Stratas expects capital outlays for unconventional oil in the Rockies to top $12 billion in 2018 as the industry’s views of the Bakken, Wattenberg and Powder River Basin change. (Source: Hart Energy and shutterstock.com)

[Editor's note: A version of this story appears in the June 2018 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Not long ago, the atmosphere encircling Rockies’ oil and gas had many in the industry and its many followers feeling as if their “metaphorical” oxygen—economic oil—was in short supply. The Bakken Shale appeared written off by many, Wattenberg Field was good but only good for select operators, and the Powder River Basin was expensive. However, that has all changed with the revival of oil prices since mid-2017.

Today, the Bakken resembles a modern manufacturer with gleaming structures and mountains of promise. Today’s Bakken is a true manufacturing model in shale. Stable, predictable capital spending, leading to steady and predictable production and reliable cash flow. The Bakken is the “steady Eddie” of the industry. Importantly, the Bakken thrives with oil prices in the $60s as a majority of Bakken wells turned on in the last two years enjoy breakeven economics below $55 per barrel (bbl) West Texas Intermediate (WTI). The best wells have breakeven prices in the low to mid-$30/bbl WTI.

Wattenberg, while different, is also a member in good standing of the “manufacturers” club. Stratas Advisors expects stable, predictable production driven by persistent and consistent spending. Despite years of drilling, existing inventories of future drilling locations look good. Completed well costs are attractive and water cuts are exceptionally low. All told, Wattenberg offers very competitive breakeven prices with stability and predictability. Together, the Bakken and Wattenberg form a strong foundation for regional oil and gas activity for decades to come.

Importantly, regional infrastructure issues appear confined to gas processing now that Dakota Access is operational. However, the region has a ready backstop in rail should needs arise. Looking further out, increasing gas production and rising water cuts will need mindful monitoring to stave off hiccups to this well-oiled operation.

Unlike its cousins, the Bakken and Wattenberg, the Powder River is offering something different—growth! The Powder possesses a notable, highly coveted quality—stacked pays. The prospect of stacked pays, coupled with well-known source rocks and competitive and improving economics has attracted fresh capital and new operators in recent years.

Powder River growth will center on familiar sounding names like Parkman, Shannon, Sussex, the Niobrara and Mowry. The anticipated growth comes on the heels of dogged persistence and sheer determination that led to dramatic improvements over the last several years. Capital efficiency is up, well operations are improved and prospects look bright. After years of effort, top-shelf Powder River wells are now competitive with the best wells in other leading shales.

Stratas expects capital outlays for unconventional oil in the Rockies to top $12 billion in 2018, with roughly 60% directed to the Bakken and 25% to the Wattenberg. Most other spending will be in the Powder River. The Bakken and Wattenberg should post steady spending throughout the year while the Powder should ramp higher in the second half.

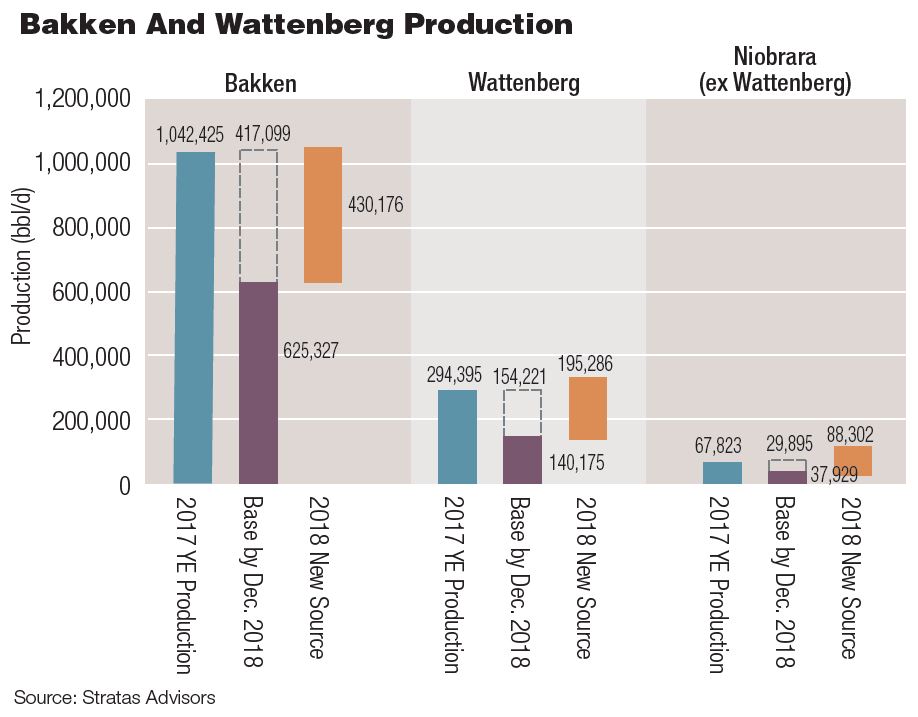

So, what can be expected from this investment? Stratas reviewed a breakdown of production by base production and production from new sources. Base production is simply the production at year-end from the prior year, in this case, 2017. Bakken production at year-end 2017 was a little more than a million barrels per day (bbl/d). These same wells are projected to produce 625,327 bbl/d at year-end 2018, which translates to a 40% base decline. Production from new wells added in 2018 is expected to contribute 430,176 bbl/d, lifting Bakken production a smidge over 2017 levels. Following this same logic, Wattenberg is expected to post slight growth, while the Powder River leaps higher.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.