Editor's note: This article first appeared in Hart Energy's Shale 2022 report. For more information and insights, view the Shale 2022 report here.

No one was prepared for a global pandemic, especially one that placed a vise grip on the world economy with lockdowns enforced in just about every country. Demand for various commodities suffered even as production fell in 2020. The oil and gas industry was hit especially hard as people stopped driving much on a daily basis. When WTI hit -$36/bbl in April 2020, it seemed as though it would be a long slog to recovery. Yet 18-plus months on, the industry—including the midstream sector—is performing at levels not seen in years, even as remote work has become the norm for many.

Part of this quick recovery can be attributed to the cyclical nature of the industry. Consistent volatility caused midstream operators to look at changes to steady the ship. One of the most prominent of these companies was DCP Midstream, which instituted a new strategy in 2016 called DCP 2020.

This strategy, designed to make DCP the safest, most reliable, low-cost midstream service provider sustainable in any environment, has become the company’s long-term vision. As part of this strategy, DCP introduced DCP 2.0, a digital transformation initiative designed to modernize the way the company operates and runs its assets.

This is no small undertaking. Currently the company’s Integrated Collaboration Center, similar to a digital central nervous system, monitors major field assets 24/7, can remotely operate 26 facilities and reviews up to 8 billion datapoints, including engineering, commercial, real-time customer information, contract and commodity prices, on a daily basis to improve its operations.

As part of this strategy, DCP Midstream also formed the DCP Tech Ventures group. This arm of DCP is focused on partnering with accelerators, venture capitalists and universities to find emerging technologies around safety, reliability, digital enablement and energy transition that can be incorporated into the company’s operations and help drive long-term value and sustainability.

Although these initiatives were not created to help the company navigate through a global pandemic, they were designed to help the company quickly adjust to market changes.

Financial discipline restoring balance

So what happens when prices go back up?

“If a company’s set up really well to weather commodity prices going down, then there is a lot of confidence that it will be well positioned when prices go back up,” Wouter van Kempen, chairman, president and CEO of DCP Midstream told Hart Energy. “For us, that has meant having financial discipline, significant free cash flow and a strong balance sheet. These foundations allow us to run a safe and reliable company no matter what the market throws at us.”

There have been a lot of headwinds for the midstream industry over the past five years, but van Kempen said there are now more tailwinds with commodity prices soaring.

“We’re in this completely different cycle coming out of the COVID-19 pandemic shutdowns and seeing really strong demand, both domestically and internationally, for all of our products,” he said. “I look at natural gas growth over the next 10 or 20 years as pretty bullish.”

Adapting to the end of the growth cycle

A great deal of this bullishness can be attributed to midstream players becoming more financially disciplined as the substantial growth cycle that marked the start of this century has come to an end.

“We knew that the super cycle of growth we were in had to come to an end and that we needed to prepare for the eventual contraction that would take place,” van Kempen said. “That is why we decided to embark on a smart growth strategy we called ‘supply long and capacity short,’ and what that basically meant was that instead of spending hundreds of millions of dollars to build a new plant and new systems, we’d partner with other companies to utilize their excess capacity.”

The Denver-Julesburg (D-J) Basin is one of DCP Midstream’s most active regions with tighter overall system capacity. In 2019, rather than build a new natural gas processing plant for up to $500 million, the company sought to rent capacity from operators that were sitting on idle capacity.

“It has created a win-win scenario,” he said. “For us, we make good margins, we still keep the NGL in our system, we reduce our environmental impact and we save money by utilizing existing infrastructure. It’s good for everyone in the industry.”

He noted this strategy has proven to be so successful that DCP Midstream is applying it in other areas, including the Permian Basin.

Cost reductions and improved margins have created enough cash flow to help DCP Midstream pay off debt and improve its leverage over the past two years. Paying down debt is helping the company reach its goal of obtaining an investment grade credit rating. According to van Kempen, DCP is on track to hit this goal in the second half of 2022.

Growing responsibly

Looking ahead to 2022, van Kempen shared that DCP Midstream will continue to emphasize optimization and emission reductions. An example of these efforts would be running fewer compressors at a higher capacity.

“When you do that, you can continue to have reliable service while reducing costs and emissions,” he said.

DCP Midstream has reduced Scope 1 and Scope 2 greenhouse-gas emissions from its assets by 16% since 2018, and the company has long-term goals of reducing emissions by 30% by 2030 and reaching net-zero emissions by 2050.

“Sustainability, financial stability and generating free cash flow and returns for our shareholders are all top priorities,” van Kempen said. “Our industry has a great opportunity to set itself up really well for the future, and I think we’ve struck the right balance between growing our company and doing so in a responsible way, from both a sustainable point of view and from a capital allocation point of view.”

DCP Midstream is also working with Kairos Aerospace to find and mitigate fugitive emissions across the company’s systems in the Permian, D-J Basin and Midcontinent by flying airplanes with specialized sensors over these assets.

“Our partnership with Kairos came from our DCP Tech Ventures group and has led to the largest voluntary, industry-led methane mapping and resolution program in the country,” van Kempen said. “We saw this as an important way to reduce our emissions and to make our systems more sustainable.”

“In my mind, operating more cleanly and more efficiently is not an option—it is table stakes.” —Wouter van Kempen, DCP Midstream

The company has a three-pronged approach to emission reduction. The first prong, “cleaning the core,” is focused on controlling emissions from its owned assets by improving efficiencies and modernizing existing operations. The second prong, “adjacent to the core,” seeks to explore opportunities to expand the company’s business portfolio, leveraging intellectual capital and existing infrastructure.

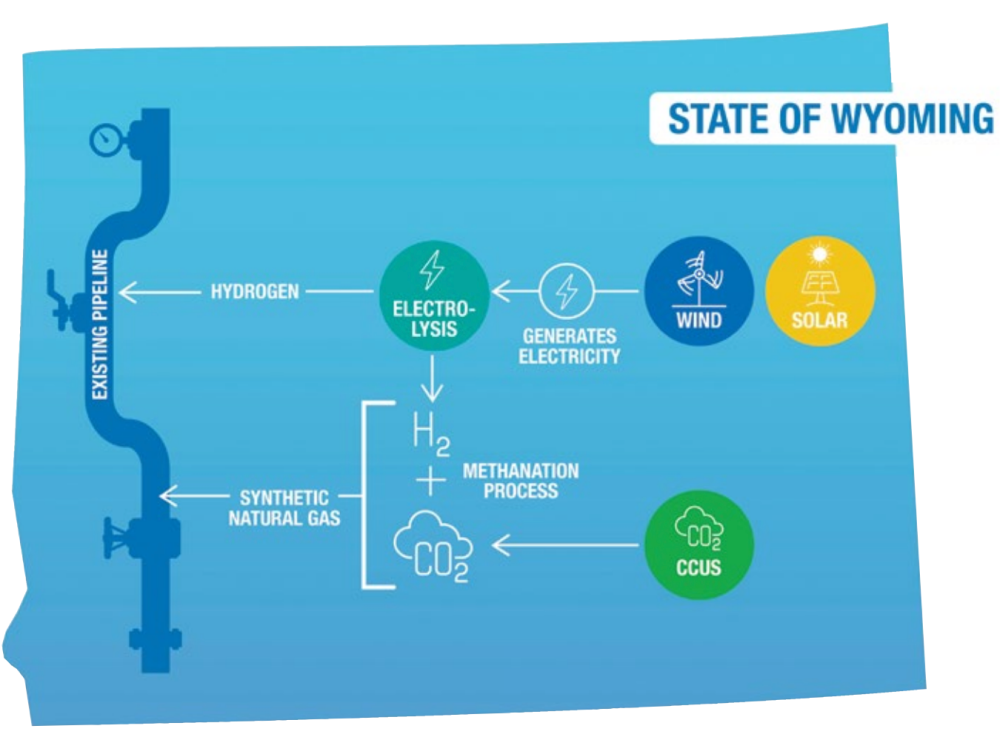

This could include carbon capture and sequestration (CCS) and other emerging technologies that reduce emissions. DCP’s primary focus of CCS has been in the company’s New Mexico footprint, but it could be expanded elsewhere. The third and final prong is called “beyond the core,” which has a longer timeline and is focused on tracking emerging green technologies and positioning the company to leverage and deploy tomorrow’s energy solutions. For DCP this could include hydrogen, large-scale solar and other renewable projects.

“In my mind, operating more cleanly and more efficiently is not an option—it is table stakes,” van Kempen said. “That’s what we have to do as an industry. It’s a requirement and part of our social license to operate. We have a responsibility to our customers, employees, stakeholders and community members to operate as cleanly, reliably and environmentally sustainably as possible.”

Producers have also shown more discipline this cycle by not bringing production back as quickly as they have in the past after price downturns. This has been a positive for the industry as it’s helped to create better supply and demand balance.

Focus on efficiency

Like DCP Midstream, EnLink Midstream is also focusing on optimizing its existing operations and improving efficiencies throughout its asset base. This strategy helped EnLink reduce its operating and administrative costs by 20% in fiscal year 2020.

Additionally, EnLink is focused on maintaining financial flexibility by using its cash flow to pay down debt while maintaining deliberate and disciplined growth.

“We have an intense companywide focus on improvement and innovation,” EnLink Chairman and CEO Barry E. Davis said. “Every single employee has been empowered to look at how they do things and think, ‘How can this be better?’ We call this ‘The EnLink Way,’ and it’s driving our current results higher and creating real, long-term value, while also reducing inefficiencies and transforming our business.”

A few recent examples of this approach include utilizing technology to debottleneck EnLink’s purity product pipelines to accommodate incremental volumes, leveraging real-time data and expertise from a cross-functional team to optimize plant recoveries, and implementing robotic process automation to save hours of spreadsheet manipulation, giving the EnLink team valuable time to analyze and make improvements.

EnLink’s innovation and efficiency focus led to the company’s first plant relocation from Oklahoma to the Midland Basin. Project War Horse began flowing volumes in third-quarter 2021. EnLink has since announced Project Phantom, its second plant relocation, which will move their underutilized Thunderbird Plant from Oklahoma to the Midland Basin. This relocation will add 200 MMcf/d of processing capacity at about half the cost of a newbuild plant and is expected to be online in fourth-quarter 2022. With the addition of Project Phantom, Midland processing capacity will increase approximately 70% by year-end 2022. EnLink is also actively working on furthering its decarbonization path, along with advancing projects that allow the company to participate in the energy transition.

EnLink formed a Carbon Solutions Group in early 2021 that is pursuing opportunities to provide a complete carbon capture, transportation and sequestration offering. The company operates an extensive Louisiana footprint that contains approximately 4,000 miles of pipeline and is connected to one of the nation’s largest concentrations of industrial CO₂ emissions. According to EnLink officials, this makes it well positioned to execute a carbon solutions offering.

“Our unique ability to utilize existing pipeline in the ground to transport CO₂ to potential sequestration locations nearby allows us to offer a cost-efficient transportation solution for all parties involved and, of equal importance, significantly reduces the environmental impact when compared to new pipeline construction in environmentally sensitive areas,” Davis said. “Additionally, we recently announced a 15-year agreement to sell 100,000 metric tonnes per year of CO₂ emitted from our Bridgeport plant to be purified for use in food, beverage and similar applications, which advances us down our decarbonization path while making a modest profit.”

EnLink is also taking full advantage of its large-scale positions in key basins. In the Permian, the company is aligned with solid operators and growing with them through capital-efficient, high-return projects.

EnLink acquired Amarillo Rattler for $75 million in April 2021. Amarillo Rattler is a Midland Basin natural gas gathering and processing system that provides significant operational synergies and minimal incremental capex to integrate the system. In connection with the acquisition, EnLink signed an amended and restated gathering and processing contract with Diamondback Energy.

“This very attractive acquisition has an excellent customer behind it, and we are very confident in achieving a 6x multiple on 2022 EBITDA,” Davis said.

Making money, not excuses

The first half of fiscal year 2021 saw the midstream as a whole improve cash flows as demand for natural gas and crude oil returned as society and the global economy continued to reopen. According to Enterprise Products Partners LP officials, natural gas volumes transported on its pipeline system equaled 2019 levels, while fractionated volumes hit record levels in the quarter. The company continues to see a surge in demand for petrochemicals, notably propylene.

Enterprise was able to achieve such levels because of its ability to quickly adapt to life and business during the global pandemic by reopening its offices early and instituting various protocols such as masking before mandates were in place, having Plexiglas around the office cubicles and social distancing.

“By this time [in 2020], we had already returned to our headquarters in what was virtually an empty downtown Houston,” said Enterprise Co-CEO Jim Teague during the company’s second-quarter 2021 earnings call. “I think it was a competitive advantage being back because we worked as a team, we moved products for our customers and producers, we were buying and selling, we were in the system and collecting on steep contango in about every product we touched. We were determined in the middle of the pandemic to make money, not excuses.”

He noted that around fourth-quarter 2020, the industry was slipping deeper into the pandemic, but the resurgence is proof that the markets work and was to be expected.

“Strong prices, backward-dated markets and lower inventories at Cushing, Okla., are signaling that volumes need to stay at home, at least for now,” he said.

As the market recovery continues, Teague said it feels like a period of hyper-growth. Enterprise remains on track to complete the expansion of its Acadian natural gas system out of the Haynesville Shale to the LNG market in Gillis, La., as well as expansions to its ethylene and propylene pipeline systems. Expansion won’t be limited to the 2021 fiscal year for Enterprise either.

“Our growth capex in 2022 and 2023 projects is currently sanctioned at $800 million and $400 million, respectively,” Teague said. “We expect these to increase as some of the projects under development are sanctioned.”

Company officials noted larger-scale projects could be announced in the near term.

New energy sources

If there is one consistent theme among midstream players in 2021, it has been sticking with a strategy and relying on market fundamentals. Similar to DCP Midstream, EnLink and Enterprise Product Partners, The Williams Companies remained focused on its long-term goal while managing its way through the pandemic-driven downturn.

The company has continued to work toward connecting the fastest-growing natural gas markets with the best supplies. This focus has resulted in strong growth in 2021 with volumes transported on the Williams system growing even as production fell slightly.

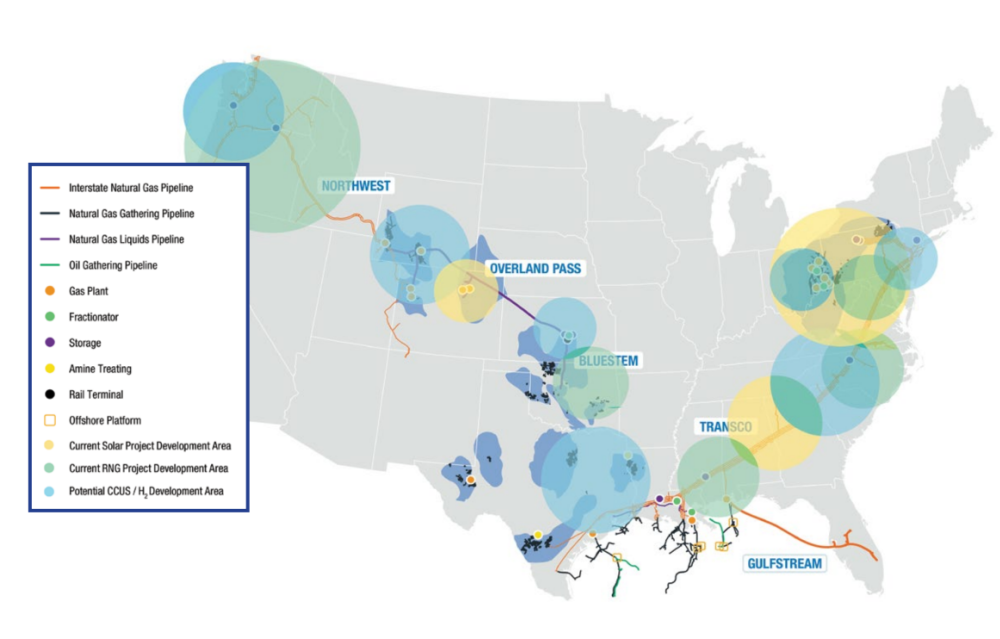

While market fundamentals remain strong and are leading a revival in fiscal results for midstream operators, Williams is studying ways to diversify itself with more sustainable energy sources. Company officials noted that Williams’ footprint is well suited and adaptable to energy sources like clean hydrogen and renewable natural gas (RNG) blending.

Williams is also building 16 solar projects awaiting approval that are expected to cost a combined $250 million in capex with another $150 million of similar projects in development. As an example of Williams leveraging its current asset base and footprint to drive clean energy solutions, the company has 1.2 million acres in the Wamsutter Basin dedicated to its midstream assets and another 200,000 acres that it intends to utilize for clean energy development.

According to company officials, renewable energy projects will be focused in areas where the company can leverage its assets to get a competitive advantage. This would largely point to transportation, but there are opportunities on the processing front as well.

Williams anticipates operating slowly when it comes to some energy sources like hydrogen to ensure the technology is developed in a way that complements its assets.

An example of this type of investment strategy is with its Regional Energy Access project that is designed to provide Northeast consumers with access to natural gas by the 2023-24 winter heating season. It will also include a pilot project involving the production of hydrogen.

It is a similar story with the RNG capture processing and delivery front. Williams officials anticipate small investments to prove their footprint and infrastructure can work with this energy source’s technology.

Besides looking to future energy sources, Williams remains committed to immediate opportunities to reduce carbon emissions. The company has up to seven RNG sources flowing into its natural gas transportation systems with nine more in progress.

Culture is key

One aspect that hasn’t been getting as much attention as sustainability and financial flexibility— but is equally important—is the cultural journey taking place throughout the midstream industry, including at DCP, according to van Kempen.

“As a company and as an industry, we deliver products that make people’s lives better—through fueling transportation and heating and cooling homes,” van Kempen said. “Everything we do is touching lives [and] enabling better lives. It’s part of our company’s purpose and something we’re tremendously proud of. At the same time, I think we also have a responsibility to do these things in a cleaner and better way and that includes having a strong culture where people can express themselves and learn.”

Social change has also been at the forefront of discussions for many industries over the past two years, and the midstream industry is no different. Inclusion and diversity efforts have been a major focal point.

“We think inclusion and diversity are extremely important,” van Kempen said. “Last year we focused lots of energy on stressing to our leaders that how they deliver results is equally important as the results they deliver. That means not just doing the work but also building an inclusive workplace environment and creating a sense of belonging.”

In an effort to create this sense of belonging, DCP Midstream formed a diversity and inclusion committee and set goals for the makeup of its workforce and leadership from a racial and gender point of view.

DCP’s diversity and inclusion goals will be tracked using clear metrics, and employees are already incentivized around the company’s people and culture measures. Similar systems are used by DCP to help reach its companywide financial, safety and reliability goals.

“Culture is part of the way we measure, reward and incentivize our people,” van Kempen said. “If you invest in it, measure it, if you make it part of people’s short-term incentive structure, you’re going to get results.”

Assessing risk

Midstream operators aren’t the only ones keeping a close eye on spending, as private equity is also assessing risk in this current environment.

“Private equity has experienced two significant drops in oil prices over the past seven years, and they’re not accustomed to that kind of risk,” Dan Lippe, managing partner with Petral Consulting, told Hart Energy. “Their risk assessment of providing capital to oil producers to drill more shale oil wells is one of the most important aspects impacting the sector heading in 2022.”

Lippe said private equity investors have been focused on their return on investment since fourth-quarter 2018 after experiencing sharp price decreases. This adjustment has resulted in a slower recovery in the rig count, but that should change if crude prices remain at $75/bbl as some private equity investors decide that the risk is far less. As growth in crude production from the Permian and other key shale plays resumes, NGL production growth rates will also increase and that will increase the utilization of midstream assets such as pipelines and fractionators.

The factors that drive growth in crude oil exploration activity eventually require growth in midstream capacity.

“Private equity investors, for now anyway, are also focused on ESG concerns with regard to providing capital funding for midstream projects,” Lippe said. “Because midstream companies provide necessary services, they will continue to base major projects on takeor-pay contracts. With sufficient customer support, they can always get money. That’s not a problem. As long as there’s a need for additional midstream capacity, midstream companies will find the money. The subjective factors that affect the flow of capital into the upstream are less relevant to what happens in the midstream.”

As crude demand slows over the next few decades with electric cars replacing more gasoline-powered vehicles, Lippe said there is likely to be an increase in demand for reliable energy sources, including natural gas, on the power grid.

It’s unlikely that many new midstream construction projects will be announced in the coming year, but two petrochemical projects are expected to be fully operational in 2022. One is Bayport Polymers, a joint venture (JV) of Total Chemicals and Borealis. Bayport Polymers has completed construction and began startup of the 1.1 million tonnes per year (mtpy) ethylene plant in the fall of 2021. The other major project is Gulf Coast Growth Ventures. This petrochemical JV between Exxon Mobil and SABIC in Corpus Christi, Texas, will have the capacity to produce 1.8 mtpy of ethylene.

“You’re talking about shrinking the surplus ethane producibility in West Texas and New Mexico by 50%, which is enough to change the psychological dynamics of the buyers and to encourage more optimistic aggressive behavior on the part of the sellers,” Lippe said. “Ethane prices are already improving, but that’s mostly because natural gas prices are stronger, not because demand is up yet. This will change that.”

Declining oil demand

Looking ahead to 2022, the majority of midstream operators anticipate demand for most hydrocarbons to continue to grow. There may be continued price fluctuations as the market balances at times, but most midstream executives anticipate steady demand growth.

Looking further out, demand for crude oil will begin to decline, according to Lippe.

“I’ve done some long-term demand forecasting based on various scenarios for sales of electric vehicles [EVs],” Lippe said. “Unless all global vehicle manufacturing companies have completely misjudged their ability to sell EVs, I do not see any upside for long-term oil demand (2030-2050). I can only see downside. The No. 1 thing that convinced me of this long-term decline is that every major auto manufacturer in Europe has declared they’re going to be 100% electric. That process is starting in 2022. Those manufacturers sell a lot of cars in the United States, which means Europe and the United States are going to be at the leading edge of the end of the oil business monopoly on transportation fuels.”

Lippe was quick to add that this decline will take a long time after peak demand is reached. “We’ll still be producing crude oil 30 years from now,” he said. “It just won’t be at the 80-90 million barrel per day level we see now. It will be more like 55 million barrels per day.”

Regardless of where crude demand is in this longterm outlook, the midstream will continue to adapt and add new sources of energy to its mix as it always has and always will.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.