Southwestern Energy Co. completed its $2.7 billion acquisition of privately held Indigo Natural Resources LLC on Sept. 1, expanding the Appalachian Basin player’s natural gas focus into the Haynesville Shale.

“With these assets and newly expanded team, we are well positioned to take the company to the next level,” commented Bill Way, Southwestern Energy president and CEO, in a company release.

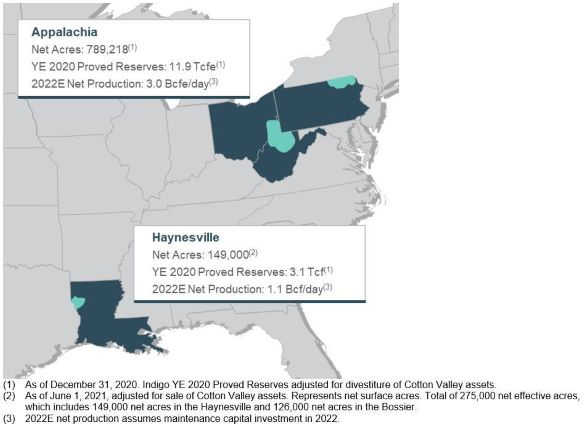

With about 275,000 net effective acres, Indigo was the third-largest private natural gas producer in the U.S., producing 1 Bcf/d net from Louisiana’s Haynesville. Southwestern, based in Spring, Texas, announced the acquisition in early June with eyes of taking advantage of the direct access to the Gulf Coast LNG corridor provided by Indigo’s position in the Haynesville.

“This acquisition materially expands our opportunity set, adding high-margin Haynesville production and substantial core drilling inventory while providing additional global market access through the LNG corridor,” Way said in the Sept. 1 release. “It also further de-risks our enterprise, increases free cash flow, extends our maturity profile and accelerates our deleveraging goals.”

The acquisition of Indigo also added over 1,000 locations across the Haynesville and Bossier zones. On the acquired acreage, Southwestern expects to complete the 2021 capital investment program currently in progress, and will average six rigs and approximately two completion crews, placing 15 to 20 gross wells to sales.

To incorporate the investment in Haynesville, the company’s expected 2021 capital investment range has increased to $1.085 billion to $1.145 billion, which also includes the associated increase in capitalization of interest and expense.

“Looking ahead, we will continue to pursue opportunities to further increase our scale and enhance our ability to responsibly and sustainably drive additional value for our shareholders,” Way added in the release.

Upon closing, Southwestern now projects it will generate $2 billion of EBITDA from more than 4 Bcfe/d of net production, about 85% natural gas, in 2022. The company plans to use this increased cash flow for debt reduction, which is expected to drive its leverage below its 2 times net debt to EBITDA target by the end of 2021.

Goldman Sachs & Co. LLC served as the exclusive financial adviser to Southwestern, while Skadden, Arps, Slate, Meagher & Flom LLP served as legal adviser. Credit Suisse Securities (USA) LLC served as the exclusive financial adviser to Indigo, while Kirkland & Ellis LLP served as legal adviser.

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.