Royal Dutch Shell Plc is rumored to be considering exiting the Permian Basin amid pressure to accelerate its energy transition strategy and deepen carbon emission cuts.

The Anglo-Dutch supermajor is reviewing its assets in the Permian Basin for a possible sale, according to a Reuters story citing unnamed sources. Last month, a landmark Dutch court ruling ordered Shell to speed up its plans to cut greenhouse gas emissions despite plans outlined earlier this year to become a net-zero carbon emissions company by 2050.

RELATED:

Shell’s Potential Permian Basin Exit Seen as Bellwether for Shale Demand

Shell’s Permian Basin position could be worth over $10 billion, according to the sources in the Reuter report.

The sources added that the sale could be for all or a portion of Shell’s assets and that there was no guarantee a deal would be struck.

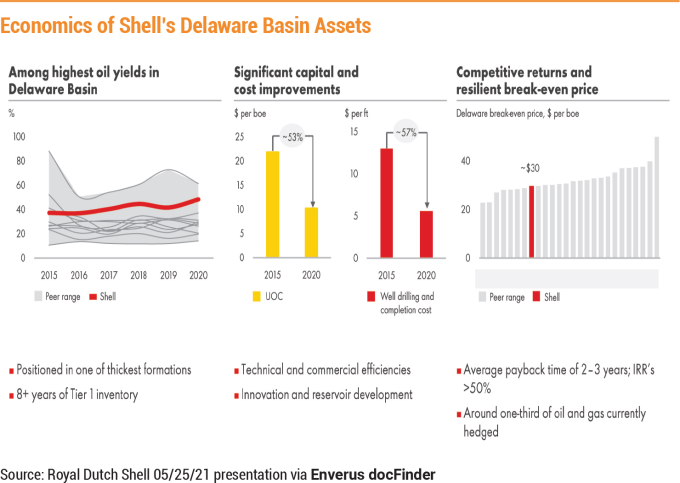

According to Enverus, the holdings cover 240,000 net acres on the Texas side of the Delaware Basin in the Permian and delivered 2020 net production of 197,000 boe/d, off 23% from 2019 and equivalent to 6% of Shell’s total.

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.