(Source: Hart Energy; Shutterstock.com)

If the oil and gas world feels a little smaller as the end of 2020 nears, it’s not just because of the roughly 40 bankruptcies that have taken many E&Ps off the board or several high-value companies snatched up in all-stock mergers.

On Nov. 12, Rystad Energy released analysis showing that values are all shrinking as the industry is ravaged by a pandemic, oil-price war and closed investor wallets.

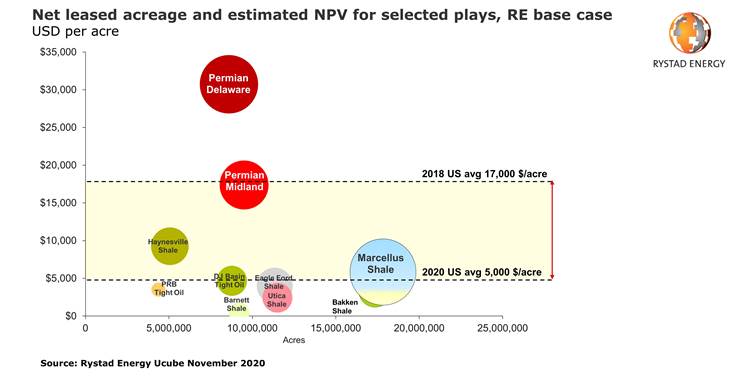

The average price for U.S. onshore shale acreage declined by more than 70% in two years, according to the independent energy consultancy firm based in Norway. Overall, per acre prices fell to $5,000 in 2020 from $17,000 2018.

“This massive drop is a result of the West Texas Intermediate (WTI) oil price losing significant value and is providing a financial push for consolidation in the shale industry in 2021 and 2022,” Rystad analysts said.

The Permian’s Delaware Basin, at $30,000 per acre, and Midland Basin, at $17,000 per acre, are still leading in terms of acreage prices. Fundamentally, tight oil and gas economics have improved significantly since 2018, yet the implied price strip in our new base case is substantially lower than it was in 2018, rendering most of undeveloped acreage far less valuable.

While multi-stacked plays allow for simultaneous development of several zones from the same spacing unit, a trend toward up spacing is also shifting inventory counts as tighter spacing has proven uneconomical at lower price points.

Among leading public operators, Rystad that that valuations declined have declined by 44% in the past two years, or about $20,000 from 2018 levels. Companies with more diversified portfolios have a slightly lower NPV/acre compared to the pure Permian Basin-focused producers.

Rystad cited EOG Resources Inc. as an example. EOG’s overall estimated acreage value is roughly $16,000/acre, offset by its Delaware Basin asset valuation of $50,000 per acre at Rystad Energy’s current base case price strip.

However, the Permian Basin has seen a more significant reduction in valuations than other basins, based on historical deal price comparisons, Rystad said. The most recent Permian-focused transactions attracted little to no acquisition premiums, with an average price of about $24,000 per acre. This corresponds to a 67% decline from the earlier deals in 2018, headlined by the sale of RSP Permian and BHP’s Permian portfolio for more than $70,000 per acre.

“The reduction in valuations is promoting consolidation that wouldn’t have happened in 2018-2019,” Alisa Lukash, senior analyst, said in Rystad’s research note. “Low equity prices and the need for investor support is motivating many operators to look for new options to merge, especially if it doesn’t involve heavy debt and cash. In turn, asset spinoffs and the sale of noncore acreage in liquids basins are comparatively lower now, and we do not foresee demand for such assets rising in the coming quarters.”

Such spinoffs and cash transactions could return when WTI recovers above the $45/bbl mark as most oil and gas operators tightly hold on to their Tier 1 inventory, Lukash said.

Onshore M&A reached a record high in the second half of the year as of Nov. 13, recovering from the dismal performance earlier in the year due to the pandemic and the oil-price war.

In 2020, so-called mergers of equals as well as large acquisitions by major producers have been announced. By contrast, in 2019 when most of the transactions were small premium deals between play-focused operators, according to Rystad.

In the most recent large-scale merger, Pioneer Natural Resources Co. agreed on Oct. 20 to acquire Parsley Energy Inc. for $7.6 billion. On Oct. 19, ConocoPhillips Co.’s announced the acquisition of Concho Resources Inc. In September, Devon Energy Corp. and WPX Energy Inc. also said they were combining in an all-stock merger.

Pioneer Natural Resources CEO Scott Sheffield said during a merger conference call he believes M&A may stall out for some time.

“It seems like the best companies have been picked off in the last few weeks with Parsley and Concho and the other transactions,” he said. “I’ve always said leverage is going to prevent consolidation for the next couple of years.”

Sheffield said more mergers along the lines of Devon-WPX Energy could continue as oil and gas companies look to bring together balance sheets that need improvement.

Based on what’s happened in Europe and data from recent International Energy Agency reports, Sheffield said he believes there will be only “three or four independents that are investible by shareholders—and we hope Pioneer is one of those.”

Sheffield said Pioneer is expected to achieve $325 million in synergies, including $150 million in operations, $100 million in G&A savings and $75 million in interest savings.

Rystad said many of the deals have been driven by scale, with operators increasing their acreage from neighboring companies in order to increase acreage and realize operational and G&A synergies. The recovery in M&A in the second half of this year is helping extend the trend of consolidation that began in 2018, which was briefly disrupted earlier in 2020.

Ongoing onshore consolidation will result in a deceleration in the country’s rate of production growth in the future, according to Rystad.

The oil and gas industry is moving away from the historical reinvestment rate of 75%-90% toward a more conservative target of 70%-80% because of a lack of investor support for aggressive growth models, the firm said. This will take the growth rate of future oil production, over 2021-25, from 7%-8% per year under the old model, to 3%-5% per year in a $40/bbl WTI environment.

Gradual recovery in U.S. tight oil production in a $40 environment should be viewed as the base case, according to the firm.

Recommended Reading

Nel Realigns Supply Agreement with Nikola, Supplies Fortescue

2024-02-02 - Nel ASA and Nikola Corp.’s new supply agreement is for 110 alkaline stacks and related balance of stack equipment.

Verdagy Awarded $39.6MM DOE Grant for Electrolyzer Production

2024-03-14 - Verdagy will use the Department of Energy grant to accelerate the manufacture of e-dynamic electrolyzers for green hydrogen solutions.

Energy Transition in Motion (Week of March 8, 2024)

2024-03-08 - Here is a look at some of this week’s renewable energy news, including a record-setting 2023 for U.S. solar.

First Solar Gunning for $1B More in 2024 Sales

2024-02-28 - Solar module manufacturer First Solar forecasts 2024 net sales of between $4.4 billion to $4.6 billion, with annual volumes sold ranging from 15.6 gigawatts (GW) to 16.3 GW.

Solar Panel Tariff, AD/CVD Speculation No Concern for NextEra

2024-04-24 - NextEra Energy CEO John Ketchum addressed speculation regarding solar panel tariffs and antidumping and countervailing duties on its latest earnings call.