The Panama Canal Authority made a brilliant move earlier this year. The agency proposed to change the tolling structure for its canal, which is currently undergoing an expansion to be finished early next year. It proposed—for the first time—a differentiated tolling rate for LNG carriers.

In a full century, the canal has never had LNG tankers transit before; they could not fit. But now with a burgeoning LNG industry, the authority recognized that its expansion could take advantage of this new traffic opportunity.

With the expansion, 80% or more of the world’s LNG carrier fleet would be able to fit through the new set of locks, according to the U.S. Energy Information Administration (EIA). EIA analyst Michael Yo said in an interview with Midstream Business that the percent age includes conventional Moss, conventional membrane and Atlantic-Max LNG carriers—everything except the two largest-extant types of carrier, the Qatar-Max and Qatar-Flex.

Silvia de Marucci, manager of marketing and forecasting for the authority, said at a recent LNG conference in Austin, Texas, that 92% of the existing LNG carrier fleet and future orderbook will fit through the new locks.

Gulf Coast lure

With the authority anticipating LNG traffic, it is refining its tolling structure to make it an attractive option for LNG projects in the Gulf Coast when they come online in the next five to 10 years. The authority solicited comments on the proposal and facilitated a public hearing in late February. Tariff rates were ap proved by the Cabinet Council of the Republic of Panama in April, and they will be implemented in April 2016.

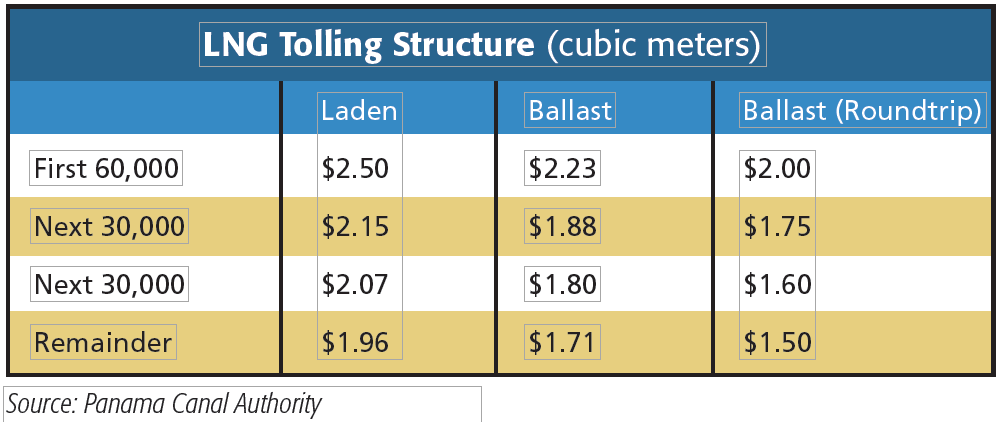

The authority took the revolutionary move to toll the LNG carriers according to cubic meters of LNG capacity. The first 60,000 cubic meters (Mcu. m) will be tolled at a rate of $2.50 per cu. m. The next 30 Mcu. m will be tolled at a rate of $2.15, the 30 Mcu. m after that at $2.07 and then $1.96 per cu. m for the remaining amount beyond 120 Mcu. m.

For ships that have less than 10% of their LNG capacity filled with cargo, a ballast toll will be used, which reduces the amount shippers must pay. The respective strata for those toll rates are $2.23, $1.88, $1.80 and $1.71. In a move to increase loyalty in choosing the canal over other routes, a special “roundtrip ballast” toll will be used for those ships that return to use the canal within 60 days of an original, outbound, laden voyage. In that instance, a special reduced fare will be exacted: $2, $1.75, $1.60 and $1.50, respectively.

According to her conference presentation, de Marucci estimated that the tolls will cost $335,000 for a laden 150 Mcu. m LNG carrier, while when it returns under the roundtrip ballast fee, the same-sized ship will pay $265,500 in tolls. A 173 Mcu. m carrier will pay $380,480 and $300,000, respectively.

Time is money

These savings make a difference on the significant journeys LNG carriers must take. Estimates from Clarkson’s, Bloomberg and AT Kearney put the roundtrip journey to Japan from the U.S. Gulf Coast at about 40 days to 50 days when traversing the expanded canal. The shortest alternative route would be to sail around the southern tip of Africa and through the Indian Ocean, which would take from 60 days to 80 days by those same estimates. In a worst-case scenario, that’s already a reduction of 10 days, or about 17% of travel time. In the best-case scenario, the time is halved.

The travel time matters to shippers because of the significant financial burden associated with daily running and chartering cost with LNG carriers. It is difficult to project what the future charter rates for LNG carriers will be, but a recent estimate by AT Kearney suggested the daily operating cost of an LNG tanker was about $88,000. According to data from Hart Energy’s Stratas Advisors, charter rates have varied in recent years from less than $50,000 per day to more than $100,000 per day. So when time is halved, operating costs follow.

The problem for the authority was how to schedule a toll rate that would not discourage use. In other words, it had to find a comfortable medium between recouping its costs and not going so high as to make shipping costs prohibitive. The authority’s de Marucci said the agency performed a sophisticated market analysis of the four main segments of canal traffic to come up with the proposed set of tolls for LNG.

“When we present a pricing for a specific type of vessel,” she told Midstream Business, “it’s after we’ve done a very thorough analysis of their voyage cost, their market, the demand for their product, their destinations, possible alternative routes and potential sources that do not require transit of the Panama Canal.”

So did the authority succeeded in providing an attractive tolling rate?

‘Rather pleased’

“We hope so,” she said. “But I have to say, I think the industry is rather pleased.

Probably not everyone is happy 100%, but I have read in some of the newspapers that they were quite satisfied with the news. The canal, what it has always done and will continue to do, is to enable trade. The rates we have presented, I think, are good enough to enable this trade and not be a barrier to gas in the Gulf [of Mexico] to end up in Asia or in South America. Or vice versa, Peru, or any place in South America going to Europe.”

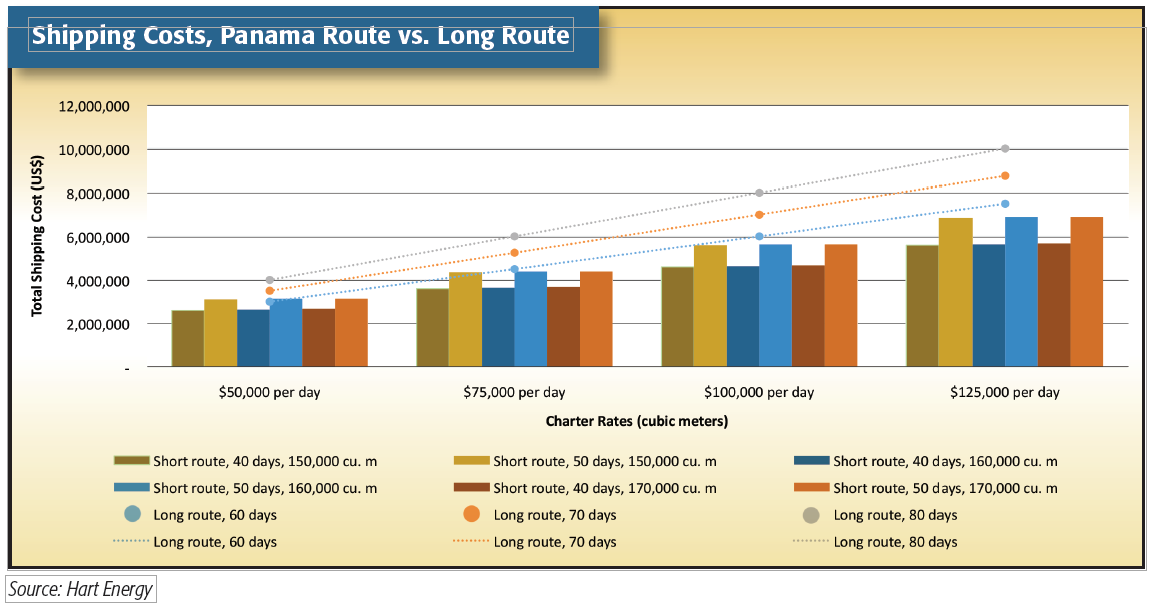

Hart Energy ran several different scenarios, attempting to make a cost analysis of which route may prove more attractive for Gulf Coast-to-Japan LNG shippers—the long route that travels around Africa or the short route through Panama. It looked at three different time scenarios for the long route, and it looked at six different scenarios for the short route, trying to take into account LNG capacity as well as variable lengths of voyage. All of these scenar ios were grouped into four categories, which assume different parameters for charter rates. The results are displayed in the chart on the next page.

Based on Hart Energy’s analysis, the Panama Canal Authority succeeded in providing an attractive option. In almost every scenario, the Panama route provides a more attractive option for LNG shippers. Only in a 60-day long route, 50-day short route, low-charter rate scenario would the route south of Africa present cost savings. In every other set of charter rate scenarios, using the Panama Canal provides a total savings of at least $114,500 for the voyage, although with more realistic scenarios, that arbitrage is likely to be higher. At charter rates of $100,000 per day, the canal presents an average savings of about $1.8 million. In sublime scenarios, using the Panama Canal can save about $3.75 million.

De Marucci, in her presentation, looked at the time savings of potential trade routes. In a Gulf of Mexico-to-Japan route, the canal could shave off 11.4 days vs. using the Suez Canal. For LNG traveling from Trinidad and Tobago to Chile, using the Panama Canal could reduce the total shipping time vs. the Magellan Strait by about 6.3 days. A route from Peru to Spain would be shortened by eight days.

Potential delays

It must be noted that these estimates do not take into account delays from canal traffic. Doubtless the enlarged canal will attract more traffic, which may present delays and therefore higher shipping costs. However, the evidence is clear: The canal stands to be a boon for Gulf LNG projects.

De Marucci said she believes that the first year of operation for the new LNG rates might be a little slow, as the main market for the rates—the LNG projects in the Gulf—will mostly still be developing.

The Sabine Pass LNG complex is projected to be first to produce first LNG around the turn of the year, but after it, other projects will take several years to come online. Cameron LNG began construction in October 2014, Freeport LNG began construction in November 2014 and Corpus Christi LNG took its final investment decision in May. All expect to go commercial in 2018. Other projects have been proposed in the Gulf Coast, but it is unclear which ones will ultimately move forward.

Asian markets

Most of those projects are eyeing Asian markets. Sabine Pass has sales agreements with Korea Gas Corp. and GAIL India. Cameron will see some gas go to Kansai Electric Power, Tohoku Electric Power Co. and Tokyo Gas through tolling arrangements with its proponents.

Freeport is looking at Toshiba, Osaka Gas and Chubu Electric Power. The authority has pointed out that 24.7 million tonnes per year of LNG from the five U.S. liquefaction projects under construction is destined to be delivered to Asian consumers.

“So we think the first year will be slow, which is good for us, because it gives us an opportunity to get accustomed to the new vessels, but we will see strong growth in 2017 and 2018 when more terminals become operational in the Gulf of Mexico,” de Marucci said. “With the volumes that are being discussed that are already contracted with the Gulf of Mexico and Asian markets, we may see probably 500 to 600 [one-way] transits in 2020.”

At the Austin conference, de Marucci followed up in her presentation with more exact numbers. The canal authority expects about 58 transits, laden and ballast together, in 2017, about 518 in 2018 and about 630 in 2019.

Dan Loughney, director of marketing and trade development at Louisiana’s Lake Charles Harbor and Terminal District, said the expansion of the canal is very important for the projects being built and proposed around the Lake Charles area. There are several more projects in the area that would presumably use the canal: Magnolia LNG, Venture Global LNG, Live Oak LNG, Southern California Telephone & Energy LNG, Trunkline LNG and others have proposed plants in addition to Cameron LNG.

Alex Munton, analyst at Wood Mac Kenzie, agrees the new tolls will help U.S. Gulf projects.

“I think it reduces some 80 cents per MMBtu [million Btu] from transportation costs. So it was pretty much in line with what we thought that the tolling fees would be. So it is a positive for U.S. exports,” he told Midstream Business.

It would seem the authority’s hard work in forecasting will pay off—and Gulf LNG projects are set to benefit.

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Imperial Oil Shuts Down Fuel Pipeline in Central Canada

2024-03-18 - Supplies on the Winnipeg regional line will be rerouted for three months.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.