Photo courtesy NexTier Oilfield Solutions.

[Editor's note: A version of this story appears in the April 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Merger appetites in the oilfield service space mirrored a wasteland of inopportunity for most of last year, and the outlook for 2020 remains mired in a bog of challenging fiscal patterns and heightened levels of uncertainty. Translation? It’s ugly out there.

Budget cuts, lower activity levels and fresh waves of right-sizing rule the day as operators look to survive in the new world order of living within cash flow.

All the financial maneuvering by E&Ps has trickled down and impacted service providers’ bottom lines. Less money and less activity by their client base means leaner times ahead for contractors that supply the tools to produce oil and gas. The stress has tempered dealmaking, according to a report by Deloitte.

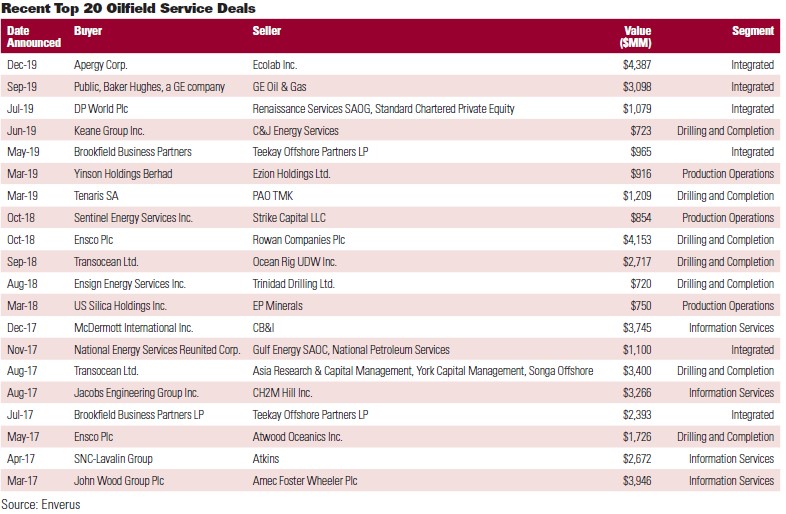

There were fewer larger deals in the sector during 2019—only 10 worth more than $500 million and four worth over $1 billion worldwide. Previous years have seen a healthy tranche of deals between companies in the offshore drilling and the engineering, procurement and construction spaces.

While Deloitte expects to see some smaller deals made in 2020, overall M&A activity is expected to be muted. One driver the firm points to as a potential jumpstart to more deals is the restructuring wave that is expected as companies look to secure better financial footing.

companies, small to mid-sized,

stock-for-stock deals most likely

with little to no premium,”

said James West, senior managing

director, oilfield services, Evercore ISI.

“I think the industry is sitting here today at a crossroads,” said James West, senior managing director, oilfield services, for Evercore ISI. “I think we have a distinct part of the industry—the North American land part of oilfield services—where we massively over capitalized the business both with existing companies and also with plenty of new start-up companies to attack what we now know was a massively over capitalized E&P industry that was going after shale oil.”

As of mid-February 2020, the shares of service giant Schlumberger Ltd. were down 30% over the company’s 52-week high of almost $49. Similarly, rival Halliburton Co. shares have slumped by a third over its peak during the past 12 months. Others are in worse shape. Global offshore driller Noble Corp. has seen its stock price erode to below $1 per share. Other offshore rig contractors—Transocean Ltd., Diamond Offshore Drilling Inc. and Valaris Plc—all have stock prices in the $4 to $5 range.

“I think everybody would generally agree there needs to be consolidation, but I think for two public companies to come together, there will have to be a meeting of the minds where the teams agree that being together versus separate is the best thing for their shareholders and for the business as a whole,” said Dean Price, managing director of energy at Opportune LLP. “I think that rationalization is still trying to work itself out. I think if everybody could see some stabilization in commodity prices in the $55 to $60 per barrel range for oil with the belief the forward look price will remain in that range, it is possible upstream companies could increase their budgets. It might give a little nudge to the consolidation notion.”

With the massive growth cycle for shale oil winding down, investors are looking for returns. E&P companies are slashing capex in a bid to live within cash flow. The strain of lower investment dollars and the fact that many upstream companies have been effectively cut off from capital markets have negatively impacted the service industry.

Pundits are pointing to consolidation as a tool to reconcentrate the industry, but underperforming stocks have made the process to defragment the service side a slow one. No one, neither management nor their boards, is too keen on stepping up and consolidating at lower valuations than they believe their companies are worth.

“We’ve told them, ‘You can consolidate at your current stock prices, you can consolidate when prices are lower or we can consolidate you in a Delaware courtroom after you’ve filed Chapter 11,’” said West. “I think the urgency is improving. But we are still at a bid/ask spread point where things aren’t aligning just yet. We’re starting to see things. You have Era buying Bristow on a reverse merger out of bankruptcy. I think you’ll see more going forward especially in the more fragmented product lines.”

Several forces, both internal and external, can drive consolidation. There are geopolitical factors that could prompt more activity. A leadership change in the U.S. could also affect M&A levels, especially if that leadership were to target the domestic oil and gas business for a regulatory reshuffle.

“Until the current conditions change, you’re not going see the necessary dynamics for potential transactions or see the number of potential transactions increase,” said David Smith, senior vice president at valuations firm Mercer Capital. “It’s a muddy way of looking at it, but to an extent that’s true. We’ve been sitting on the current conditions, without material change for a while now, and that doesn’t happen in the energy industry for very long.

“To an extent we’re kind of due for something to happen. But it’s not within our crystal ball clarity level to know what it’s going to be and when it’s going to happen. It just kind of seems like we’ve been sitting where we are for quite a while, and we’re due,” Smith said.

Whether the nudge that sets the industry on a change of course is imminent is anybody’s guess; however, most don’t believe the larger, integrated companies are where any merger activity will start. It will likely be the smaller, more fragmented segments that will take the leap first.

“I think the large, diversified service companies right now are more focused on culling their own businesses, so looking internally at underperforming product lines and in some cases jettisoning those, or in some cases, shutting them down,” said West. “You can see just from Schlumberger’s last quarter [when] they announced they had shut down coiled tubing in the U.S. They also announced a major restructuring of their U.S. operations. As did Halliburton, as they are pivoting from a growth focus to a returns focus. I think it is going to be like-for-like companies, small to mid-sized, stock-for-stock deals most likely with little to no premium.”

Deals like the 2019 merger between pressure pumpers C&J Energy Services and Keane Group is a good example. Both companies entered the shale solutions space and grew rapidly. The deal was an all-stock, merger-of-equals to create NexTier Oilfield Solutions, a larger, more diverse oilfield service company that has a combined enterprise value of $1.8 billion. Similar deals in the shale space could follow given the current barometer for activity in the near term.

Usually M&A is fueled by companies attracted to a new technology or an additive piece of business not already in their portfolio. However, deals in the current climate may stray more toward the necessity of joining forces with a rival in order to reset financial stability.

The oilfield service industry is a broad one dotted with companies with high-fixed cost structures, low-fixed cost structures and those that can lay off employees and bring them back when things improve. However, some don’t have that sort of flexibility.

“It really depends on their particular position or niche, whether they’re more exposed to the extended mediocre oil price or whether they can weather that much more easily than others,” said Smith. “And it depends on how deep their bank account is right now. Those are all the factors that are going to come into play.

“It’s really a case by case, or a niche by niche, and even a company by company, and a depth of bank account that determines at what point do they cry ‘uncle’ and say, ‘Call the investment bankers and tell them to find me a buyer; I’m not going to continue funding this.’ There are going to be people who are running short on runway and don’t want to continue funding the business unless they see a sign of improvement in demand for their services.”

During the shale boom of the last decade, new money entered the space from the private-equity side of the equation. Not only funding start-up E&Ps driven by the attractiveness of a drill-and-flip style entry and exit strategy, but on the service side as well. Firms like Riverstone Holdings pumped cash into contractors like Liberty Oilfield Services and Proserv among others. The exit strategy from these types of deals isn’t as cut-and-dried as it was previously. Many private funds are having to retrench and remain engaged. Consolidation could offer an exit from these investments. Additionally, private-equity groups might look to build the attractiveness to outside parties by pairing comparable companies within their portfolios.

“With private-equity investors, we’ve seen a little bit of consolidation in their portfolio companies,” said Price. “You might have two or three companies within your portfolio that are compatible or maybe have compatible services. We thought we were going to see more of that, and that doesn’t seem to be happening as quickly.”

Deal-making motivations can vary between companies, but it appears clear that most see 2020 as a year that could see an uptick in oilfield service marriages. The climate for mergers in the space during the past 12 month has been weak at best. As there are factors that lie ahead that could spur new deals, things could occur that may well extend the M&A slump through the rest of the year and beyond.

“If we see an oil price spike, that would kill it pretty fast,” said West. “A lot of this is forced consolidation. It’s not companies looking for new product lines or embracing new technology. It is really about trying to get the G&A [general and administrative] out of the system, trying to right the ship for a resized market that is smaller than what they built for. If the oil price were to go up substantially and E&P’s started spending a little more, that could prolong that lack of serious M&A.”

Recommended Reading

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.