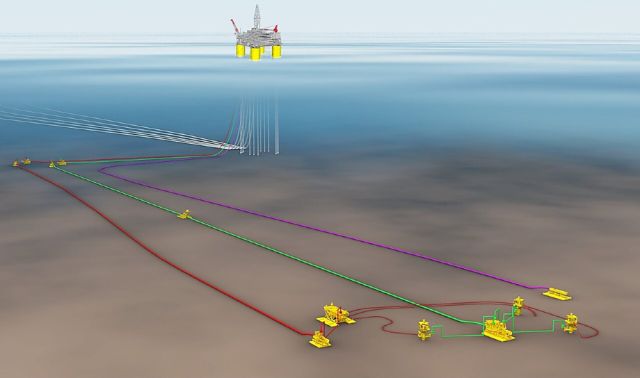

PowerNap is located in the south-central Mississippi Canyon area of the U.S. Gulf of Mexico. (Source: Shell)

Royal Dutch Shell Plc subsidiary Shell Offshore Inc. has sanctioned its 100% operated deepwater PowerNap project in the U.S. Gulf of Mexico (GoM), the company said Aug. 1.

The company said the deepwater project, which will be developed as a subsea tieback to the Shell-operated Olympus production hub, has a forward-looking break-even price of less than $35 per barrel.

“PowerNap further strengthens Shell’s leading position in the Gulf of Mexico,” said Wael Sawan, Shell’s upstream director, said in a news release. “It demonstrates the depth of our portfolio of deepwater growth options, and our ability to fully leverage our existing infrastructure to unlock value.”

The move comes as operators continue improving the economics of offshore developments including by using infrastructure already in place. Subsea tiebacks are playing an integral role.

“Shell’s final investment decision regarding the PowerNap field reflects a broader trend of majors embracing subsea tiebacks that offer quicker paths to first oil and attractive returns,” Michael Murphy, research analyst, Gulf of Mexico, for Wood Mackenzie, said in a statement.

He added that “with internal rate of returns above 30% and development breakeven in the low-to-mid US$30s, the sanctioning of subsea tiebacks is proving that deepwater can compete with tight oil.”

Shell’s deepwater Kaikias subsea tieback came online in 2018 with a breakeven in the low $30s per bbl.

Kaikias, located in the Mars-Ursa Basin in GoM, was discovered in 2014, the same year as PowerNap.

PowerNap is located in the south-central Mississippi Canyon area of the GoM in about 1,280 m (4,200 ft) of water. The company aims to start production in late 2021, producing up to 35,000 barrels of oil equivalent per day at peak. Oil produced from the field will travel via the Mars pipeline to market.

PowerNap is believed to hold more than an estimated 85 million barrels of oil equivalent resources, Shell said.

Recommended Reading

CERAWeek: JERA CEO Touts Importance of US LNG Supply

2024-03-22 - JERA Co. Global CEO Yukio Kani said during CERAWeek by S&P Global that it was important to have a portfolio of diversified LNG supply sources, especially from the U.S.

Excelerate Energy’s CEO Kobos Bullish on US LNG

2024-02-22 - In a world rattled by instability, his company offers a measure of energy security to natural gas users via its fleet of floating storage and regasification units.

CERAWeek: Tecpetrol CEO Touts Argentina Conventional, Unconventional Potential

2024-03-28 - Tecpetrol CEO Ricardo Markous touted Argentina’s conventional and unconventional potential saying the country’s oil production would nearly double by 2030 while LNG exports would likely evolve over three phases.

Tinker Associates CEO on Why US Won’t Lead on Oil, Gas

2024-02-13 - The U.S. will not lead crude oil and natural gas production as the shale curve flattens, Tinker Energy Associates CEO Scott Tinker told Hart Energy on the sidelines of NAPE in Houston.

ConocoPhillips CEO Ryan Lance Calls LNG Pause ‘Shortsighted’

2024-02-14 - ConocoPhillips chairman and CEO Ryan Lance called U.S. President Joe Biden’s recent decision to pause new applications for the export of American LNG “shortsighted in the short-term.”