The Permian Basin continues to drive U.S. oil production growth. (Source: GB Hart/Shutterstock.com)

With plans to invest between $3 billion and $4 billion annually in shale through 2025, Shell sees its entire shale business becoming free cash flow positive this year, having already reached that milestone in the Permian Basin, executives said this week.

The Anglo-Dutch energy company, which is positioning its portfolio for the energy transition, said it is focusing on high-margin tight oil and low-cost gas assets as it targets $2 billion to $3 billion in organic free cash flow for shale in 2025.

“We have been on a significant performance journey, optimizing our portfolio and directing our capital to developing high-margin assets,” said Wael Sawan, incoming upstream director for Shell. “We now have a proven track record of delivery. By 2020, we expect over half of our production to come from liquid-rich assets in Permian, Fox Creek and Argentina.”

The company anticipates production will hit 600,000 barrels of oil equivalent per day within six years with the Permian Basin driving growth. Shell’s Vaca Muerta project is also among those in line for 2019-2020 startup.

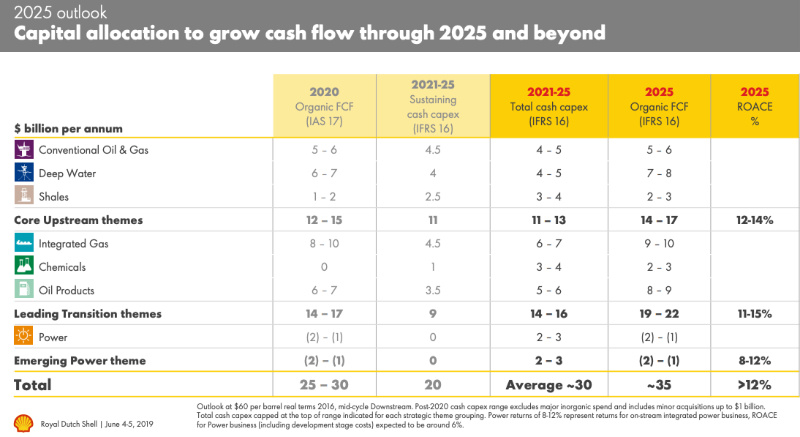

Shale is one of the so-called “core upstream themes” Shell is betting on to generate cash and help sustain the business as it prepares for a low-carbon future. The others are deep water and conventional oil and gas, which each have an annual capital allocation of between $4 billion and $5 billion from 2021-2025.

In all, the company said its cash capital investment would average about $30 billion each year—no more than $32 billion—during that time. That’s up from nearly $25 billion in 2018.

Oil and gas companies are increasing spending following the 2014 market downturn as conditions improve. With technology and efficiency gains at their side, large IOCs—Exxon Mobil Corp. and Chevron included—are spending a bit more, and the Permian players are looking to that basin to significantly drive growth.

Here, Shell—like its peers, large and mid-sized independents and E&Ps—have cut drilling and completion (D&C) costs, optimized completion designs and turned to technology to add value. The company reported June 4 it cut D&C costs by 40% and grew average cumulative oil production by 60% from 2015 to 2018.

“We see technology, particularly our iShale program, as an integral part of our business that drives delivery today and into the future,” Sawan said. “A quick example…is Shell Geodesic. By the end of 2019, nearly all wells in shales will be geo-steered using this AI technology. This allows us to stay in zone nearly 100% of the time, which allows for greater overall recovery and adding at least 5% per well to our EURs.”

But he added that Shell is “not in a rush to grow through acquisition given the quality and depth of the portfolio. If we choose to grow inorganically we will be selective and would only consider value accretive opportunities that fit within our financial framework.”

Similar sentiments were shared when executives spoke with the media.

Shell CFO Jessica Uhl referred to the company’s overall organic growth outlook for 2025.

“Our ability to generate the $35 billion of organic free cash flow in 2025, our ability to potentially return up a $125 billion and more to our shareholders, is based on an organic view of our future and so it is not dependent on any material M&A opportunities,” Uhl said.

If an opportunity arose, it would have to add value and fit with the company’s strategy, she added, noting the same holds true for Shell’s shale business.

“We’re very pleased with the delivery capability we’ve established with that part of our business. … We would have appetite for expanding, but it has to fit within the financial framework,” Uhl said.

She added, “most of the things we see tend to look overpriced and I think we’ve tried to maintain cool heads and have confidence in our strategy and in our portfolio.”

Shell’s planned 2021-2025 cash capex investment excludes major inorganic opportunities, but includes up to $1 billion for minor acquisitions.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.