SilverBow Resources Inc. recently closed its cash-and-stock acquisition valued at roughly $71 million of SandPoint Operating LLC, marking the Houston-based company’s latest purchase in the Eagle Ford Shale.

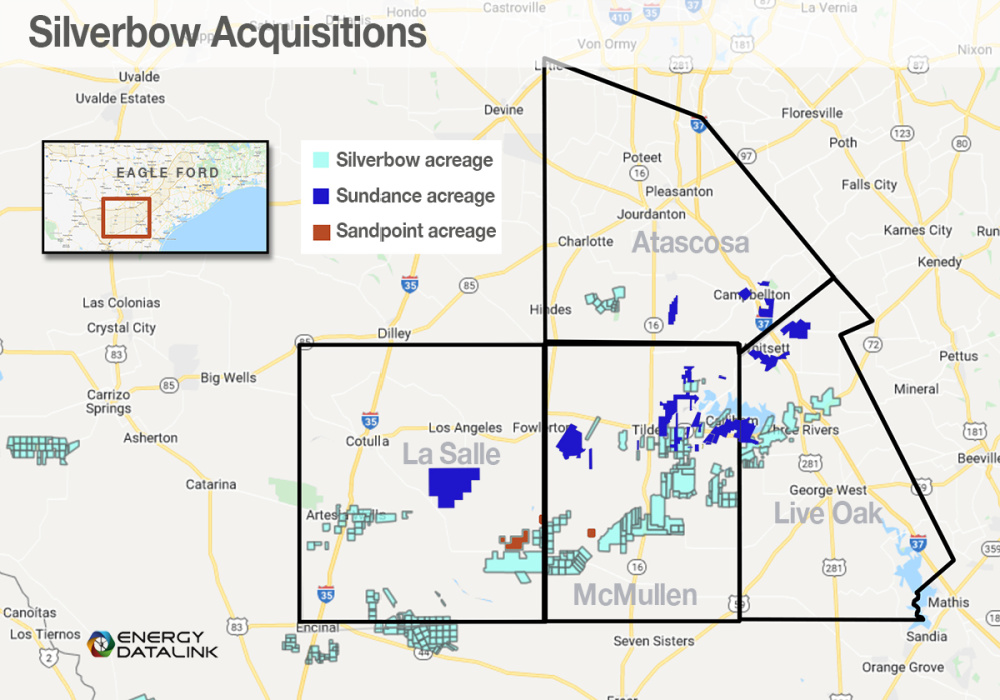

Backed by Carnelian Energy Capital Management LP, SandPoint is an independent oil and gas company focused in the Eagle Ford. The SandPoint assets add meaningful production, inventory and reserves across a highly contiguous acreage position in La Salle and McMullen counties in South Texas, according to SilverBow CEO Sean Woolverton.

“This is the fourth deal we have closed since August of last year as we continue to execute on our strategic objectives,” Woolverton commented in a company release on May 11.

SilverBow Resources is actively engaged in the exploration, development and production of oil and gas in the Eagle Ford Shale and Austin Chalk in South Texas.

The company announced in April it had entered separate agreements to acquire certain assets from SandPoint Operating, a subsidiary of SandPoint Resources LLC, and substantially all of the assets of Sundance Energy Inc., both operators in the Eagle Ford Shale. These deals, worth a combined $440 million including contingent payments, marked the fourth and fifth SilverBow announced since the second half of 2021.

“Looking ahead, we expect to close the acquisition of the Sundance assets in June or July, at which time we will provide updated guidance,” Woolverton continued. “We expect an uplift to our borrowing base in conjunction with the closing of Sundance assets, which positions SilverBow with enhanced liquidity and multiple avenues of continued growth through the drill bit and accretive acquisitions.”

Eagle Ford Acquisitions

|

|||

| Date Announced | Seller(s) | Location | Value ($MM) |

| 4-14-22 | Sundance Energy | Atascosa, La Salle, McMullen & Live Oak Cos. | $354 |

| 4-14-22 | SandPoint Operating | La Salle & McMullen Cos. | $71 |

| 10-11-21 | Teal Natural Resources; Castlerock Resources | La Salle, McMullen, DeWitt & Lavaca Cos. | $75 |

| 8-13-21 | Undisclosed | Atascosa, Fayette, Lavaca, Live Oak & McMullen Cos. | $33 |

| 8-4-21 | Undisclosed | Webb County | $24 |

Purchase consideration for the SandPoint acquisition was comprised of approximately $31 million in cash and 1.3 million shares of SilverBow’s common stock. The cash portion of the purchase was funded with cash on hand and borrowings under the company’s revolving credit facility.

According to the SilverBow release from April, SandPoint operated roughly 27,000 net contiguous acres in La Salle and McMullen counties with a PDP PV-10 of approximately $89 million. The company net production in May is estimated to be 4,650 boe/d (70% gas, 30% liquids) with two new wells expected to be coming online in the second quarter.

The acquisitions of SandPoint and Sundance is expected to increase SilverBow’s acreage footprint in South Texas by 50% to approximately 198,000 net acres with an inventory of more than 645 gross (507 net) high-return locations across the company’s Eagle Ford and Austin Chalk focus areas.

Pro forma for the transactions, SilverBow’s net production is projected to range between 300-330 MMcfe/d (64% gas) for full-year 2022. The company also listed its pro forma PDP reserves at approximately 750 Bcfe with a PDP PV-10 of $1.6 billion.

SilverBow said in April it intends to run one drilling rig on the acquired assets starting in the second half of 2022 in addition to the one rig SilverBow is currently running.

Both the SandPoint and Sundance transactions have an effective date of May 1.

Latham & Watkins LLP served as legal adviser to SandPoint for the transaction.

Barclays is financial adviser to SilverBow on the Sundance transaction. Gibson, Dunn & Crutcher LLP is serving as legal adviser to SilverBow on both transactions.

Piper Sandler & Co. and TD Securities (USA) LLC are financial advisers to Sundance. Kirkland & Ellis LLP is serving as legal adviser to Sundance.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.