Regardless of a recent rebound in oil prices, “investors would be wise to continue to view shale-focused companies as high-risk enterprises,” IEEFA analysts said in a recent report. (Source: Hart Energy)

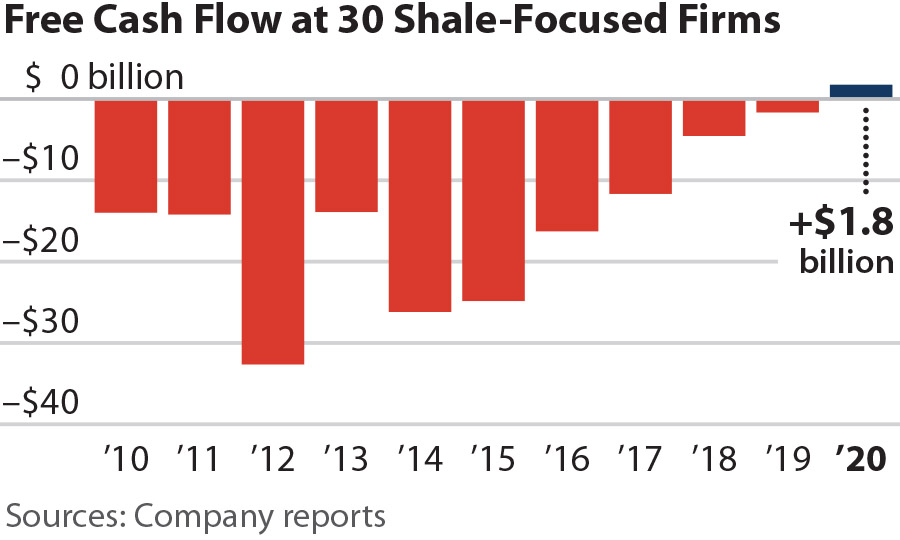

Shale oil and gas producers seem to have achieved on their long-promised, free cash flow goal in spite of the obvious turbulence of 2020.

Last year marked the first full year of positive free cash flows generated by shale oil and gas producers since the fracking boom began, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA) published March 24.

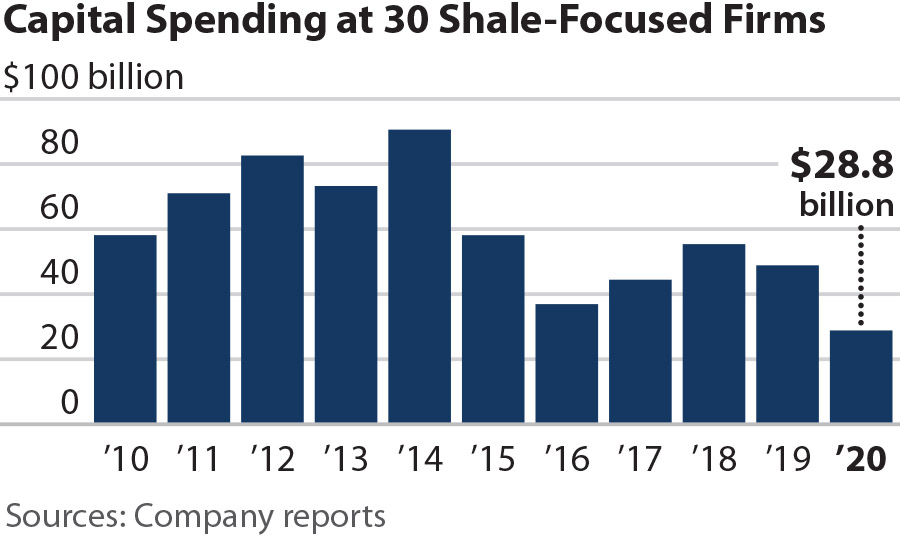

“Last year’s positive free cash flows were only possible because shale companies cut their capital spending to the lowest level in more than a decade,” said Clark Williams-Derry, energy finance analyst at IEEFA who co-authored the firm’s report examining capital spending of a cross-section of 30 North American shale-focused oil and gas producers.

IEEFA’s report found that the 30 producers generated $1.8 billion in free cash flows in 2020 after slashing capital spending by $20 billion from the previous year. By comparison, the companies the firm examined had reported negative free cash flows since 2010 totaling $158 billion.

However, Williams-Derry said shale producers could still be facing obstacles ahead despite of this milestone for the industry.

“Restraining capital spending could help the fracking sector generate cash, but low levels of investment also undermine the industry’s prospects for growth,” he added.

The oil and gas industry’s financial underperformance began long before 2020’s tumultuous year for oil markets. Near the end of 2017, investors began demanding capital efficiency and shareholder returns—a stark difference from the production volume growth story favored by Wall Street during the early years of the U.S. shale boom.

The global COVID-19 crisis last year only helped to exasperate these woes with falling sales volumes, low prices, weak revenues, and a wave of bankruptcies for the oil and gas industry.

Still, the 30 producers in IEEFA’s report responded quickly to the turmoil last year by slashing capital spending to $28.8 billion, a 41% cut from the 2019 figure of $48.9 billion. Capex reductions, which started in mid-2018, have helped the companies report positive free cash flows during five of the preceding seven quarters.

“Despite this turnaround, a decade of dismal financial performance casts a shadow over the industry,” said Trey Cowan, IEEFA oil and gas industry analyst and report co-author. “The positive free cash flows pale in comparison to the industry’s accumulated debt loads.”

The 30 shale producers owe almost $90 billion in long-term debt, and the reductions in capex are unlikely to ensure that the industry grows, according to the report.

As a result, oil and gas producers are now facing a dilemma, according to Ashish Solanki, an IEEFA fellow and co-author of the report.

“Keeping capital spending in check could improve the industry’s cash performance,” Solanki said. “Yet falling investment will also constrain production.”

Falling capital investment pares back growth prospects for the industry, also sending clear signals to investors that North America’s oil and gas production is poised to shrink.

In the U.S., oil production plunged last year by 332 million barrels, the largest one-year drop in history. The U.S. Energy Information Administration now forecasts another production decline yet again in 2021, the IEEFA report said.

The oil and gas sector is also currently confronting unprecedented global headwinds it didn’t face five years ago, such as renewables, which IEEFA analysts report are now cheaper and far more abundant, eating into fossil fuel market share. New technologies will make some uses of fossil fuels obsolete, they added.

Regardless of a recent rebound in oil prices, IEEFA said “investors would be wise to continue to view shale-focused companies as high-risk enterprises.”

“The potential for improved stock performance may tempt short-term buyers. But long-term investors should be wary of an industry that has produced disappointing results for a decade, and that now faces challenges unlike any that the industry has ever faced,” the IEEFA analysts concluded in the report.

Recommended Reading

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

Mitsubishi Makes Investment in MidOcean Energy LNG

2024-04-02 - MidOcean said Mitsubishi’s investment will help push a competitive long-term LNG growth platform for the company.

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.