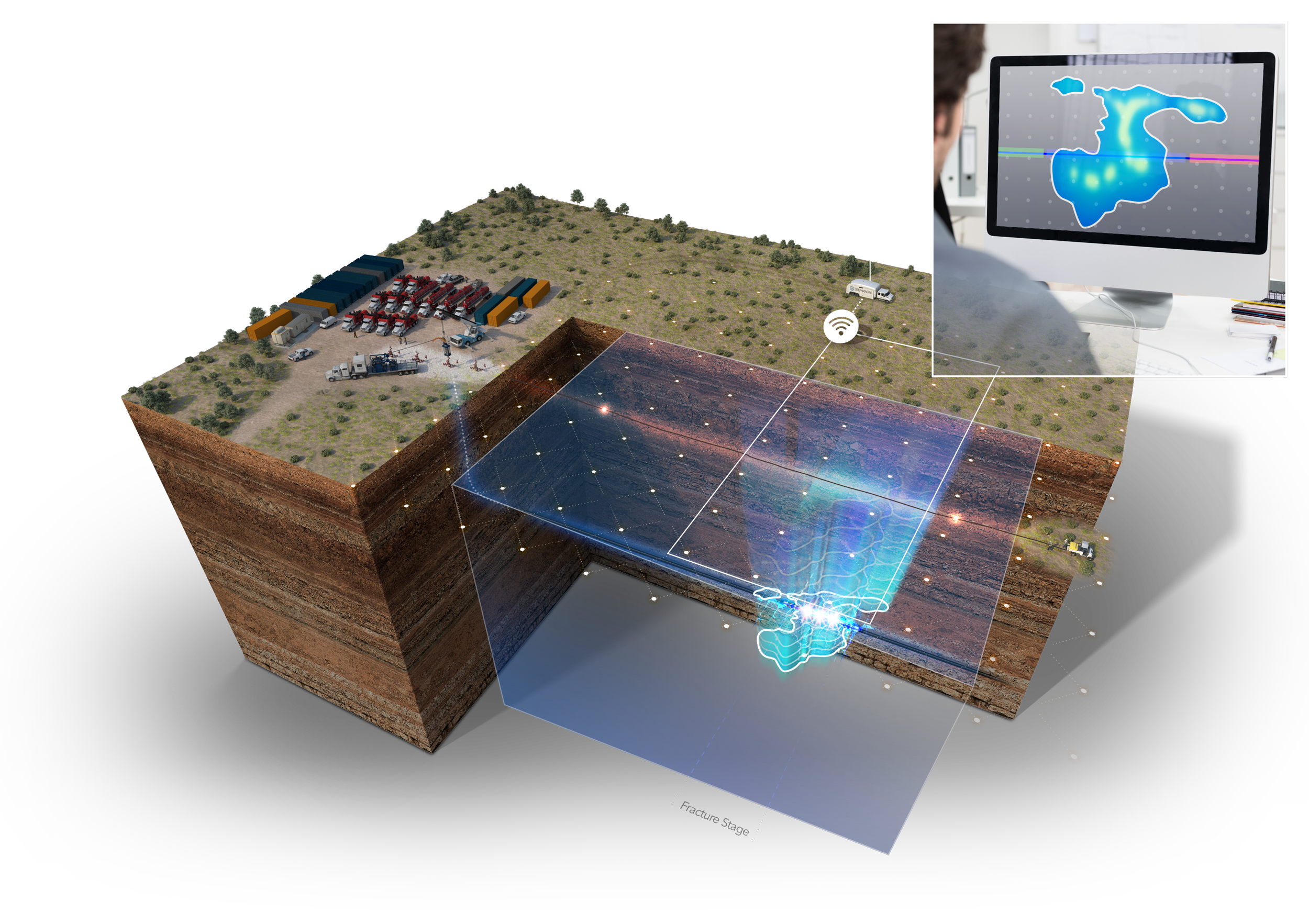

Frac fluid migration (blue) is tracked using electromagnetics. (Source: Deep Imaging Technologies)

If one were to chart out the developmental time lines for conventional and unconventional resources, one would find that the line for one is about a mile in length while the other stretches on and on. This difference in lengths is understandable as the bits and pieces that made the shale revolution possible only recently came together.

Operators and service companies certainly know more about the downhole environment of a shale well than they did at the start more than two decades ago. With each technological breakthrough, the industry takes another step closer to solving the great challenges posed, like mitigating frac hits or improving recovery rates. Each step, however, creates more data and more questions.

Advances in digital technologies have enhanced the industry’s abilities to analyze and model the extreme amounts of data streaming out of well sites and into algorithms for refinement, creating even more questions. It is a vicious cycle of plan, test, analyze, adjust and repeat.

Deep Imaging Technologies, Reveal Energy Services and Shale Value are three of many technology companies working to answer the big questions about the unconventional subsurface using their own unique approach to decipher shale’s tightly held subsurface secrets.

Determining frac fluid migration

Deep Imaging Technologies tracks fluid migration during hydraulic fracturing operations through the use of its Agile Electromagnetic method.

The method creates an electromagnetic field that is absorbed by the subsurface casing to create a secondary electromagnetic field, according to the company. This secondary field is measured, and when fluid is pushed into the formation, the field’s impedance changes, according to Joshua Ulla, chief development officer at Deep Imaging Technologies.

“We see where the impedance of the secondary field changes and we measure that,” Ulla said. “It is a direct measurement of where the fluid is flowing. In most instances, for example, not only do we see where the fluid went stage by stage, we see that it was not symmetrical or matching the modeled distribution.”

The company’s low impact field operations are entirely surface-based and off pad with no need to go downhole to collect measurements. There is zero interference with the operator or the wellpad and the small field layout with receivers close to transmitters ensures better resolution, according to the company.

The transmitter wire is placed parallel to and directly above the lateral portion of the wellbore with receivers along each side. The receivers consist of grounded dipole sensors, sampling the secondary electromagnetic signal at a high sample rate. Data are processed and imaged using in-house software, with results shown in a 2-D representation of the fluid movement from the signal.

“We can tell you where the frac fluid went in your well, which stages will produce [and] where flowback is coming from within the well,” he said. “We can tell when an adjacent well is about to take a frac hit.”

In a recent completion in the Anadarko Basin, Deep Imaging showed an overlap in treated reservoir space of more than 50%. The operator adjusted the completion design and expects to save about $1 million per well while maintaining production, according to Ulla.

Mapping pressure responses

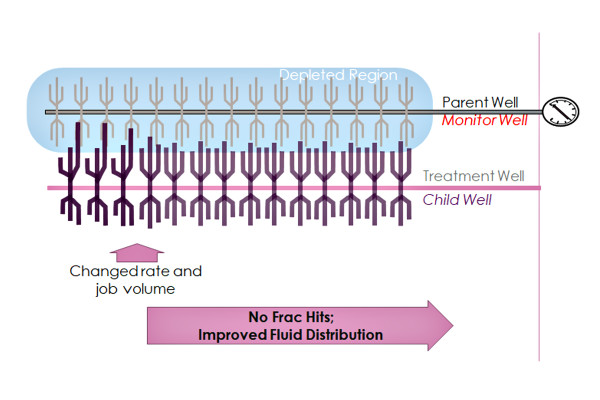

Reveal Energy Services uses a surface pressure gauge on a monitor well to observe the poroelastic pressure response from a nearby treatment well during hydraulic fracturing to create pressure-based fracture maps.

“Our technique works by taking the pressure measurement in one of the wells not being fractured. For example, let’s say you have a four-well pad and you’re performing fracturing operations on the No. 1 well,” said Sudhendu Kashikar, CEO of Reveal Energy Services. “We take our measurements on well No. 2 as you’re fracturing the No. 1 well. As you switch to another well, we switch too. We do not need a dedicated well to serve as a monitor well. “We typically go back and forth between wells on the same pad that you’re either fracking or using as a monitor. This is a big departure from some of the legacy techniques that required a dedicated monitor well.”

Alternating wells ensures that the operator can maintain operational efficiencies while still collecting sufficient data to answer the questions that need answering, Kashikar explained.

A Permian Basin operator was concerned about pressure communication between a parent well and child well during hydraulic fracturing, according to the company. Reveal Energy Services deployed offset pressure monitoring using its FracEYE frac hit analysis service and IMAGE Frac pressure-based fracture maps in near-real time to determine whether the pressure signal was direct fluid communication, fluid migration or undrained poroelastic behavior.

“By applying the company’s technology to categorize the type of pressure communication, the operator would know the appropriate corrective action to mitigate frac hits and develop a tailored pumping schedule to improve completion effectiveness,” Kashikar said.

The analysis enabled the operator to identify the type of frac hit, change the treatment parameters and verify that the adjustments minimized the frac hits and improved the fluid distribution in the stage, according to the company. These steps prevented damaging frac hits at the parent well and improved the fracture geometry. By implementing near-real-time offset pressure monitoring, the operator made informed, better decisions on the fly about reducing frac hits.

Performing PVT analysis in the cloud

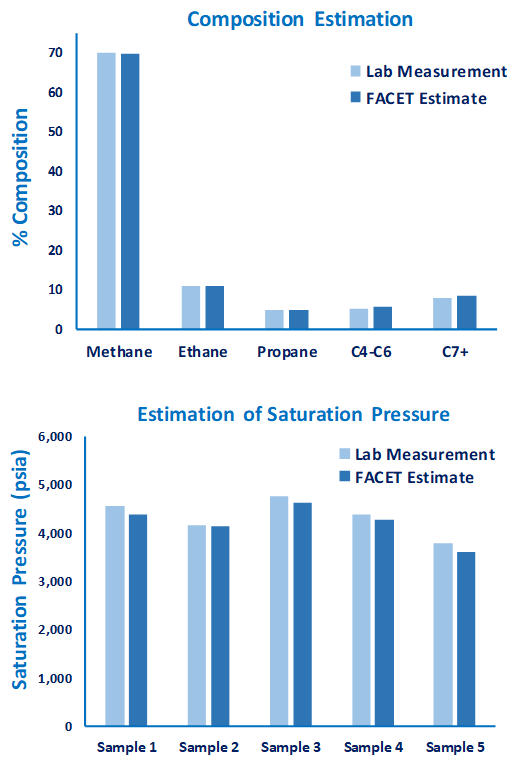

Shale Value combines publicly available data along with proprietary algorithms to perform reservoir pressure, volume and temperature (PVT) analysis. The company’s fluid analysis and composition estimation tool, or FACET, is a cloud-based system that can provide accurate PVT analysis across any operator’s entire acreage with the click of a mouse, according to the company.

The challenge with shale plays is the gradation in reservoir fluid properties across the play and that the reservoir changes with depth, noted Phani Gadde, CEO and co-founder of Shale Value.

“When you collect a PVT sample, it is valid for a certain radius. Beyond that radius, the fluid has changed, and so too has the rock,” he said. “A new sample needs to be collected.”

The PVT analysis is important for reserves calculation, frac optimization and determining a long-term drawn down strategy for the well.

“The past 10 years has been the ‘Age of Frack,’” he said. “We’ve gone after the rock, cracked it, fracked it and we’ve been enormously successful. But a reservoir is a rock-fluid system. We’ve gone after the rock. Now, the next era will be spent tackling the fluid side of the system.”

PVT sample collection is limited due to high cost and lack of expertise, he noted.

“What we’re providing is an alternative so that you do not need to spend six weeks waiting for results back from a lab,” he said. “If you have any well, we can enter five simple inputs, that you can get from the public domain even, into our FACET system, and we’ll give you the entire PVT analysis for each well drilled across any play and productive zone.”

In one operator-requested demonstration, Shale Value estimated saturation pressures using its FACET application that were within 3% and compositions that were within 5.5% of laboratory measurements. The model highlighted a laboratory measurement error with one of the samples that the operator was not aware of. The operator found that the margins of error with FACET were very much within acceptable limits, according to the company. For the reservoir engineering analysis that the operator has planned, the operator believes FACET would enable it to significantly reduce the PVT sample collection and analysis compared to the previously planned testing program, thereby improving accuracy and reducing costs.

While shale development has made significant strides operationally, the forecasting side is playing catch up, according to the company. Forecasting using public data by industry consultants and government agencies is based on curve fitting existing production, spanning a few months to a few years, to obtain a 30-year forecast and reserves, according to the company.

“Curve fitting alone cannot capture complex flow behavior,” Gadde said.“The market and investors react to deviations from erroneous forecasts.”

The challenge with using public domain data for engineering analysis is that the rock, fluid, completion, spacing and drawdown are different for each well, and production data alone are not sufficient to capture the effect of these key factors. The company’s modified rate transient analysis, or SMA-RTA, has been used to infer these factors across every well drilled in the shale and tight oil plays. Using the inferred properties, analytical equations, compositional reservoir simulations and advanced data science, the company’s FIRM analysis now allows operators to benefit from learnings from wells drilled across the entire play and not just on their acreage.

Thinking deeper

E&P recently spoke with Deep Imaging Technologies, Reveal Energy Services and Shale Value about the advances made in understanding the subsurface and how their particular approach is delivering results and extending the unconventional time line.

E&P: The unconventional oil and gas industry has made great strides in its understanding of the subsurface. What are your thoughts on this evolution?

Deep Imaging Technologies

Ulla: More data can often complicate a problem before leading to a solution. Before you have any data, the problem may seem relatively simple. For example, every frac model is bi-wing, goes out 300 ft [91 m] each side and has very little impact on the following stage. As you get more data, it builds on your understanding of the problem. If the data do not fit the simple frac model started with, people often deploy ‘science’ to get even more data to hopefully easily explain these field observations in the hopes that the original model was right.

You end up learning even more about the system you are trying to understand, which has led to where we are today.

The industry now has insights into what is going on and the structure to test the different hypothesis. People can better harness these variables that they previously did not understand, and in turn, improve the economics of development programs.

Kashikar: We have made significant strides in our understanding of the unconventional resources in the last 10 or 12 years. But like with any new venture, there is a lot of room to improve that understanding. If you look at where we are as an industry with our understanding of conventional resources, we are definitely not there with the unconventional resources, in terms of the understanding of the reservoir and how it produces at the degree that we understand conventional reservoirs.

Gadde: The industry’s focus on better understanding the subsurface accelerated after the 2014 commodity price drop, which provided an impetus to optimize operations further. The industry has transformed from brute-force fracking to better understanding the rock and customizing fracs to maximize well productivity. For example, technologies that enable us to decipher the rock’s geomechanical properties gathered during drilling are used to design cluster spacing to improve completions.

E&P: Do we still have more questions than answers? What more is needed?

Ulla: I would say careful scientific method of testing applications is needed with a partnership between service companies and operators to solve specific questions. Likely an operator-to-operator partnership will help largely as well.

Reveal Energy Services

Kashikar: We will always have more questions than answers. The more we learn, the more questions we have because we have an inherent desire to improve continuously. It doesn’t matter how much improvement we have made. The question becomes, ‘how do we get to the next level of performance?’ There are two categories of questions when it comes to unconventional resource development.

One is surrounding the supply chain, operational efficiency and cost. I think that if you look not only at the number of wells we drill per month and the footages that we are capable of drilling, we’ve seen phenomenal improvement in the accuracy of well placement. So the question then becomes how do we improve where we actually place these wells? How do we do that while also reducing the cost? Can it be done?

The second question is how do we improve recovery factors? How do we get to the next level of recovery factors from the unconventionals, without incurring a significant cost? So, if we keep the same cost situation, how do we take recovery to the next level?

Shale Value

Gadde: The reservoir is a rock-fluid system, and the last decade has almost entirely been spent focused on the rock and frac, and the industry focus is just beginning on gaining a better understanding of the reservoir fluid behavior. With operators experimenting with EOR in unconventionals, fluid PVT behavior is going to be further in focus. Fluid PVT behavior in self-sourced systems is considerably different from that in conventional migratory systems. A better understanding of this behavior will be vital as the industry seeks the next set of technologies to deliver step changes in well productivity improvements.

A true convergence between science and data science is required to improve our understanding of the subsurface further. With thousands of wells drilled across each play, the data available to the industry are growing by the day. However, for operators to truly benefit from the learnings from across the entire play and not just their wells for which they have comprehensive data, the ability to use public-domain data for engineering analysis is required.

The challenge with public data is that the rock, fluids, completions, drawdowns and spacing vary across each well in the play, and in order to meaningfully benefit from the advances in data science, these effects need to be deconvolved. Employing domain science before data science greatly enhances the utility of the vast data in furthering industry’s understanding of the subsurface.

E&P: What is the next challenge we need to solve and/or better understand when it comes to developing shale resources?

Ulla: Before we get into specifics, we need to create a better base model, formation by formation. I don’t mean earth model, but instead a mean model of how the rock reacts to hydraulic fracturing and how it is drained. Each formation will behave differently and once we understand it, we can then begin to exploit it.

Kashikar: So that we can continue to improve our understanding, we as an industry need to learn from and adopt some of the techniques that other industries, like the automotive manufacturers, have done. Theirs is one of continuous improvement. So how do we bring those techniques to not just supply chain operational efficiencies but also to developing a better understanding of the subsurface and to improving rates of recovery?

For example, with parent/child well interactions, we help our customers understand the interaction between the parent and child, and this leads to improvements in the completion design to deal with that interaction.

Gadde: The Holy Grail in frac optimization is the comprehensive understanding of the interaction between the fractures and the reservoir. Developing reliable models is very important as the industry marches down the road of frac optimization. It is very complex, and current understanding is still relatively empirical and reliant on trial and error. The challenge with this approach is that the solutions are limited to the statistical bounds of the experiments and may not truly be the optimum solutions.

Recommended Reading

New Fortress Starts Barcarena LNG Terminal Operations in Brazil

2024-03-01 - New Fortress’ facility consists of an offshore terminal and an FSRU that will supply LNG to several customers.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Commentary: Are Renewable Incentives Degrading Powergen Reliability?

2024-02-01 - A Vistra Corp. chief, ERCOT’s vice chairman and a private investor talk about what’s really happening on the U.S. grid, and it’s not just a Texas thing.

FERC Approves Extension of Tellurian LNG Project

2024-02-19 - Completion deadline of Tellurian’s Driftwood project was moved to 2029 and phase 1 could come online in 2027.

Babcock & Wilcox to Convert Coal Plant to NatGas

2024-03-18 - B&W will convert the plant’s two coal-fired boilers to natural gas by designing and installing burners, air systems, fans and other equipment.