Upstream executives may complain about the market’s general indifference or impatience regarding oil and gas equities, which continue to languish compared to improving commodity prices. But from the C-suite of midstream MLPs, the view is even worse.

As MLP analysts at Seaport Global Securities see the sector dwindling in popularity among retail and institutional investors, they think investors must find a new way to value these companies on multiples of cash flow—and that MLPs must find a new way to fund themselves.

But even if these two things were to happen, the analysts don’t see an imminent rebound in MLP unit prices, according to a recent report.

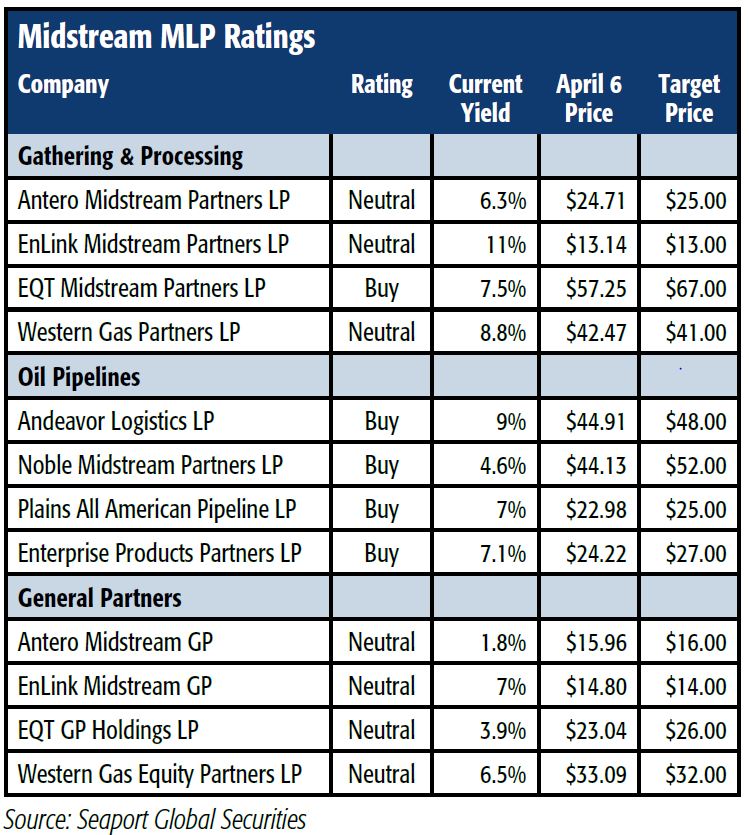

The investment banking firm said it has revised its price target calculation methodology to include EV/EBITDA multiples. Instead of price targets based fully on the dividend discount model (DDM), it now uses a combination of 50% DDM and 50% consolidated EV/EBITDA for limited partners and a sum-of-the-parts methodology for the general partners (GPs).

This results in price target reductions across its coverage universe averaging about 20%. It revised downward its price targets for 11 midstream MLPs. Seaport maintains Buys on Plains All American Partners and its publicly traded GP, Enterprise Products Partners, EQT Midstream and its public GP, and Noble Midstream Partners.

The report points to investors who “are in full-on revolt over incentive distribution rights (IDRs).”

It said IDRs will continue to disappear over time, but that it will take years. “In the meantime, with a few exceptions, companies paying IDRs will be under increasing attack to eliminate them or restructure,” it said.

“In the face of the existential issues facing the MLP structure, we continue to advocate a focus on companies with simple structures (no IDRs, ideally C corp-structured), high-quality assets, manageable financial leverage, ample distribution coverage and minimal external equity needs,” the Seaport Global report said. “Companies that meet these criteria are able to execute their strategies without relying on incremental, non-dedicated investors (those providing marginal demand for units). For companies that continue to rely on equity markets to execute their business strategies, we believe the worst is yet to come …”

So far in 2018, there has been widespread repricing of energy infrastructure companies.

“Unlike some, we do not expect a substantial and durable rebound in share prices overall. As the MLP structure (and IDRs) dwindles, and non-dedicated investors provide the incremental bid in the stocks, multiples of operating cash flow become more important.

“In addition, the stocks are increasingly compared to investment alternatives outside the industry. We believe electric utilities provide a good (but not perfect) comparable industry,” the report continued. “Our coverage continues to trade at 12.4x 2018 consolidated EV/EBITDA, while a subset of peer companies without IDRs trades at 11.4x, and electric utilities trade at 10.8x. Consistent with this view, we revised our price target calculation methodology to include EV/EBITDA multiples.”

Seaport Global said that in many cases, it makes more sense for an MLP to cut its distribution to free up capital to invest in growth projects rather than issue new common or preferred equity. We believe payout ratios will migrate lower in general as other options for capital stay difficult and expensive. For a company with robust capital spending plans and no excess distribution coverage, a reduction in payout will make the most sense.”

Recommended Reading

Exclusive: Mitsubishi Power Plans Hydrogen for the Long Haul

2024-04-17 - Mitsubishi Power is looking at a "realistic timeline" as the company scales projects centered around the "versatile molecule," Kai Guo, the vice president of hydrogen infrastructure development for Mitsubishi Power, told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

Google Exec: More Collaboration Needed for Clean Power

2024-04-17 - Tech giant Google has partnered with its peers and several renewable energy companies, including startups, to ramp up the presence of renewables on the grid.

Hirs: Aspirations Meet Reality—The Undisclosed High Cost of the Energy Transition

2024-04-16 - The nation is trying to keep up with the growth of renewable power resources, but before transmission lines can be built, the power plants must first have interconnects with the grid.

Nova Clean Energy Acquires BNB’s 1-GW HyFuels Portfolio in Texas

2024-04-16 - Covering about 25,000 acres on the Texas Gulf Coast, HyFuels’ power supply will be split evenly between wind and solar energy.