Presented by:

Uncertain times call for cold-blooded thinking.

At a Rice University’s Baker Institute discussion on oil prices and the Russian war in Ukraine, moderator Mark Finley recalled a terrorist attack in one of the countries he covered early in his career as an analyst and manager at the CIA.

Finley said he found an upset analyst at a desk asking, “How can I do my job? How can you ask me not to care?”

Finley responded that it was normal to care, but the way to do the job in a stressful situation is to focus on the facts “and the cold-blooded analysis.”

As events unfold, including reports of possible war crimes, they mirror the unpredictability seen during the early days of the pandemic that gripped the world for the past two years. Minor events and untrustworthy pronouncements, such as the Kremlin’s suggestion that its army would pull back from Ukraine’s capital, Kyiv, have driven oil prices flailing.

Like kerosene thrown into a campfire, war has inflamed an already antsy world. Inflation and supply chain bottlenecks along with lingering outbreaks of COVID have seared one clear theme into first-quarter 2022: uncertainty.

No one is sure how long Russia will wage war or how much of its oil will stay off the market and for how long. Or whether the massive disruption of energy supplies to the EU will hasten the energy transition. And fears persist that surging oil prices may rise so high that demand destruction begins to erode the economy.

But the unintended consequences of Russia’s invasion of Ukraine could permanently redraw the world’s energy map, particularly as U.S. LNG begins to flow to Europe to replace Russian natural gas. The more prolonged the conflict, the more indelible those new lines become.

“The end result of the crisis in Ukraine could affect the world order for decades to come,” said Andrew Fletcher, senior vice president for commodity derivatives at KeyBank National Association. “Whatever the outcome, it will have significant and immediate implications for European energy policy, positively affecting the LNG industry here in the U.S.”

Sanctions on Russian crude oil, including bans by the U.S., Canada and several other countries, have been augmented by energy companies that are “self-sanctioning” by refusing to purchase heavily discounted Russian cargos.

“The end result of the crisis in Ukraine could affect the world order for decades to come. Whatever the outcome, it will have significant and immediate implications for European energy policy, positively affecting the LNG industry here in the U.S.” —Andrew Fletcher, KeyBank National Association

Shikha Chaturvedi, head of global natural gas strategy at J.P. Morgan, said Russian oil exports will decrease by about 2 MMbbl/d in April. At the event where Finley was moderated, Chaturvedi said that some of those exports will be lost “in perpetuity.”

“We think that there is a loss of Russian supply by probably about a million barrels a day … where consumers can find other sources for their oil imports,” Chaturvedi said.

OPEC, with spare capacity, could have come to the rescue, but on March 31, the cartel decided to stay the course on a gradual increase in production, providing an additional 432,000 bbl/d by May 1. Analysts had seen a dramatic increase unlikely since Russia has spent years fostering relationships with OPEC+ members and have brushed off some attempts at U.S. communication, opting instead to consult with Russian President Vladimir Putin.

“That makes the group more reluctant, I would say, to bring spare capacity into play because Russia has been deepening its energy ties with all of those key Middle East and OPEC+ members,” Emma Richards, senior oil and gas analyst for Fitch Solutions, said during a March webinar prior to OPEC’s March 31 meeting.

OPEC’s strategy regarding the markets isn’t solely economic, but also political.

“Oil is a lever, but that’s always been the case. It’s a geopolitical lever,” said Kenneth B. Medlock III, senior director of the Center for Energy Studies at the James A. Baker III Institute for Public Policy.

With no additional supply coming, President Joseph Biden has ordered the release of 180 MMbbl of oil from the Strategic Petroleum Reserve.

And while he simultaneously hailed the rise in U.S. oil production, he also criticized the industry for not doing more. He said Congress should require companies to pay fees on federal leases that they haven’t used. Biden began his term by ordering the Secretary of the Interior to pause new oil and natural gas leases on public lands or offshore waters “to the extent possible.”

But it is likely U.S. E&Ps that have the largest impact on picking up the slack going forward, particularly when it comes to weaning Europe off European gas.

In the field

With the world’s oil supply as taut as a screeching violin string, the International Energy Agency (IEA) dusted off its plan for reducing demand. The agency’s top strategy hasn’t changed in 16 years: carpooling.

The simplicity of ridesharing to alleviate tight oil supplies belies the bedlam at work in the oil and gas markets. Even before Russian forces invaded Ukraine, the world’s oil and natural gas supplies were unusually tight as the economies began to rebound from the pandemic.

In the Dallas Fed’s quarterly survey released March 23, oilfield service companies laid out what has become a common refrain: elevated geopolitical risk, persistent supply-chain issues, continued labor shortages, shrinking capital availability and rising inflation.

Ryan Keys, CEO of Permian Basin driller Triple Crown Resources LLC, said the one thing he can predict is more volatility and the risk of a “severe recession” should energy prices get too high for too long.

“It’s almost too volatile to estimate right now, but we’re seeing well costs across the industry 20% to 30% higher now than this time last year,” Keys said, adding that things change daily. “There are shortages everywhere, which makes it difficult to plan. And with the industry spread so thin, efficiency and performance suffer some. No one is immune.”

U.S. diesel costs have risen by 44% since January, to about $5.19 per gallon in late March, hurting the energy industry, which is one of the biggest customers of its own products.

“It takes a lot of energy to drill and complete a new well,” he said. “Diesel and natural gas prices are almost twice what they were last year, and we use a lot of both to drill and complete a new well.”

In comments to the Dallas Fed, oilfield service companies said COVID has starved them of finding seasoned employees, adding to delays and expenses.

“The biggest constraint remains finding qualified employees to hire,” one respondent said.

Another: “Commodity prices are a guess with the current turmoil in the markets across the globe.”

“Our onshore U.S. exploration and production customers continue with their cautious and disciplined approach. There is no exploration spending,” another respondent said.

And on what happens next, one person told the Fed Survey, “So much uncertainty makes it, for me at least, virtually impossible to predict anything beyond this afternoon. There is uncertainty domestically, globally and regulatory.”

The crude reality

The first quarter of 2022 has been marred by unrelenting confusion, backwardation and wide variance among analysts’ oil price predictions.

Fitch Solutions said demand is overestimated and that prices this year will average $82/bbl. On March 7, Goldman Sachs raised its 2022 Brent spot price up by 38% to $135/ bbl from an initial forecast of $98/bbl.

In a doomsday scenario in which Europe bans Russian oil, J.P. Morgan said Brent spot prices could careen out to $185/bbl. Reported atrocities in Kyiv suburbs have pushed Europe to the brink of such sanctions and driven a promised reduction of Russian coal imports.

A nervous market can be seen in daily Brent spot prices, which in an 18-day span beginning Feb. 24 prices yo-yoed from as low as $98 to as high as $133, according to Energy Information Administration (EIA) data.

Despite a restrained and disciplined E&P sector, companies are on track to see oil production growth in 2022 led by the Permian Basin.

After U.S. crude oil production fell below 11.6 MMbbl/d in December, the EIA forecast that production will rise to average 12 MMbbl/d in 2022 and then to record-high production on an annual average basis of 13 MMbbl/d in 2023. The previous annual-average record of 12.3 MMbbl/d was set in 2019.

Kristine Petrosyan, an oil analyst at the IEA, said that the closest thing the U.S. has to spare capacity are DUCs that were built up and then completed during COVID.

“We are sitting currently on the floor of availability of these wells that can be brought online very quickly and contribute to increased production,” Petrosyan said.

With E&Ps hampered by limited labor shortages and supply chain problems, the time to get oil to market from new wells has also increased.

In the past, companies could bring wells online within three to six months. Now Petrosyan sees about two months of active work required to bring a well online, “but in general, it takes up to eight months with all the waits [and] the time required to sit between subsequent stages of perforations in the well. So really we’re talking about an eight month lead for a well to come online.”

Shale drillers could increase production by 500,000 bbl/d by the end of 2022, but she said that production will cost about 30% more, in line with what Keys said he already sees happening.

“The world is arguably ‘on the precipice of dipping into another sort of recessionary period,’ though not to the depth that COVID caused.” —Kenneth B. Medlock III, James A. Baker III Institute for Public Policy

Paradigm shift

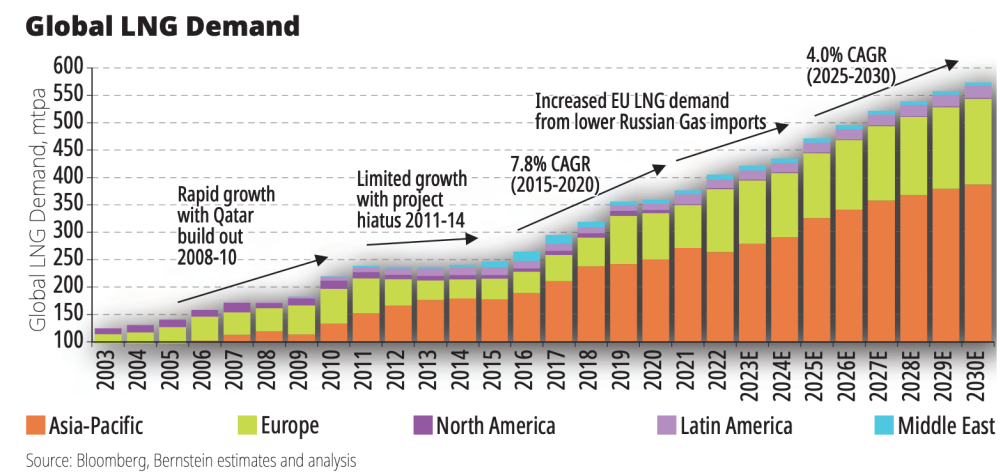

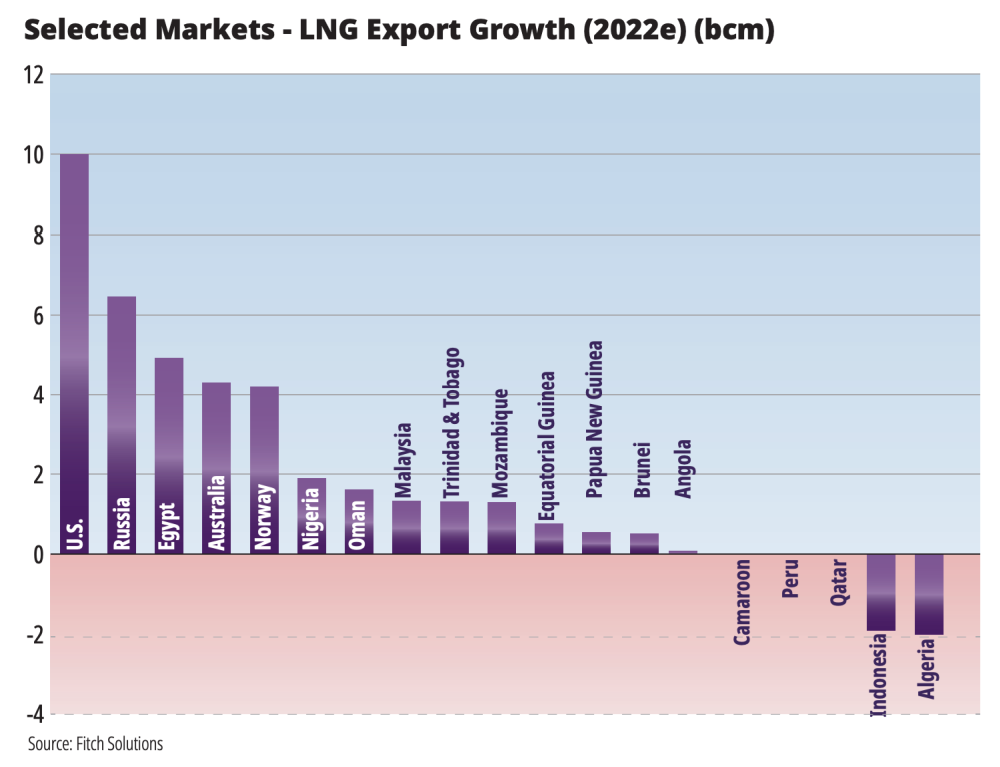

Bernstein analyst Neil Beveridge said a new LNG paradigm is coming as Europe pledged to reduce its Russian gas imports by two-thirds.

“The Russian invasion of Ukraine is a game changer for LNG. In the near term, increased European LNG demand will result in higher prices and demand destruction in Asia to balance the market through higher prices. This is good for upstream LNG suppliers and bad for downstream gas utilities in Europe and Asia.”

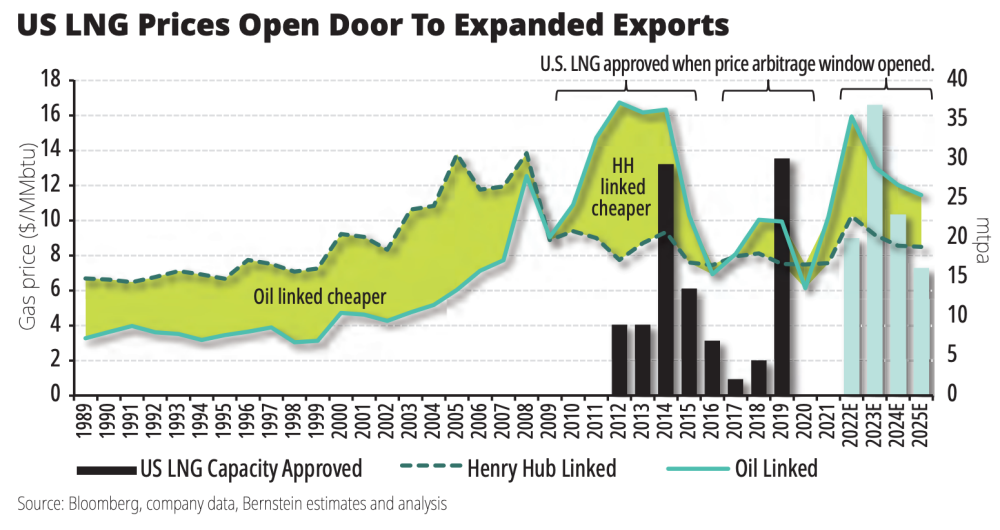

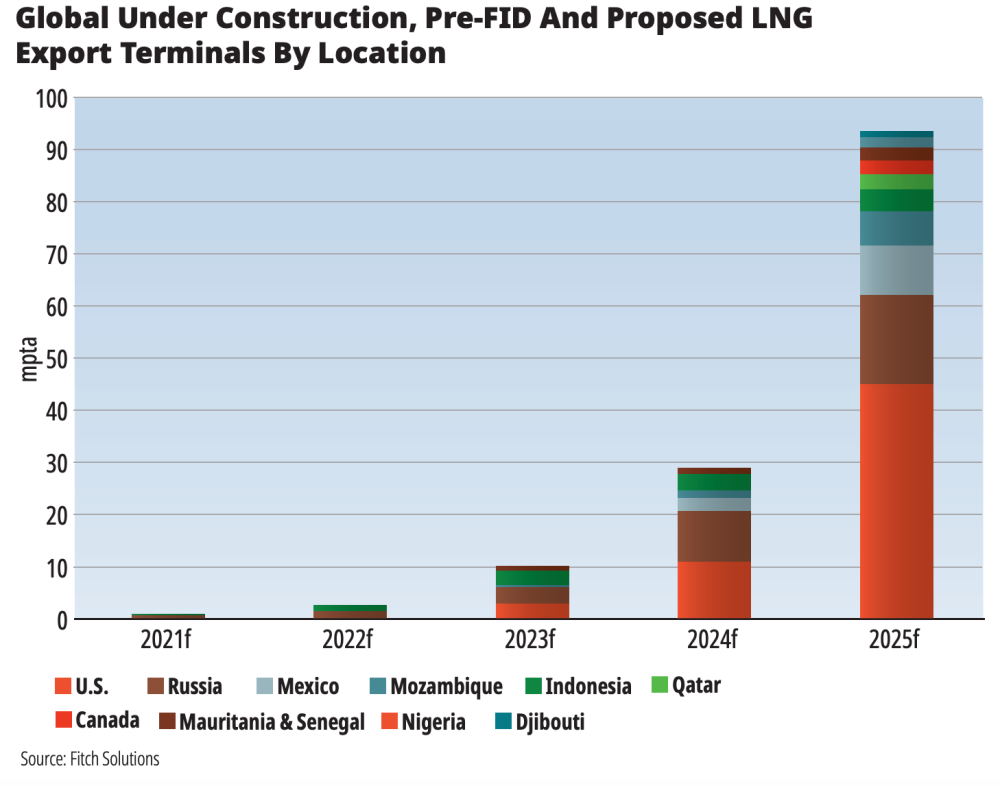

U.S. LNG players are arguably the biggest beneficiary, Beveridge wrote in a March 28 report.

“The U.S. can add liquefaction trains quicker than any other county, has proximity to European LNG markets and ticks all the right boxes geopolitically,” he said. “Qatar also has the resources to expand, but with six trains being built, there are limits. Australasia is possible but has longer time scales.”

The war in Ukraine represents a “paradigm shift” for LNG.

“In the short term, global LNG demand will be unaffected however, given that there is no spare capacity,” Beveridge said. “Over the next 12 months Europe plans to replace 100 Bcm of Russian pipeline gas with LNG, energy efficiency and renewable energy,” he said. “This will add a minimum of 35 mtpa [million tonnes per annum] of LNG demand. Longer term, we think that Europe will need to replace 100 Bcm of LNG to the EU market this year, with expected increases going forward.”

Despite U.S. exports of natural gas, higher domestic prices are disconnected from global gas prices and are unrelated to the Ukraine war, said Samantha Dart, an analyst at Goldman Sachs.

U.S. prices are “mainly driven by weather, production and low liquidity,” Dart said.

While oil prices are not at a historic high, natural gas prices are at record highs, which is why energy prices as a percent of GDP are at alarming levels.

Demand destruction

Like all estimates, those posed by analysts include assumptions that are subject to change.

But measurable effects of the war, COVID and related factors have started to show up.

The cost of oil, coal and natural gas as a percentage of GDP reached 8% in March, the highest since the global financial crisis in 2008, Beveridge said in a March 7 report.

“Demand destruction tends to occur when oil costs as a percentage of GDP rise to greater than 4% over a sustainable period,” he said. “There is no single magic number for demand destruction, but oil as a percentage of global GDP has surged to 4.5% of GDP in March, which historically has triggered demand destruction in subsequent periods, and there is a possibility that history could repeat. Past events suggest that there are high risks of oil demand destruction when oil reaches greater than 4% of global GDP for a sustainable period.”

Medlock said the world is arguably “on the precipice of dipping into another sort of recessionary period,” though not to the depth that COVID caused.

Medlock said that it’s still early days and that while price shocks have been tough, the sky isn’t falling.

Demand destruction could kick in when prices are high enough to discourage use of oil and gas, causing an economy-wide reduction in investment activity.

When energy costs are unpredictable, investments tend to slow down as people try to understand what comes next.

“As a result, that tends to put a drag on overall economic activity from the consumer perspective; higher prices mean you’ve got less disposable income, which means you don’t go out to as many movies or out to dinner as often,” he said. “That reduction in disposable income means you’re spending less as well as a consumer, which tends to trigger a reduction in overall GDP.”

Keys said demand destruction has already started.

“There are indicators that people’s behaviors have already changed,” he said. “But right now, it’s probably not impactful enough to affect the crude shortages we’re projecting this year.

“Energy prices affect everything, and every other part of the economy is a derivative, to some extent, of energy prices,” he said. “So we’ll get indirect demand destruction by all this inflation we’re seeing elsewhere in the economy. Demand is the only knob we can turn right now. The supply knob is stuck where it is.

Recommended Reading

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Carlson: $17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

2024-02-09 - East Daley Analytics expects the $17 billion Chesapeake and Southwestern merger to shift the risk and reward outlook for several midstream services providers.