The combined business will have approximately 9,000 employees globally and generate an estimated synergy potential of more than $100 million per annum. (Source: Schlumberger Ltd.)

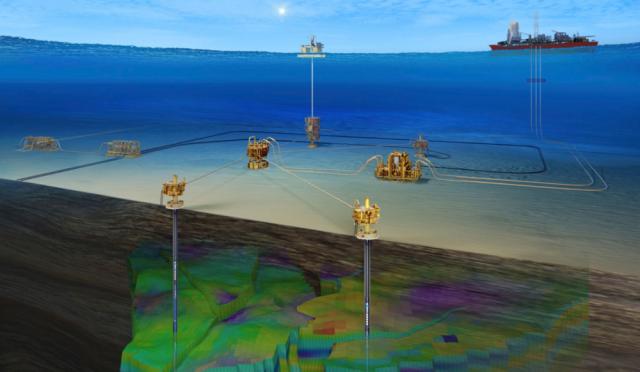

Schlumberger, Aker Solutions and Subsea 7 agreed on Aug. 30 to merge their subsea oil and gas businesses as part of a joint venture (JV) transaction worth roughly $700 million.

The proposed JV will combine Schlumberger’s and Aker Solutions’ subsea businesses. Subsea 7 will be an equity partner in the new JV, according to a joint release.

“As investment in the offshore market—particularly in deepwater—continues to increase, our customers will benefit from enhanced services that leverage digital and technological innovation to drive improved subsea asset performance while increasing energy efficiency and reducing CO₂ emissions,” Schlumberger CEO Olivier Le Peuch commented in the release.

At closing of the JV, Schlumberger will own 70%, with Aker Solutions owning 20% and Subsea 7 owning 10%. The combined business will have approximately 9,000 employees globally and generate an estimated synergy potential of more than $100 million per annum.

“Aker Solutions, Schlumberger and Subsea 7 are complementary businesses, both in terms of products and services, as well as customers and geographical presence. Furthermore, Schlumberger shares our commitment to innovation, such as deploying digital solutions and decarbonization technologies,” said Øyvind Eriksen, president and CEO of Aker ASA, which owns a 39.41% stake in Aker Solutions.

In addition to contributing its subsea business to the JV, at closing Schlumberger will issue to Aker Solutions shares of Schlumberger common stock valued at $306.5 million in a private placement. Concurrently, Subsea 7 will purchase its 10% interest in exchange for $306.5 million in cash to Aker Solutions. The JV also will issue a promissory note to Aker Solutions for $87.5 million.

In total, Aker Solutions will receive $700.5 million in cash and Schlumberger stock as part of the deal. Aker Solutions expects to book a profit of $1 billion at closing, the Norwegian company said in a separate release.

“The offshore market activity is increasing, and this joint venture will drive enhanced offerings both in terms of subsea production economics and low-carbon solutions,” Aker Solutions CEO Kjetel Digre commented in the release.

Additionally, upon closing of the proposed JV transaction, the existing subsea integration alliance (SIA) between Schlumberger and Subsea 7, will be amended so that the new JV will assume Schlumberger’s role in the alliance, which will be renewed for a 10-year term.

“We are excited to build on our highly successful alliance with Schlumberger and partnership with Aker Solutions. This new joint venture is a critical step as we collaborate on integrated subsea projects that drive maximum value for our customers,” added Subsea 7 CEO John Evans.

The JV transaction is subject to regulatory approvals and other customary closing conditions and is expected to close in the second half of 2023.

The board of directors of the JV will consist of three representatives from Schlumberger, two from Aker Solutions and one from Subsea 7.

Recommended Reading

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Orange Basin Serves Up More Light Oil

2024-03-15 - Galp’s Mopane-2X exploration well offshore Namibia found a significant column of hydrocarbons, and the operator is assessing commerciality of the discovery.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.