its employees live and work.

Concho plans to use the $925 million proceeds from the sale to pay down debt and initiate a $1.5 billion share repurchase program the company’s board of directors also authorized on Sept. 3.

Analysts with Tudor, Pickering, Holt & Co. (TPH) said if assuming no undeveloped acreage value, the transaction’s price tag would imply a per barrel flowing metric valuation of about $37,000 per boe/d.

“This falls in-line with management’s previous messaging of desire to sell about $1 billion of assets that aren’t competing for capital at the drill-bit within their portfolio,” the TPH analysts wrote in a Sept. 3 research note.

In a statement, Concho CEO Tim Leach said the transaction reduces the company’s cost structure while allowing it to achieve its leverage target.

“Proactively managing our asset portfolio has long been a key part of our strategy,” Leach said. “Divesting our New Mexico Shelf position enables us to accelerate the value of these legacy assets, while focusing our portfolio on opportunities with the highest potential for strong returns.”

Concho said it expects to close the transaction in November. RBC Richardson Barr served as its financial adviser on the sale of the Shelf.

Recommended Reading

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.