Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Laden with 220,000 cubic meters of chilled cargo, the big LNG tankers will slowly pull away from their docks, be guided by tugs to open water and slice through waves on their own power until the greenish depths of the Gulf of Mexico turn bluish. Then the ships will set their course: east toward Europe, west through the Panama Canal to Asia or south to ports in Latin America.

It all depends on who wants to buy it. The great North American LNG export experiment is transitioning from the remarkable—gas reserve estimates for shale alone rising 23% in 2014; global capital expenditures for the industry expected to reach $259 billion from 2015 to 2019—to the realistic, i.e., how much can we actually sell and at what price?

Proposals have been filed to build multiple export terminals with capacity of more than 43 billion cubic feet per day (Bcf/d) on U.S. Lower-48 coasts. That’s remarkable.

The reality

Nowhere near that number will be built. That’s reality. There isn’t a need. The volume is there but the buyers are not.

“The challenge is getting the customers,” Patrick Nevins, Washington, D.C.-based partner in the Hogan Lovells law firm, told Midstream Business. “There is a certain amount of market out there for LNG but not nearly enough to support anything close to all the proposed export projects.”

More than that, it’s getting the right customers, those who will not just buy, but buy a lot of gas to propel growing economies and keep filling those big tankers.

“I think everyone pretty much looks to Asia as the most deep-pocketed buyers,” N. Foster Mellen, senior strategic industry analyst with Ernst & Young’s Global Oil & Gas Center, told Midstream Business. “They are in a holding pattern waiting to see what’s happening with oil prices.

“The challenge for the group of U.S. projects that are underway and are going forward and have their commitments locked in,” he continued, “is just keeping their construction and operating costs under control and then trusting that global LNG demand will fill in as currently expected.”

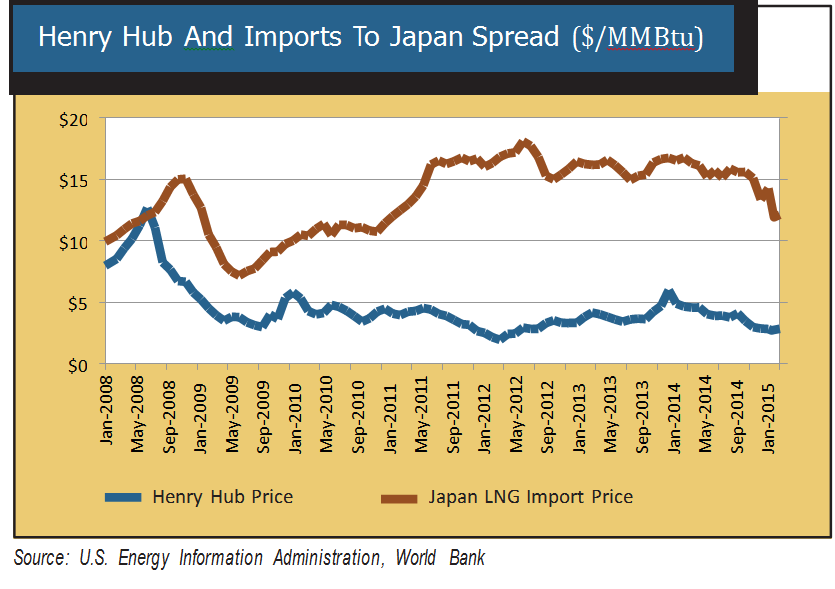

That spellbinding arbitrage opportunity of low North American natural gas prices and very high prices in Asia has faded along with other dynamics, Mary Hemmingsen, Toronto-based partner and national industry lead in power and utilities and Global LNG lead for KPMG, told Midstream Business.

“There is considerable uncertainty around the level of future demand, because many Asian countries’ economies are reassessing their electricity needs in light of cooler economies and exploring other non-gas based options. Many are looking for a lower price point that triggers broader adoption of gas in their electricity and transportation fleets and the question is whether the supply can be delivered economically at the new price point,” she said. “What you saw was a lot of initial interest in the Gulf Coast when the spread between gas and oil was big. It doesn’t look quite as attractive as it did now that oil prices have cratered.”

Finding the funds

The vast majority of projects won’t go forward, Mellen said, because without firm offtake commitments, they won’t be able to secure funding. He expects a second round of U.S. projects to go forward following the initial few: Cheniere Energy Inc.’s projects in Sabine Pass, La., and Corpus Christi, Texas; Sempra’s Cameron LNG in Hackberry, La.; Freeport LNG in Texas; and Dominion Resources’ Cove Point LNG in Maryland.

Mellen does not expect many projects to succeed in the second round, but stressed that Ernst & Young does not pick winners and losers.

However, Stratas Advisors, a Hart Energy company, does. On its website, its analysts assess projects on a one to five scale for six categories: gas supply, export infrastructure, regulatory positioning, proponent size, proponent experience and contracts.

For example, Golden Pass LNG’s export terminal in Sabine Pass, Texas, rates high in export infrastructure (5), proponent size (5) and proponent experience (5). Its gas supply is judged at slightly lower (4) as is its regulatory positioning (3). Those are relatively high marks, but Golden Pass gets only a 1 for the critical aspect of contracts, and Stratas does not expect this project to move forward.

Contrast that assessment with the score for Corpus Christi LNG: top scores for gas supply and proponent experience and marks of 4 for the rest for a total of 26. While not rating much higher than the 23 registered by Golden Pass, Corpus is good to go in the opinion of Stratas.

In pursuit of ‘huge’

Liquefying natural gas so that it can be transported is not new. The first liquefaction plant, CAMEL, was completed in Arzew, Algeria, in September 1964, and the first carrier specifically built to carry LNG, the Methane Princess, delivered the first shipment from that plant to the Canvey Island regasification facility in the U.K. in October of that year. Today, nearly 450 specially built LNG tankers traverse 400 global routes to support an aggregate volume that represents 30% of the international natural gas trade.

What is new is the convergence of a slew of new export sources and growing Asian economies.

Thomas Moore, a Houston-based partner with Mayer Brown LLP, sees Asian demand as the most significant trend that will transform the LNG field. An endless flow of data concerning China, India, Japan and South Korea bedazzles analysts and influences export ambitions.

“The first [issue] is how fast demand for natural gas as a fuel as opposed to any alternatives grows in the Far East,” Moore told Midstream Business. “Clearly, because of the problems with nuclear in Japan, Japan is going to continue to be a major importer. Korea is going to be a major importer and China is beginning to be a major importer, but each of those markets is affected by local forces that are very hard to anticipate. For example, how fast will China’s economy grow? And at what point will this increased environmental awareness push China away from its current reliance on coal? So it’s hard, at least for me, to predict long term what the Chinese market will be.”

“The Chinese market is huge,” agreed Tom Campbell, director for Stratas Advisors. “Japan and Korea, in terms of import capacity, are the big players, and that’s not going to change,” he told Midstream Business.

In Japan, the aftermath of the Fukushima Daichii nuclear disaster, following the March 2011 tsunami, forced that country to move away from nuclear toward alternative sources, at least temporarily. Gas-fired generation is considered by Moore to be the only really viable replacement in the short term.

Hogan Lovells’ David Locascio, a Houston-based partner, echoed that sentiment to Midstream Business. But the Chinese part of the global LNG equation, true to the nature of China in general, is complicated.

“If customers’ analysis is that in the long term the Australian LNG supply will not be there because of limited reserves,” Locascio said, “that may limit the appetite of Asian customers to contract long-term for large quantities of Australian LNG.”

Last year, South Korea-based SK E&S Inc. imported less than 1 million tons of LNG to China. That number will quadruple by 2020, Shaun Parvez, president of SK E&S Americas, said at Mayer Brown’s recent conference in Houston.

SK is partnered with Oklahoma City-based Continental Resources Inc. to exploit the Woodford Shale, but also has interests in Australia’s offshore Barossa-Caldita gas fields that it shares with ConocoPhillips and Santos. Its global production projects include Camisea LNG in Peru, Freeport LNG, Yemen LNG, Ras Laffan LNG and Oman LNG.

“China is going to be a huge LNG market,” Parvez said. “How that pans out remains to be seen.”

China’s downturn

In the near term, however, what has been noted is a sharp downturn in China’s appetite for natural gas, Wood Mackenzie observed in a recent report. Forecasted demand is down 14% to 360 billion cubic meters (Bcm) in 2020 and down 13% to 560 Bcm in 2030.

Wood Mackenzie’s principal gas consultant, Gavin Thompson, cited short-term drivers for the reduced demand, including low oil prices, high domestic gas prices, an about-face on environmental policies, competition from cheaper coal and hydroelectric power and warm winters.

“As a result, there is an oversupply of contracted LNG into the market, particularly during periods of low seasonal demand,” he said. “We expect China will be over-contracted by about 18 Bcm from 2015 until 2017.”

LNG deals have customarily been built around long-term contracts, but Locascio is watching a growing willingness on the buy side to consider purchases on a spot basis. The emergence of a bevy of projects coming online in Australia and North America will likely provide some volume of uncommitted capacity, he said, with competitive pressures driving prices lower and perhaps making the spot market a good place to be for buyers.

Whether a trickle toward uncontracted production and capacity turns into a wave would hinge on how much risk buyers are willing to accept. The trend could be viable “if people are not quite as worried about oil spiking and causing a price differential or spike in spot prices,” he said.

This aspect is uncertain as well, as no one really knows yet how the market will react. Hemmingsen expects Asian buyers to be intent on resisting any return to the previous heady levels of $16 to $18 per million Btu (MMBtu).

“They’re going to be much more disciplined and moderate their demand by introducing other sources into their generating mix,” she said. “You see Japan with policies toward introducing more renewables into the mix and positioning to bring nuclear facilities back into service. You see China continuing to add more coal into the mix and Korea looking at nuclear and coal as well.”

Even if Japan does move aggressively toward LNG, Moore questioned how much its market can grow, citing recent occurrences in Korea as an example.

“Although South Korea is a large LNG importer, the Korean government has become much more resistant to increased imports of LNG and is looking again at alternative fuels, including coal,” he said. “So the question is: Will the natural gas market in the Far East continue to grow the demand for natural gas—and therefore LNG—in that market irrespective of the price of alternative fuels?”

Demand from Europe

“A related question is, will Europe—because of the problems in Ukraine—really spend the money necessary to develop an alternative natural gas supply source for which LNG is probably, at least in the short term, the only alternative?” Moore asked. “And that is going to depend a lot on how long the Ukrainian crisis takes to be resolved and the willingness of Europe to move away from cheaper alternative energy sources such as coal, at least in power generation.”

Cameron Gingrich, Calgary-based director of gas services for Solomon Associates Natural Gas Services, is also watching closely to see which direction the Europeans choose.

“They’ll basically pay a higher price for LNG, but they’ll diversify some of that security-of-supply issue,” he told Midstream Business. “Whether they go all in on LNG is yet to be seen, but certainly Russian gas—a lot of those contracts are linked to oil as well for those European folks. They pay a higher cost of gas already there, so the incremental LNG is a lot smaller delta than it would be for North America to start bringing that LNG. Certainly there are opportunities in Europe. [The supply of LNG doesn’t] have to be low cost because there’s value in diversity because of the security- of-supply issues for a lot of these buyers and utilities in Europe. But will LNG supply take all the Russian gas? I can’t see that happening.”

And Europe is not an energy monolith, either, which presents another type of diversity.

“I think you’re going to see Europe staying an interesting market in some ways,” Campbell added, “particularly in the development of smaller to midscale import terminals for countries like Finland and Sweden. They look at this as an opportunity to diversify their gas supply as well as use this gas for inland markets for fuel solutions and as a marine fuel.”

Geopolitics plays a key role, but the drop in commodity prices is never far from the conversation.

“I do think that customer focus has probably shifted somewhat more toward Europe, partially driven from the falling oil prices,” Nevins said. “At some level it shouldn’t matter when you’re looking at 20-year contracts starting in 2020, but why does the current oil price matter? Because it affects the dynamic of the negotiations.”

Europe’s market targets

“Originally, everyone was looking at Asia because the price differences were so great,” he said. “Even factoring in liquefaction costs, transportation costs, regas costs, you could still land LNG in Asia for a lot less than the prices were a year ago. Demand for gas and LNG in Europe has been pretty flat for a fair number of years, but there is a real interest in diversity of supply and security of supply so there are some good targets in Europe.”

And with environmentally conscious Europe favoring clean-burning gas over coal, this market is a sure bet, right?

Not so much.

“At some price point, even if you put a dollar value on the environmental costs of using coal, people may go back to coal,”

Moore said. “This is a very interesting and sort of odd impact of the development of renewables in Europe, particularly Germany. Renewables are not reliable—you have to have secondary capacity because the sun doesn’t always shine. Renewable energy is also still expensive. Although it is counterintuitive, subsidizing renewables for environmental reasons has led Germany to return to coal for backup generation capacity.

“At some gas-price level, people may return to coal even if they monetize the environmental costs of coal, because, frankly, it will be cheaper,” he said.

Hemmingsen cites a number of factors influencing the direction that Europe takes, but reiterates that cost rules much of the decision making.

“They are increasingly concerned about security of supply so obviously they have significant, extensive relationships with Russia and a lot of their policies now are directed toward getting more self-security with more contribution of renewables,” she said.

But it’s not that simple.

Renewables and coal

“Renewables are currently relying on significant coal generation to balance the intermittent profile of solar and offshore wind,” she said, “so you’re actually seeing [European utilities] burn more carbon then they ever have in the recent decade as a result of the differential prices between other carbon-based fuel options relative to gas, even gas from Russia.”

And while political pressure in the form of environmental concerns exists, its focus has been on nuclear plants.

“At this juncture, you see more environmental pressure on U.S. coal plants than you have in Europe,” Locascio said. “Germany is retiring its nuclear plants, so you’ve got to make that up at some point in some way, whether it’s renewable or natural gas or other power generation. The question is: Will end users drive that or will there be something more at the governmental level or EU level saying, ‘we need to provide for a greater energy security. We’re going to help make these LNG import facilities happen?’

“I don’t get a sense that anything like that is in the works.”

Market price

Hence, the $120 billion question—the amount companies are investing in North American LNG export projects, according to Lux Research: What is the optimum price point for natural gas? The Henry Hub, La., gas price, which is the U.S. benchmark, must be high enough to sustain profit margins for domestic producers, but not so high as to undercut the competitiveness of LNG exports on the Asian market.

Gingrich doesn’t worry about price. “Our cost curve foresees for the next 500 Tcf [trillion cubic feet] of supply in that $4 to $5 [per million Btu (MMBtu)] range or less than that $4 to $5 range on a full-cycle basis, so that includes [finding and development], op costs, overhead, royalties and return on 15% for producers before tax,” he said. “In our view, with the North American market in that 25 Tcf to 30 Tcf per-year demand, and you think about 500 Tcf of supply in that low-cost range, we should have a market in North America where we will have reasonably priced gas with little price risk going forward. That’s Solomon Associates’ view.”

Moore isn’t so sure. He cites the boom-and-bust cycles of the U.S. LNG market over the last half-century and wonders how the sparkling new export facilities will fare.

“I don’t have a crystal ball,” he said, “but some people who are smarter than I am in this area are really concerned about whether or not U.S. gas prices will remain, over a 20-year period, low enough so that exports from the U.S. are attractive in either the European or Asian markets. And frankly, LNG from other sources may have the same problem. In Africa and Australia, it’s not the cost of the natural gas, but it’s being able to keep the capital costs of the liquefacion facilities under control.

“The market for LNG is subject to a large number of variables, and people are making very large capital investments on the hope that things will turn out OK,” he continued, “but there’s certainly no guarantee.”

“There is also a policy aspect that cannot be underestimated,” he said. “It may not be in the best interests of the United States to allow unlimited exports of LNG if that leads to higher domestic gas prices since many parts of the United States economy are best served by restricting exports and keeping domestic costs low.”

Campbell’s research reaches similar conclusions.

Capital costs

“Nobody’s talking about a serious jump in the price of natural gas,” he said. “I think the concern, really, is not that gas is not going to stay cheap, it’s that the capital costs are going to be brutal for anyone trying to build these things, and it’s that the import markets that were, a couple of years ago, so white hot, have come down a lot.”

While the price downcycle should not have much bearing on a sector that relies on 20-year contracts, it can and has inhibited the industry to some extent this year.

“What the oil prices have done beyond the demand uncertainty is cause significant capital program retrenching,” Hemmingsen said.

“They’ve made those massive capital investments in LNG facilities somewhat unaffordable in the current environment because capital had to be cut back to match lower revenue cash flows and it became somewhat unaffordable to carry large capital programs. What that means is you will see some rationalization in the industry and deferrals,” he added.

Cheniere’s Sabine Pass plant represents an investment of $18 billion, a sum that is more than double the annual gross domestic product of the Bahamas. The Golden Pass LNG import regasification plant nearby requires a commitment of $10 billion from co-owners ExxonMobil Corp. and the Government of Qatar to build a liquefaction facility and allow for exports. A similar investment will be pumped into the Cameron LNG facility that is a joint venture among Sempra LNG, Mitsui & Co. Ltd., Mitsubishi Corp., GDF Suez and NYK Line.

In Campbell’s view, companies like Cheniere that are building onto existing import terminals have a huge capital cost advantage.

‘Not cheap’

“You’re building a gigantic concrete tank with this really expensive, really complicated interior containment system for keeping it so cold, so that’s expensive,” he said. “The cost of just building a big thing—the docking port—all that is expensive. The cryogenic pipelines to run it from the plant to the ship—expensive. The liquefaction system—we’re using dozens of turbines—expensive, expensive turbines. Your electrical costs—very expensive. So it’s not cheap.”

But it could be worse. Your plant could be in Australia.

“What you see with the Australian ones,” Campbell said, “is that labor costs have escalated tremendously.”

There is no mystery here. There simply aren’t a lot of people in the world who happen to have LNG project skills. A non-degree technician working offshore Western Australia will earn as much as $105,000 a year, as reported by the 2014 Hays Salary Guide. The typical Australian oil and gas worker brings in $163,600 a year. A welder can be paid as much as $250,000.“You’re building a gigantic concrete tank with this really expensive, really But the high price of labor isn’t the only issue, Moore contended.

Australia’s challenges

“One problem with Australia is that the Australian LNG projects are very expensive and have been beset by many delays, largely because of the expensive labor market in Australia, but also because the gas supplies that are being served are very expensive to develop,” he said. “The question for Australia is: Will Australian LNG, even given its geographical proximity to markets, be economical on a long-term basis especially when compared to U.S. and East African supplies?”

When Nevins examines those costs, he sees a chance for U.S. exporters to compete with Australia in Asian markets.

“The traditional model in Asia has been a function of the Japanese Crude Cocktail price,” he said. “Generally speaking, it’s tied to oil. There’s a breakeven price that’s somewhere in the $70 to $80 per bbl oil range. When oil was $100, LNG looked great. When oil is at $50, it doesn’t look so good, but you have to figure out what you think oil prices are going to be for the next 20 to 25 years to do that comparison, as well as the question of, do you want diversity of supply?

“For a lot of the Asian customers, they already [were buying LNG from] Australia. Not putting all of your eggs in one basket and not putting your pricing mechanism all tied into the same factors opens some opportunities for U.S. LNG.”

Superior reserves also tilt toward the U.S. when competing in Asia.

“One of the things that the U.S. has as an advantage over the Australian markets is that we have a lot more reserves, and we’re able to produce those reserves much more cheaply than Australia,” Erica Bowman, vice president for research & policy analysis, Washington-based America’s Natural Gas Alliance, told Midstream Business. “Now granted, we’re farther away so some of that is complicated by the fact that you have transportation costs that will be higher, but we can certainly compete in the Asian markets.”

The disadvantage faced in reserves could also translate into a disadvantage for long-term funding for those Down Under.

Portfolio diversification

“There is clearly considerable rotating out of the sector due in part to cost escalation experience and associated margin reductions, as well as portfolio diversification to address concentration and emerging concerns about the depth of cost-effective upstream resources to supply existing facilities and growth,” Hemmingsen told Midstream Business.

“While expansion economics should be generally good on the plant/infrastructure side, and with opportunities to apply cost optimization learnings, the challenges in the depth of the upstream resources are causing investors sober reflection on future investment,” she said.

And there is optimism on opportunities to tackle cost overruns in Australia.

“A lot of the clients I’m dealing with are still very bullish,” Jonathan Smith, KPMG’s Perth, Australia-based oil and gas sector leader for Australia, told Midstream Business. “I think I’m already seeing some downward pressure on the costs and that’s moving all through the industry. There’s so much focus on that.”

In Campbell’s view, the Australian experience serves as a cautionary tale for the U.S. industry.

“I think people are trying to assess that out with LNG in North America and say, ‘Wait, we can’t really build 20 plants in Louisiana and expect our capital costs to not get absolutely terrifying,’” he said. “I think they’re wising-up to that in pretty short order.”

Hemmingsen agrees.

“Australia was in the pole position in terms of positioning its supply for growth in Asian demand—10 years ahead of others,” she said. “It has seized a significant market share in very short order. However in doing so, Australia experienced significant development pain points that have eroded its economics and returns.”

That has made the Australian effort into something of a laboratory for the study of industrial development and investment. What kind of trouble can a relatively small economy get into when it matches limited labor depth with a concentrated buildout?

“North America, particularly Canada in presenting a similar-sized economy and with similar labor/workforce constraints that drove up costs, can take stock of what it needs to do to avoid some of the investment/development challenges,” she said.

Ian Macfarlane, Australia’s minister of science and industry, already knows the answer. He offered this advice during the 2015 IHS CERAWeek conference in Houston to anyone wishing to follow his country’s example: Don’t build 14 liquefaction trains at once. The multiple, massive construction projects overwhelmed the skilled labor market, he said.

Hope floats

The centerpiece of Australia’s floating LNG aspirations is Shell Global’s Prelude vessel, a seagoing wonder of the world under construction in South Korea that has developed into something of an industry unto itself. Designed to operate in depths of up to 820 feet, the 600,000-ton floating facility will be based 125 miles offshore Western Australia and is expected to produce 3.6 million tonnes per annum (mtpa) of LNG, 1.3 mtpa of condensate and 0.4 mtpa of LPG.

“Shell’s project really is a phenomenal innovation when you consider the size of the floating LNG,” Smith said, adding that the project is intended to lower costs associated with onshore plants. “Certainly Shell wants to push that technology and is looking for further opportunities. That’s probably the biggest game changer that I’m seeing in this region.”

The facility is in such a league of its own that Shell hearkens to sports analogies:

• Length longer than four soccer fields; and in another example

• Storage tank capacity greater than 175 Olympic-sized swimming pools. “Prelude is a different animal, because you’re not worried about capital cost escalation with that,” said Campbell. “What you’re worried about is the theoretical feasibility of the entire endeavor.

“It’s an extraordinary machine,” he continued. “It’s half-a-kilometer long; it’s the biggest floating thing ever built by human hands. There will be challenges.”

That Prelude is an unparalleled feat of technology gets no argument from Ernst & Young’s Mellen.

“Unfortunately, like the rest of the Australian projects, it’s just extremely expensive,” he said of the project that analysts estimate to cost more than $12 billion. “I think pretty much the technology will work. Possibly the smaller scale than Shell’s Prelude may be the answer. The technology is a good one, it’s just that time is going to tell whether Shell can make money there.”

GDF Suez and Santos Ltd. backed away from the challenges of the Bonaparte FLNG project, designed to operate 106 miles off Australia’s coast. The companies expressed confidence in the natural gas fields—Petrel, Tern and Frigate—but said they wanted to pursue a different direction than FLNG.

“I think eventually there may be an interesting opportunity for floating LNG plants,” Campbell said. “It’s going to be a while, though. People are going to want to see Prelude in action. They’re going to want to see it work.”

Panama Canal expansion

On a smaller marine scale, the Panama Canal’s expansion project is expected to be completed and its new locks open for business in early 2016. The U.S. Energy Information Administration says that the renovation to accommodate new Panamax-class tankers up to 1,200 feet long and 161 feet wide will allow the century-old canal to handle 80% of the world’s LNG tankers and everything short of the still-bigger Suezmax and very large crude carriers.

With uncertainty—in the form of unfinished canal renovations, volatile markets and plants under construction—draped over the LNG industry, it might be reassuring to return to known quantities. Gingrich can list several advantages to operating in North America.

“We have a stable government, rule of law, here in North America,” he said. “You certainly have opportunities to move upstream, like we’ve seen some of these folks do. You have a huge deregulated market in North America, so you don’t need gas to be exported for whatever reason—say, a plant shut-down—you can put that gas to market and continue to receive revenues for it. Whereas, if that happens in Australia, you really have no place for that gas to go; same with East Africa.”

East Africa

“Here is a well-established, deregulated market that is based on gas supply/demand fundamentals, not based on any oil industry,” he continued. “That’s certainly attractive for the buyers and certainly limits some of the risk around the geopolitical issues like you have in East Africa.”

Moore looks at price stability when he assesses whether a proposed project will make it to completion and divides the projects into two categories:

• Projects that are equity-financed by major oil companies, such as those in Africa; and

• Projects that are project-financed, like those in the U.S. that operate 60% to 70% on borrowed money. “In order for project financing to be successful, you have to be able to demonstrate to the lenders that there is long-term price stability for sales to credit-worthy entities,” he said. “So, for example, the U.S. projects that have reached the final investment decision all have long-term offtake contracts from credit-worthy-rated counter parties. If you’re financing a project, what you still need to be successful is sell out your project for a 15- to 20-year period to somebody who has an investment-grade rating.

“For the equity-financed projects, which would include the East African projects and the Australian projects, although you don’t have the discipline of finance, you really have the same issue. Are the project sponsors sanguine enough about the long-term price that they will receive or do they have long-term sales contracts, which will make the project viable over a 20-year period?” he asked. “To be successful, you obviously have to have enough financial capability to actually develop the project but the real question is: Can you either sell forward on a long-term basis, or are you comfortable enough with the long-term market that you’re willing to invest your own money in something that’s going to cost several billions of dollars?”

A crucial known quantity is the resource. “Of course, you also have to have a stable gas supply,” he said. ”Because U.S. projects pipeline gas, the question for gas supply is price. In African and Australian projects, you’re taking reserve risk—is the gas actually in the ground?—but that’s what oil companies do on a daily basis.”

Great expectations

By mid-June, the Stratas Advisors LNG database listed 309 liquefaction plants hosting 524 trains worldwide. This includes all plants no matter the status, whether they are operational, proposed, shelved, under construction, decommissioned or unknown. Of these, 153 plants with 357 trains are categorized as world-scale (0.5 mtpa and up).

In the U.S. alone, 30 plants with 80 world-scale trains were listed. Only one was operational (ConocoPhillips’ Kenai LNG plant in Nikiski, Alaska); four were under construction (Cheniere’s Sabine Pass trains); and the other 53 were proposed. If all are built and operate to capacity, output would reach a staggering 321.65 mtpa.

“Any time there’s a new opportunity, the market kind of goes wild,” said Campbell, explaining the irrational exuberance of the planning phase. “Right now, that’s going on in North America, where you’ve got almost 60 proposed projects, which is crazy. It won’t happen. It won’t even come close to happening. A fraction of that will come about.”

What drives this optimism is price, specifically the price of Japanese imports—more specifically, the differential between Japan’s price and the U.S. price.

At year-end 2010, LNG that was imported into Japan cost $10.75 per MMBtu. One year later, with the country’s power generation system crippled by the tsunami, the price had increased by 53% to $16.48. At the close of third-quarter 2014, that price was $17.17. At the close of third-quarter 2014 in the U.S., the Henry Hub price was $4.02. In mid-June, it had fallen to $2.86.

‘Unsustainable highs’

“When we’re talking about 2011 to 2012, where you’ve got gas prices in Japan at utterly unsustainable highs and gas prices in North America unbelievably low, this is when a lot of this thinking starts happening,” Campbell said. “Everyone gets very excited and everyone starts putting in applications and everyone starts announcing plans. It’s not going to work that way. So already you’re starting to see people, particularly in British Columbia, get worried about that. The infrastructure challenges are tremendous, the capital cost is tremendous. They are not easy things to build. That’s why there aren’t that many of them, all told, in the world.”

At first glance, it might seem that a $13 gap between Henry Hub in Louisiana and the Fukuoka LNG Terminal on the Japanese island of Kyushu would provide plenty of margin for profit. It’s not that simple.

The cost of moving product that distance and changing the state of the element twice (gas to liquid, liquid to gas) adds up. Data from a U.S. Department of Energy study produced by NERA Economic Consulting projects a 2015 price of $13.52/MMBtu. That’s still considerably below what the Japanese are paying.

U.S. companies betray no lack of confidence in their export plans.

“Although construction has only just begun, we already have signed contracts for the entire output capacity,” said Karl R. Neddenien, media relations and community relations manager for Dominion Resources Inc.’s Cove Point LNG terminal offshore Maryland. “All the LNG we produce will be received by GAIL Ltd. of India and Sumitomo Corp. of Japan. Those two companies will provide the natural gas we liquefy for them, and they will receive the LNG. We will not own the gas or the liquid.”

Too much too soon?

With Sabine Pass almost ready to roll and Australian projects nearing completion, the possibility of a glut has crossed some minds.

“From 2016 to 2017 onwards, many Australian and U.S. liquefaction projects will indeed come onstream and may ease the current market tightness,” Vincent Demoury, deputy general delegate for the International Group of Liquefied Natural Gas Importers, told Midstream Business. “Therefore, there may be a slight oversupply in this period.”

The suburban Paris-based organization acknowledges the need for more capacity in the future, but notes the difficulty in determining how much.

“Post-2020, new projects are required although many uncertainties remain, both on demand, especially how fast Chinese and Indian LNG demand continues to grow, and supply, the speed of emergence of projects in East Africa, Canada and elsewhere,” Demoury said.

Moore agrees.

“I think there is already a glut,” he said. “With the U.S. projects coming online in the next few years and major Australian projects not far behind, in at least the short term, there are expanding LNG supplies chasing relatively flat demand. The question is, how fast will the market expand? You do have a great deal of interchangeability of fuels. When the market gets out of balance, LNG prices should be forced down, which should, if economic theory holds, increase the demand for LNG because LNG is now cheaper than alternative fuels.”

U.S. exporters are vulnerable, he said, because the domestic price for natural gas, and therefore the cost of LNG, is largely tied to U.S. supply and demand. These fundamentals could change in ways that make U.S. LNG uneconomic in world gas markets.

“This may mean that the U.S. LNG plants stop producing well before the African and Australian LNG plants, even though those plants have a much higher fixed cost,” he continued. “Because the African and Australian plants have already paid for the gas they liquefy through the cost of developing their gas fields, they can operate as long as LNG prices allow them to recover their marginal costs of liquefaction and transportation, which may be far less than the marginal costs of production of the U.S. plants, which have to pay for feed gas.”

Hemmingsen sees a global surplus, but not necessarily a glut.

“I think intermediate term, what will prevent a glut is that these facilities can’t be financed unless they have some coverage by long-term contracts, so there’s sort of a natural leveling mechanism in the market,” she said.

The excess has apparently already become an issue in China, according to Wood Mackenzie’s analysis. “As a result, there is an oversupply of contracted LNG into the market, particularly during periods of low seasonal demand,” Thompson said. “We expect China will be over-contracted by about 18 Bcm from 2015 until 2017.”

‘We want to be in it’

As recently as 2008, the average wellhead price of natural gas in the U.S. was $7.97 per MMBtu, almost triple what it is today. The shale boom has unleashed a super-abundance of gas on the U.S. market, depressing the domestic price but offering an opportunity to penetrate overseas markets and sell to emerging economies where gas is much more expensive.

The endeavor entails risk—big-time, long-term risk, but that is the nature of the business. However it is viewed in years to come, the LNG export model is terribly important today for economic and environmental reasons.

“I think if you’re an Exxon or a Shell or a Cheniere looking to spend billions of dollars that has to be covered over a 25-year time period, the economics has to make sense today,” Gingrich said. “The geopolitical pendulum will swing to and fro—it helps your cause in some years and hurts your cause in other years—but you have to make your decision today based on the economics, whether it is sustainable.

“Certainly we’ve seen a lot of folks invest a lot of money developing these projects,” he said. “A lot of folks have basically voted with their dollars that ‘this is a sustainable business line and we want to be in it.’”

As long as the customers are there, of course. This new era looks to be a competitive one, at least at the start.

“I would think the Australian LNG capacity that comes online would certainly put a crimp in new projects,” Locascio said. “Could I see five to 10 projects built? Possibly, if you had enough third-party interest.

“Could you have 10 more projects? Maybe,” he said. “To me, that would be a lot, at least in the short term. Ten years from now, if oil’s at $200 per bbl and the U.S. is still producing massive amounts of natural gas, you might have more projects.”

Small Is The New Big

To size up the phenomenon, the biggest indication that small-scale LNG will be huge is the willingness of large-scale operators to invest massive amounts of capital on relatively diminutive projects.

For Stavanger, Norway-based Statoil ASA, it’s a way in to another revenue stream.

“We’d like to see LNG and natural gas used much more widely as a marine fuel going forward and small-scale LNG could contribute to that,” Tor Martin Anfinnsen, the company’s executive vice president, marketing, processing and renewable energy, told Midstream Business.

Cheniere Energy Inc.’s deal with Houston-based Parallax En-ergy involves developing up to 10 million tonnes per annum (mtpa) of LNG production capacity in two projects in Louisiana: Live Oak LNG and Louisiana LNG. Parallax, led by former BG Group Plc COO Martin Houston, announced in February that it would invest $2 billion to build Live Oak on the Calcasieu waterway. Its startup date is expected in late 2019. The company purchased Louisiana LNG Energy LLC in April.

Both projects are expected to have two trains with capacity of 2.5 mtpa each when completed for a total of 10 mtpa. In contrast, the six trains at Sabine Pass will boast a capacity of 27 mtpa and the three trains in Corpus Christi, Texas, will be able to produce 13.5 mtpa.

“We think we can continue to grow this platform at 10% per year until 2025 and reach approximately 60 mtpa of expected total nominal LNG production capacity with our new projects while remaining a low-cost global LNG supplier,” said Cheniere Chairman and CEO Charif Souki in announcing the plans.

N. Foster Mellen of Ernst & Young said that smaller-scale projects have potential, but are more likely to succeed in Canada than the U.S.

“Whether smaller ones will take hold here in the U.S. is kinda’ iffy,” he said. “They can be smaller than the big behemoths like the Cheniere facility and some of the others going in. Canada has a couple of little ones that—surprisingly—look like they may go forward, but I don’t see a lot of that happening here in the U.S.”

Stratas Advisors, a Hart Energy company, lists 33 plants and 57 trains, almost all proposed, in Canada. AltaGas Ltd.’s proposed Dawson Creek LNG would have capacity of 312,500 tonnes per annum and occupy just 5 acres within the city limits of the British Columbia town. The project carries a price tag of $229 million.

The $450 million proposed Douglas Channel LNG Barge project in British Columbia would produce 800,000 tonnes per annum when complete. It is owned in part by the Haisla Nation.

“Western Canada has potential to present as attractive relative to the U.S.,” Mary Hemmingsen, Toronto-based partner and national industry lead in power and utilities and Global LNG lead for KPMG, told Midstream Business. “It has better shipping proximity to Asia if it can contain its costs of greenfield development, create interest in expansion economics given its depth of resource relative to domestic supply and reduced traditional sales to the U.S. as well as its relative openness to Chinese co-investment.”

Small Is The New Big

To size up the phenomenon, the biggest indication that small-scale LNG will be huge is the willingness of large-scale operators to invest massive amounts of capital on relatively diminutive projects.

For Stavanger, Norway-based Statoil ASA, it’s a way in to another revenue stream.

“We’d like to see LNG and natural gas used much more widely as a marine fuel going forward and small-scale LNG could contribute to that,” Tor Martin Anfinnsen, the company’s executive vice president, marketing, processing and renewable energy, told Midstream Business.

Cheniere Energy Inc.’s deal with Houston-based Parallax En-ergy involves developing up to 10 million tonnes per annum (mtpa) of LNG production capacity in two projects in Louisiana: Live Oak LNG and Louisiana LNG. Parallax, led by former BG Group Plc COO Martin Houston, announced in February that it would invest $2 billion to build Live Oak on the Calcasieu waterway. Its startup date is expected in late 2019. The company purchased Louisiana LNG Energy LLC in April.

Both projects are expected to have two trains with capacity of 2.5 mtpa each when completed for a total of 10 mtpa. In contrast, the six trains at Sabine Pass will boast a capacity of 27 mtpa and the three trains in Corpus Christi, Texas, will be able to produce 13.5 mtpa.

“We think we can continue to grow this platform at 10% per year until 2025 and reach approximately 60 mtpa of expected total nominal LNG production capacity with our new projects while remaining a low-cost global LNG supplier,” said Cheniere Chairman and CEO Charif Souki in announcing the plans.

N. Foster Mellen of Ernst & Young said that smaller-scale projects have potential, but are more likely to succeed in Canada than the U.S.

“Whether smaller ones will take hold here in the U.S. is kinda’ iffy,” he said. “They can be smaller than the big behemoths like the Cheniere facility and some of the others going in. Canada has a couple of little ones that—surprisingly—look like they may go forward, but I don’t see a lot of that happening here in the U.S.”

Stratas Advisors, a Hart Energy company, lists 33 plants and 57 trains, almost all proposed, in Canada. AltaGas Ltd.’s proposed Dawson Creek LNG would have capacity of 312,500 tonnes per annum and occupy just 5 acres within the city limits of the British Columbia town. The project carries a price tag of $229 million.

The $450 million proposed Douglas Channel LNG Barge project in British Columbia would produce 800,000 tonnes per annum when complete. It is owned in part by the Haisla Nation.

“Western Canada has potential to present as attractive relative to the U.S.,” Mary Hemmingsen, Toronto-based partner and national industry lead in power and utilities and Global LNG lead for KPMG, told Midstream Business. “It has better shipping proximity to Asia if it can contain its costs of greenfield development, create interest in expansion economics given its depth of resource relative to domestic supply and reduced traditional sales to the U.S. as well as its relative openness to Chinese co-investment.”

Small Is The New Big

To size up the phenomenon, the biggest indication that small-scale LNG will be huge is the willingness of large-scale operators to invest massive amounts of capital on relatively diminutive projects.

For Stavanger, Norway-based Statoil ASA, it’s a way in to another revenue stream.

“We’d like to see LNG and natural gas used much more widely as a marine fuel going forward and small-scale LNG could contribute to that,” Tor Martin Anfinnsen, the company’s executive vice president, marketing, processing and renewable energy, told Midstream Business.

Cheniere Energy Inc.’s deal with Houston-based Parallax Energy involves developing up to 10 million tonnes per annum (mtpa) of LNG production capacity in two projects in Louisiana: Live Oak LNG and Louisiana LNG. Parallax, led by former BG Group Plc COO Martin Houston, announced in February that it would invest $2 billion to build Live Oak on the Calcasieu waterway. Its startup date is expected in late 2019. The company purchased Louisiana LNG Energy LLC in April.

Both projects are expected to have two trains with capacity of 2.5 mtpa each when completed for a total of 10 mtpa. In contrast, the six trains at Sabine Pass will boast a capacity of 27 mtpa and the three trains in Corpus Christi, Texas, will be able to produce 13.5 mtpa.

“We think we can continue to grow this platform at 10% per year until 2025 and reach approximately 60 mtpa of expected total nominal LNG production capacity with our new projects while remaining a low-cost global LNG supplier,” said Cheniere Chairman and CEO Charif Souki in announcing the plans.

N. Foster Mellen of Ernst & Young said that smaller-scale projects have potential, but are more likely to succeed in Canada than the U.S.

“Whether smaller ones will take hold here in the U.S. is kinda’ iffy,” he said. “They can be smaller than the big behemoths like the Cheniere facility and some of the others going in. Canada has a couple of little ones that—surprisingly—look like they may go forward, but I don’t see a lot of that happening here in the U.S.”

Stratas Advisors, a Hart Energy company, lists 33 plants and 57 trains, almost all proposed, in Canada. AltaGas Ltd.’s proposed Dawson Creek LNG would have capacity of 312,500 tonnes per annum and occupy just 5 acres within the city limits of the British Columbia town. The project carries a price tag of $229 million.

The $450 million proposed Douglas Channel LNG Barge project in British Columbia would produce 800,000 tonnes per annum when complete. It is owned in part by the Haisla Nation.

“Western Canada has potential to present as attractive relative to the U.S.,” Mary Hemmingsen, Toronto-based partner and national industry lead in power and utilities and Global LNG lead for KPMG, told Midstream Business. “It has better shipping proximity to Asia if it can contain its costs of greenfield development, create interest in expansion economics given its depth of resource relative to domestic supply and reduced traditional sales to the U.S. as well as its relative openness to Chinese co-investment.”

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2024-02-02 - Baker Hughes said U.S. oil rigs held steady at 499 this week, while gas rigs fell by two to 117.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.