Rystad’s forecast for offshore services demand suggests a 45% jump from 2018 to 2025. (Source: Hart Energy/Shutterstock.com)

Offshore is taking the lead from shale in oilfield employment, according to recent analysis by Rystad Energy.

The global research consultant analyzed the oilfield service sectors having the highest percent change in employment between 2016 and 2018. The results showed that “the main driver of employment is shifting from shale to offshore,” according to the report published in late July.

“This is a clear effect of the increase in offshore sanctioning,” said Matthew Fitzsimmons, vice president on Rystad Energy’s oilfield services team. “We expect offshore commitments to nearly double from 2018 to 2020, and sustain high levels of spending over the next five years.”

RELATED:

Oilfield Service Providers See Stronger Offshore Activity Ahead

While the Permian Basin dominated shale activity in the U.S. in recent years, adding ballast to oilfield hiring, it was the headcount of the top 50 oilfield service companies that took the lead from 2017 to 2018. Given the more recent struggles of oil prices this year, however, whether the oil service sector can continue to maintain this growth seems in question unless offshore potential truly proves robust.

Rystad’s forecast for offshore services demand suggests a 45% jump from 2018 to 2025, representing $442 billion in the latter year. The outlook comes after the offshore industry suffered a significant falloff in activity from 2015 to 2017, prompting companies to pare their workforces by more than a third.

The service companies registering the most substantial gains in workforce from 2017 to 2018 were “primarily exposed to the offshore industry,” according to the report.

Among those were Norwegian shipping company Solstad Offshore ASA, Rystad reported, which “nearly doubled its workforce... a significant staff ramp-up which bet on the long-term improvement of market conditions.”

Also boosting its workforce was drilling contractor Seadrill Ltd., which posted a 15% overall rise in employment, sparked by contracts with Saudi Aramco and Equinor ASA. But looked at in the light of longer-term trends, the numbers appear less positive.

Seadrill’s 2018 year-end headcount “is only 100 people more than after massive layoffs in 2016, and remains just over half of what it was in 2014,” the Rystad researchers noted. Still, the company is expected to continue to grow its workforce through 2022 if offshore markets continue to expand.

As in past downcycles, many workers have left the industry since 2014, and oilfield companies are finding it difficult to find experienced personnel who they can lure back to take advantage of offshore growth. Fitzsimmons noted it hasn’t been easy to attract new professionals either.

“History would show that to bring back experienced professionals into an industry, higher wages will be required,” he said.

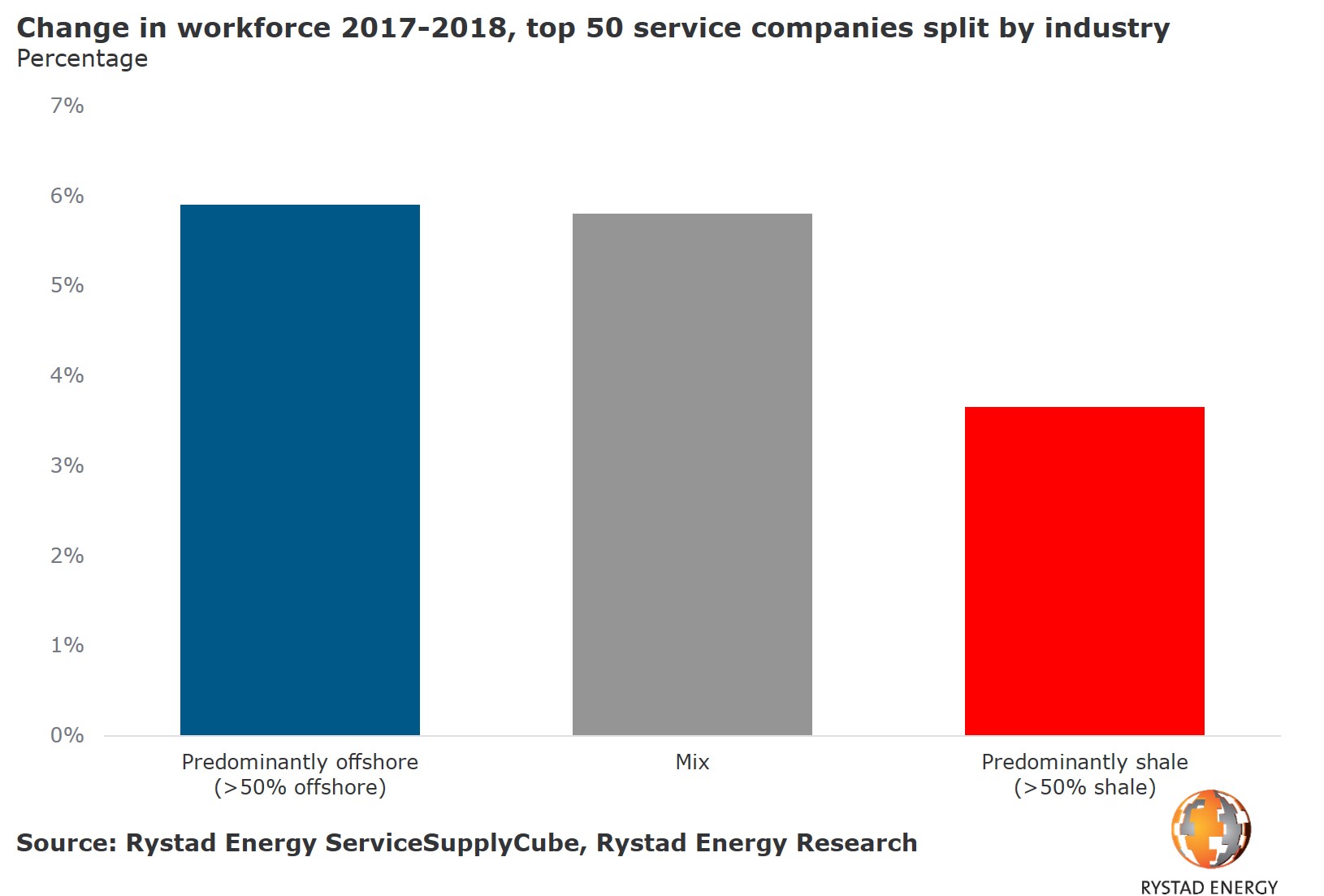

Overall, the data analysis showed that from 2017 to 2018, for the top 50 service companies, those having more than 50% of their work offshore grew their workforce by about 6%. Meanwhile, those with a mix of work grew by nearly the same amount and companies with more than 50% of their business focused on shale grew their workforces by less than 4%.

In early August, Rystad also released a note expressing concerns about oil demand in the light of the worsening trade war between the U.S. and China, with both economies showing signs of deceleration.

“Continuing worsening of U.S.-China trade relations could lover demand growth by 200,000 barrels per day (bbl/d) to 1 million bbl/d in 2020,” according to the report. The consultants also warned of downside risk to 2020 prices due to excessive supply growth.

Recommended Reading

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

CERAWeek: JERA CEO Touts Importance of US LNG Supply

2024-03-22 - JERA Co. Global CEO Yukio Kani said during CERAWeek by S&P Global that it was important to have a portfolio of diversified LNG supply sources, especially from the U.S.

Silver Linings in Biden’s LNG Policy

2024-03-12 - In the near term, the pause on new non-FTA approvals could lift some pressure of an already strained supply chain, lower both equipment and labor expenses and ease some cost inflation.

Dispatch from the LNG Front: Development Not ‘Paused’ so much as Slowed

2024-04-04 - Analysts: Low prices may stall upcoming gas gathering projects that are needed for an expected boom.

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.