A LNG vessel and tugboats seen near the port of Gladstone, Australia. (Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

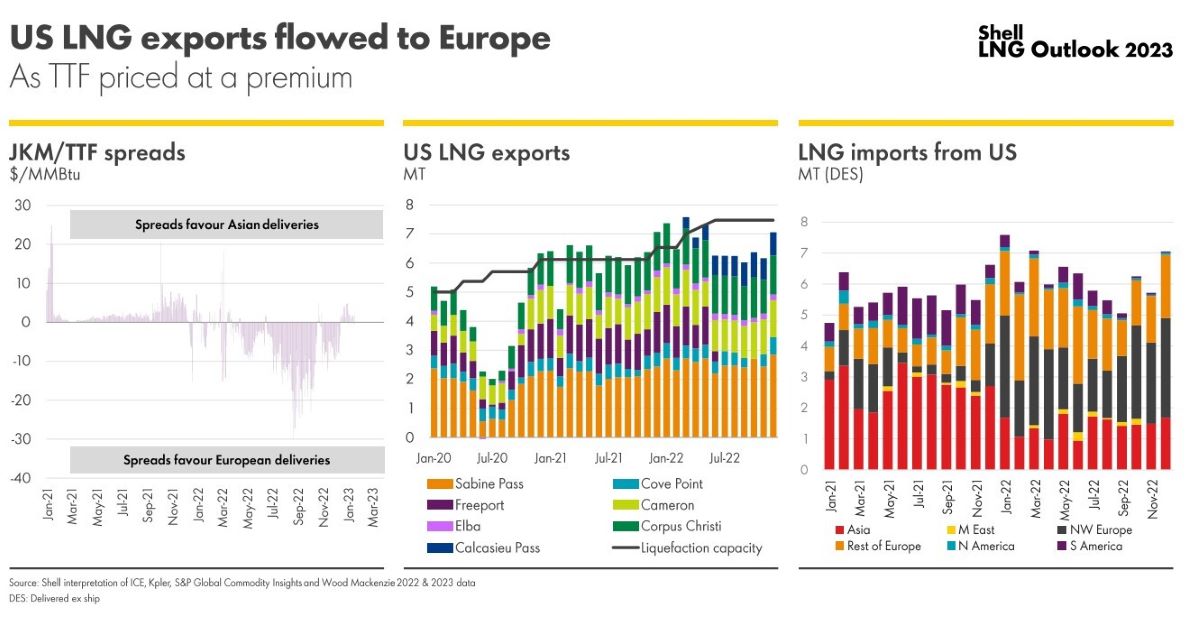

Europe’s energy crisis in 2022 was arguably softened by U.S. LNG exports, but a reliance on U.S. gas supply comes with its own risks, Shell highlighted in its LNG Outlook 2023.

In 2022, European LNG imports rose by 60% to replace Russian gas thanks to higher U.S. LNG imports as well as increased imports of LNG originally destined for Asian markets, Shell said in the yearly report on the LNG sector in February.

Robust gas production from the Permian Basin and other U.S. shale plays has anchored rising U.S. LNG exports. A slew of new liquefaction capacity additions in coming years will only boost U.S. LNG supplies.

But this rising role for U.S. supply in the global LNG market increases the exposure to U.S. gas market risks, Shell said.

Shell said principal risks relate to forecasts for U.S. LNG to account for nearly 20% of total U.S. gas production by 2028 compared to about 10% now; a concentration in Texas and Louisiana of over 95% of U.S.’ LNG capacity by 2030; and higher U.S. gas demand by 2028 driven by the LNG and industrial sectors.

More LNG investment needed

Russia’s invasion of Ukraine in February 2022 led to a reduction of Russian piped gas exports to Europe and forced the region to turn to LNG, pushing up prices for cargoes. Europe was aided by the import of more LNG cargoes from the U.S. and other suppliers. Those cargoes were originally intended for Asia but diverted owing to lower gas demand in China due to its zero-COVID restrictions as well lower demand in South Asia due to high prices.

LNG will remain a key energy source in coming years amid the energy transition, and Europe and China will likely contend for limited LNG cargoes until more liquefaction capacity comes online in the U.S. and Qatar, Shell said Feb. 16 in a separate press release. LNG demand is forecast to span from 650 million tonnes per annum (mtpa) to over 700 mtpa by 2040. Total global LNG trade was 397 mtpa in 2022.

“More investment in liquefaction projects is required to avoid a supply-demand gap that is expected to emerge by the late 2020s,” the European major said.

Shell’s executive vice president for energy marketing Steve Hill said the Ukraine war has caused shifts in the market likely to impact the LNG sector over the long-term.

“It has also underscored the need for a more strategic approach – through longer-term contracts – to secure reliable supply to avoid exposure to price spikes,” Hill said.

While the term LNG contracts will help reduce exposure to price volatility, Europe and major Asian economies China and Japan have different approaches.

By 2030, Europe is forecast to have less than 20% of its LNG demand under term contract compared to around 30% in 2022. In comparison, China and Japan is forecast to have on average around 80% by 2030 compared to around 100% in 2022.

Recommended Reading

DUG GAS+: Chesapeake in Drill-but-don’t-turn-on Mode

2024-03-28 - COO Josh Viets said Chesapeake is cutting costs and ready to take advantage once gas prices rebound.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

CERAWeek: Two Minutes with EQT’s Toby Rice on Energy Security

2024-03-22 - EQT Corp. President and CEO Toby Z. Rice spoke to Hart Energy on March 20 on the sidelines of CERAWeek by S&P Global to discuss natural gas infrastructure bottlenecks, energy security and the company’s advances on LNG.

Commentary: Fact-checking an LNG Denier

2024-03-10 - Tampa, Florida, U.S. Rep. Kathy Castor blamed domestic natural gas producers for her constituents’ higher electricity bills in 2023. Here’s the truth, according to Hart Energy's Nissa Darbonne.

Exclusive: Can NatGas Save the 'Fragile' Electric Grid?

2024-02-28 - John Harpole, the founder and president of Mercator Energy, says he is concerned about meeting peak electric demand and if investors will hesitate on making LNG export facilities investment decisions after the Biden administration's recent LNG pause, in this Hart Energy LIVE Exclusive interview.