Andy Huggins, Southwestern’s senior vice president of the Haynesville division, at the DUG Haynesville Conference in Shreveport, Louisiana, on March 29. (Source: Hart Energy)

SHREVEPORT, La. – Southwestern Energy Co. grew into the Haynesville Shale’s largest natural gas producer after two major acquisitions. But as gas prices have slumped, Southwestern is shifting activity to chase more favorable liquids pricing from its Appalachia assets.

The Spring, Texas-based E&P created a presence in the Haynesville and Bossier shales in Louisiana by acquiring Indigo Natural Resources and buying GEP Haynesville in late 2021.

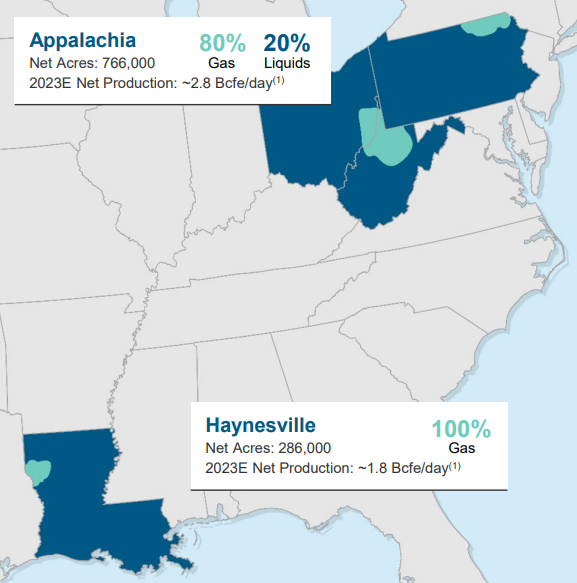

After integrating the new Louisiana assets into its portfolio, Southwestern produced 679 billion cubic feet in the Haynesville during 2022. Including Southwestern’s natural gas production from its sizable footprint in Appalachia, the company produced approximately 4.2 billion cubic feet per day (Bcf/d) of gas in 2022.

But while the Haynesville puts Southwestern’s gas production in closer proximity to Gulf Coast demand centers and the growing U.S. LNG corridor, its liquids-rich Appalachia asset provides the company with additional flexibility.

RELATED

International Players Eye Haynesville Potential Through M&A

Southwestern produced a total of 1.1 trillion cubic feet equivalent from Appalachia in 2022, including an average 97,000 barrels per day (bbl/d) of liquids production. Liquids production is expected to grow to 100,000 bbl/d this year, while gas production falls to 4 Bcf/d in 2023 from 4.2 Bcf/d last year.

“Our portfolio optionality really helps us manage through what we believe is increased structural volatility in natural gas prices,” Andy Huggins, Southwestern’s senior vice president of the Haynesville division, said at the DUG Haynesville Conference on March 29.

Bearish short-term outlook

Analysts and operators are generally pretty bearish on U.S. natural gas prices for the next 12 months to 24 months.

Henry Hub natural gas prices are expected to average about $3 per million Btu (MMBtu) this year, down more than 50% from 2022 levels, according to the U.S. Energy Information Administration’s latest forecast. Gas futures for April delivery were trading up over 3% at $2.18/MMBtu near midday on March 31.

A months-long outage at Freeport LNG following an explosion at the facility last summer, as well as a mild winter season, have contributed to weak gas demand since late 2022.

Southwestern sees a more constructive gas market reemerging in 2024 after a short-term downcycle, the company said on its fourth-quarter earnings call in late February.

Fellow Haynesville Shale driller Chesapeake Energy Corp. thinks it could be 2025 before gas prices rebound, Chesapeake’s vice president of Haynesville operations David Eudey said at DUG Haynesville.

RELATED

Chesapeake Intentionally Reducing Haynesville Gas Production, Rigs

Faced with short-term gas price volatility, E&Ps such as Southwestern are adjusting drilling strategies.

The company expects to average between 10 and 11 rigs in 2023, Southwestern COO Clay Carrell said on the company’s fourth-quarter earnings call. That includes 7 to 8 rigs and 2 to 3 frac fleets in the Haynesville, while in Appalachia the company will run 3 rigs and between 1 and 2 frac fleets.

In 2022, Southwestern averaged 13 rigs and five frac fleets.

The company is also shifting greater activity to its liquids-rich acreage with about eight more wells placed to sales than in 2022 — a move expected to grow average crude oil production in Appalachia to 15,000 bbl/d or 16,000 bbl/d.

Oil production averaged about 13,000 bbl/d in Appalachia in fourth-quarter 2023, while natural gas liquids production came in at 87,000 bbl/d.

“We have the ability, when liquid prices are strong, to divert capital into that area [and] when gas prices are strong, to move back,” Huggins said. “It’s a balanced approach. The assets complement each other.”

RELATED

Public, Private E&Ps Split on Permian Basin Drilling Strategies

Bullish long-term macro

Despite the current shakiness in the natural gas market, Southwestern remains encouraged about the long-term outlook for Haynesville gas, Huggins said.

The company sees advantages to being able to deliver more gas directly to the LNG corridor being developed along the Texas and Louisiana Gulf Coast.

Southwestern currently has about 1.8 Bcf/d of transport access to the Gulf Coast. That’s slated to grow to 2.3 Bcf/d by the end of 2024, Huggins said.

The company also intends to explore further market diversity through LNG deals linked to premium international pricing, he said.

Several other U.S. shale gas players, including Chesapeake, Devon Energy Corp. and EOG Resources Inc., have signed gas supply agreements with exposure to international LNG markets.

RELATED

Chesapeake LNG Deal Moves Its Haynesville Gas Closer to Global Price

Recommended Reading

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.