(Source: Shutterstock)

Saudi Arabia will implement a voluntary 1 MMbbl/d cut in oil production in July while the rest of its OPEC+ cohorts agreed at their June 4 meeting in Vienna to extend their current, reduced production levels through the end of 2024.

In a June 4 statement posted on Saudi Arabia’s Ministry of Energy website, a source said “the Kingdom will implement an additional voluntary cut in its production of crude oil, amounting to one million barrels per day, starting in July for a month that can be extended, so that the Kingdom’s production becomes 9 million barrels per day, and the Kingdom’s total voluntary cut will be 1.5 million barrels per day.”

The ministry said that Saudi Arabia’s additional voluntary cut is meant to “reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets.” Commentators, however, saw the move as a way to discourage oil market traders from shorting crude stocks.

Rystad Energy noted that Saudi Arabia’s announcement comes after crude oil prices dropped 16% in the past seven weeks, dipping to an 18-month low, senior vice president Jorge Leon said in a June 4 commentary.

Oil prices jumped more than $2/bbl in early Asian trade on June 5, hours after Saudi Arabia, the world's top exporter, made the pledge, Reuters reported.

“After more than six hours of lengthy discussions among member countries, the OPEC+ group of oil exporting countries today decided not to implement additional official production cuts this year, choosing instead to set a new and lower target production for 2024,” Leon said.

Additionally, all nine countries that in April implemented voluntary cuts of 1.66 MMbbl/d—Saudi Arabia, Iraq, the United Arab Emirates (UAE), Kuwait, Oman, Algeria, Kazakhstan, Gabon and Russia—agreed to extend the cuts by a year, through the end of 2024.

“This move will add limited short-term upside price pressure in the coming weeks, according to our projections,” Leon said. “The long-term price development will hinge on macroeconomic sentiment and the possible extension of the voluntary Saudi Arabian production cut beyond July. The pure possibility of the Saudi production cut extending beyond July will limit downside price pressure for the rest of 2023.”

Jefferies equity research analysts said in a June 4 commentary OPEC+’s meeting reinforces Saudi Arabia’s uneasiness with the level of short positions in the market, rather than signaling concerns about demand outlook.

Jefferies analysts Giacomo Romeo and Lloyd Byrne said that Saudi’s unilateral cuts were likely left open-ended to discourage future short positioning. In late May, Saudi Energy Minister Prince Abdulaziz bin Salman told investors that he said were shorting the oil price to "watch out," which many market watchers interpreted as a warning of additional supply cuts.

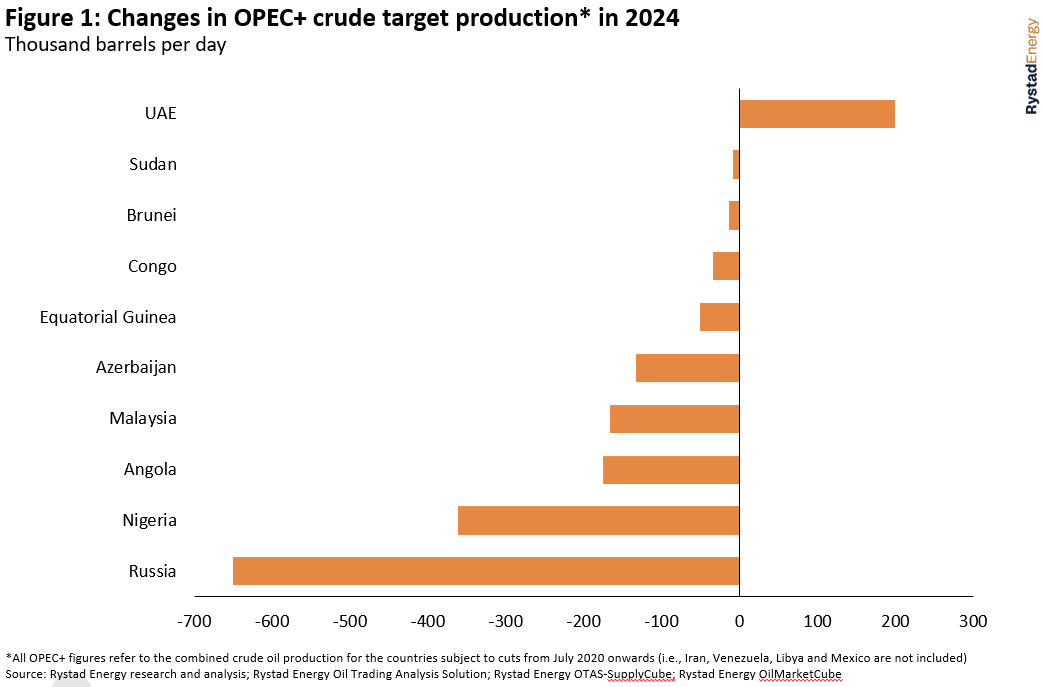

In other OPEC+ developments, Jefferies said that in 2024, the UAE will get an increased production target to 3.219 MMbl/d, an increase of 200,000 bbl/d.

Rystad said OPEC has downshifted its production target from a current target of 40.1 MMbbl/d (from November 2022 until December 2023). The new target production for 2024 is 38.7 MMbbl/d, which is 1.4 MMbbl/d lower than this year’s target.

The new target production numbers for 2024 include a significant reduction for Russia (650,000 bbl/d), Nigeria (360,000 bbl/d) and Angola (175,000 bbl/d), among others, and a 200,000 bbl/d increase in the UAE’s target production.

Rystad noted what it called “signposts” for the market to look out for:

- Possible extension of the Saudi oil cuts beyond July;

- Macroeconomic risk and the evolution of global demand as refineries ramp up to meet summer demand in the U.S. and Europe, while mainland China's local demand accelerates again; and

- Future Russian compliance with its voluntary cuts.

Recommended Reading

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

Bill Gates: ‘A Heroic Effort’ is Beginning, but Climate Goals Still Won’t be Hit

2024-03-26 - Bill Gates said during CERAWeek by S&P Global that the energy transition was picking up speed but still wouldn’t be able to achieve the climate goals established under the Paris Agreement of 2015.

Tangled Up in Blue: Few Developers Take FID on Hydrogen Projects

2024-04-03 - SLB, Linde and Energy Impact Partners discuss hydrogen’s future and the role natural gas will play in producing it.

IEF Chief: When the Public Figures out Transition’s Cost, ‘We’re in Big Trouble’

2024-03-22 - Also, developing and undeveloped countries are pushing back, with one African minister saying “we will decarbonize after we carbonize.”

Energy Transition in Motion (Week of Feb. 9, 2024)

2024-02-09 - Here is a look at some of this week’s renewable energy news, including the latest on a direct lithium extraction technology test involving one of the world’s biggest lithium producers and the company behind the technology.