Camino’s Cora Mae 10-15-1WH well is located in Grady County, Okla. Camino has drilled some of the SCOOP’s top wells. (SOURCE: CAMINO NATURAL RESOURCES LLC)

[Editor's note: A version of this story appears in the June 2020 edition of Oil and Gas Investor. Subscribe to the magazine here. It was originally published June 1, 2020.]

Ward Polzin was in Dallas when an email ticked into his inbox the morning of January 17, 2013. He was there on assignment with Pioneer Natural Resources Co. while working as a managing director for investment bank Tudor, Pickering, Holt & Co. The email was from an old friend, David Hayes, a partner at the private-equity firm NGP Energy Capital Management LLC. Hayes had a proposition: He wanted Polzin to run an MLP the firm would set up in Denver. Intrigued, Polzin agreed, but he needed a few months to tie up his affairs with the investment bank.

The MLP never happened.

In the interim, an NGP-backed producer in the Delaware Basin needed management willing to take the company public. NGP asked Polzin if he would shift his priorities and build a team that could execute in the Delaware and get the producer on an IPO track. By April 2014,

Polzin was in charge of the newly-renamed Centennial Resource Development Inc. He and his team navigated Centennial through the ebb and flow of 2014 and 2015, successfully driving costs down and productivity up, and began positioning the company to go public.

The IPO never happened.

Instead, former EOG Resources Inc. CEO Mark Papa and his Silver Run special purpose acquisition company came calling in mid-2016, eager for an entry into the Delaware. Centennial was sold to Silver Run later that year.

The same year, a Marcellus producer, Vantage Energy Inc., was purchased by Rice Energy Inc. for $2.7 billion. The deals left a pair of veteran leadership teams without a home. NGP had conversations with Vantage vice president Seth Urruty about possibly moving forward with a new NGP-backed venture, but then a light bulb went off. NGP partner Chris Carter introduced Urruty to Polzin, and the pair hit it off.

“So we had these two groups that had done these large, private-equity-backed things on the cusp of going public, sold at roughly the same time,” Polzin said. “These teams spun out around the same time to figure out what was next career-wise. There was a lot of common DNA [such as] running multiple rigs in a big shale play and having quality [rock and people] and financially [being capable of going] public. So we said let’s try it again. We merged the teams together in late 2016.”

The result was Denver-based Camino Natural Resources LLC.

Camino’s Oklahoma growth spurt

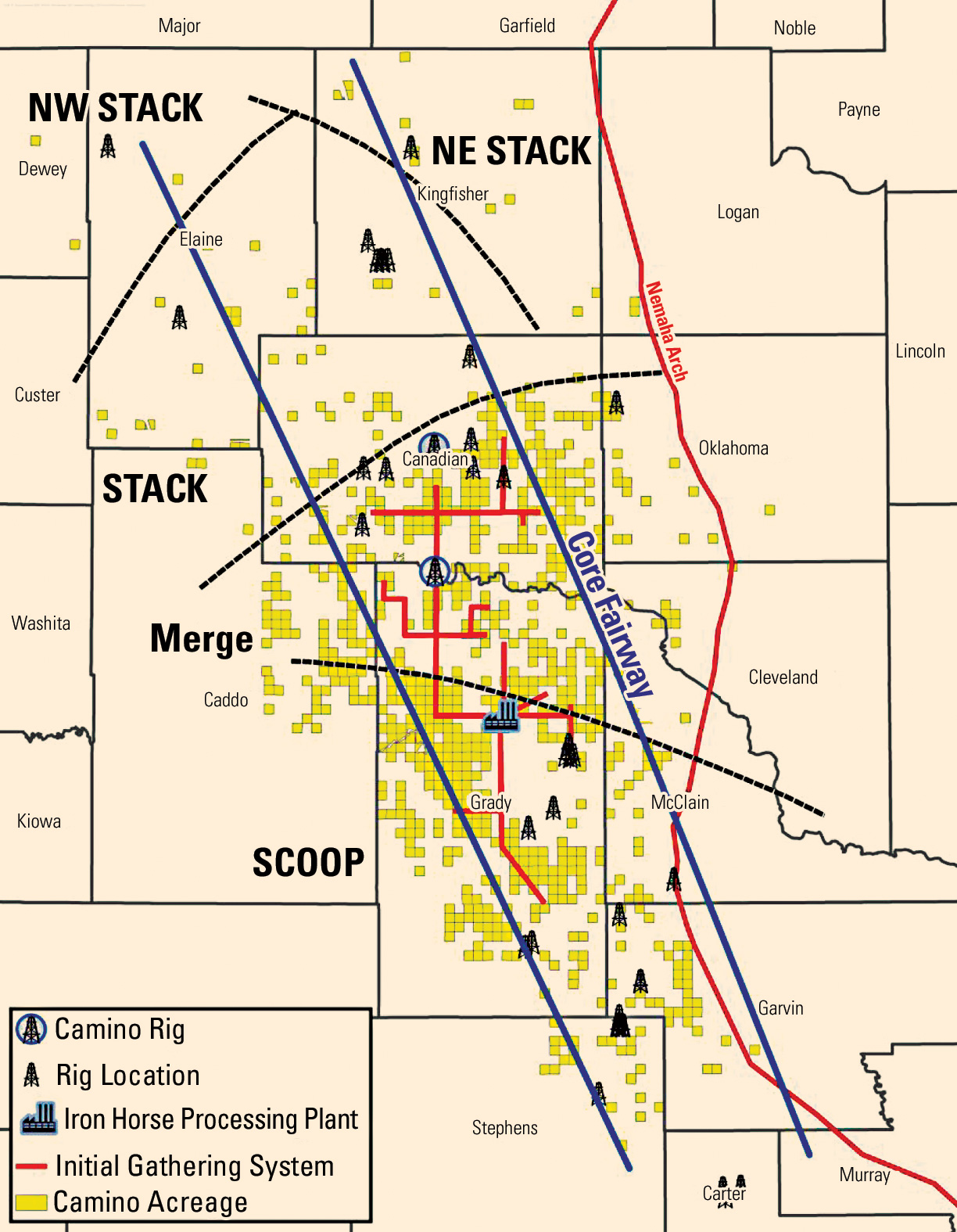

(Source: Camino Natural Resources LLC)

The new NGP-backed venture’s first order of business was targeting assets for A&D. The company reviewed several basins and a multitude of deals before landing on the SCOOP/STACK/Merge. But how does a company headquartered in the Rockies and filled with veterans of the Permian and Marcellus shales end up with an appetite for acreage in western Oklahoma?

“Rock-wise, [the SCOOP/STACK/Merge] had a lot of productivity,” Polzin, now CEO of Camino, explained. “There were a lot of private-equity-backed companies there, but they were [generally] small. We didn’t see that one company trying to become a large private company in that space. We thought it had a lot of running room, and we wanted to go big again.

“I’m a strong believer in what you learn in one shale play is 100% applicable to other shale plays. Ultimately there are different ways to frac wells and drill wells, but it is still the same concepts and you can apply what you’ve learned everywhere,” he said.

The company made its first acquisition in the middle of 2017.

Camino purchased the SCOOP and Hoxbar oil trend assets of Ward Energy Partners LLC, a subsidiary of Ward Petroleum Corp. Around the same time, NGP-backed companies Rebellion Energy LLC and 89 Energy Holdings LLC contributed assets in the SCOOP and Merge for Camino equity. By the end of January 2018, Camino closed its fourth acquisition—the purchase of Chesapeake Energy Corp.’s Merge position. The culmination of these deals brought Camino’s holding to roughly 100,000 acres split evenly between the SCOOP and the Merge.

“Through those acquisitions, 89 and Rebellion each had a rig running, so we stepped into some activity,” said Camino COO Seth Urruty. “We were able to almost immediately apply some of our completion beliefs and do some testing with slightly larger water and sand concentrations, but [we focused] mainly [on] optimization around the types of sand and the types of fluids that we believed were appropriate.”

The first well the company drilled 100% as Camino was the ABEL 25-36-1XH—an early lower Mississippian/Sycamore target in Grady County. The probe was an offset to a Ward-operated well that was drilled a year before the acquisition. It was challenging drilling for the new operator right out of the gate and resulted in a series of tool failures and lessons learned, but ultimately it became one of the SCOOP’s better wells. IP from the ABEL well was 18 MMcf/d of natural gas and 450 bbl/d of oil with a high NGL cut.

“Based upon that IP30 rate, it is still one of the top three wells ever drilled in the SCOOP,” Polzin said.

Today, Camino holds about 118,000 net acres in the STACK/SCOOP/Merge and is producing about 40,000 boe/d.

As the company grew, the importance of scale continued to drive its narrative. From its earliest days, Camino was organized and run like a public company; scale was going to be important as the headwinds facing the industry stiffened. Even though there were three dozen private-equity-backed companies in the SCOOP/STACK/Merge, none of

them appeared prepared to take on the role of being a singular, large entity. They simply were not capitalized to do so. It was an opportunity for the Camino team and its investors that wouldn’t arise somewhere like the Permian Basin, where many billion-plus dollar private-equity-backed operators reside.

“The bigger you are, historically it’s either a ‘go public’ or a ‘smaller buyer’ universe,” Camino CFO Ryley Hegarty said. “If you want to do the scalable concept, then you have to think through longer time horizons than the normal three-year to five-year private-equity model. It was that common DNA across Vantage and Centennial.

“With Centennial, the whole plan was to go public. You need to be prepared to run that thing for the long term. At Vantage, that was a 10-year run for those guys. Seth brought a lot of good practices when thinking about running this for 10 years. It’s serendipitous now with where the market is, but that was how we started.”

Scale is seen as part of the longer model for private equity in the oil and gas space. The industry has emerged from the days of the three-year flip to those of a lower-for-longer and living within cash flow approach. Camino has not only gotten bigger via acreage deals; they have also integrated, taking on a midstream partnership with Cardinal Midstream and its Iron Horse System and a minerals partnership with Land Run Minerals.

“We had a track record with our previous companies of improving EURs and production rates, reducing costs and getting full cycle returns out of that,” Polzin said. “We’re applying that here, too. We can work marketing better now that we’re bigger and optimizing our infrastructure, whether it’s water handling or selling gas and moving NGL downstream with pipes.

“Equally important to all of that is financial [structure]. To last longer, you need to be financially conservative, frankly, and create optionality. We’ve done that by having the large equity support from NGP. By having scale we have a large lending capacity with our senior lenders. I think capacity is important, both equity and debt.”

A hedging imperative

One area where Camino has proved ahead of the game has been with its robust hedging strategy. Most public companies hedge portions of their production for the span of the current calendar year if they hedge at all. Sometimes a portion will also be pushed into the following year. In contrast, Camino has hedged a lot.

“It’s imperative that we have consistent and robust hedges,” Hayes explained. “I think public companies reposition the optics of their hedge book depending on the direction of commodities prices, but generally speaking they hedge about half of their next year’s production. Whereas with most of our companies, we have not only hedged their

projected PDP [proved developed producing] but a significant amount of the projected increase in production [as well]. Now today, nobody’s drilling.”

He added, “We don’t really get into business with anybody who is not willing to hedge.”

During 2018 and 2019, the company locked in pricing for its 2020 and 2021 production. Today, basically 100% of the company’s PDP wedge is hedged for the balance of 2020. Its oil production is 100% hedged for 2021. Placing the hedges early locked in a per barrel crude price in the mid-$50 range.

“If we are going to be here a long time, we’re not going to roll the dice, so to speak, and be unhedged,” Polzin said. “That could be a good place to be if oil goes to $80, but a bad place when it goes to $20. We were certainly giving up upside but reducing our downside.”

Flexibility in a complex shale

During the time Camino was growing its position in western Oklahoma, the play was slipping out of favor with many. Touted early on as “Permian Jr.,” the play was deemed an expensive underachiever by pundits. The per barrel cost to develop in the region swelled to the upper-$40 range by some estimates. Operators were pushing the boundaries of the core, while the issue of parent/child well interference began to rear its ugly head.

Camino knew the area was complex. Even as it reviewed deals, it studied what made each play tick—the natural drivers.

“I think the capital markets’ narrative that the Midcontinent will never recover is a false narrative—it’s fake news,” Hayes said. “You had this land rush to grab lots of acreage across the basin, but it is not all created equal. There is a trend with some primo rock. It got drilled too tightly, and there were really high expectations. There is no 500-foot spacing; it’s 1,200-plus foot spacing. You have multiple zones. During the land rush, people paid up for it while there was still a lot of learning going on across the industry. The capital markets felt like they got burned and threw the baby out with the bath water.”

The underlying Woodford Shale in western Oklahoma is shallow in the east and deep in the west. When the original SCOOP area started around 2012, it was right atop of the very thick Woodford. The Woodford is thick in northwest Canadian County where the Cana Field resides. The Woodford is also thick in the middle of the basin.

“Our basin gets gassier to the west and oilier to the east, but quite frankly, we’ve found when you are looking for returns, it is not the oilier eastern part that has the highest returns,” Polzin said. “It is somewhere in the middle. You lose pressure when you move to the east. You gain pressure to the west, but you lose oil. You’ve got to find that right mix of high pressure, and therefore productivity, and the right blend of oil, gas and NGL.”

“[We found] the sweet spot runs southeast to northwest in our basin. Continental [Resources Inc.’s] Springboard [SCOOP] is right in the middle of that, the Lone Rock area for Cimarex [Energy Co.], the Cana Field—all of those go right down the spine of the basin. We’ve tried to focus in those areas as well, whether it’s STACK, SCOOP or Merge. It still has those same characteristics,” he said.

in the play.

When the play overheated in 2017, operators pulled away from the core, trying to find productive extensions to widen the footprint. Pushing the STACK northwest and northeast did not yield the same results. In addition, fracture-driven well interaction issues arose once operators pushed aggressive well spacings during development.

“[With] every well we drill, we’re learning, and we’re trying to improve and advance, but you have to be cautious that you haven’t drilled too many wells at a well density or a landing before you have technical certainty on the EURs and well productivity,” Urruty said. “That’s been a negative for our play. Interwell spacing was way too tight over the last couple of years, and people are now having to up-space and come back, but also the combined targeting of the formations. Certain folks had views that they were independent petroleum systems and you could stack wells, or drill Woodford wells and then come on top and drill lower Mississippian, and not have interference.

“Our view has been that those are going to communicate to some degree, certainly aided with the fracturing and the structural complexity that we see in the formations. You have to be thoughtful, and on a DSU [drilling spacing unit] by DSU basis, come up with a plan to develop those reservoirs together. We’ll step into it more conservatively on an absolute spacing basis,” he said.

Camino has drilled about 10 wells to date that offset either another operator’s well across the lease line or one of its own. Most drilling has been done with one year to three years between completions, and the company has encountered infill—or child—well degradation. The company employs different strategies for managing the primary well to help optimize the fracture complexity in the child.

“The child wells are right in line on average with our type curve expectations,” Urruty said. “There absolutely are issues with parent wells, and that’s a big piece of wanting to understand how to protect the parent, how [to] produce that parent and help it get the frac fluid off early.

“It’s a different answer for every well depending on where you are at in the basin and whether you’ve got more gas or more pressure to work with versus oily and lower pressure. We will do additional testing with some artificial lift mechanisms to try to get that frac fluid back and return those [wells] to previously forecasted rates,” he said.

Intentions to consolidate

In late 2019, Camino was running three rigs on its western Oklahoma acreage. When it became apparent that oil prices were heading for $50, the company moved down to a two-rig program to stay within cash flow. By February 2020, the company was operating a single rig. Today, they are at zero.

“We were already decelerating before the big move,” Polzin said. “We were anticipating a tough market. We certainly weren’t anticipating this tough of one, but thank goodness we were already making moves to do better in a tougher market. Now, the new world order is like the old world order on steroids. It’s lower prices for a longer time frame, and deeper cuts [are] required. It’s more of that U-shaped recovery. We think this is going to be a rough environment through 2021. I hope we’re out of it in 2022, but it’s a minimum of 18 months.”

Camino hopes it can bring a rig back if prices inch up, but for now all drilling activity has paused. The company reduced its capex by 70% over last year’s spend. It is also fortunate to be able to continue paying down debt. The plan is to lower its debt from 2x EBITDA to closer to 1x by year-end. Additional hedges are also being examined as far out as 2023.

“The last thing we’re worried about is production growth,” Polzin said. “It’s an output, not an input. It will probably run about flat this year, but we’re really not aiming to be flat. We’re not aiming to grow. It just is what it is. I want to be a survivor, and we will be. There is no question about that.”

Survival is on a lot of minds in the oil patch today. The oil markets are flooded with product, and the COVID-19 pandemic has smothered demand. Bankruptcies in the space have already begun, and many more are expected. Camino intends to be a consolidator when the time comes, adding more of the critical scale it covets.

“For the same reasons [that] the publics want to get bigger, we believe that privates need to get bigger,” Polzin said. “There will always be room for the small, entrepreneurial, focused company, but we think we need to position ourselves to be a larger private. I expect we will be bigger, and that’s the goal. Merge with some other companies, maybe. Buy some other companies, maybe, but the goal is to be bigger because it is just a better economic, stable position for everybody involved. We hope to do some deals.”

Hayes added, “They are very well hedged. Lightly levered. They stand out among smaller industry players in that geography as a team that is a likely consolidator based on the strength of their balance sheet and strength

of performance.”

Recommended Reading

CEO Darren Woods: What’s Driving Permian M&A for Exxon, Other E&Ps

2024-03-18 - Since acquiring XTO for $36 billion in 2010, Exxon Mobil has gotten better at drilling unconventional shale plays. But it needed Pioneer’s high-quality acreage to keep running in the Permian Basin, CEO Darren Woods said at CERAWeek by S&P Global.

Uinta Basin's XCL Seeks FTC OK to Buy Altamont Energy

2024-03-07 - XCL Resources is seeking approval from the Federal Trade Commission to acquire fellow Utah producer Altamont Energy LLC.

Athabasca Oil, Cenovus Energy Close Deal Creating Duvernay Pureplay

2024-02-08 - Athabasca Oil and Cenovus Energy plan to ramp up production from about 2,000 boe/d to 6,000 boe/d by 2025.

Analysts: Why Are Investors Snapping Up Gulfport Energy Stock?

2024-02-29 - Shares for Oklahoma City-based Gulfport Energy massively outperformed market peers over the past year—and analysts think the natural gas-weighted name has even more upside.

SilverBow Saga: Investor Urges E&P to Take Kimmeridge Deal

2024-03-21 - Kimmeridge’s proposal to combine Eagle Ford players Kimmeridge Texas Gas (KTG) and SilverBow Resources is gaining support from another large investor.